GIMI and Xiaomi are competing partnerships in some areas. Jimi focuses on the fields of smart projection and laser TV, and is a high-tech innovation enterprise integrating design, R&D, manufacturing, sales and service; while Xiaomi focuses on the research and development of smart hardware and electronic products, smart phones, smart electric vehicles, A global mobile Internet company building an ecological chain for Internet TV and smart homes. Although XGIMI and Xiaomi have the same word, there are differences in their establishment time, founder, and main product lines, and they are competitors in a sense.

The operating environment of this tutorial: Windows 7 system, Dell G3 computer.

GIMI and Xiaomi are competing partnerships in some areas.

Jimi (Chengdu Jimi Technology Co., Ltd.) was established in 2013 and is headquartered in Chengdu, China. It focuses on the fields of intelligent projection and laser TV. It is a design, A high-tech innovation enterprise integrating R&D, manufacturing, sales and service. Based on the mission of "letting light and shadow change life", Jimi is committed to breaking through limits and pursuing perfection. It has created a number of industry-leading innovative technologies in the field of intelligent projection and has won a total of 31 international awards, including Red Dot, iF, and Good Design Award. , IDEA world's four major industrial design awards. Currently, through a combination of online and offline retail, Jimi has users in many countries and regions around the world.

Xiaomi (Xiaomi Technology Co., Ltd.) was established on March 3, 2010. It focuses on the research and development of intelligent hardware and electronic products, smartphones, smart electric vehicles, Internet TV and smart phones. A global mobile Internet enterprise and innovative technology enterprise building a home ecological chain. Xiaomi has created a model that uses the Internet model to develop mobile operating systems and enthusiasts participate in the development and improvement.

"Born for fever" is Xiaomi's product concept. "Let everyone enjoy the fun of technology" is Xiaomi's vision. Xiaomi has applied the Internet development model to develop products, used the geek spirit to make products, and used the Internet model to eliminate intermediate links. It is committed to allowing everyone in the world to enjoy high-quality technology products from China.

The difference between Jimi and Xiaomi

Although Jimi and Xiaomi have the same word, there are differences in their establishment time, founder, main product lines, etc. They are not Enterprises in the same ecological chain.

1. Jimi was established in November 2013 and is mainly responsible for the production of smart projections; Xiaomi was established in March 2010. Its product line covers mobile phones, smart TVs, TV boxes, power banks and other smart hardware and consumer products. , finance and other fields.

2. The chairman of Jimi is Zhong Bo, and the location of Jimi is Chengdu, Sichuan; the chairman of Xiaomi is Lei Jun, and the location of Xiaomi is Beijing.

3. Jimi’s business scope is smart cinema products, while Xiaomi’s business scope is electrical appliances, digital products and software.

The confused Baidu system

"Ximi? Oh, it's the company in the Xiaomi ecological chain, right?"

Perhaps because of the similar names and the fact that the products were sold on Xiaomi Youpin, XGIMI, a non-Xiaomi company, often encounters such embarrassing situations. In fact, not only are XGIMI and Xiaomi not related in any way, they are also competitors in a sense.

One of the shareholders behind Jimi is Baidu.

Since its establishment in 2013, Jimi has received a total of 7 rounds of financing. Among them, Baidu Capital has entered the game since 2017 and has participated in investments three times through Baidu Venture Capital and Baidu Investment and M&A Department. Jing Kun, general manager of Baidu’s smart life business group, also joined Jimi and has been a director since June 2019.

The prospectus shows that before the IPO, Zhong Bo, founder and chairman of Jimi Technology, directly held 25.02% of the shares and actually controlled 46.34% of the voting rights of the shares. Baidu Netcom and Baidu KPMG hold a combined 15.48% stake in Jimi Technology, making it its largest institutional investor.

So, what is the strength of this Baidu company?

In terms of products and services, Jimi’s business includes intelligent projection products, projection-related accessories and Internet value-added services. Among them, XGIMI smart projection products mainly include smart micro-projection series (including H series, Z series, portable series, MOVIN series and other products), laser TV series (using laser light source, mainly used in home scenes such as living rooms) and innovative products Series (innovative products launched based on the characteristics of specific markets and application scenarios, such as ceiling lamps with integrated smart projection equipment).

In terms of operating income, from 2017 to 2020, Jimi’s revenue was 999 million yuan, 1.659 billion yuan, 2.116 billion yuan, and 2.828 billion yuan respectively, and its net profits were 14.4938 million yuan, 9.5172 million yuan, and 9340.48 yuan respectively. Ten thousand yuan, 269 million yuan. Jimi explained in the prospectus: "The growth in main business income mainly benefited from the growth in sales of projection equipment products."

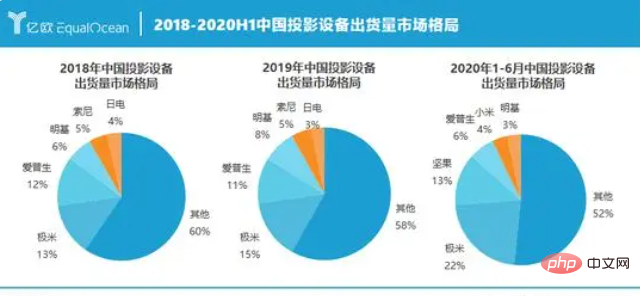

In terms of market share, Jimi has been at the top of China’s projection equipment market for three consecutive years. According to data from market research firm IDC, in the first half of 2020, the total shipment volume of China's projection equipment market reached 1.69 million units; among them, the top five brands in terms of shipments were XGIMI, Nut, Epson, Xiaomi and BenQ. The market shares are 22.2%, 12.8%, 6.3%, 3.8% and 3.3% respectively.

With the "gun" of intelligent micro-projection, Jimi was able to break out of the tight encirclement on the track. However, since XGIMI is more dependent on this category, if it wants to further expand its revenue scale, it needs to seize a higher market share. The market share gap between Jimi and its competitors is not too big, but this is obviously far from enough.

Be the “next Xiaomi”?

The gross profit margin that can be obtained from hardware products is very limited, so like most hardware manufacturers, Jimi also has a service heart.

According to the data released in Jimi’s prospectus, from 2017 to the first half of 2020, its Internet value-added services had the highest gross profit margin, followed by accessory products, and the gross profit margin of complete machine products was the lowest. "The more 'marginal' products the company has, the higher the gross profit margin. Jimi is very similar to Xiaomi in this regard," said Wang Qiang (pseudonym), an industry insider.

Although it can be seen that Jimi is trying to increase the gross profit margin of its complete products, it was still less than 30% as of the first half of 2020. The profit margins brought by Internet value-added services are very attractive, with gross profit margins as high as 87.77% in the first half of 2020.

In this regard, Jimi explained in the prospectus: “Since the company’s Internet value-added service business does not include traditional raw material procurement, operating costs mainly consist of providing support services for products (such as leasing cloud data services) and a small amount of Labor costs are incurred and the amount is small, so the gross profit margin is maintained at a high level."

Provide Internet services through hardware products to obtain higher gross profit margins. This approach is similar to Xiaomi. "It can be said that XGIMI Technology is trying to be the next Xiaomi." Wang Qiang said.

However, the difference between the two is that Xiaomi's Internet services have achieved a certain scale, thus filling the gap of low gross profit margin of hardware products; however, Jimi's Internet value-added services business currently accounts for a relatively small proportion and has not yet formed Significant scale effect is one of the difficulties that Jimi has to overcome.

And compared with Xiaomi’s AIoT ecosystem, XGIMI, which focuses on smart micro-projection business, has certain limitations. This is mainly due to the fact that the social attributes of the projector itself are not strong.

"Without the barrier of social attributes, consumers will pay more attention to the hard indicators of the product itself." Wang Qiang said, "For Jimi, it is very important to have strong R&D capabilities."

From the perspective of R&D capabilities, although most of Jimi's production was in the form of outsourced processing in the early days, the proportion of its independent production has increased significantly in recent years.

“A few years ago, Jimi reduced costs and increased gross profits by developing core components by itself.” The above-mentioned Jingwei China related person said, “With the rapid growth of Jimi’s sales, the company has gradually moved towards Expand the upstream of the industrial chain and increase the construction of its own optical machine production capacity." According to the prospectus data, by the first half of 2020, XGIMI's self-developed optical machines accounted for close to 60%.

But a major problem faced by Jimi in terms of R&D capabilities is the risk of "stuck neck" where core technology is controlled by others.

Currently, mainstream consumer-level projection equipment uses DLP projection technology, and its core patents are in the hands of Texas Instruments (TI). The DMD devices used by XGIMI are produced by TI. Although the two parties have established a long-term cooperative relationship, Jimi still admitted in the prospectus that "the company has raw material procurement risks."

From this point of view, if Jimi wants to follow the path of Xiaomi, it still has a long way to go.

Where is Jimi going?

Tianfeng Securities research report believes that intelligent projection equipment, with its characteristics such as large screen and eye protection, is quite popular in entertainment scenarios such as film and television. It has natural advantages over mobile network devices such as mobile phones and tablets, and has gradually become an important Internet content platform.

But in today’s smart micro-investment market, in addition to Jimi, there are also players such as Epson, Nut, BenQ, NEC, Xiaomi, etc., fighting in a melee, and no real overlord has yet emerged. To stand out, Jimi needs to continuously enhance its competitive advantages.

“For the smart micro-investment market, players need to form a certain extension.” Yang Ge, founder of Xinghan Capital, told EqualOcean.

Judging from the prospectus, Jimi will further expand its product line. This time, Jimi plans to raise a total of 1.2 billion yuan, of which 1 billion yuan will be invested in hardware-related "intelligent projection and laser TV series product R&D and upgrade industrialization projects" and "optical machine R&D center construction projects."

At the same time, Jimi is also stepping up its efforts to expand sales channels. Currently, Jimi is mainly sold online through platforms such as JD.com and Tmall. The prospectus shows that Jimi plans to promote the construction of offline channels, explore channel expansion methods such as franchise stores, and further consolidate online sales channels.

However, Yang Ge said: "Smart micro-investment is a very vertical industry. The more vertical the track, the lower its total market capacity."

In order to expand the market space in the limited track, Jimi is extending its tentacles to overseas markets. In the prospectus, Jimi stated: "The company will implement market development plans in the future to further consolidate its position as the number one projection equipment market share in China, and at the same time actively explore and develop other regional markets such as Europe, North America and Japan."

Expanding overseas markets is not easy. "There may be considerable challenges for Chinese smart projection equipment players to enter the European and American markets, because there are already giant competitors with technological and cultural advantages in this market." Yang Ge said, "But if players choose to enter the Southeast Asian market, opportunities will Much bigger."

Conclusion

Looking at the overall situation, the attacking Jimi is just a microcosm of China's smart micro-investment market.

In recent years, China's projection equipment market has developed rapidly. IDC data shows that the average annual compound growth rate of China's projection equipment shipments from 2011 to 2019 reached 14.19%, and the industry space is gradually opening up.

"In this market, it is really difficult to increase gross profit margins purely by relying on hardware. If players are not careful, they will fall into a vicious cycle of price wars." Wang Qiang said with emotion, "The entire smart micro-investment market It has not yet entered the most brutal stock stage where leading manufacturers are fighting.”

After all, Jimi is not Xiaomi, and will even face competition from Xiaomi’s brands. To carve its name in the smart micro-investment market, it needs to find its own path.

For more related knowledge, please visit the FAQ column!

The above is the detailed content of What is the relationship between Jimi and Xiaomi?. For more information, please follow other related articles on the PHP Chinese website!

How to flash Xiaomi phone

How to flash Xiaomi phone

Edge browser cannot search

Edge browser cannot search

What is the interrupt priority?

What is the interrupt priority?

How to set header and footer in Word

How to set header and footer in Word

What is the difference between a router and a cat?

What is the difference between a router and a cat?

Introduction to frequency converter maintenance methods

Introduction to frequency converter maintenance methods

The main function of the arithmetic unit in a microcomputer is to perform

The main function of the arithmetic unit in a microcomputer is to perform

Binary representation of negative numbers

Binary representation of negative numbers