Brief overview:

• The cryptocurrency and NFT market fell by 30% in April.

• Binance leads the way with $699.25 billion in trading volume.

• Bitcoin Puppet and WZRDs bucked the trend and rose.

In April, the cryptocurrency and non-fungible token (NFT) markets experienced a significant decline, marking a cooling-off period for trading in digital assets.

The crypto market has indeed gone through a series of changes as trading activity has decreased. Key players and crypto platforms are facing declining trading indicators, reflecting a recalibration process the market is undergoing. This shift in market dynamics suggests investors are becoming more cautious and reassessing asset values.

Cryptocurrency trading volume and NFT sales decline

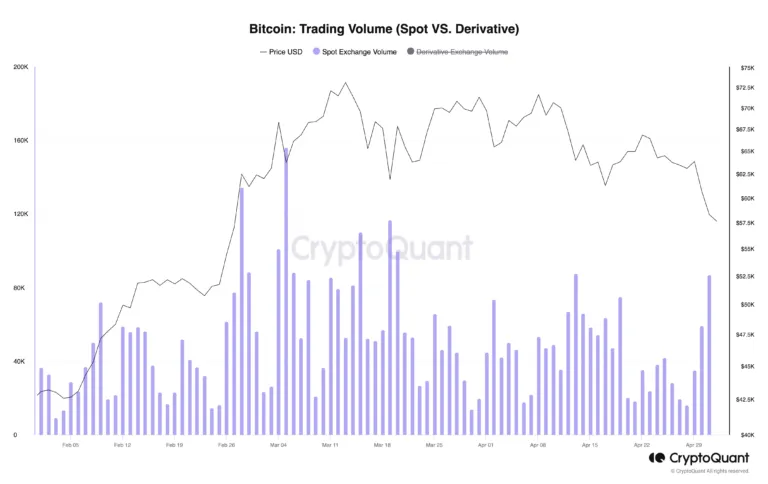

Data from centralized exchanges (CEX) show a significant decline in spot trading volumes. Compared to March’s $2.49 trillion, these transaction volumes fell 35.7% to just $1.6 trillion.

Binance, the largest player in the space, accounts for 43.7% of trading volume, equivalent to approximately $699.25 billion.

Bitcoin transaction volume|Source: CryptoQuant

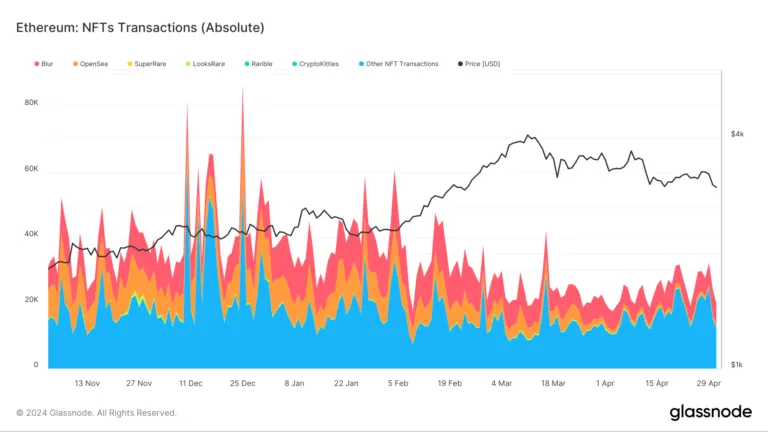

At the same time, the NFT field has also experienced a downturn. NFT sales dropped to $1.15 billion in April, a 31.26% decrease from the previous month.

The NFT market has experienced a significant correction in recent times, which is not only reflected in the decline in sales volume. According to the information provided, market activity is also decreasing, which is reflected in the significant reduction in the number of NFT buyers and sellers. Buyer participation dropped by more than half, 51.88% to be exact, while seller activity also dropped by 45.72%.

The downturn has affected several blockchains where NFTs are typically traded. For example, Ethereum and Solana have seen significant declines in NFT sales.

In the recent period, Ethereum’s NFT trading volume has experienced a significant decline, with a decline of 56.8%. At the same time, sales of Solana, a rapidly emerging blockchain in the NFT field, also fell by 39.4%. This downward trend is reflected on multiple blockchain platforms, reflecting that the entire NFT market may be facing a period of adjustment.

However, in an overall declining market environment, platforms such as Immutable X and Avalanche unexpectedly achieved growth in NFT trading volume. This phenomenon may indicate that although the market as a whole may be facing challenges, there are still specific platforms or projects that are able to attract the interest of investors and collectors due to their unique advantages or emerging characteristics, thereby achieving growth despite the market trend.

These data points reveal the dynamics and diversity of the NFT market, while also highlighting the importance of strategic selection and market trend analysis for different blockchain platforms under current market conditions. Although the overall market may be showing a downward trend, there are always some innovative platforms or projects that can attract users and achieve growth by providing unique value propositions.

Karim Chaib, CEO of Dopamine, said in an interview that “the decline in sales and participation of NFTs on blockchain platforms may hinder innovation in the field, as the market is shifting from speculation to seeking actual value. Creators and platforms Prioritize real-life use cases such as proof of ownership, digital identity, and gaming experience assets with actual in-game uses, and ensure transfer fees are a small portion of the asset price.”

Ethereum NFT trading | Source: Glassnode

Despite the overall downward market trend, some specific Bitcoin-based NFT collectibles experienced significant growth in value in April. The value of two Bitcoin-based NFT collection series, Bitcoin Puppets and WZRDs, has increased significantly by 2064.97% and 25796% respectively. This contrarian performance may have something to do with these NFTs attracting curiosity and interest from the crypto community due to their novelty on the Bitcoin network. At the same time, these NFTs are particularly attractive to collectors and investors due to the scarcity of historical data and the novelty of Bitcoin Ordinals, which coincides with the bullish sentiment surrounding the Bitcoin halving event.

Chaib concluded that due to its novelty on the Bitcoin network, Bitcoin-based NFTs have shown stronger market resilience than NFTs based on Ethereum and Solana. This novelty has successfully attracted the curiosity and interest of the crypto community. . The historical data scarcity and innovation of Bitcoin NFTs make them particularly attractive to collectors and investors. In addition, discussions of Bitcoin halving events usually cause bullish sentiment in the market, which may also be a factor driving the value of these NFTs.

The above is the detailed content of Cryptocurrency trading volume and NFT sales fell more than 30% in April. For more information, please follow other related articles on the PHP Chinese website!