Found a total of 10000 related content

Comparison and risk assessment of grid trading and Martin trading

Article Introduction:In order to help you trade better in the market, the exchange provides you with two strategies: grid trading and Martin trading, which are designed to help you get better returns in a bear market, although the purpose is to get returns. , but there are also some differences. What is the difference between grid trading and Martin trading when investors understand it? In order to better meet your investment needs, the difference between grid trading and Martin trading is that the former is based on price fluctuations to establish orders and hedge risks, while the latter is based on the increase or decrease in transaction amount to manage risks and profits, and then small The editor will tell you in detail. What is the difference between grid trading and martin trading? Grid trading and Martin strategy are two different trading strategies with different principles and execution methods. Their difference mainly lies in the original

2024-01-26

comment 0

1311

What are the techniques for contract trading?

Article Introduction:Learn the advanced techniques of contract trading and improve your trading winning rate and profit potential. This article introduces seven strategies, including: quantitative trading, arbitrage trading, hedging trading, algorithmic trading, high-frequency trading, community trading and planned trading. By employing these techniques, traders can take advantage of market volatility, reduce risk and maximize returns.

2024-12-13

comment 0

337

Contract trading steps

Article Introduction:Steps to get started with contract trading, including choosing a platform, opening an account and making a deposit.

The basics of contract trading, covering key concepts, risks and rewards.

Contract trading operation guide, breaking down order placement, position management, and stop-profit and stop-loss.

2024-12-13

comment 0

194

In-depth explanation of what is the difference between currency-to-crypto trading and perpetual contract trading?

Article Introduction:Coin and Perpetual are two of the most popular methods in the cryptocurrency market, but it is difficult for a novice to figure out what is the difference between Coin and Perpetual? Making it difficult to make a choice, crypto-to-crypto trading is generally a relatively simple and straightforward method of trading in which traders earn profits or take risks through actual cryptocurrency holdings and transfers. Perpetual contracts increase the possibility of investors making profits or losses because they support leveraged trading. To put it simply, the difference between the two mainly lies in four aspects: trading methods, trading objects, leverage and margin, as well as risk and arbitrage. Next, the editor will lead you to an in-depth explanation of the differences between currency-to-crypto trading and perpetual contract trading. What is the difference between currency-to-crypto trading and perpetual contract trading? Cryptocurrency trading and perpetual contract trading are two different cryptocurrency trading parties

2024-03-14

comment 0

648

What is the difference between contract trading and spot trading?

Article Introduction:Contract trading involves buying and selling contracts that represent the future value of the underlying asset and carry higher risks and potential rewards. Spot trading, on the other hand, involves buying and selling underlying assets directly, with lower risk and no leverage.

2024-12-13

comment 0

219

What are the currency trading systems?

Article Introduction:The coin trading system assists cryptocurrency traders by simplifying the trading process through features such as automated trading, technical analysis, risk management, arbitrage systems and social trading platforms. When choosing a trading system, you should consider strategy, level of automation, risk management tools, cost, and support. Using a trading system helps save time and energy, improve discipline, optimize trading strategies, manage risks and gain insights.

2024-04-17

comment 0

436

What is contract trading and what are its characteristics? Contract trading: a leverage tool in the currency circle

Article Introduction:Contract trading is a type of financial derivative that allows traders to trade without holding the underlying asset. In the cryptocurrency space, contract transactions often use cryptocurrencies as the underlying asset. Compared with spot trading, contract trading has the characteristics of high leverage, two-way trading, perpetual contracts and good liquidity. Contract trading has the advantages of amplifying profits, hedging risks and trading flexibility, but it also has risks such as high leverage risk, liquidation risk and violent fluctuations.

2024-12-13

comment 0

191

What is contract trading? Read what is contract trading.

Article Introduction:Contracts trading is an advanced form of cryptocurrency trading that offers experienced traders the potential to gain leverage, hedge risk and pursue profits. Contracts are financial derivatives that represent the future price of an asset or currency pair, and traders can bet that the price will increase (long position) or decrease (short position). Features of contract trading include leverage (amplifying potential profits and losses), hedging capabilities (reducing the risk of spot positions), various contract types (based on stocks, commodities, FX or cryptocurrencies) and the importance of risk management.

2024-12-13

comment 0

488

Key Features of Contract Trading

Article Introduction:This article provides a comprehensive analysis of the key features of contract trading, from bilateral trading mechanisms, margin requirements and leverage, to settlement prices and different contract types. Contract trading provides two-way trading, leverage and risk management tools, but it also has risks such as volatility, leverage risk and liquidation mechanisms. Understanding these characteristics is critical to participating in contract trading, as it is a complex and high-risk method of trading.

2024-12-13

comment 0

288

Which is more suitable for beginners, contract trading or spot trading?

Article Introduction:Contract trading and spot trading are two different investment strategies, and it is important for beginners to understand their differences. Contract trading is a derivatives transaction that allows speculation on price movements without owning the underlying asset, whereas spot trading involves buying and selling the underlying asset, with the buyer and seller exchanging the asset immediately after the transaction is completed. Factors such as risk tolerance, experience level, target rate of return, and time investment need to be considered when evaluating which type of trading is more suitable for beginners. For beginners with low risk tolerance, inexperience, seeking stable yields and limited time, spot trading is more suitable. For beginners with high risk tolerance, certain market knowledge, pursuit of high profit potential and sufficient time, contract trading is an option worth considering.

2024-12-13

comment 0

922

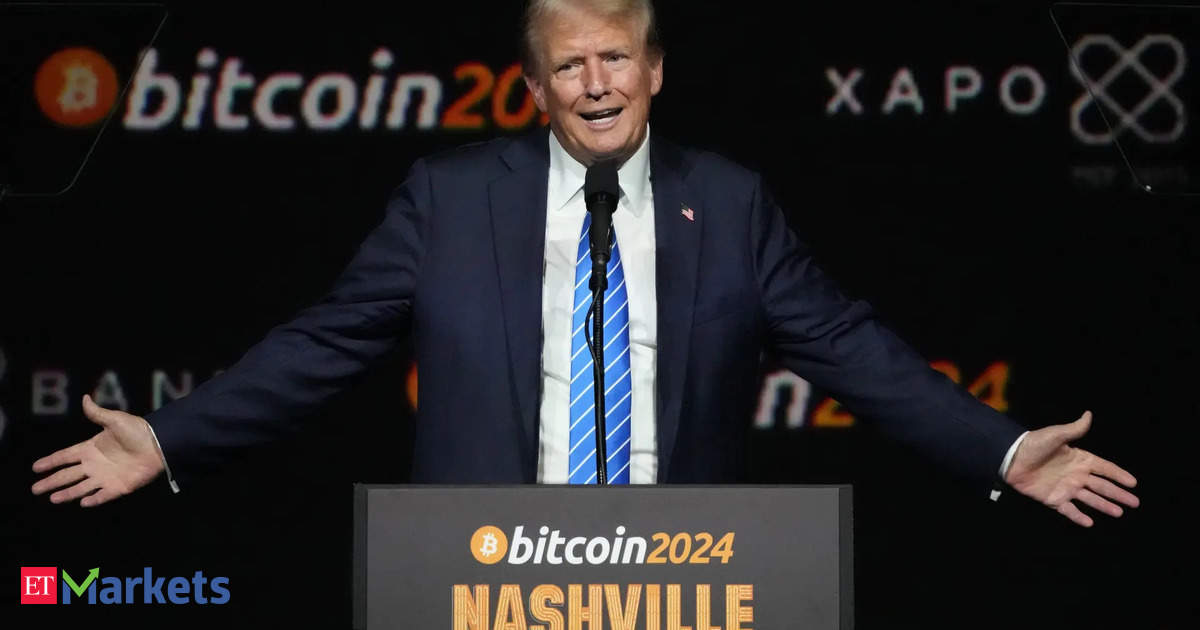

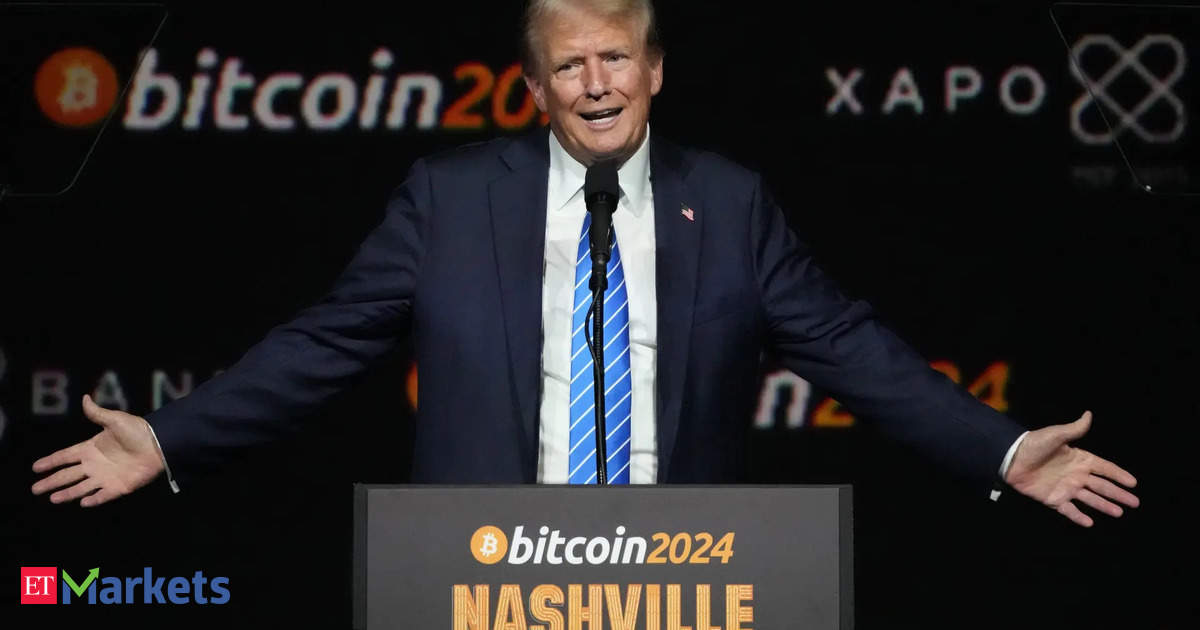

Is Bitcoin Trading Legal?

Article Introduction:The legality of Bitcoin trading depends on your jurisdiction. In mainland China, Bitcoin trading is illegal, but in many other countries and regions, Bitcoin trading is legal. For example, in the United States, Canada, Japan, Singapore and other countries, Bitcoin is regarded as a virtual commodity or asset that can be legally held and traded.

2024-03-14

comment 0

530

Summary of blockchain digital currency trading apps Ranking of the top ten blockchain digital currency trading software in 2024

Article Introduction:1. Blockchain digital currency trading apps include: Huobi, OKX, Binance, Bittrex, Kraken, Gemini, Bybit, KuCoin, Coinbase, and FTX. 2. Huobi Exchange: Provides digital asset trading, contract trading and other services, providing users with global digital currency trading services. 3. OKX Exchange: Provides a variety of trading services such as digital asset trading and futures contracts, and has a complete risk control system and security guarantee.

2024-07-15

comment 0

376

Ouyiokex contract trading explanation

Article Introduction:Contract trading is a type of derivatives trading that allows traders to trade the underlying asset on margin without taking ownership. OKEx provides contract trading products such as perpetual contracts, delivery contracts and options contracts. Contract trading involves selecting the underlying asset, contract type, margin, direction, and setting risk management measures. The advantages of contract trading include leverage trading, two-way trading and risk hedging, but there are also leverage risks, liquidation risks and market risks. Before trading contracts, you need to have a thorough understanding of the mechanics and risks, and adopt appropriate risk management strategies.

2024-07-22

comment 0

890

Top ten digital currency trading apps

Article Introduction:1. The top ten platforms for digital currency trading apps include: Ouyi, Binance, Huobi, Gateio, Bitfinex, Coinbase, Kraken, KuCoin, BitMEX, and Bithumb. These platforms provide a wide range of trading services, such as spot trading, contract trading, leverage trading, etc. They have strong security measures in place and have been providing reliable and trustworthy services for many years. 2. OKEx, founded in 2013, is a leading company in the field of digital currency trading.

2024-04-10

comment 0

1230

How to play currency circle contract trading

Article Introduction:Cryptocurrency contract trading is a type of derivatives trading that allows traders to predict cryptocurrency price trends and make profits, using a leverage mechanism to amplify profits and risks. The contract trading process includes selecting a trading platform, opening a contract account, selecting a contract type, setting trading parameters, placing orders and managing positions. Contract trading involves risks, including liquidation risk, liquidity risk and leverage risk. Common contract trading strategies include trend trading, range trading and arbitrage trading. Contract trading tips recommend understanding risks, using leverage cautiously, setting stop loss and take profit, paying attention to market information and starting trading with small orders.

2024-07-02

comment 0

370

What is digital asset trading

Article Introduction:Digital asset trading involves financial activities of buying and selling digital assets and operates based on blockchain technology: Order placement: Buyers and sellers submit orders. Matching: The trading platform matches buy and sell orders. Settlement: After a transaction is completed, assets and funds are transferred. There are a variety of trading platforms, including centralized exchanges, decentralized exchanges, and over-the-counter trading. Digital asset trading offers the advantages of globalization, transparency, liquidity and high investment returns.

2024-07-23

comment 0

1072

Is Xi'an Art Trading Center formal?

Article Introduction:Xi'an Art Trading Center is a formal art trading platform supported by the Xi'an Municipal Government and the largest art trading center in Shaanxi Province. The center was established in 2010 and is located on Chang'an North Road, Yanta District, Xi'an City, covering an area of nearly 5,000 square meters. As an important part of Xi'an's cultural industry, the center is committed to building a standardized, transparent, fair and credible art trading platform. Xi'an Art Trading Center has a good market reputation and brand influence. Over the years, the center has insisted on being market-oriented and aiming to protect the healthy and orderly development of the art trading market, and has attracted many art collectors, investors and enthusiasts. Within the industry, the center is generally recognized as a highly reputable and professional art trading platform. Xi'an

2024-07-31

comment 0

415

Where is the virtual currency trading center?

Article Introduction:The Virtual Currency Trading Center is an online platform for buying and selling cryptocurrencies, providing trading, storage and asset management services. Common virtual currency trading centers include centralized trading centers such as Binance, Huobi and OKEx, as well as decentralized trading centers such as Uniswap, PancakeSwap and SushiSwap. When choosing a trading center, you should consider security, transaction volume, fees, currency support, and availability.

2024-04-15

comment 0

1097

Bitcoin trading app official website_Bitcoin trading website collection

Article Introduction:Bitcoin trading app official website_Bitcoin trading website collection As more and more people join the army of Bitcoin trading, a useful Bitcoin trading app official website and Bitcoin trading website collection have become a must. This article will introduce you to the official website of the Bitcoin trading app and the collection of Bitcoin trading websites, and conduct an in-depth analysis from the following aspects: transaction security, transaction fees, transaction speed, and transaction support. Transaction Security First of all, transaction security is the issue that users are most concerned about. When choosing the official Bitcoin trading app and Bitcoin trading website, be sure to pay attention to information such as official certification and handling fees. Bitcoin trading is a decentralized digital currency transaction that is not regulated by any agency or organization. In this case, users need to

2024-08-01

comment 0

964