This site (120BTc.coM): Securitize, an American asset tokenization company, announced yesterday (1) that it had successfully completed US$47 million in financing from asset management giant BlackRock Lead investment.

Participating investments also include two listed companies: Hamilton Lane (HLNE), one of the world's largest private equity market investment companies, and fixed income trading platform Tradeweb Markets (TW), as well as influential companies in the crypto market. of ParaFi Capital, Aptos Labs, Circle and Paxos.

This investment is an important step for BlackRock to further actively enter the field of real world assets (RWA) after launching the Bitcoin spot ETF and the tokenized fund BUIDL in cooperation with Securitize.

BlackRock Global Strategy Head Becomes Securitize Board Member

As part of the investment, Joseph Chalom, BlackRock’s head of global strategy ecosystem partnerships, has been appointed to Securitize, Securitize said in a statement. Member of the board. In this regard, Chalom said: At BlackRock, we believe that tokenization has the potential to drive major changes in capital market infrastructure, and our investment in Securitize is another step in the development of our digital asset strategy. We are excited to lead this investment round along with other participants and help drive innovation to meet the future needs of our customers.

Securitize said it will use funds from this round to accelerate product development, expand its global footprint and further strengthen its partnerships in the financial services ecosystem. Securitize co-founder and CEO Carlos Domingo said: We will continue to promote the digitization of capital markets through tokenization. We believe that the transformative potential of blockchain technology to reshape the future of finance, especially tokenization, is promising.

BUIDL becomes the first tokenized U.S. Treasury bond fund

This round of financing coincides with BlackRock’s first tokenized fund launched on Ethereum - BlackRock USD The launch of the Institutional Digital Liquidity Fund (BUIDL), which investors can subscribe to through Securitize. BUIDL seeks to provide a stable value of $1 per token and pay out daily accrued dividends as new tokens directly into investors’ wallets every month.

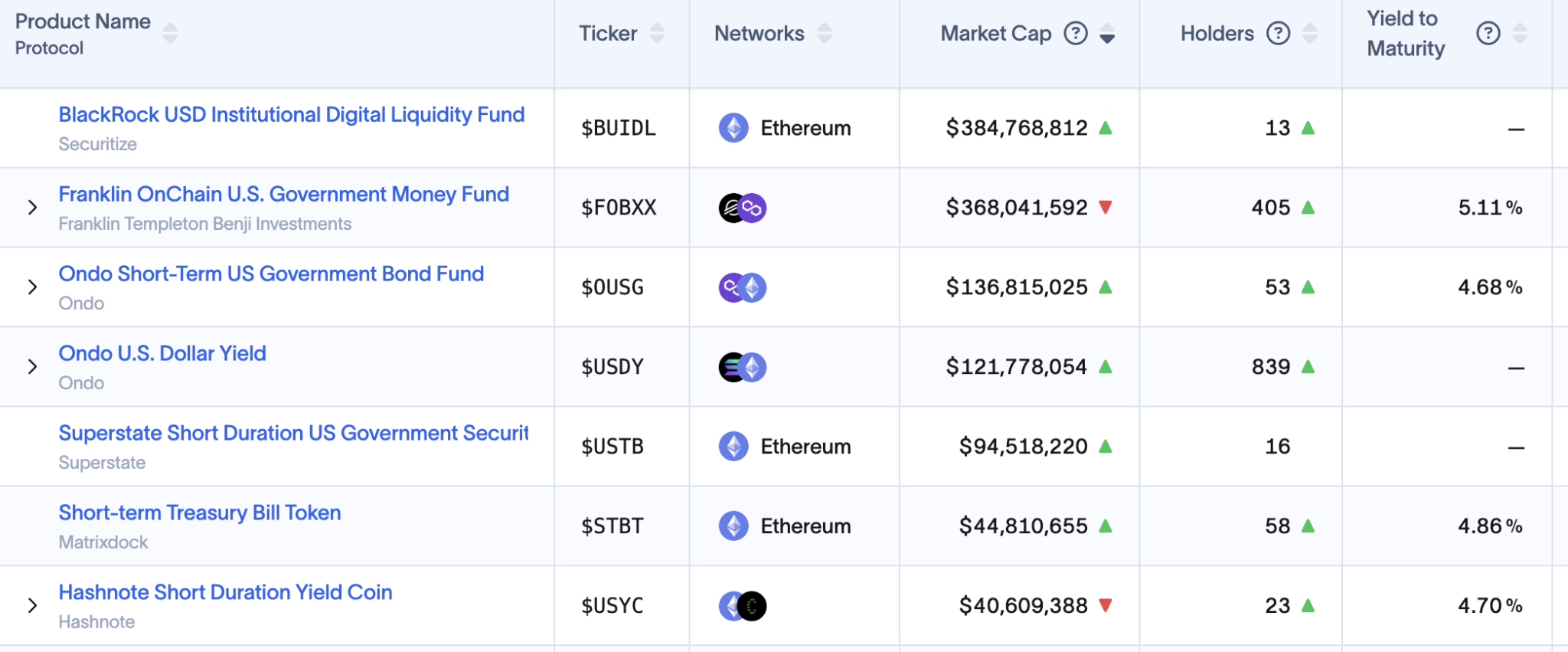

The fund invests 100% of its total assets in cash, U.S. Treasury bonds and repurchase agreements, allowing investors to earn income while holding tokens on the blockchain. At present, BUIDL has only been launched for less than a month and a half, and its market value has reached US$384 million. It has overtaken Franklin's "Franklin On Chain US Government Money Fund (FOBXX)" established in June 2021 and became the largest in scale. Large tokenized Treasury bond fund.

Investors can transfer their BUIDL tokens to other qualified investors 24/7/365, through Circle, and can also redeem them for USDC with flexible custody options , allowing them to choose how to hold their tokens.

Currently, according to the RWA.xyz website, U.S. Treasury bonds have been tokenized through 30 products, with a current value of up to US$1.289 billion, up 5.36% in the past week.

The above is the detailed content of Capture the RWA market! BlackRock leads Securitize in completing $47 million in financing, BUIDL becomes largest tokenized U.S. bond fund. For more information, please follow other related articles on the PHP Chinese website!