Author/Baked Buns under the Starry Sky

Editor/Spinach’s Starry Sky

Typesetting/Yakult under the starry sky

Let’s ask who is the darling of the capital market in the first half of this year. With the popularity of ChatGPT, artificial intelligence (AI) has received widespread attention. Looking for 10-fold stocks in the AI track has become something that investors talk about after dinner.

AI is becoming popular, and the demand for AI computing power will also increase accordingly. Furthermore, the AI server that has been hidden behind has recently surfaced. The most intuitive thing is its price. In less than a year, , the price of AI servers has increased nearly 20 times.

So can the AI server really take off as successfully as imagined? The author will take you to find out.

1. Players are flying fast, don’t dare to neglect

The most essential reason behind the price increase of AI servers is the imbalance of supply and demand.

GPU is the core component of AI server. Big players Nvidia and AMD have been slow to expand their production capacity in GPU products, but they also have high technical barriers (it is difficult for others to achieve the performance of their products), resulting in limited GPU supply and rising prices.

Sensitive players in the industry will naturally not let go of this opportunity to enjoy bonuses. Last year, NVIDIA's net profit was close to US$10 billion, a year-on-year increase of 125%, and its revenue also increased by 61%, achieving an increase in revenue and profit. Moreover, NVIDIA's stock price has risen by more than 90% this year, making it the stock with the worst losses for short sellers. Faced with the imbalance between supply and demand, downstream players also began to frantically look for solutions. For example, Oracle and Microsoft have recently begun brainstorming, saying that if either of the two companies runs out of computing power, they can rent AI servers from each other to cope with the shortage of server supply.

Domestic players are also galloping on this track. For example, Inspur Information (000977) provides efficient computing power support for Baidu's "Wen Xin Yi Yan" and is also planning a larger-scale liquid cooling base. However, due to the reduction in shipment demand in the first quarter, its revenue and net profit in the first quarter were Profits have dropped by more than

35%, which makes people faintly worried.

Inspur Information Stock Price Situation

Friends who are familiar with computer structure know that servers are generally composed of processors, memory, chipsets, hard drives, etc. For an ordinary server, the CPU and chipset account for about

50%of the production cost. However, with the emergence of AIGC, the complexity of AI models has been recognized by more people, which has also driven the rapid growth of computing power demand. According to statistics, in the past 10 years, with the surge in computing resources for AI training models, the computational complexity of AI training has increased by more than

10 timeson average every year.

Global computing power continues to grow As the complexity increases, the scale of the AI server can naturally be imagined. Last year, the scale exceeded

As the complexity increases, the scale of the AI server can naturally be imagined. Last year, the scale exceeded

, accounting for about 17% of the total server market, and the growth rate exceeded 40%. Compared with the dominance of traditional server CPUs, GPUs, which are more suitable for AI servers (using computationally intensive and easy-to-parallel programs), have become the dominant players. The market share of GPU servers is approximately 90%. According to predictions by professional institutions, with the large-scale implementation of AIGC, autonomous driving, Internet of Things and other technologies in the future, the demand for global AI servers will increase day by day, with the growth rate exceeding

10%in the next three years. The growth in shipments has basically become the consensus in the industry.

AI Server Number Forecast

Although it is an indisputable fact that the demand for shipments is increasing, the shortage of upstream GPUs from time to time has affected the shipments of AI servers.

For example, the Inspur information we mentioned at the beginning, GPU purchases from NVIDIA accounted for

24% of total purchases in 2021. In the first quarter of this year, there was a certain performance decline due to upstream supply issues. . But having said that, Nvidia’s product capabilities are also obvious to all in the industry. For example, its three generations of GPU chips V100, A100 and H100 can be used for AI model training and reasoning. The latest generation of H100 is about ## faster than A100. #3 times.

NVIDIA GPU chip 1/3 than the A100. In addition, Nvidia's delivery cycle has also been lengthened to three months or more.

90% in Alibaba, Tencent, and Baidu AI servers. In the upstream GPU field, Tsinghua Unigroup (000938) has various types of GPU servers to meet various AI scenario applications. The parameters of many products are gradually approaching those of NVIDIA, but compared to accounting for about 80% of the global market share Nvidia still has a long way to go.

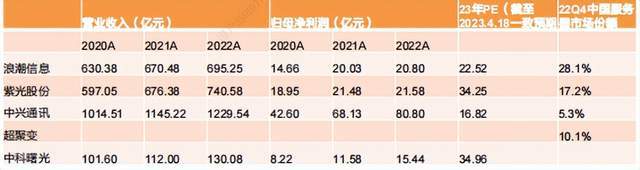

Server player comparison

The above is the detailed content of Prices have risen sharply, where is the future for AI servers?. For more information, please follow other related articles on the PHP Chinese website!