php editor Apple brings you tips on tax refund application! The personal income tax refund process is simple and easy to understand. You only need to prepare relevant materials, such as ID cards, bank cards, etc., and then go to the local tax bureau to apply. After filling out the application form and submitting the materials, just wait patiently for the tax refund to arrive. Remember to carefully check the information before making a tax refund to ensure it is accurate to avoid affecting the tax refund progress. I hope this application guide can help you successfully complete the personal income tax refund process!

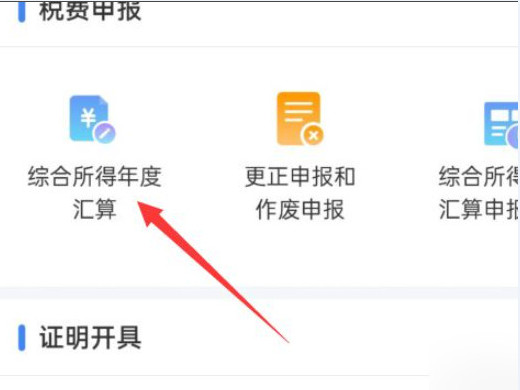

Select the comprehensive annual settlement on the tax processing page in the APP, then log in to your account and select the year to declare to make an appointment.

Model: iPhone 13

System: IOS15.3

Version: IIT 1.8.0

1First open the personal income tax APP and click on tax processing at the bottom of the homepage.

2Then find and click the comprehensive annual settlement option on the pop-up page.

3Then register and log in to the account on the pop-up page.

4Next select the year to declare.

5Finally, click on the pop-up page to make an appointment.

1Personal income tax is a type of tax paid by individuals after receiving income. As independent individuals with social attributes in today's society, we need to use various services provided by various relevant departments of the country. Most of these services are basically free. Of course, these services are free for everyone, but they will also consume my country's financial expenditure. Therefore, whenever we make a profit, we have to pay taxes.

Comprehensive income includes various income items, such as wages and salaries, labor remuneration, author remuneration income and royalties. Before June 30 of each year, an application needs to be submitted for annual settlement.

The above is the detailed content of How to apply for tax refund How to apply for personal income tax refund. For more information, please follow other related articles on the PHP Chinese website!