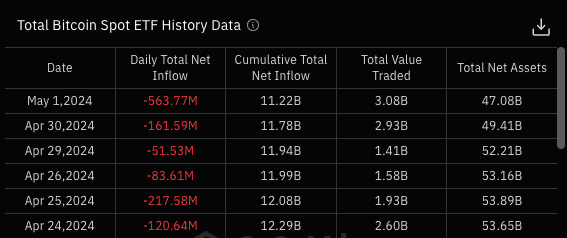

This site (120BtC.coM): As expected, the U.S. Federal Reserve (Fed) announced that interest rates will remain unchanged again, even though Chairman Jerome Powell generally ruled out that "the next move will be to raise interest rates." However, the effect of boosting the market is still limited. Investors accelerated their selling of Bitcoin spot ETFs, with more than US$560 million in funds withdrawn in one day alone, setting a record high.

According to data from Farside Investors and SoSoValue, on May 1st, Eastern Time, among the 11 Bitcoin spot ETFs in the United States, only HashDex’s DEFI funds flowed into "zero", and the remaining 10 funds all suffered withdrawals. Total The net outflow was US$563.7 million, setting a record for the largest single-day net outflow since its listing on January 11, and it has been bleeding money for 6 consecutive trading days. Since April 24, investors have withdrawn nearly $1.2 billion from Bitcoin spot ETFs.

Further observing the performance of various funds on May 1, BlackRock’s IBIT experienced its first capital outflow since its listing, with a single-day net outflow of 36.93 million US dollars; FBTC, owned by Fidelity, suffered the most severe bleeding, with a net outflow of US$191.1 million. This situation may shock many investors, because IBIT and FBTC performed very well in the first quarter of this year, and their ability to attract gold has been very strong.

At the same time, Grayscale’s GBTC had a net outflow of US$167 million on May 1, and a cumulative net outflow of US$17.47 billion since its transformation into a spot ETF; while ARKB jointly launched by Ark/21Shares Saw $98.1 million in net outflows.

It is worth noting that the "premium/discount rate" of each ETF (except for BTCO jointly launched by Hashdex's DEFI and Invesco and Galaxy Digital) is a discount, among which the discount rate of BlackRock IBIT is -1.67 %.

The above is the detailed content of The U.S. Bitcoin spot ETF lost more than $560 million in a single day! Becomes the largest capital outflow since listing. For more information, please follow other related articles on the PHP Chinese website!