Found a total of 10000 related content

What is a modular lending protocol? What?

Article Introduction:The DeFi lending industry has been sluggish, mainly due to complex multi-asset lending pools and governance-driven project decisions. Against this background, modular lending protocols were launched. Many people still don’t understand what a modular lending protocol is? According to the data, the modular lending protocol is a design concept of a lending protocol that aims to make the lending function more flexible, scalable and customizable. This protocol is usually composed of multiple independent modules, each module is responsible for different functions or business logic. These modules can be combined and configured according to needs to implement various lending services and functions. The editor below will give you a comprehensive introduction to the modular lending agreement. What is a modular lending protocol? Modular lending is a flexible lending framework that allows the creation of customized lending through a combination of different modules.

2024-05-31

comment 0

429

Delphi: Modular lending is the next stage of the DeFi market

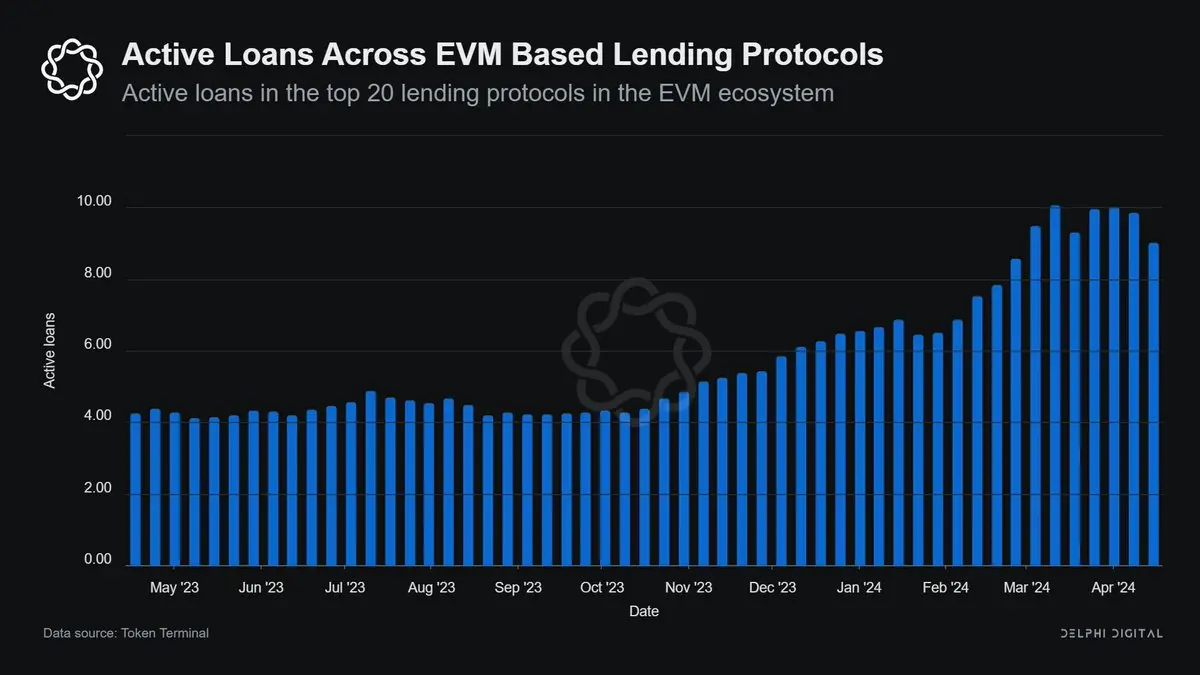

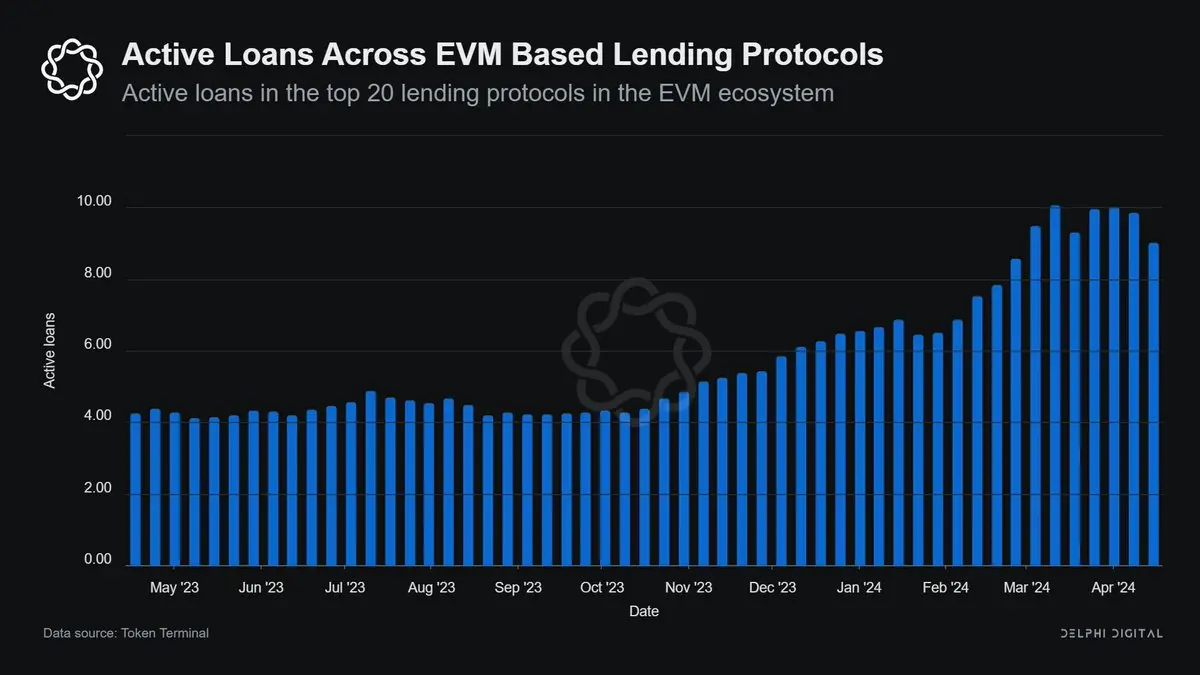

Article Introduction:Original author: DelphiDigital Original compilation: Luffy, ForesightNews The DeFi lending industry has been sluggish, mainly due to complex multi-asset lending pools and governance-driven project decisions. Our latest report explores the potential of a new type of lending product – modular lending, revealing its features, design and impact. The Current Situation of DeFi Lending DeFi lending protocols are active again, with borrowing volume increasing by nearly 250% year-on-year, from US$3.3 billion in the first quarter of 2023 to US$11.5 billion in the first quarter of 2024. At the same time, the need to whitelist more long-tail assets as collateral is increasing. However, adding new assets significantly increases the risk of the asset pool, thereby discouraging borrowing

2024-05-06

comment 0

986

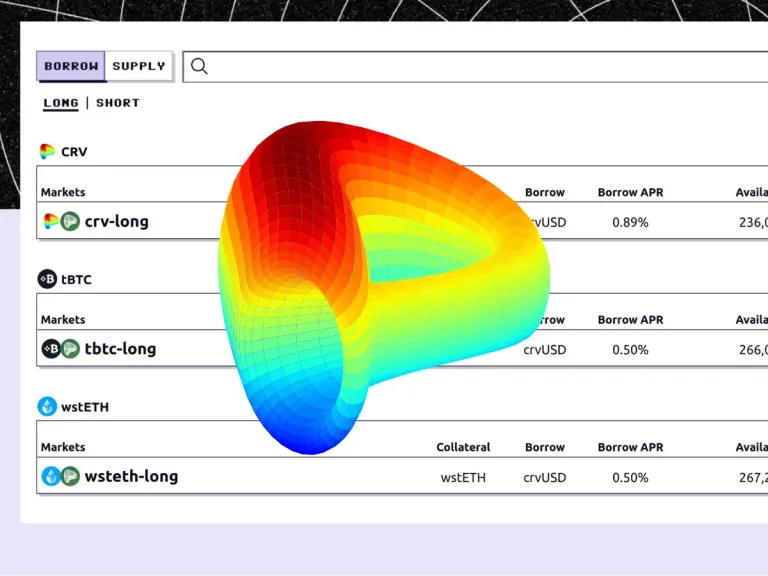

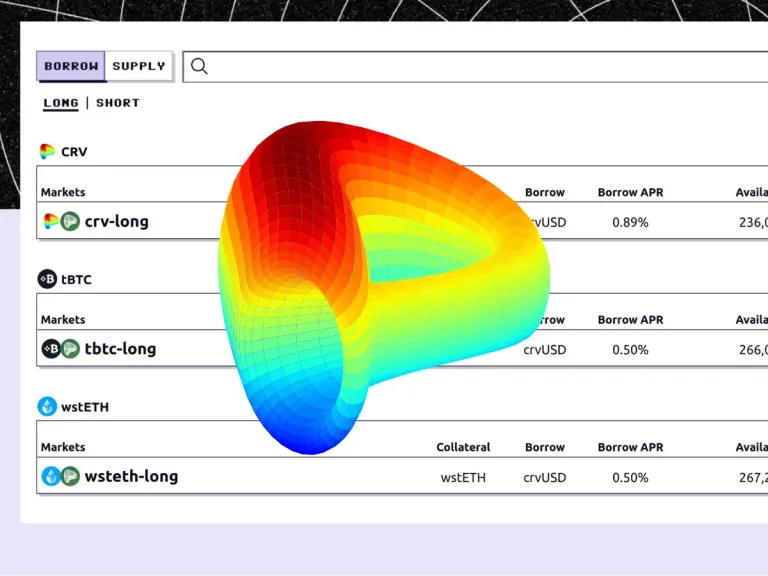

Curve launches Curve Lend, a lending marketplace! Reduce risk with soft liquidation

Article Introduction:Stablecoin AMM blue-chip protocol Curve yesterday released its own lending market CurveLend. Unlike traditional lending platforms such as Aave, Curve adopts a unique liquidation mechanism to effectively reduce the risk of users being liquidated. In addition, Curve also allows users to freely open the lending market for various tokens, providing users with more flexible choices. The launch of CurveLend brings new lending tools to the cryptocurrency market, providing users with a wider variety of lending options and is expected to further promote the development of the DeFi ecosystem. Introduction to CurveLend CurveLend is a permissionless lending market. Users can use oracle prices to borrow crvUSD with any asset to achieve

2024-03-14

comment 0

822

Aave: A Prominent DeFi Lending and Borrowing Platform

Article Introduction:Aave is one of the most prominent DeFi lending and borrowing platforms. It offers a wide variety of features that cater to both casual users and experienced traders.

2024-09-30

comment 0

787

How to implement an online book lending system using MySQL and Java

Article Introduction:How to use MySQL and Java to implement an online book lending system Introduction: With the advancement of informatization in modern society, more and more people choose to borrow books on the Internet. In order to facilitate users to borrow books, an efficient and reliable online book lending system needs to be established. MySQL and Java are currently one of the most widely used relational databases and programming languages. This article will introduce how to use MySQL and Java to implement an online book lending system and provide specific code examples. Database design begins with writing code

2023-09-20

comment 0

768

How to avoid risks after lending a Douyin account? How to open a second account on Douyin?

Article Introduction:In some cases, users may encounter situations where they need to lend their Douyin account to others. This approach, while unavoidable in some cases, also comes with certain risks. This article will explore how to avoid potential risks after lending your Douyin account, and how to open a second account if needed. First of all, you need to be cautious when lending out your Douyin account. Users should carefully consider the purpose and risks of lending their accounts and ensure that the other party is trustworthy. Communicate and understand fully beforehand to avoid possible consequences. Secondly, in order to avoid lurking in times of risk, users can consider the following points: 1. Set a strong password: ensure the account number 1. How to avoid risks after lending a Douyin account Lending with caution: Try not to lend the account to others, especially if you do not familiar person. Set permissions: if necessary

2024-05-09

comment 0

983

How to write a simple online lending management system through PHP

Article Introduction:How to write a simple online lending management system through PHP requires specific code examples. Introduction: With the advent of the digital age, library management methods have also undergone tremendous changes. Traditional manual recording systems are gradually being replaced by online borrowing management systems. Online borrowing management systems greatly improve efficiency by automating the process of borrowing and returning books. This article will introduce how to use PHP to write a simple online lending management system and provide specific code examples. 1. System requirements analysis before starting to write the online borrowing management system

2023-09-27

comment 0

1642

The evolution of DeFi: a panoramic overview of revenue strategies from staking, liquidity mining to recursive lending

Article Introduction:DeFi, or decentralized finance, has set off a revolution in the financial sector with its unique earning potential. It uses blockchain technology to provide investors with diversified income opportunities, which are often accompanied by innovative financial mechanisms. From simple token staking to complex recursive lending, every strategy in DeFi brings different return prospects and risk considerations. This article provides an in-depth analysis of DeFi’s profit strategies, covering staking, liquidity provision, lending, airdrops and points systems, and points out their respective profit methods and risks. The article also specifically discusses advanced leverage strategies such as recursive lending, as well as the prospects for the integration of DeFi and traditional finance, aiming to help readers fully understand DeFi investment and make wise decisions. Staking: DeFi earnings

2024-07-17

comment 0

579

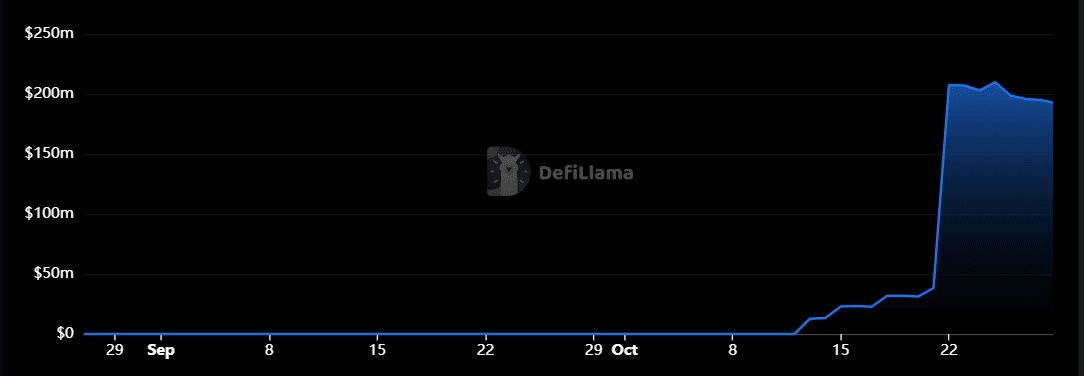

NFT lending protocol ParaSpace is rumored to have misappropriated funds! A large number of users are withdrawing funds

Article Introduction:This afternoon, NFT lending agreement ParaSpace reported internal disputes and misappropriation of public assets. Major communities said that for insurance reasons, please withdraw money as soon as possible. Currently, USDT loan APY has exceeded 82%, ETH loan APY has exceeded 58%, and USDC fund utilization rate Approaching 100%, Yubo, the head of ParaSpace, is currently explaining the situation on TwitterSpace. Loan interest rates soared, and users were withdrawing funds. This rumor began to ferment in the afternoon, and major groups began to spread the word to remind users to withdraw funds. According to observations, lending users in ParaSpace are withdrawing funds from the protocol in large numbers, causing loan interest rates to soar.

2024-04-17

comment 0

499