Original author: Delphi Digital

Original compilation: Luffy, Foresight News

## The #DeFi lending industry has been sluggish, largely due to complex multi-asset lending pools and governance-driven project decisions. Our latest report explores the potential of a new type of lending product – modular lending, revealing its features, design and impact.

The Current Situation of DeFi Lending

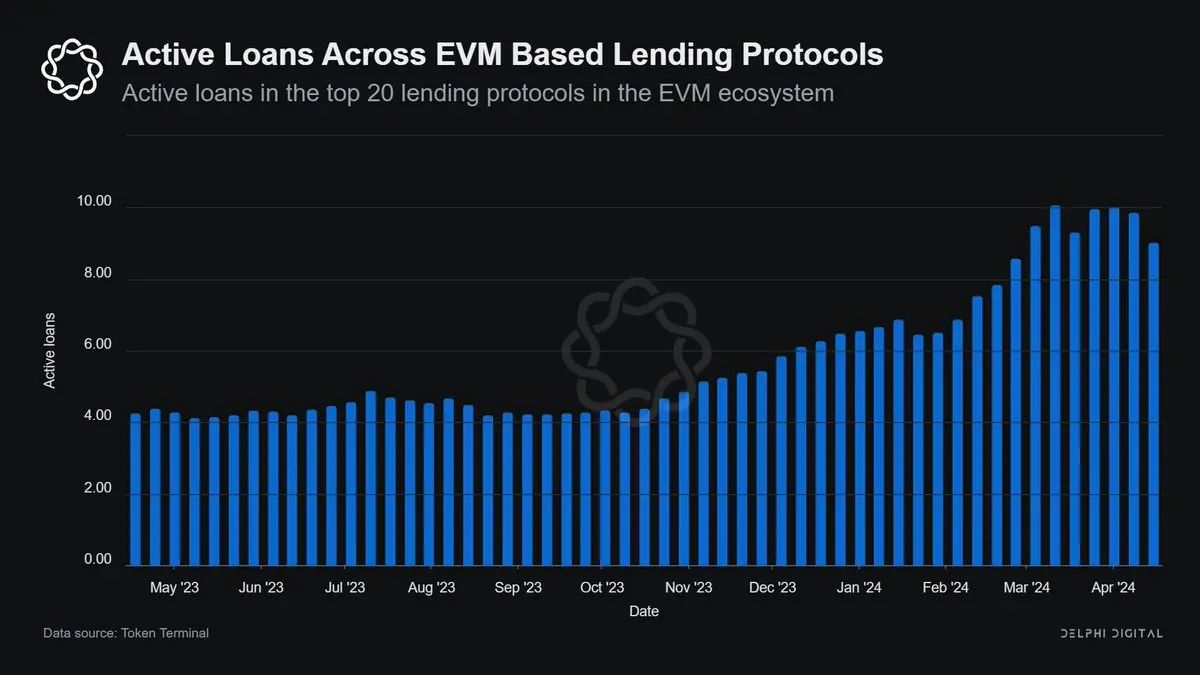

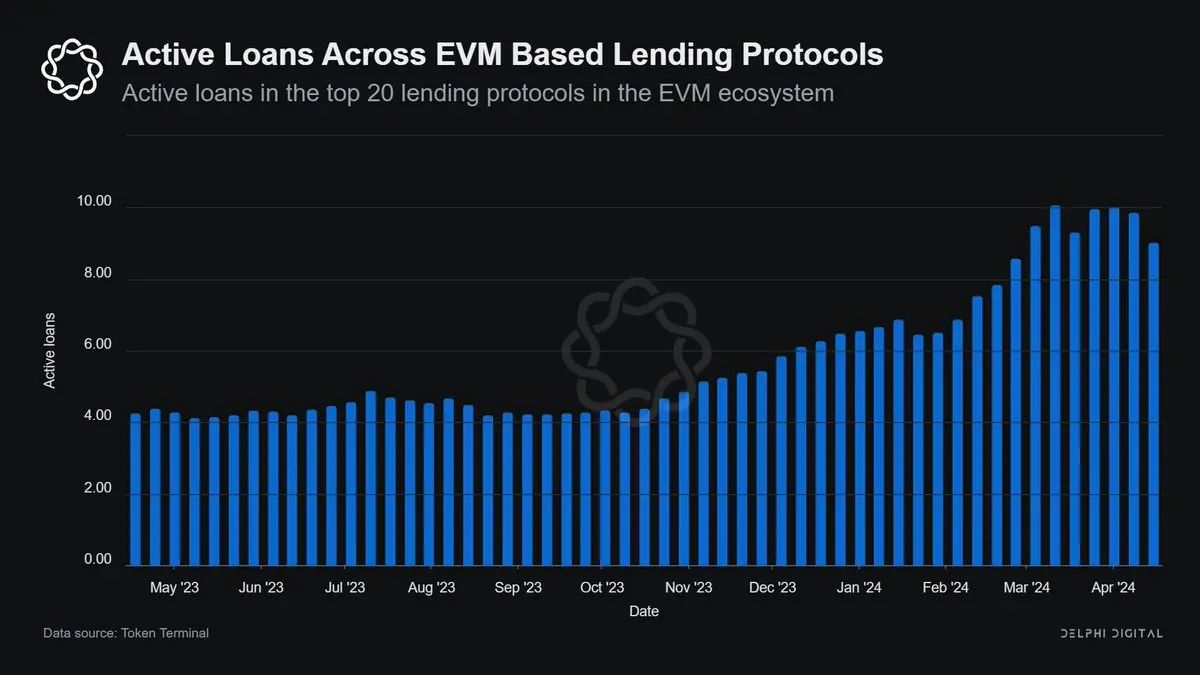

DeFi lending protocols are active again, with borrowing volume increasing by nearly 250% year-on-year, from US$3.3 billion in the first quarter of 2023 to US$115 in the first quarter of 2024 One hundred million U.S. dollars.

#At the same time, the need to whitelist more long-tail assets as collateral is also increasing. However, adding new assets significantly increases the risk of the asset pool, preventing lending protocols from supporting more collateral assets.

To manage additional risks, lending protocols need to employ risk management tools such as deposit/borrowing caps, conservative loan-to-value ratios (LTV), and high liquidation penalties. At the same time, isolated lending pools provide flexibility in asset selection but suffer from liquidity fragmentation and capital inefficiency.

DeFi lending is recovering from innovation, shifting from pure “permissionless” lending to “modular” lending. “Modular” lending caters to a wider asset base and allows for customized risk exposures.

The core of the modular lending platform lies in:

· The base layer handles functions and logic

· The abstraction layer and aggregation layer ensure user-friendly access to protocol functionality without Adding Complexity

The goals of the modular lending platform are: base layer primitives with a modular architecture that emphasizes flexibility, adaptability and encourages end-user-centric product innovation.

In the transition to modular lending, there are two main protocols worth paying attention to: Morpho Labs and Euler Finance.

The following will focus on the unique features of these two protocols. We dive into the trade-offs, all the unique features, improvements, and conditions required for modular lending to move beyond DeFi money markets.

Morpho

Originally launched as an improver on lending protocols, Morpho has successfully become the third largest lending platform on Ethereum with over $1 billion in deposits.

Morpho’s solution for developing a modular lending marketplace consists of two separate products: Morpho Blue and Meta Morpho.

Morpho’s Liquidity Amplification

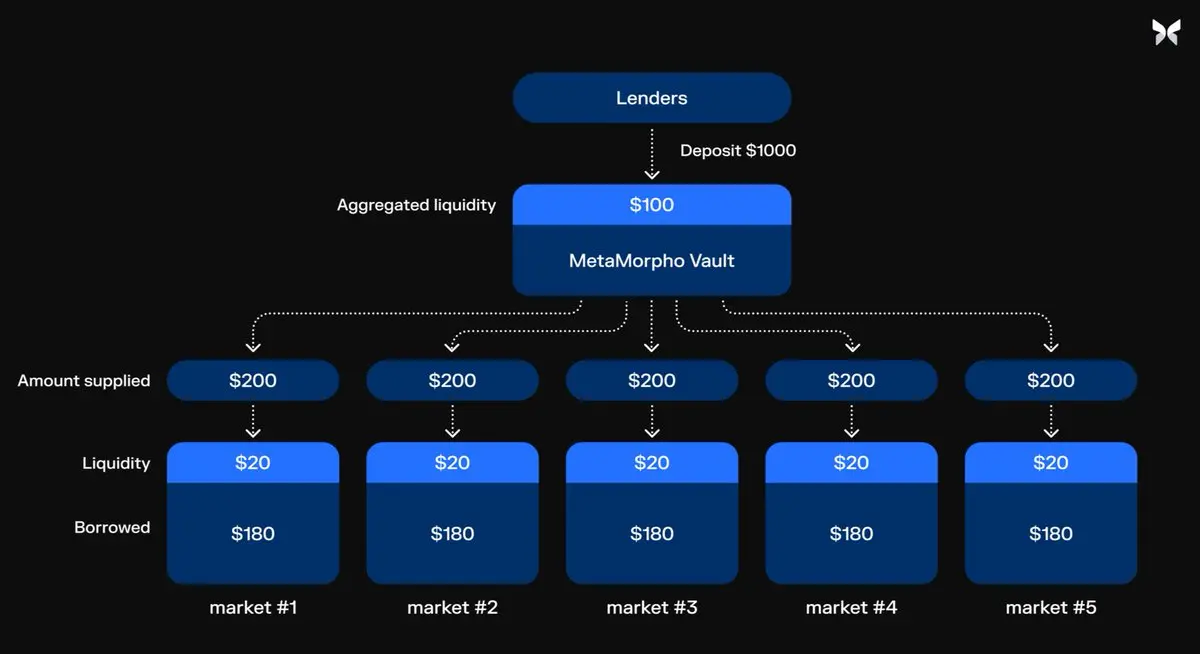

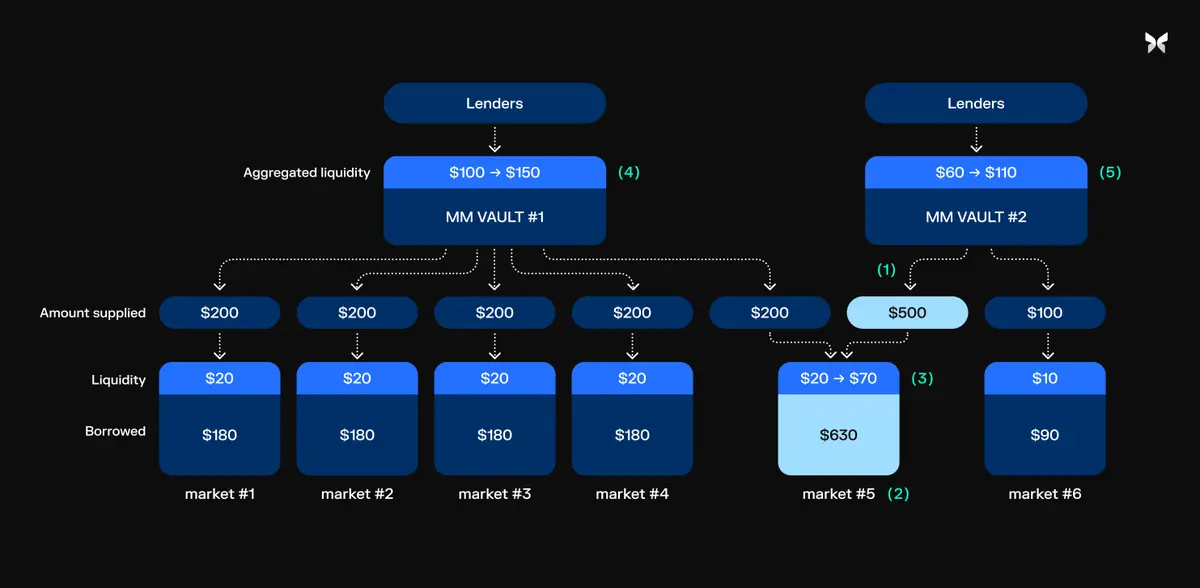

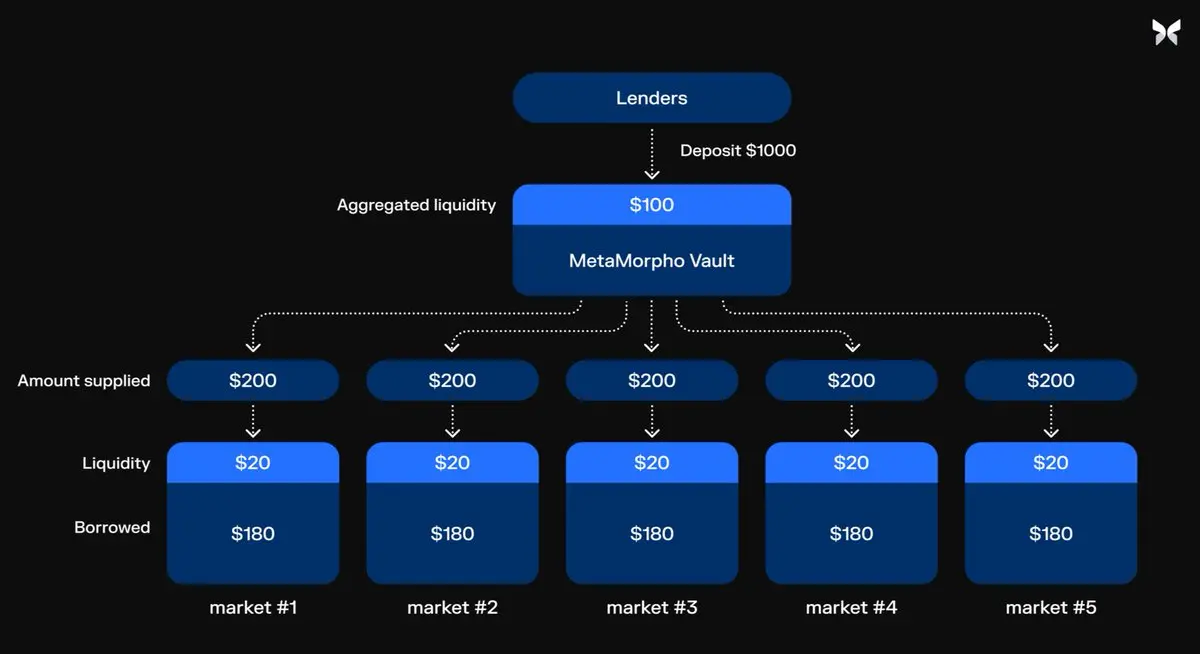

Before Morpho Blue, liquidity dispersion was the main criticism of the isolated lending market. But the Morpho team solved this challenge through aggregation at both the lending pool and vault levels.

Re-aggregating liquidity

Lending to isolated markets through MetaMorpho vaults avoids liquidity dispersion. Liquidity in each market is aggregated at the vault level, providing users with withdrawal liquidity comparable to multi-asset lending pools while maintaining market independence.

Sharing model expands liquidity beyond lending pools

Meta Morpho vault enhances lenders’ liquidity position to better than single loan pool. Each vault’s liquidity is centralized on Morpho Blue, benefiting anyone who lends to the same market.

Vaults significantly enhance lenders’ liquidity. As deposits accumulate on Blue, subsequent users deposit funds into the same market, increasing withdrawal funds for users and their vaults, freeing up additional liquidity.

Euler

Euler V1 changes DeFi lending by supporting non-mainstream tokens and a permissionless platform. Euler V1 was decommissioned due to a 2023 flash loan attack that cost it more than $195 million.

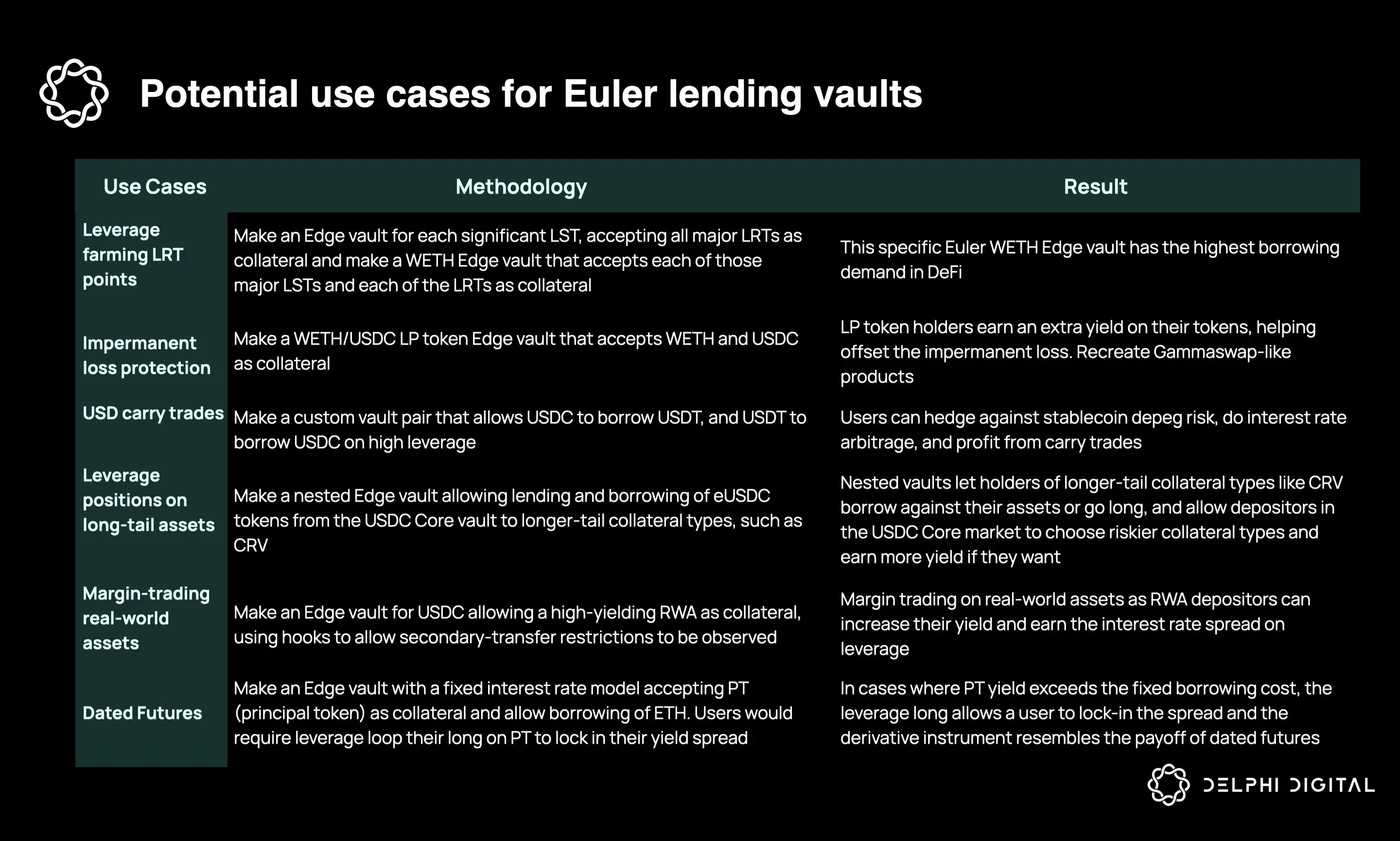

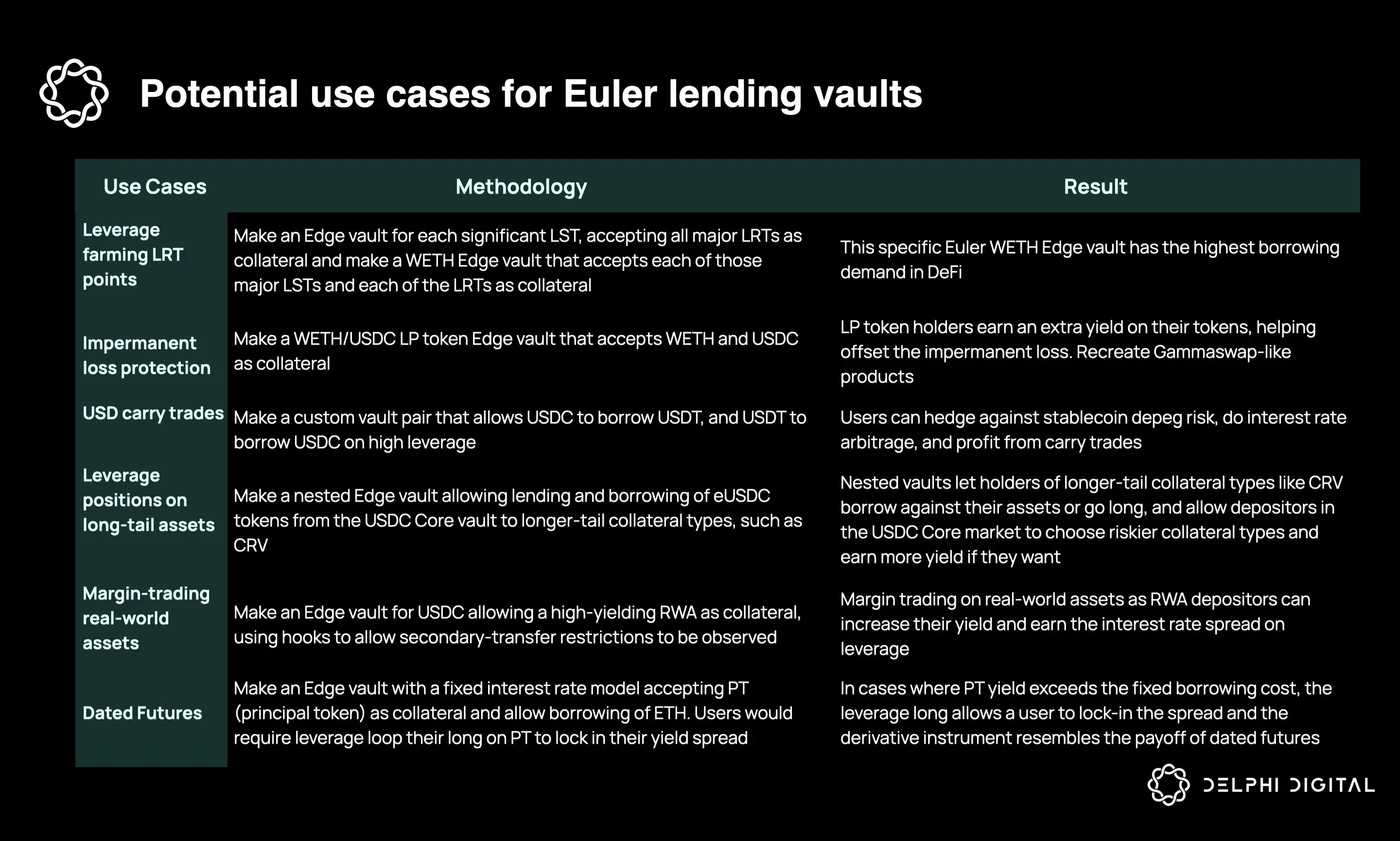

Euler V2 is a more adaptable modular lending primitive, including:

(1) Euler Vault Kit (EVK): allows permissionless deployment and customization of lending vaults.

(2) Ethereum Vault Connector (EVC): Enables vaults to connect and interact, enhancing flexibility and functionality.

Euler V2 is set to launch this year, and we’re curious how long it will take for it to gain a foothold in the competitive DeFi lending market.

The following is an overview of Euler V2 use cases, focusing on the unique DeFi products that can be achieved using Euler V2’s modular architecture.

Morpho and Euler comparison

Comparing Morpho and Euler side by side reveals their main differences, which are the result of different design choices. Both projects have mechanisms designed to achieve similar end goals, namely lower liquidation penalties, easier reward distribution and bad debt accounting.

Morpho’s solution is limited to an isolated lending market, a single clearing mechanism, and is primarily intended for lending of ERC-20 tokens.

In contrast, Euler V2 supports lending using multi-asset pools, allows custom liquidation logic, and aims to be the base layer for all types of fungible and non-fungible token lending.

The above is the detailed content of Delphi: Modular lending is the next stage of the DeFi market. For more information, please follow other related articles on the PHP Chinese website!