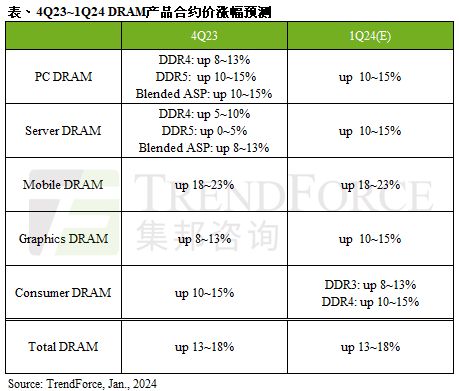

According to news from this site on January 9, TrendForce recently released a report, predicting that global DRAM contract prices will increase by 13-18% month-on-month in the first quarter of 2024, with Mobile DRAM continuing to lead the increase.

TrendForce reported that the original manufacturer believes that the demand outlook for 2024 is still unclear, and it is still necessary to continue to reduce production to maintain the supply and demand balance in the memory industry.

This site attaches the following information on DRAM:

Since the DDR5 order demand has not been met, At the same time, buyers expect that the price of DDR4 will continue to rise, driving the buyer's momentum to continue purchasing. However, due to the gradual upgrade of machine models to DDR5, the purchase volume of DDR4 bits may not necessarily expand.

However, since the selling prices of DDR4 and DDR5 have not yet reached the original manufacturers’ targets, and buyers can still accept continued increases in the first quarter, the overall PC DRAM contract price is expected to increase quarterly by about 10~15%. Among them, the increase of DDR5 will be slightly higher than that of DDR4.

Due to the focus of buyers last year on accelerating the elimination of DDR4, the proportion of DDR5 inventory in the fourth quarter of 2023 has risen to about 40%, compared with 20~25% of the market Penetration rate, it is obvious that the market demand has not yet been fully realized.

However, original manufacturers continue to reduce DDR4 supply and significantly increase DDR5 output in order to improve profitability, causing the server DRAM contract price to expand to 10~15% quarter-on-quarter in the first quarter of 2024.

However, some original manufacturers negotiated prices earlier, which made the contract price benchmark in the fourth quarter of last year higher. Therefore, the price increase of some manufacturers in the first quarter of 2024 was about 8~13% month-on-month.

Since the contract price is still at a relatively low level in history, buyers are more inclined to continue to establish safe and relatively low-priced inventory levels, so the purchase demand continues to increase, so the first Mobile DRAM demand continued unabated in the third quarter.

As buyers actively purchase, supply and demand have become tight. However, due to the uncertainty in the future of the smartphone market, original manufacturers dare not rush to resume full production.

On the other hand, the semiconductor manufacturing process takes a long time, and the tight supply and demand situation is difficult to alleviate in the short term, which will be beneficial to the price increase of original manufacturers.

Therefore, it is estimated that the contract price of Mobile DRAM in the first quarter will increase by about 18~23% month-on-month, and it is not ruled out that the month-on-month increase may expand due to the oligopoly market structure or the panic pursuit of prices by brand customers.

As buyers continue to stock up under the continued upward trend, the demand for the mainstream specification GDDR6 16Gb is still strong, and the purchasing mentality is generally willing to accept the increase. It is estimated that in the first quarter Graphics DRAM contract prices increased by approximately 10~15% quarterly.

TrendForce TrendForce observes that Graphics DRAM has no signs of falling prices in the short term. The current momentum of shipments is mainly driven by buyers’ advance stocking. In addition, Graphics DRAM is a shallow market product, so special attention needs to be paid to subsequent terminal consumption. Can the sales momentum of electronic products keep up?

The original manufacturers have strongly raised the contract price, prompting buyers to prepare goods in advance, and the momentum of the purchase has improved. However, the first quarter coincides with the off-season of the industry. It is expected that in the case of weak terminal sales, buyers' strategy of stocking up in advance will lead to an increase in inventory.

Original manufacturers generally believe that due to the quarter-to-quarter expansion of HBM and DDR5 penetration in 2024, low-margin DDR4 production capacity will be squeezed out and cause shortages. Therefore, the quarterly increase in the contract price of DDR4 in the first quarter will be higher than that of DDR3. , about 10~15%.

There are still manufacturers that continue to supply DDR3, and the general inventory level is still high. The contract price in the first quarter increased by about 8~13% quarter-on-quarter.

The above is the detailed content of 2024Q1 DRAM contract price is expected to increase by 13-18% quarter-on-quarter: TrendForce provides estimated data. For more information, please follow other related articles on the PHP Chinese website!

How to check memory

How to check memory

What are the video server configuration parameters?

What are the video server configuration parameters?

How to use HttpCanary packet capture tool

How to use HttpCanary packet capture tool

What are the formal digital currency trading platforms?

What are the formal digital currency trading platforms?

Computer prompts that msvcr110.dll is missing and how to solve it

Computer prompts that msvcr110.dll is missing and how to solve it

Springcloud five major components

Springcloud five major components

What are the advantages of the Spring Boot framework?

What are the advantages of the Spring Boot framework?

How to solve the problem of 400 bad request when the web page displays

How to solve the problem of 400 bad request when the web page displays