Stablecoin AMM blue-chip protocol Curve released its own lending market Curve Lend yesterday. Unlike traditional lending platforms such as Aave, Curve adopts a unique liquidation mechanism to effectively reduce the risk of users being liquidated. In addition, Curve also allows users to freely open the lending market for various tokens, providing users with more flexible choices. The launch of Curve Lend brings new lending tools to the cryptocurrency market, providing users with a wider variety of lending options and is expected to further promote the development of the DeFi ecosystem.

Introduction to Curve Lend

Curve Lend is a permissionless lending market. Users can use the oracle price to borrow crvUSD with any asset and realize long and short operations on the asset.

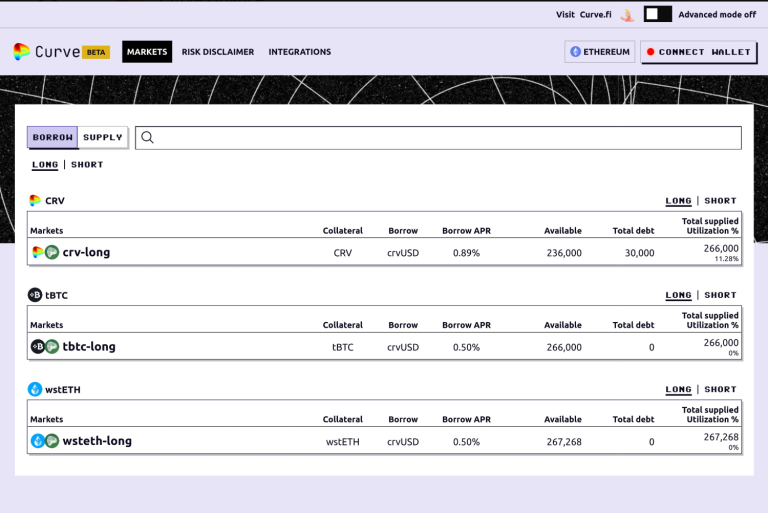

Curve Lend Lending Page

Curve Lend Soft Liquidation: LLAMMA

Curve Lend is built based on Curve’s unique liquidation algorithm LLAMMA. This algorithm injects the borrower's collateral into the AMM model and uses AMM automatic exchange for partial liquidation, thereby reducing the risk of full liquidation when the price of collateral fluctuates. The team calls this mechanism soft liquidation mode. Curve Lend's LLAMMA algorithm aims to reduce the impact of market fluctuations on collateral through intelligent liquidation methods, providing users with a more stable and sustainable lending experience. This unique clearing method brings a more robust and secure environment to the lending market and provides users with more reliable services. Through the application of the LLAMMA algorithm, the Curve team has brought a new lending model to the DeFi ecosystem, providing users with more protection and choices. Curve Lend

Traditional lending markets such as Aave need to strictly control the types of collateral tokens and ensure sufficient liquidity of the collateral to greatly reduce the risk of bad debts. Different from the traditional lending market, Curve Lned has its own liquidity due to LLAMMA's soft liquidation mechanism, so it is more receptive to types of collateral and can achieve a more diverse market. The team stated that it can lend any token supported by LLAMMA with crvUSD.

However, soft liquidation is not without its shortcomings. Once price fluctuations trigger soft liquidation, even if the price of the collateral later returns to its original state, because part of the handling fee is charged for transactions through AMM, there will be more capital wear and tear compared to the traditional lending market.

Curve Lend Design Architecture

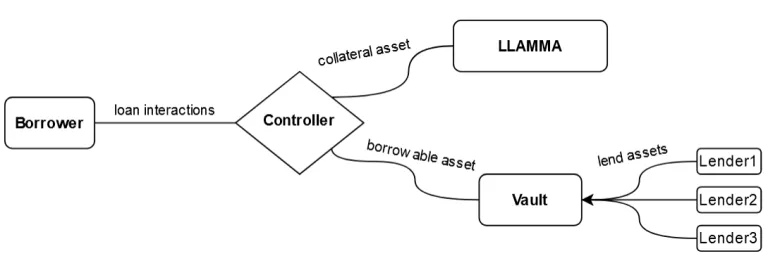

The entire system of Curve Lend is similar to the protocol for minting crvUSD. The lending market of each token has a separate controller (Controller), LLAMMA and vault (Vault). ).

Curve Lend design architecture

The controller is some kind of on-chain interface where most user operations occur. For example, creating a loan, repaying a loan, or managing an existing loan are all done through this contract.

LLAMMA is an AMM trading model that holds mortgage assets and is also the key to performing soft liquidation.

The treasury is a protocol for people who lend funds to provide assets. It adopts the ERC-4626 specification to improve composability and security. However, the contract does not actually hold any assets, but is held by the controller.

DeFi Development Strategy to Expand the Product Line

Curve Lend is a brand new product created by the team using the existing technical architecture to enter the relatively mature lending market with innovative products. However, the market’s acceptance of the advantages and disadvantages of soft liquidation remains to be seen over time.

In addition to the original stablecoin trading protocol, Curve continues to launch stablecoins, other cryptocurrency trading protocols, lending protocols, DAO governance protocols, etc., to improve the product line and meet the multi-faceted financial management needs of users.

Curve’s strategy is similar to Uniswap, Frax, and Alpacafinance. They all continue to launch diversified financial services, and their audiences are gradually segmented and niched to create special positioning.

It can be predicted that blue-chip DeFi protocols will continue to deepen and broaden their services in the financial field to serve the niche market of specific customer groups.

The above is the detailed content of Curve launches Curve Lend, a lending marketplace! Reduce risk with soft liquidation. For more information, please follow other related articles on the PHP Chinese website!