Course Advanced 21482

Course Introduction:"Tutorial on Simple Book Front Desk Lending System Developed in PHP" introduces the development of a simple book front desk borrowing system through PHP to realize electronic book borrowing.

Course Intermediate 11332

Course Introduction:"Self-study IT Network Linux Load Balancing Video Tutorial" mainly implements Linux load balancing by performing script operations on web, lvs and Linux under nagin.

Course Advanced 17637

Course Introduction:"Shangxuetang MySQL Video Tutorial" introduces you to the process from installing to using the MySQL database, and introduces the specific operations of each link in detail.

Ways to fix issue 2003 (HY000): Unable to connect to MySQL server 'db_mysql:3306' (111)

2023-09-05 11:18:47 0 1 828

Experiment with sorting after query limit

2023-09-05 14:46:42 0 1 728

CSS Grid: Create new row when child content overflows column width

2023-09-05 15:18:28 0 1 618

PHP full text search functionality using AND, OR and NOT operators

2023-09-05 15:06:32 0 1 580

Shortest way to convert all PHP types to string

2023-09-05 15:34:44 0 1 1008

Course Introduction:The DeFi lending industry has been sluggish, mainly due to complex multi-asset lending pools and governance-driven project decisions. Against this background, modular lending protocols were launched. Many people still don’t understand what a modular lending protocol is? According to the data, the modular lending protocol is a design concept of a lending protocol that aims to make the lending function more flexible, scalable and customizable. This protocol is usually composed of multiple independent modules, each module is responsible for different functions or business logic. These modules can be combined and configured according to needs to implement various lending services and functions. The editor below will give you a comprehensive introduction to the modular lending agreement. What is a modular lending protocol? Modular lending is a flexible lending framework that allows the creation of customized lending through a combination of different modules.

2024-05-31 comment 0 428

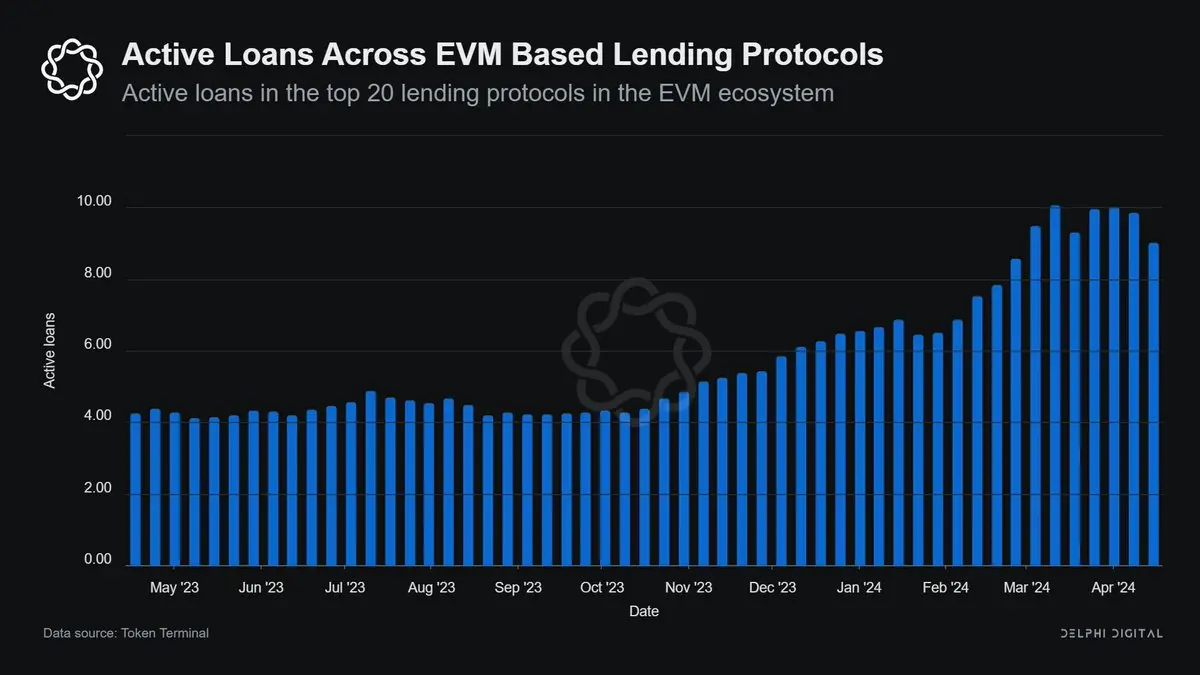

Course Introduction:Original author: DelphiDigital Original compilation: Luffy, ForesightNews The DeFi lending industry has been sluggish, mainly due to complex multi-asset lending pools and governance-driven project decisions. Our latest report explores the potential of a new type of lending product – modular lending, revealing its features, design and impact. The Current Situation of DeFi Lending DeFi lending protocols are active again, with borrowing volume increasing by nearly 250% year-on-year, from US$3.3 billion in the first quarter of 2023 to US$11.5 billion in the first quarter of 2024. At the same time, the need to whitelist more long-tail assets as collateral is increasing. However, adding new assets significantly increases the risk of the asset pool, thereby discouraging borrowing

2024-05-06 comment 0 985

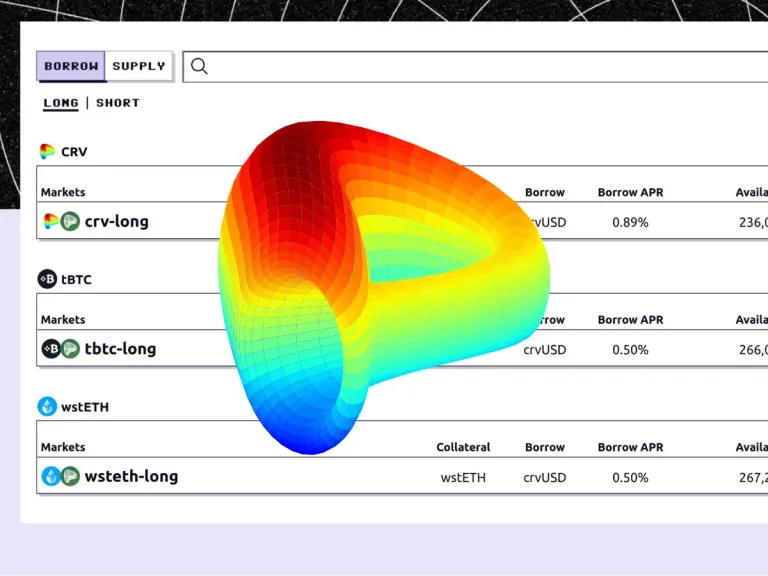

Course Introduction:Stablecoin AMM blue-chip protocol Curve yesterday released its own lending market CurveLend. Unlike traditional lending platforms such as Aave, Curve adopts a unique liquidation mechanism to effectively reduce the risk of users being liquidated. In addition, Curve also allows users to freely open the lending market for various tokens, providing users with more flexible choices. The launch of CurveLend brings new lending tools to the cryptocurrency market, providing users with a wider variety of lending options and is expected to further promote the development of the DeFi ecosystem. Introduction to CurveLend CurveLend is a permissionless lending market. Users can use oracle prices to borrow crvUSD with any asset to achieve

2024-03-14 comment 0 821

Course Introduction:As we move deeper into 2024, the idea of utilizing Bitcoin (BTC) as collateral for lending is becoming increasingly common.

2024-11-05 comment 0 539

Course Introduction:The financial services company will start with $2 billion in lending.

2024-07-28 comment 0 1085