Author: @charlotte0211z, Metrics Ventures

1 Jupiter: Laying out the leverage targets of the Solana ecosystem

1.1 Will Solana become the “Ethereum killer”?

Solana is rebounding from the FTX storm. After becoming the leader in cryptocurrency gains in the fourth quarter of 2023, it will continue to ignite the market in 2024 with ecological airdrops and high-fold increases in MEME tokens. Emotionally, Solana has become the top player in the “Ethereum Killer”. We review the growth of the Solana ecosystem from the perspectives of data, market sentiment, and ecological prosperity, and explain why the importance of deploying the Solana ecosystem should be significantly increased during this cycle.

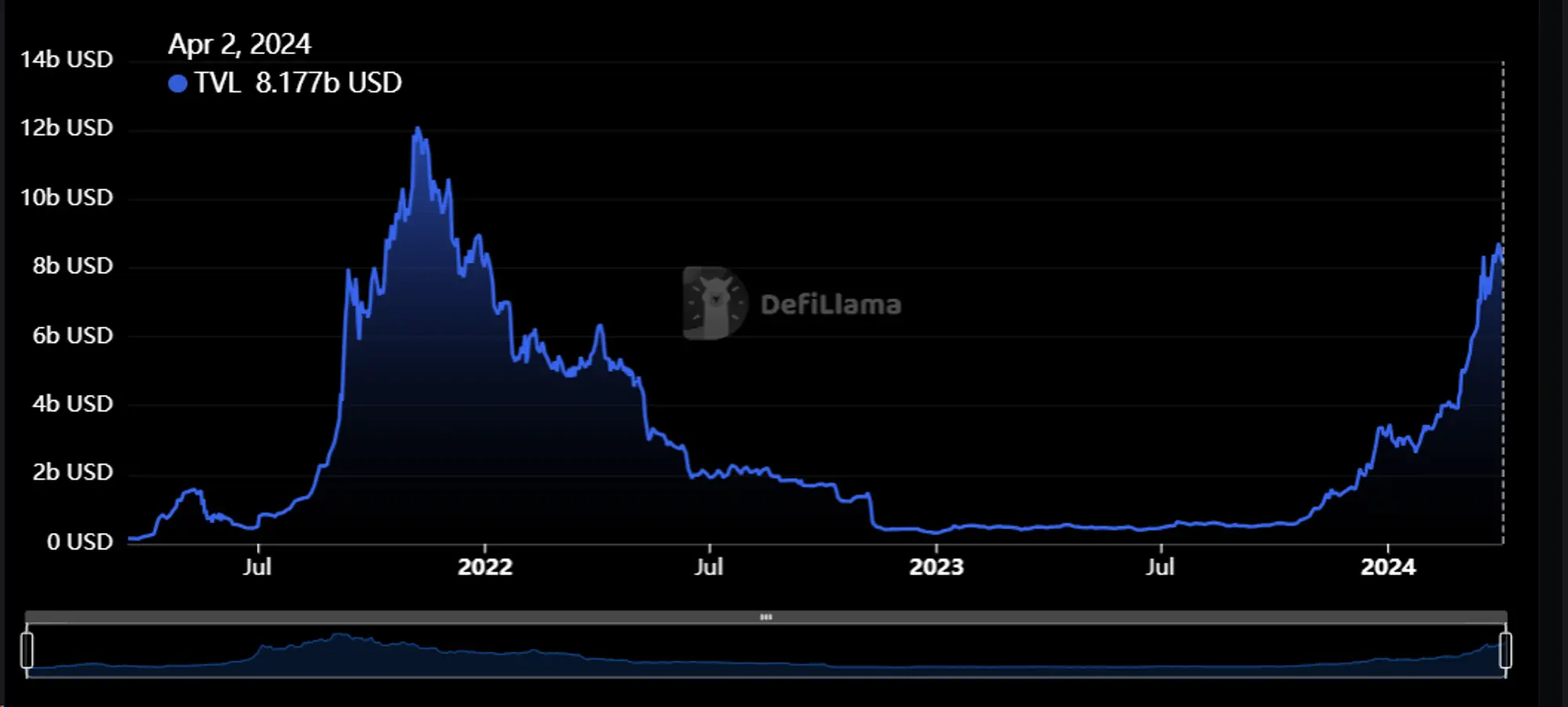

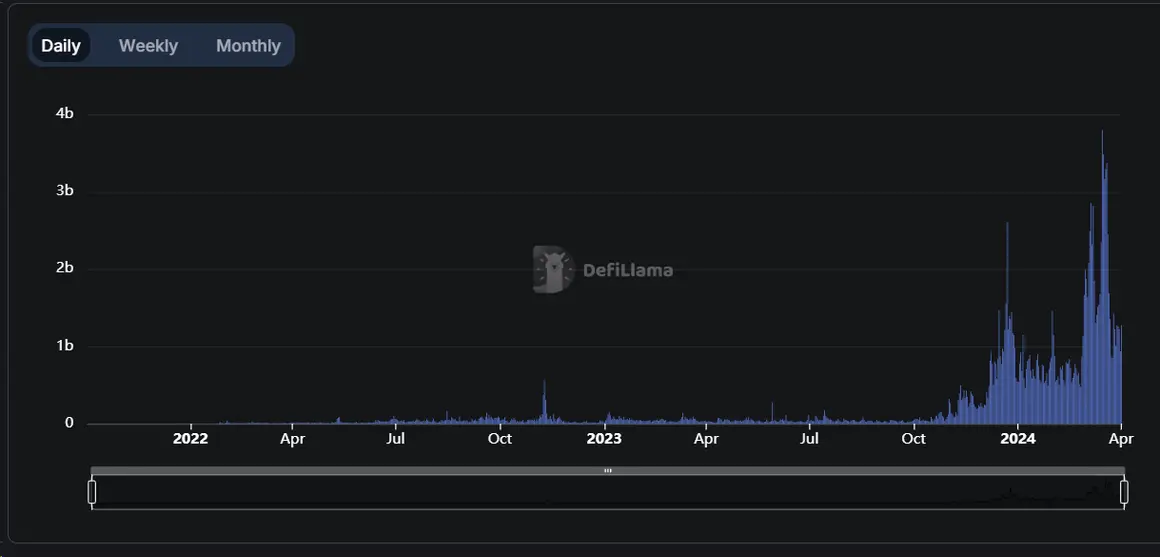

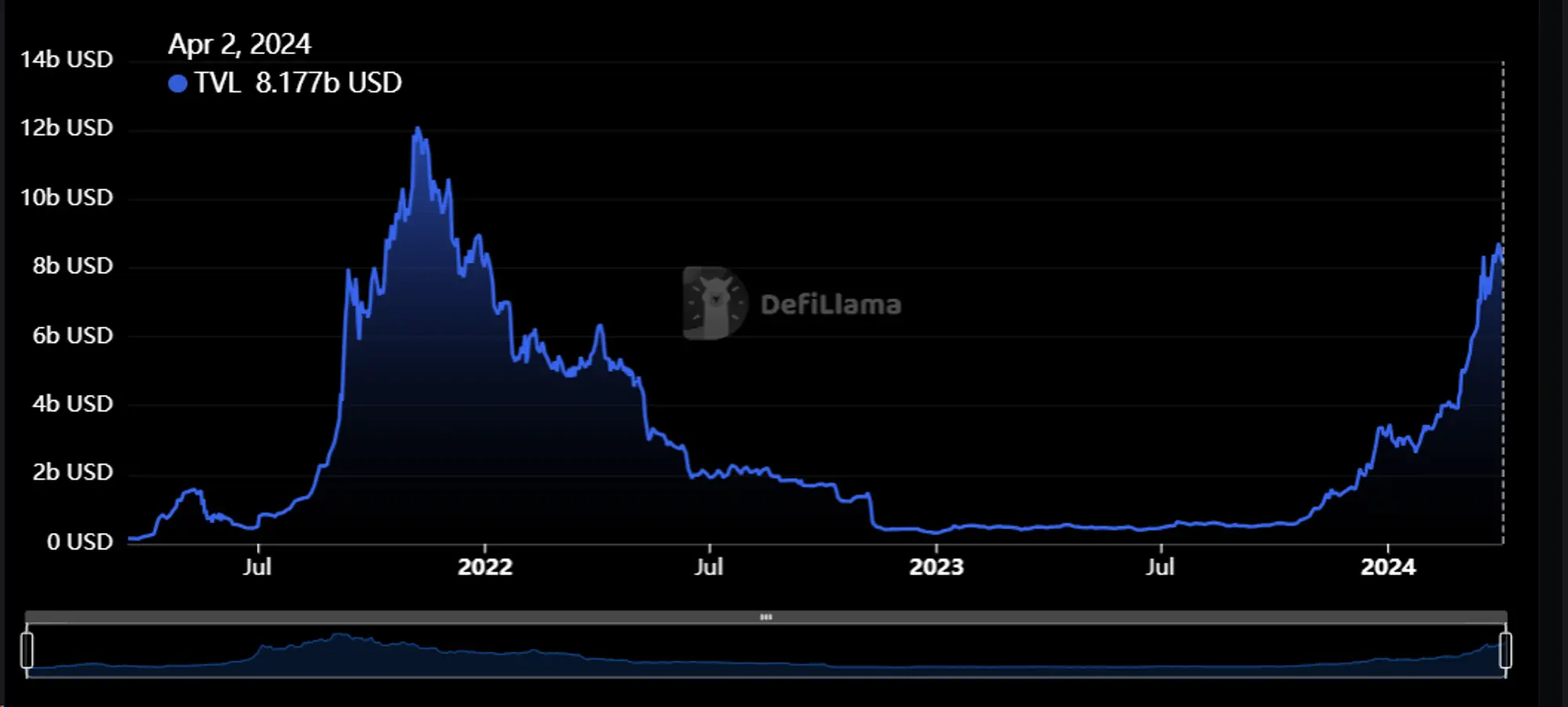

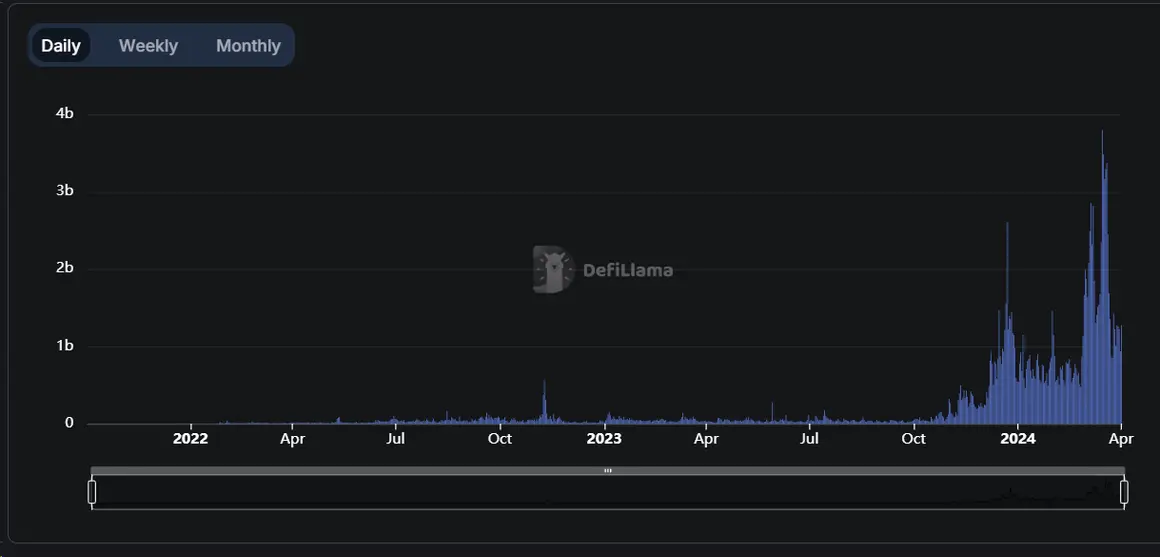

Solana’s various data are soaring rapidly. Solana's TVL began to grow rapidly in the fourth quarter of 2023, rapidly growing from approximately $500M on October 1, 2023 to $8B recently. It has increased by 1500% in two quarters and is approaching $12B in November 2021. Vertex; DEX trading volume is increasing rapidly due to the influence of the MEME token. On March 16, the trading volume exceeded $3.8B, a record high. The proportion of DEX trading volume has grown rapidly, approaching Ethereum and even surpassing it in a short time; in the generation In terms of currency performance, Solana’s token price began to surge in October 2023 and is approaching a peak of $250. The total market value has exceeded the peak of the last bull market.

(Solana TVL over time chart, source: DeFiLlama)

(Chart of Solana DEX trading volume over time, source: DeFiLlama)

(Chart of DEX Volume Dominance changes over time for each public chain, source: DeFiLlama)

(Chart of Solana’s total market capitalization over time, source: Coingecko)

In terms of ecology and market sentiment, etc. From a perspective, the reasons why the Solana ecosystem is growing rapidly and still has room for substantial growth include the following points:

-

Solana has overcome the negative impact of the FTX incident: With the SBF trial coming to an end, the FTX thunderstorm incident has basically come to an end. From the perspective of the Solana ecosystem, Solana has gradually come out of the trough of the FTX incident. Whether in terms of ecological development, investor views and market sentiment, the negative impact of the FTX incident on Solana has disappeared. According to The Block, citing people familiar with the matter, FTX lock-up The 41 million SOL has attracted multiple buyers, and the market demand for the acquisition of SOL tokens is high. Both in terms of funding and institutional sentiment, it provides a positive indicator for Solana's future growth expectations.

-

Solana has become the main position of the DePIN project, and multiple ecological projects are about to issue coins: Solana has become the main ecosystem carrying the DePIN narrative with its low fees and high performance, in addition to Helium, Shadow, Hivemapper Other DePIN head projects, a number of AI × DePIN projects have also chosen the Solana ecosystem, including io.net, Render, Grass, Nosana, etc. At the same time, many projects in the Solana ecosystem have not yet issued coins, such as io.net, Magic Eden, etc. Refer to JUP and JTO, etc. The currency issuance and airdrops of these projects will continue to inject vitality into the Solana ecosystem.

-

Solana has achieved product-market fit and may become the main interactive ecosystem for retail investors and new users in this round: Solana’s high performance and extremely low transaction fees make it extremely suitable for retail investors Transactions and lowering the threshold of transaction fees for new users. The transaction fees of Ethereum L1 can be as high as tens or even hundreds of dollars during the peak period, and this number is rising with the growth of ETH price. L2 liquidity is dispersed and The operation difficulty for new users has increased; in addition, the concept of Fair Launch has been deeply loved by retail investors in this cycle. Retail investors generally believe that Ethereum has become the main position of VC disk. On the contrary, Solana ecosystem’s strong support for MEME currency has driven the development of MEME coins from below. The market sentiment on the market, simple operations, low-priced chips and wealth creation effects will become the main driving forces to attract new retail investors to enter.

In summary, regardless of data performance, ecological prosperity and market sentiment, the Solana ecosystem has shown strong strength in the past period, and has shown the ability to continue to grow and the logic of growth in the bull market Deductive path. Regardless of whether Solana is an "Ethereum killer" or not, from a configuration perspective, the Solana ecosystem deserves the same status as the Ethereum ecosystem, and from a growth perspective, it is even more offensive.

1.2 Jupiter will resonate with Solana at the same frequency

Jupiter, as the liquidity infrastructure of Solana ecology, will resonate with Solana at the same frequency.

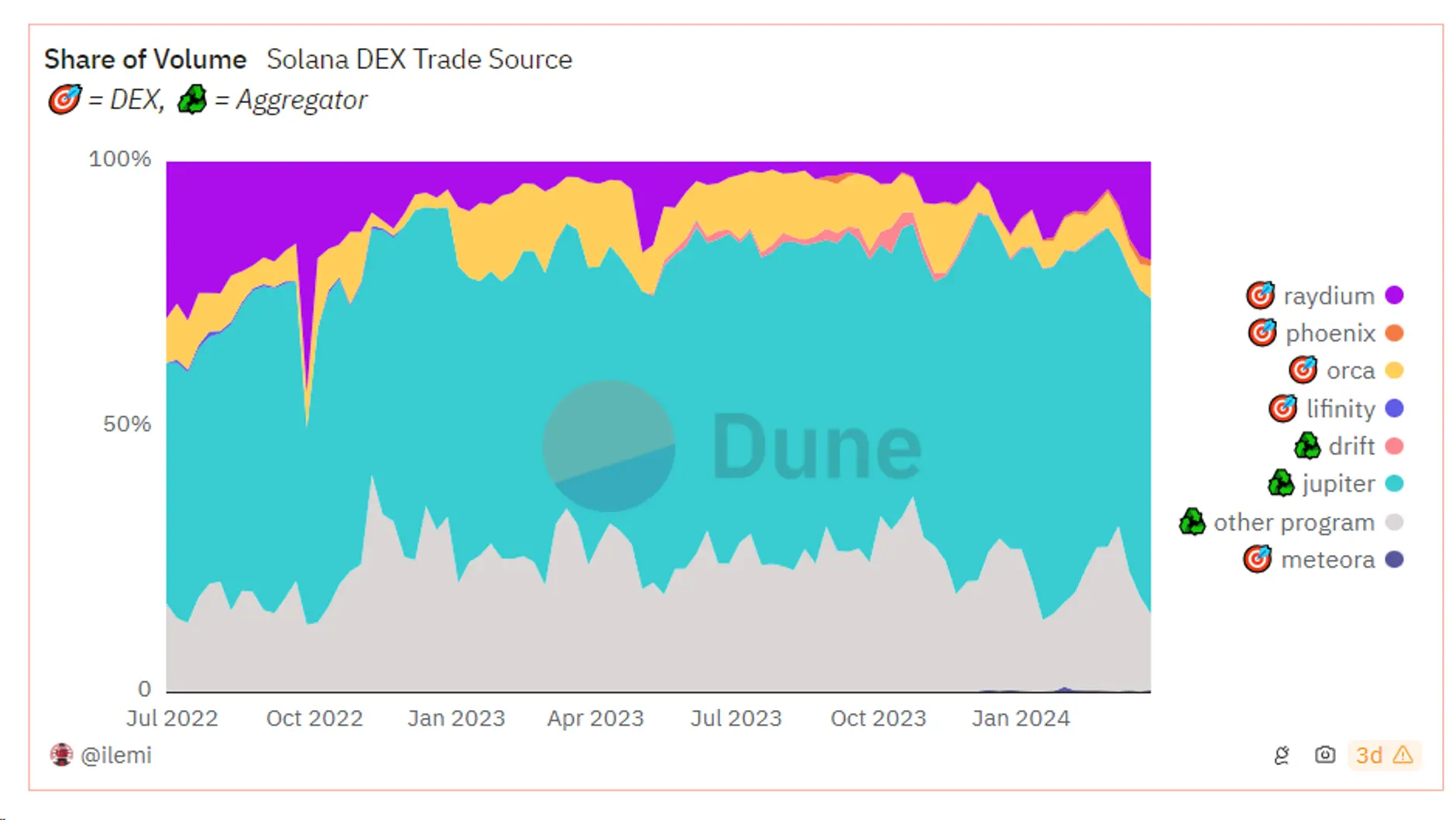

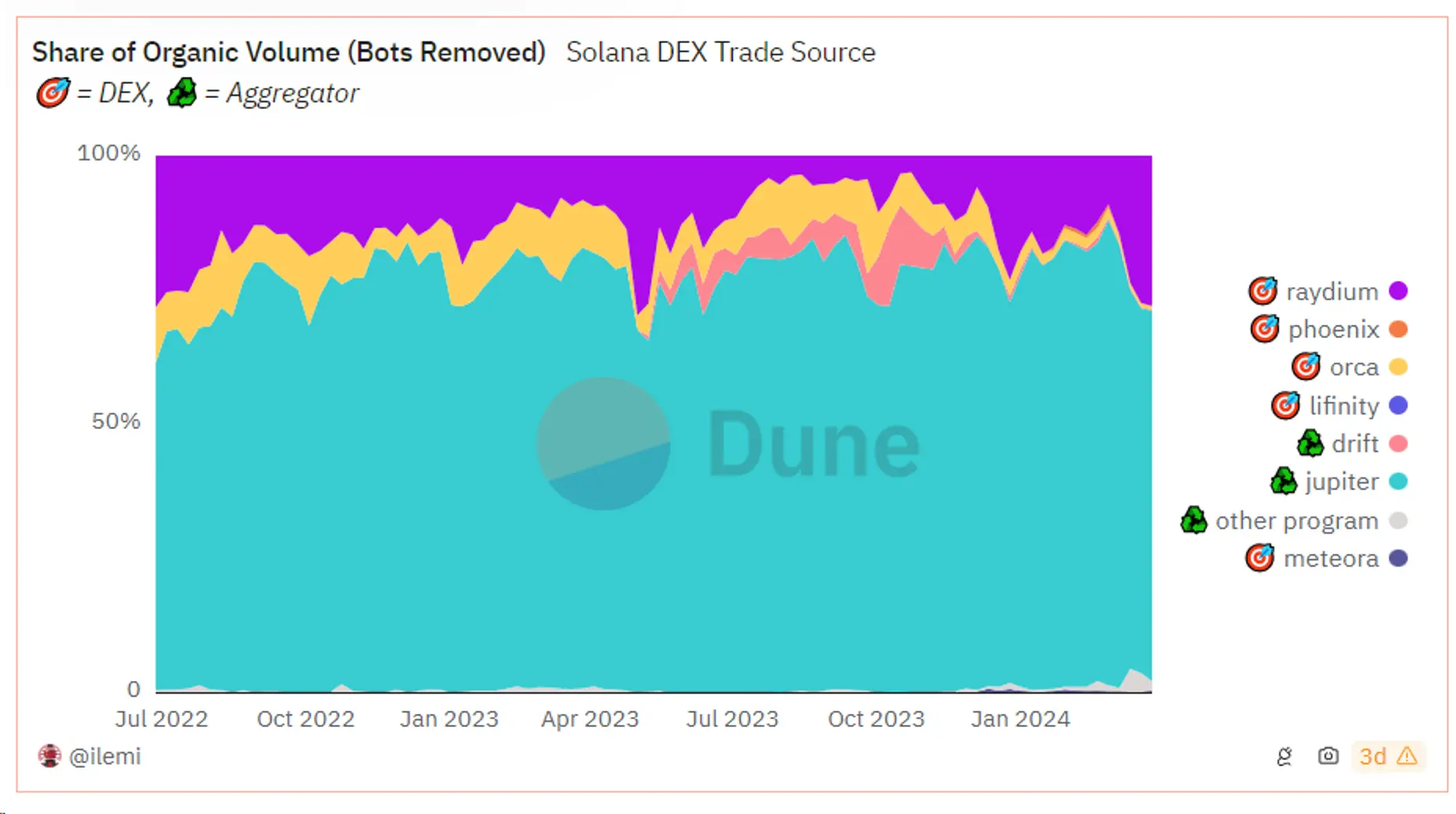

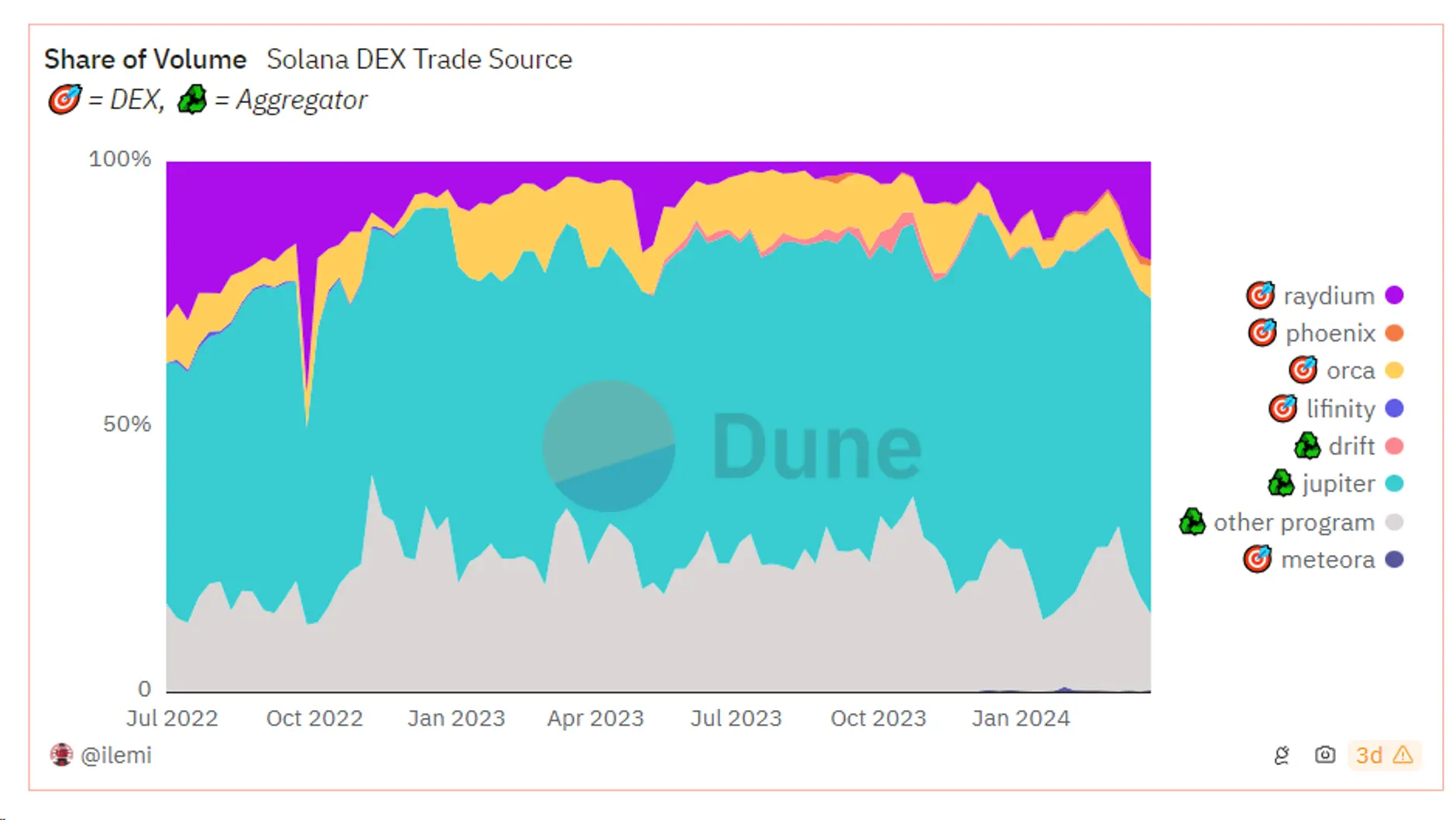

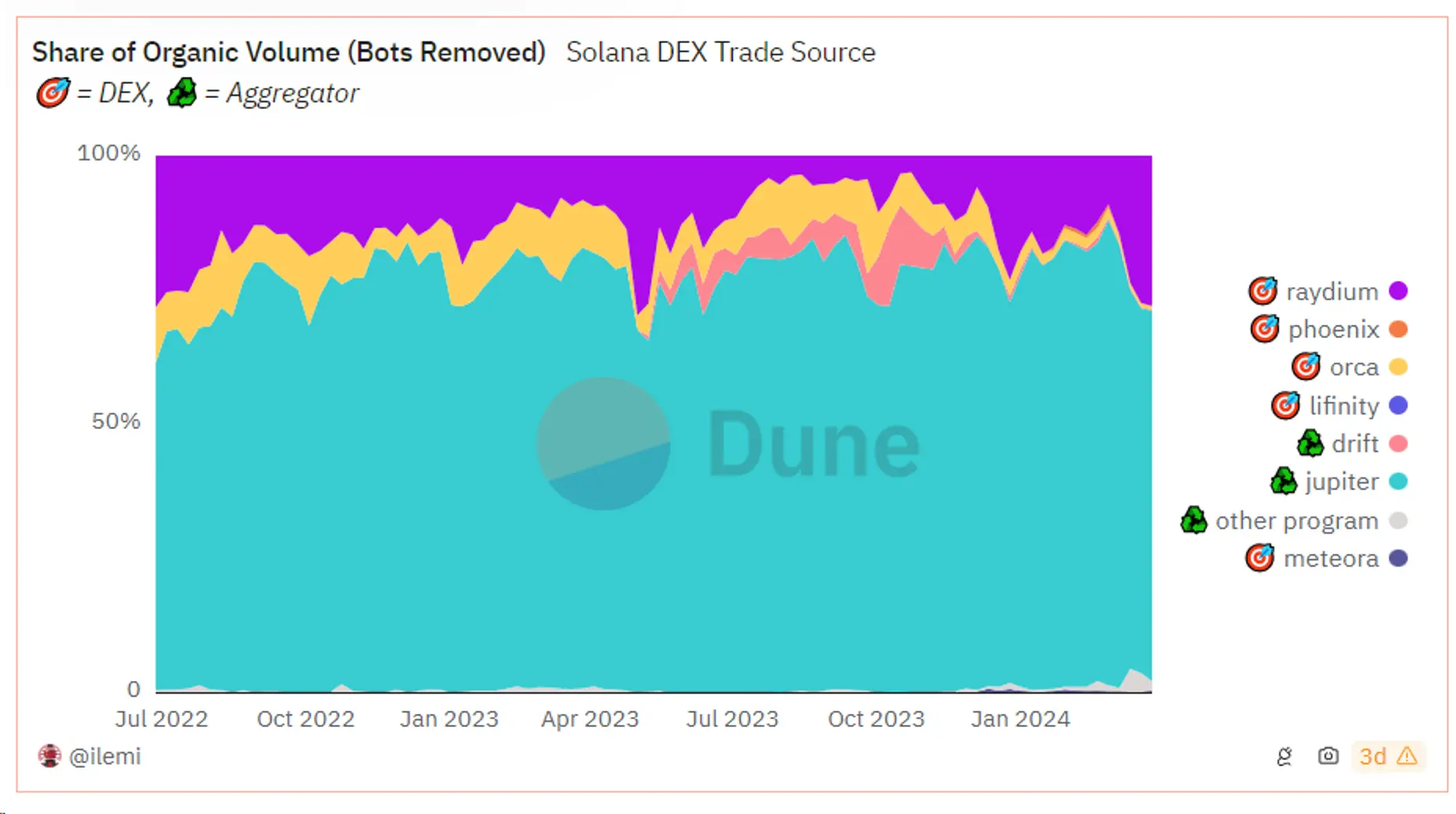

First of all, on the Solana network, Jupiter guides about 50%-60% of the trading volume, and more than 80% of the organic trading volume (excluding Trading bots), which means that traders participating in the Solana ecosystem , in addition to using Trading bots, the vast majority of transactions require interaction with Jupiter's front-end. Jupiter has become one of the most important protocols in the Solana ecosystem by virtue of its status as a trading infrastructure and its extremely large customer capture volume. In addition, Jupiter, as a DEX aggregator, is actually much more important to the Solana ecosystem than 1inch is to Ethereum, because Solana is inherently more suitable for a liquidity aggregator, and dividing a transaction into multiple times will generate higher gas costs. , which has brought high friction to Ethereum, which already has high gas fees, and the cost to users on Solana is still very small. Therefore, in terms of transaction volume, Jupiter is basically equivalent to Uniswap, and even surpassed it for a short time. Second, It is much higher than other trading infrastructure, can be said to be the Uniswap of Solana ecosystem.

#Secondly, Jupiter has launched Jupiter Start and Launchpad. With Jupiter’s great capture of users and traffic in the Solana ecosystem, it is foreseeable that future new projects in the Solana ecosystem will be highly bound to Jupiter, whether it is Whether through Jupiter Launchpad or directly airdropping to JUP holders, Jupiter will greatly benefit from the birth and growth of new projects in the Solana ecosystem.

Looking at the token performance at this stage, the price growth of Jupiter and Solana is basically synchronized. In the past month, JUP has risen more than SOL, which also shows that JUP will become the leverage of SOL. target.

2 Fundamental Analysis: The top DEX aggregator on Solana

##Jupiter was launched in November 2021. The product can basically be divided into two parts: Trading infrastructure and LFG Launchpad, where trading infrastructure includes: liquidity aggregation, limit orders, DCA (fixed investment strategy) and Perps trading. This section will provide a brief introduction to Jupiter's products.

2.1 Liquidity Aggregation

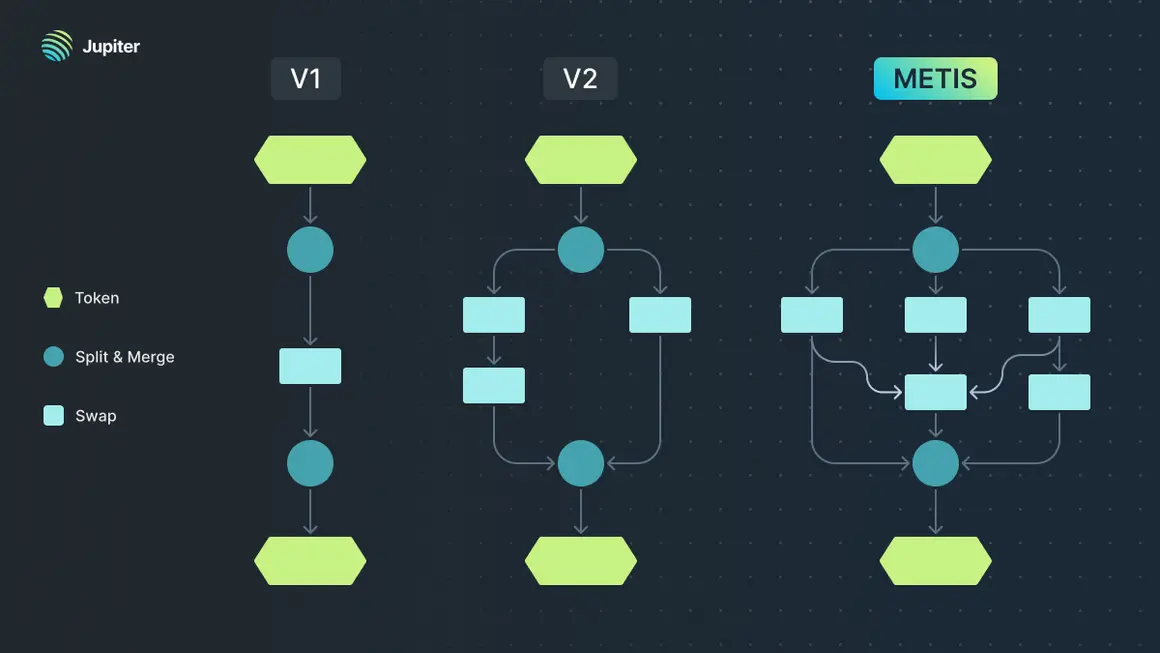

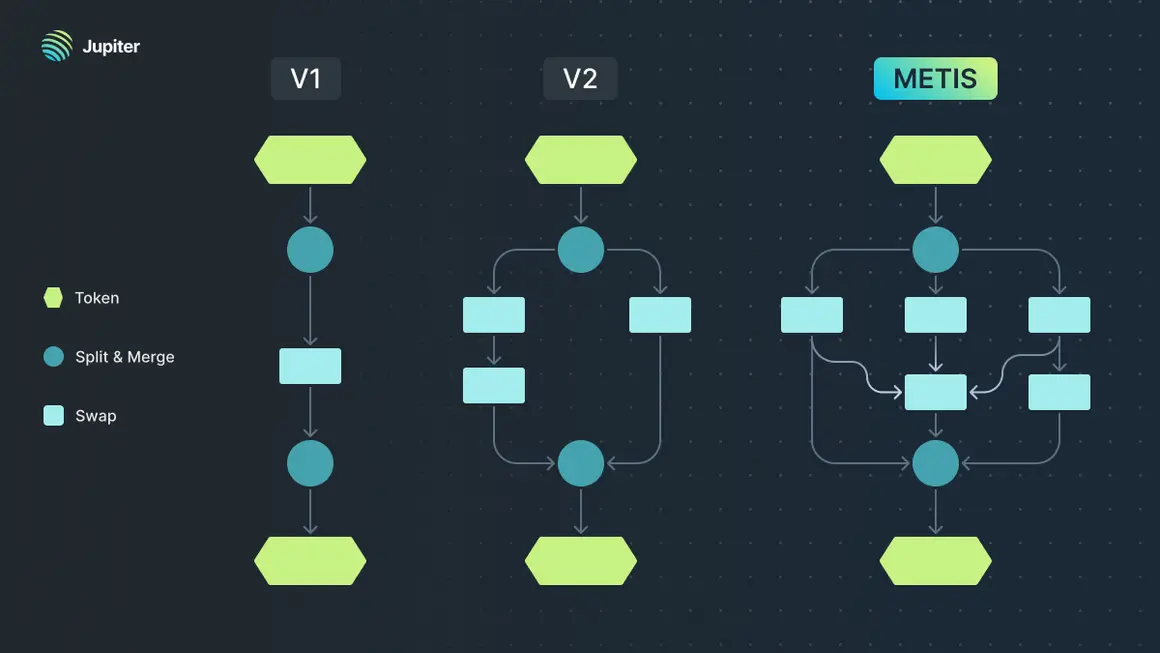

Token prices change rapidly at any time. The transaction with the best price is not always on one DEX, but may involve a combination of transactions on multiple DEXs. Jupiter as The liquidity aggregator will find the most favorable price routes among all major DEXs and AMMs on Solana, minimizing slippage and transaction fees, making the transaction process more efficient and user-friendly. The working methods of the aggregator are mainly divided into two types: Multi-hop routing and order splitting. Multi-hop refers to achieving better exchange of A tokens to B tokens through the intermediary token C (A-C-B). Order splitting is It is to split one transaction into multiple transactions and complete them on different DEXs.

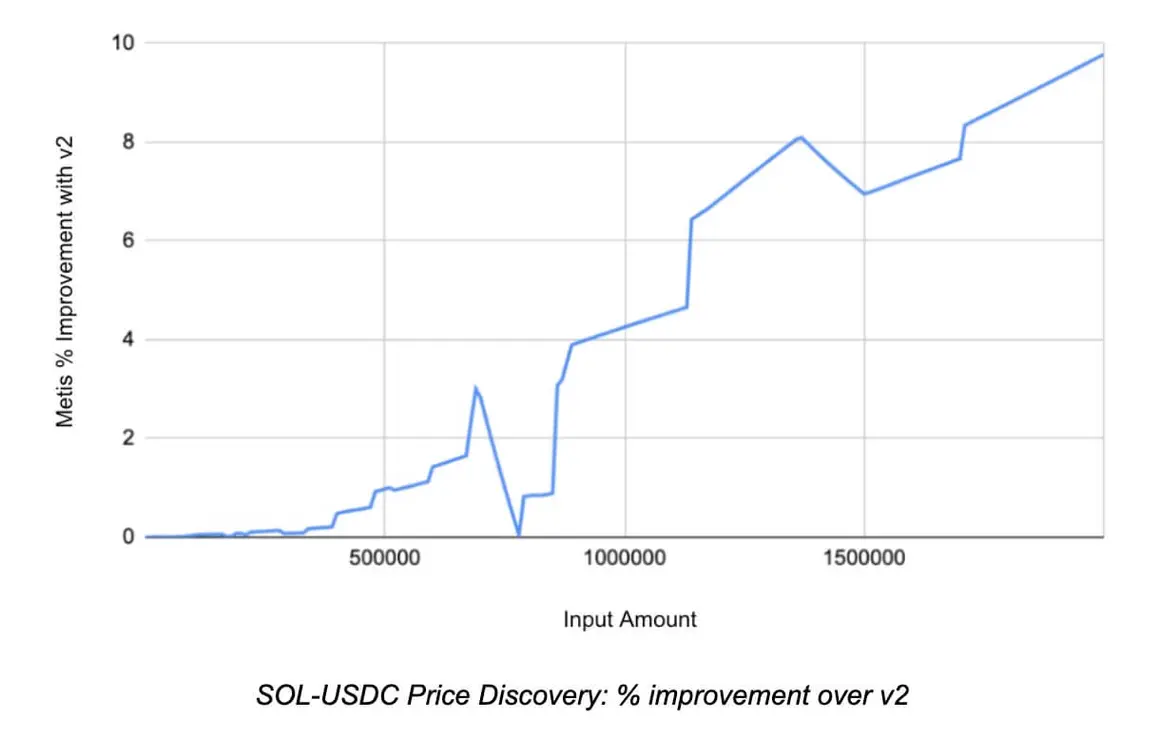

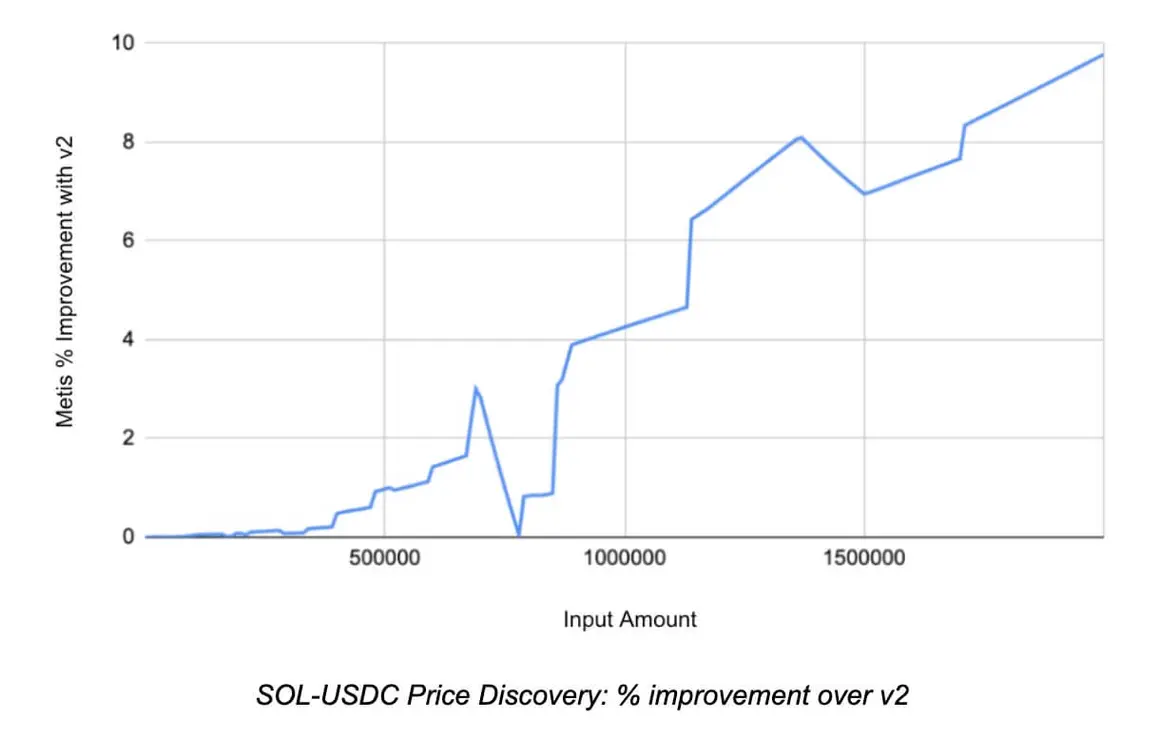

Jupiter currently uses a routing algorithm called Metis, designed to provide optimal price routing within Solana’s fast block times. Compared with V1 and V2, Metis provides more flexible and complex trading paths, thereby achieving better price discovery. In addition, the Metis algorithm has increased the number of DEXs it can support and has shown stronger quoting capabilities in large transactions. According to Jupiter official data, Metis's quoting capabilities are on average 5.22% higher than the V2 engine, and the degree of improvement is Increases rapidly with the increase in transaction amount.

Currently, the Jupiter aggregator does not charge users. It mainly serves as a front-end for user transactions, attracting users from the Solana ecosystem. attention and traffic, which also makes it perfect for launching a Launchpad business. However, it should be noted that during the last Solana MEME wave, Jupiter’s status as a trading front-end was impacted by Trading bots. On the one hand, Trading bots have a more user-friendly operation method and are equipped with sniping, token information query, etc. Function, naturally born for MEME tokens. On the other hand, Jupiter's token pair update speed cannot meet the requirements of MEME's opening rush. Token pairs must be displayed on Jupiter only after certain liquidity and other requirements are met.

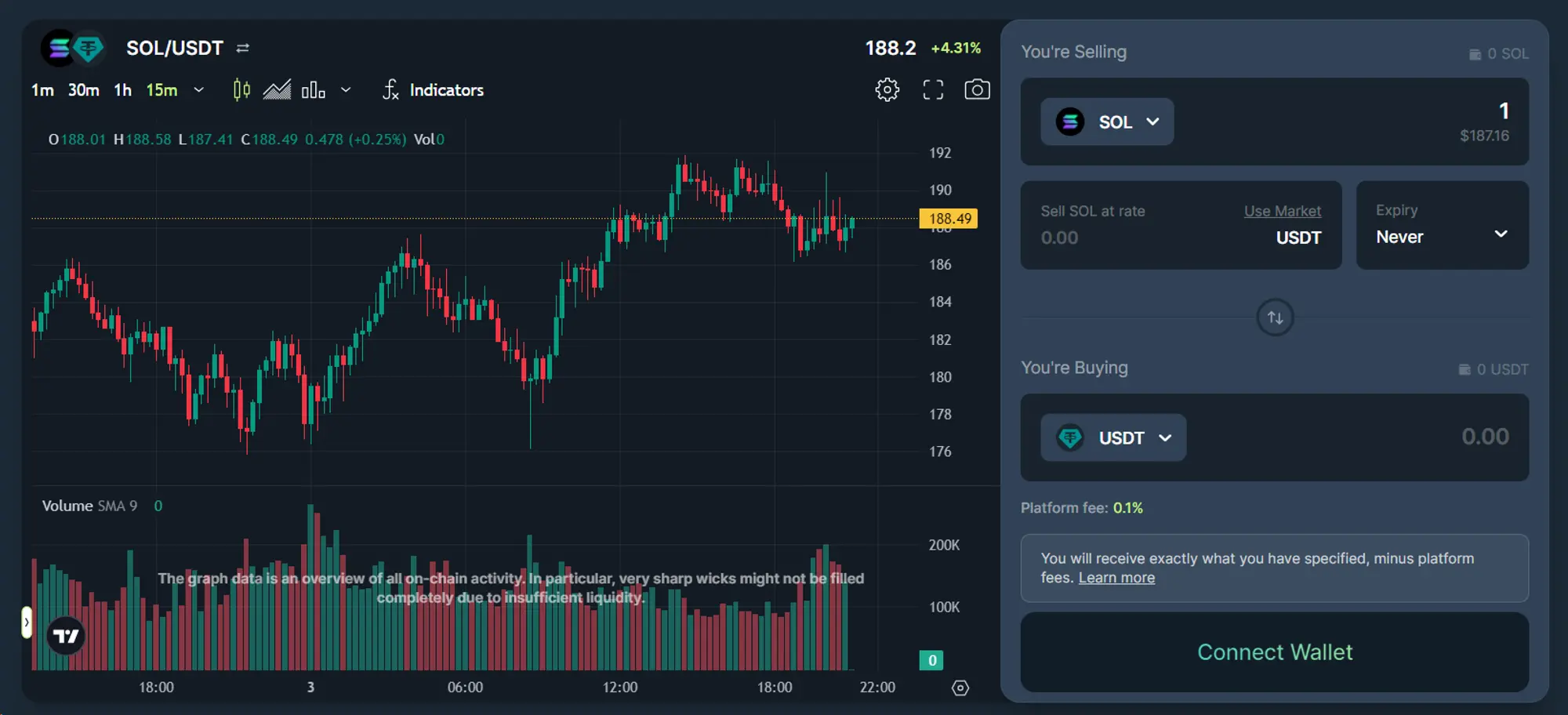

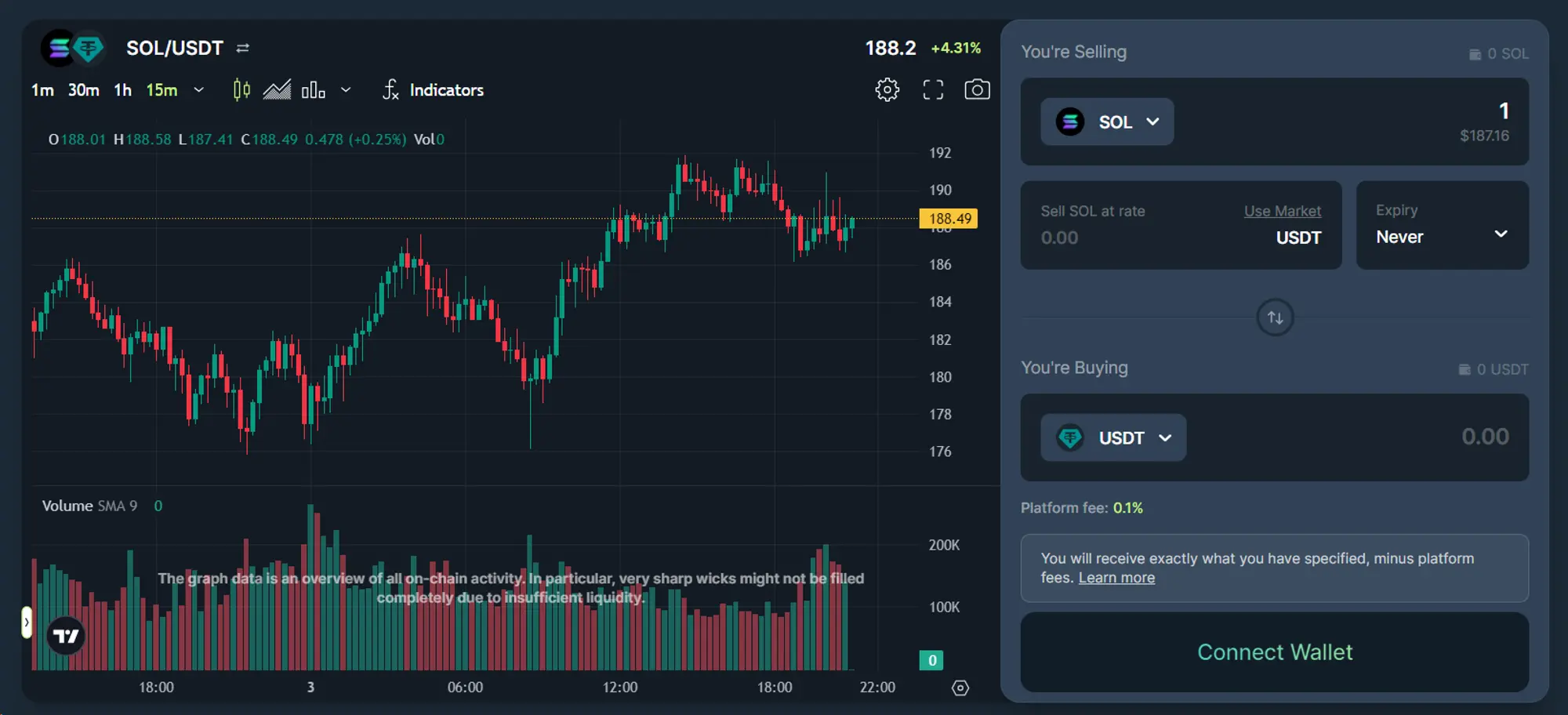

2.2 Limit order

Jupiter provides users with a limit order function, allowing users to have a CEX-like trading experience and avoid problems such as slippage and MEV caused by rapid price changes on the chain. Similar to other on-chain price limit order platforms, Jupiter limit order is not an order book system. Instead, Keeper uses the Jupiter Price API to monitor on-chain prices and execute transactions when the price reaches specified standards. Benefiting from Jupiter's liquidity aggregation function, limit orders can also use multiple liquidity pairs on Solana to complete transactions.

Currently, Jupiter supports transactions between any token pairs, which actually provides a more convenient trading experience than CEX. At the same time, Jupiter cooperates with Birdeye and TradingView. Birdeye provides on-chain price data, and TradingView is integrated on the front end to provide users with more convenient chart data display. Jupiter currently charges a platform fee of 0.1%.

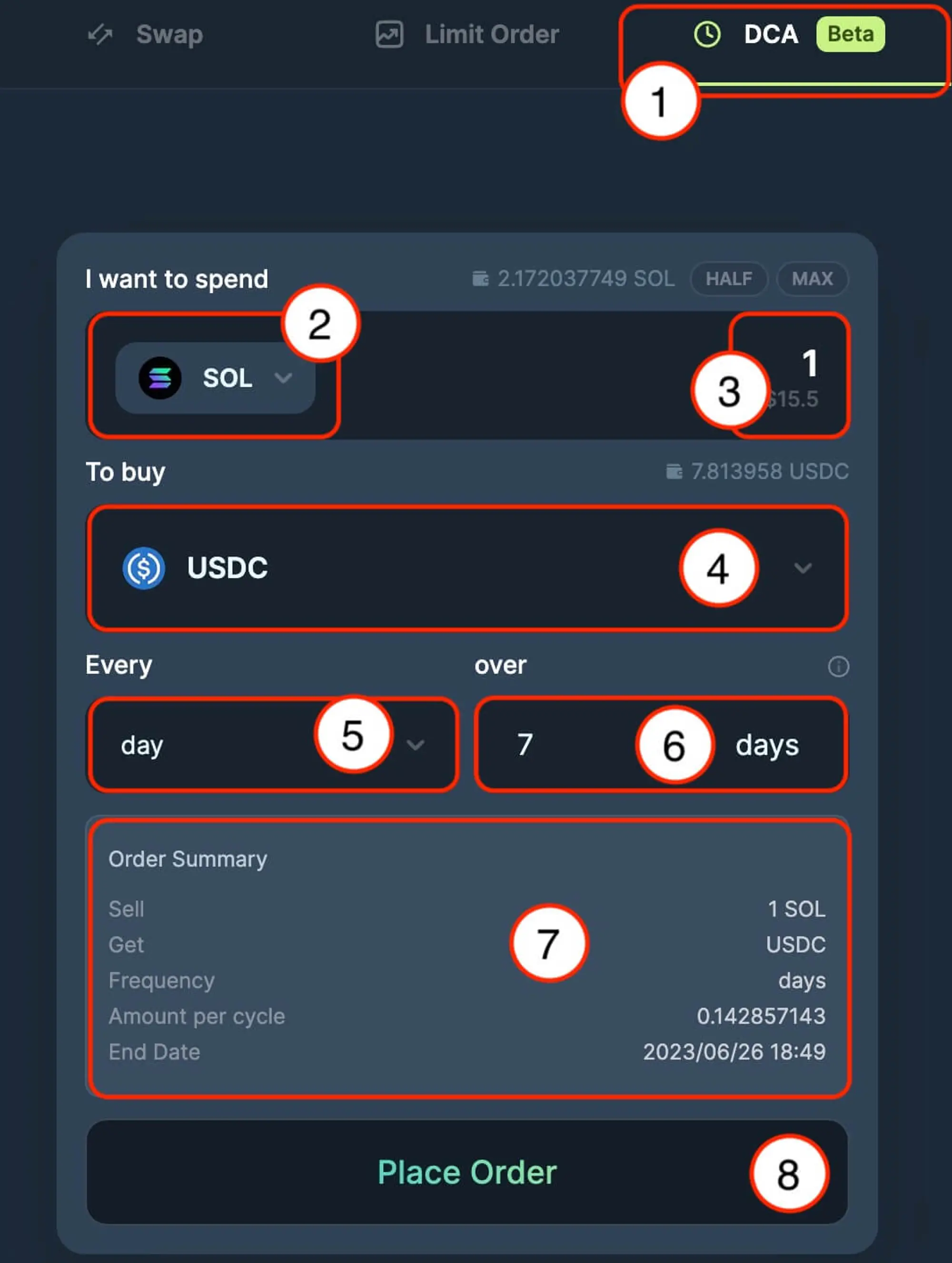

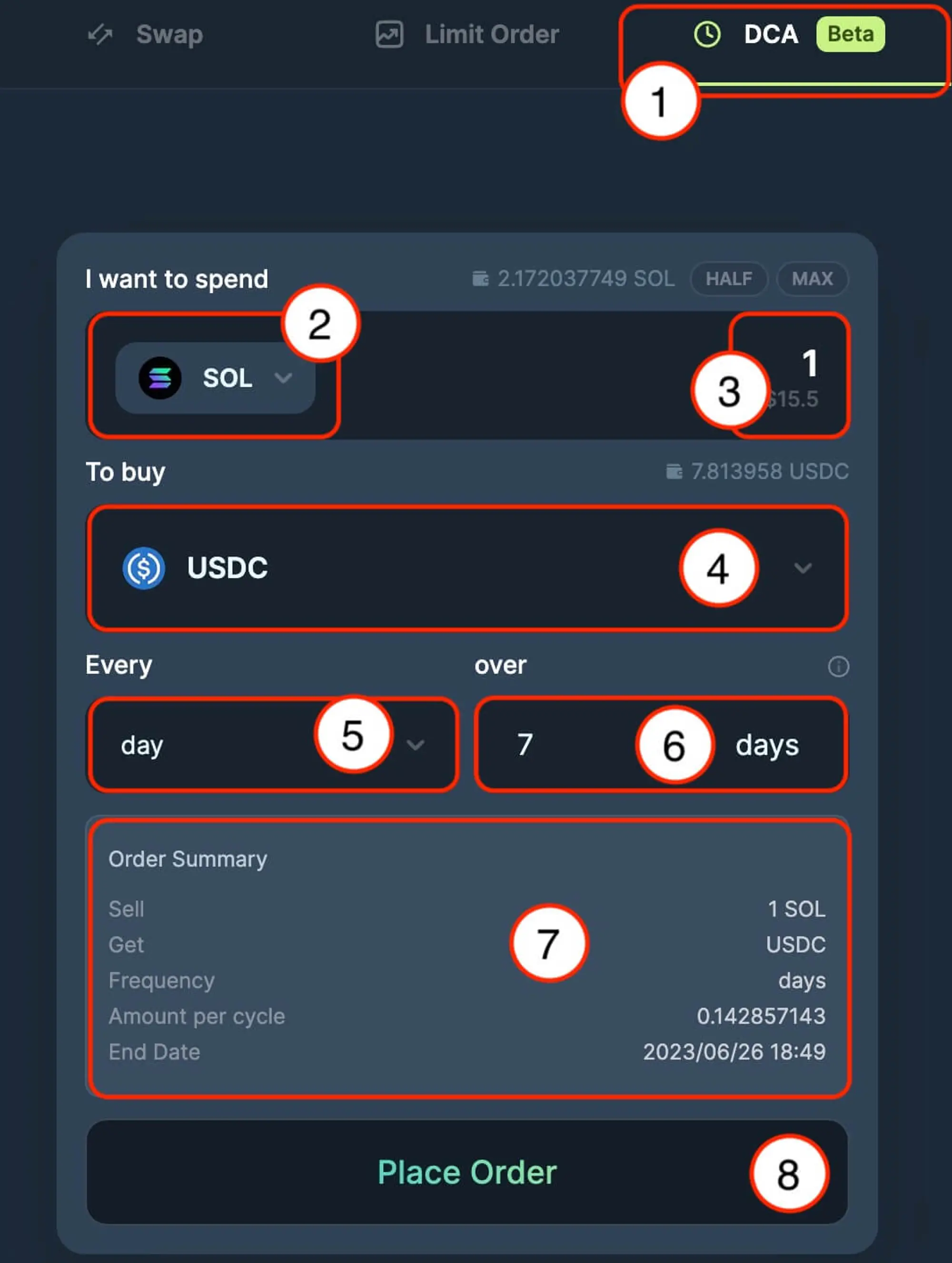

2.3 DCA

Jupiter DCA (Dollar Cost Averaging) is a fixed investment plan that enables users to automatically buy or sell any dollar amount regularly within a certain period of time. Solana ecological token. Jupiter DCA charges a platform fee of 0.1%, which will be charged every time a trade is executed. The DCA method is a very important basic strategy for both buying and selling. Using fixed investment to accumulate chips can avoid sharp price fluctuations and obtain a more stable and average cost price within a period. DCA is also suitable for selling strategies during bull market profits. In addition, for large transactions or tokens with poor liquidity, you can choose to continue to accumulate funds within a period of time to reduce the price impact.

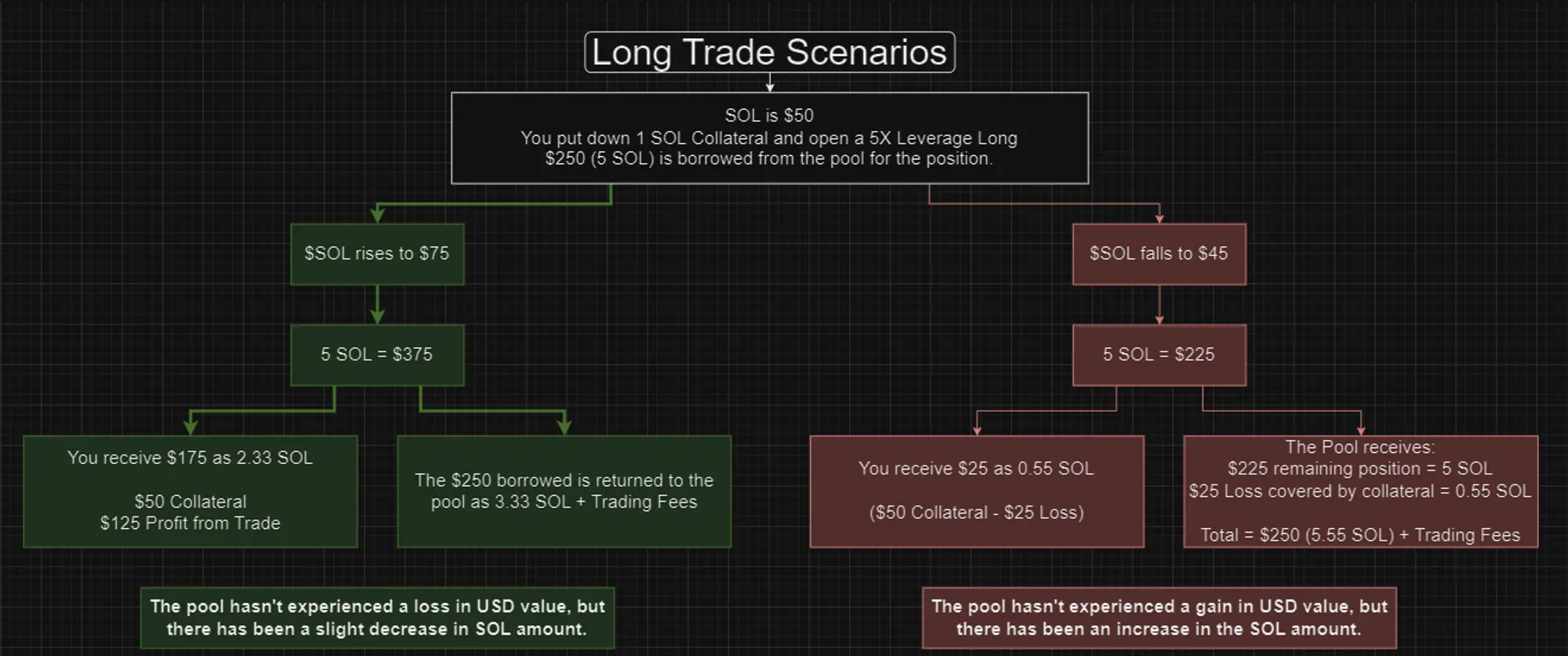

2.4 Perps trading

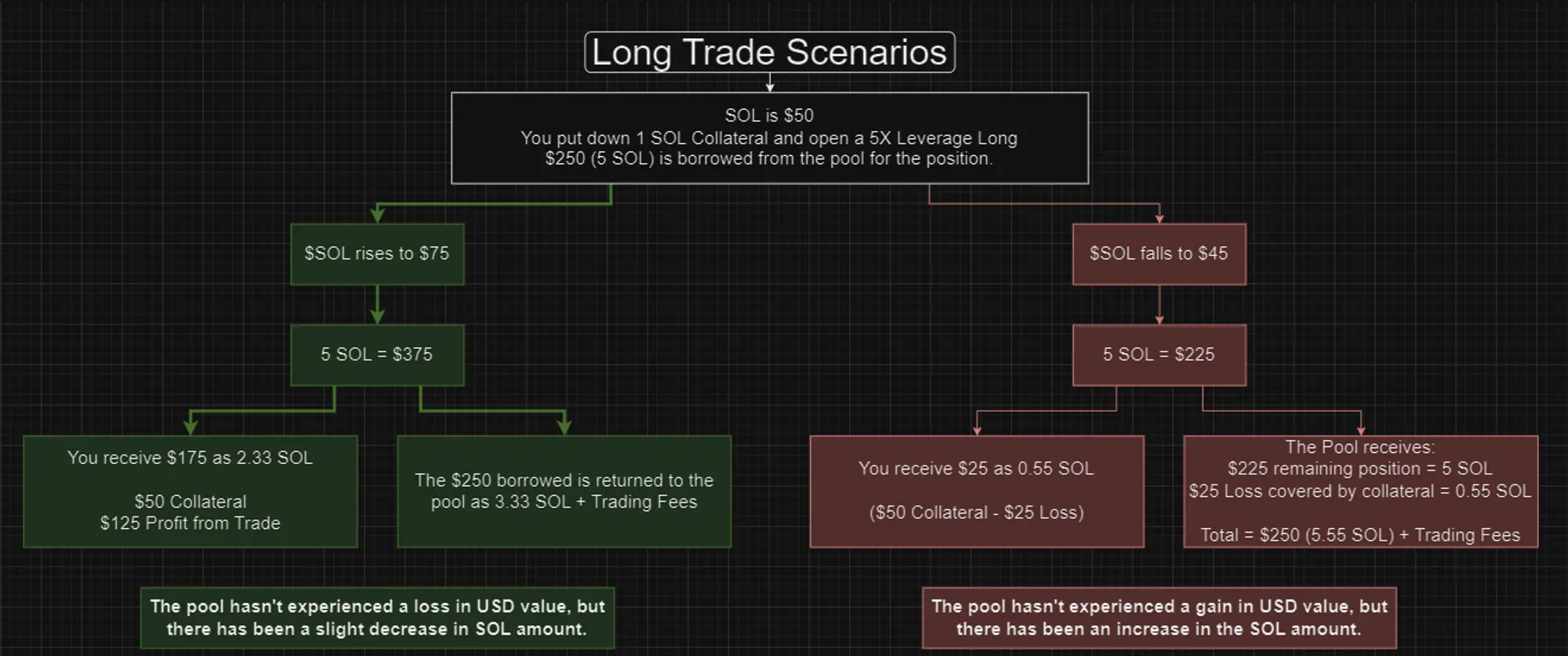

Perps trading operates based on the liquidity provided by LP and the price data provided by the Pyth oracle, and is currently in the Beta testing stage. The operating mechanism of Perps trading is similar to GMX’s GLP pool model. LP provides liquidity to the JLP pool. Contract traders mortgage various Solana assets, select a leverage multiple of 1.1x-100x, and lend relevant liquidity from the JLP pool ( For example, if you are long SOL, you need to lend a corresponding amount of SOL according to the leverage multiple, and if you are short SOL, you need to lend stablecoins). After closing the position, the trader obtains profits/settles losses, and returns the remaining tokens to the JLP pool. , for long SOL, if the trader makes a profit, the number of SOL owned by the JLP pool will be reduced, and the trader's profit will come from the JLP pool.

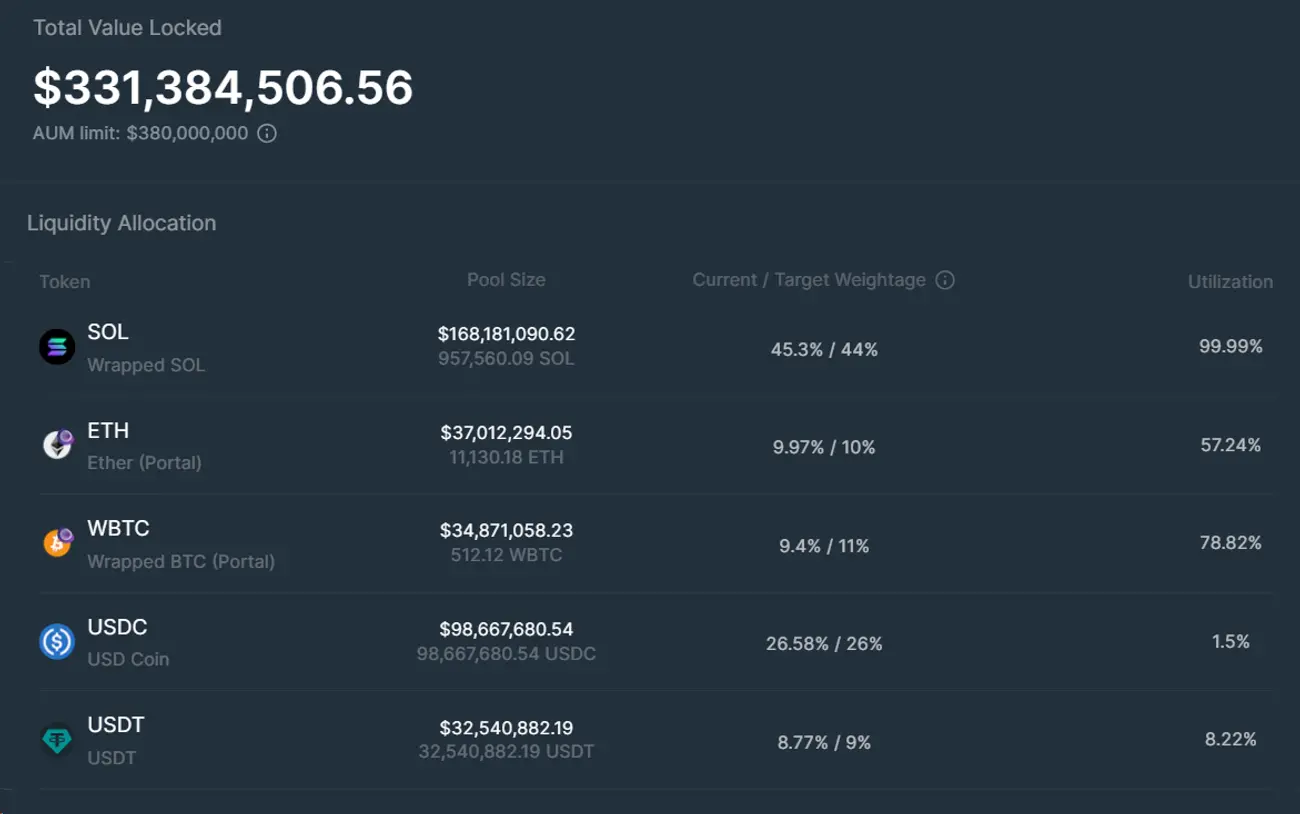

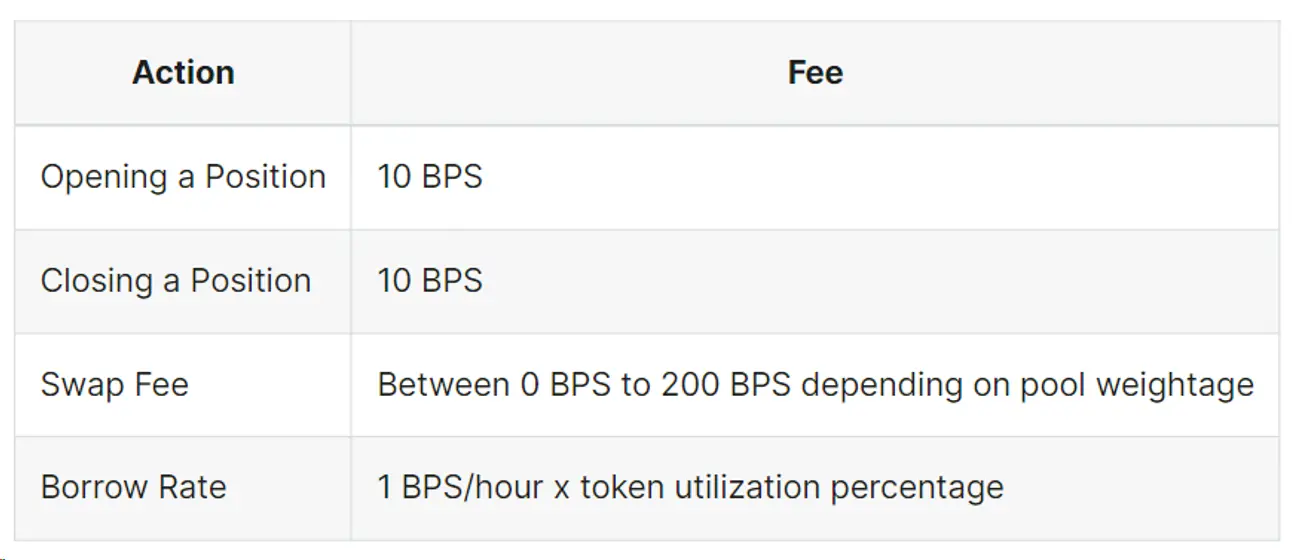

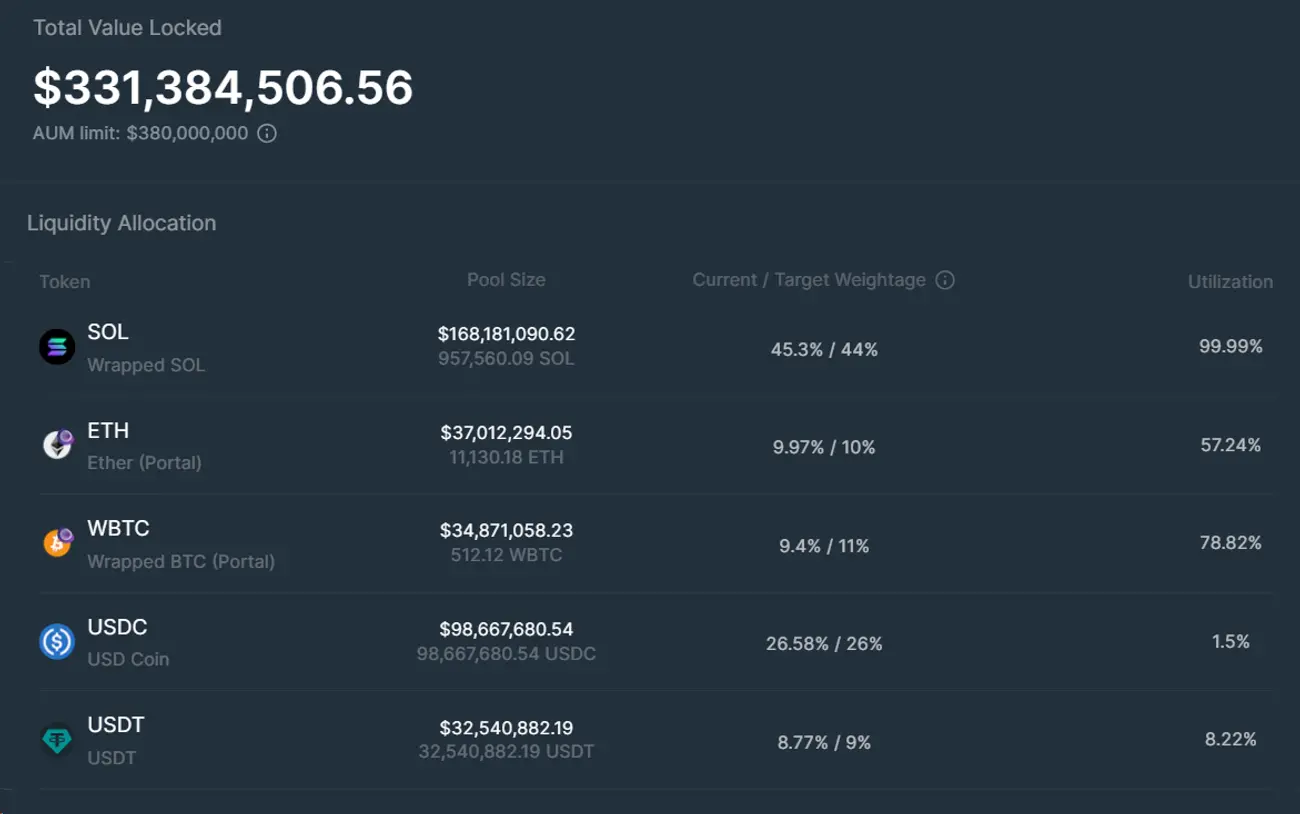

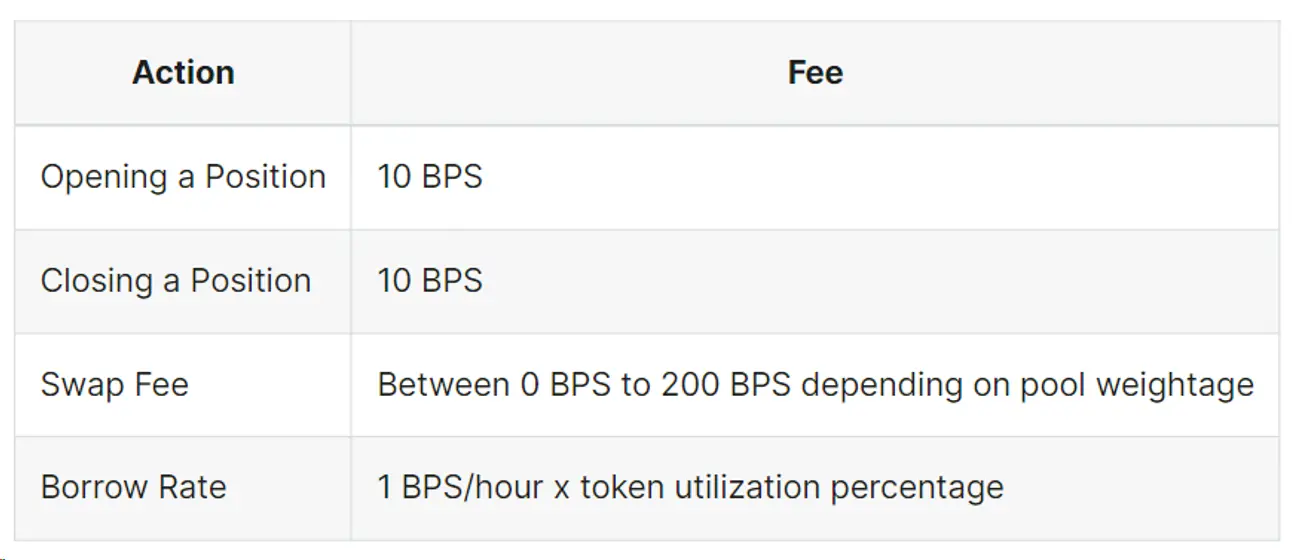

Currently, the JLP pool supports five assets: SOL, ETH, WBTC, USDC, and USDT. The JLP pool will receive 70% of the exchange’s revenue, which includes transaction fees for opening and closing positions, as well as interest fees for borrowing (the relevant charging standards are shown in the table below). The current TVL of the JLP pool is $331,384,506.56, and the corresponding asset proportion is shown in the figure below.

2.5 LFG Launchpad

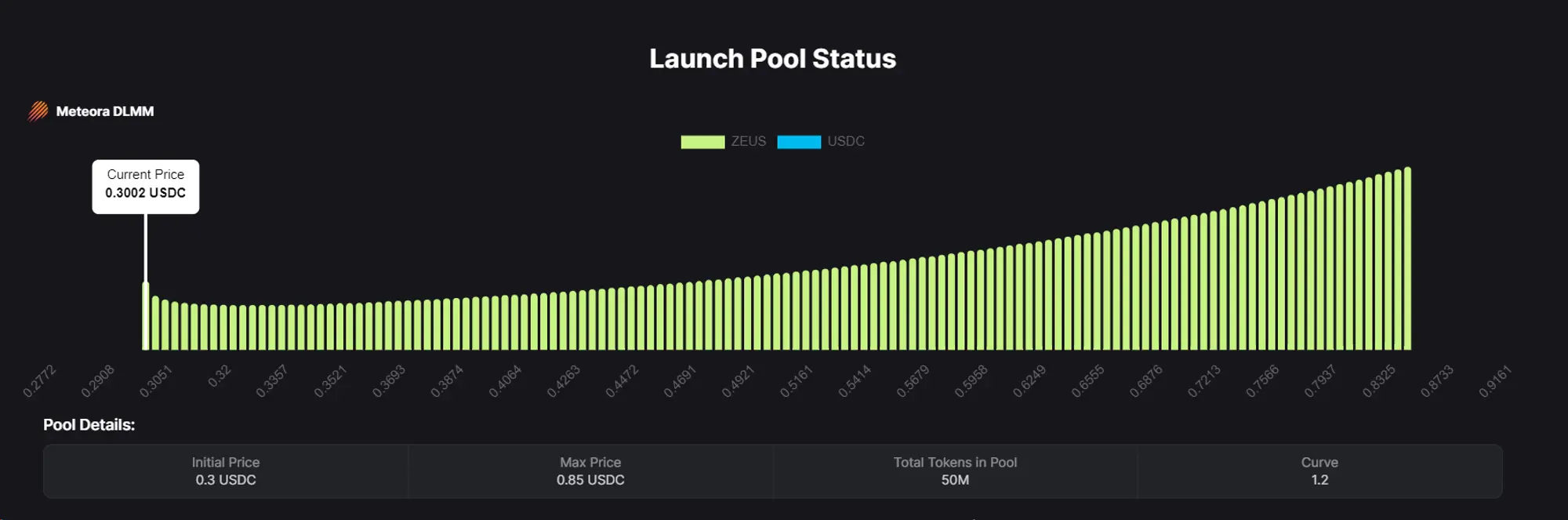

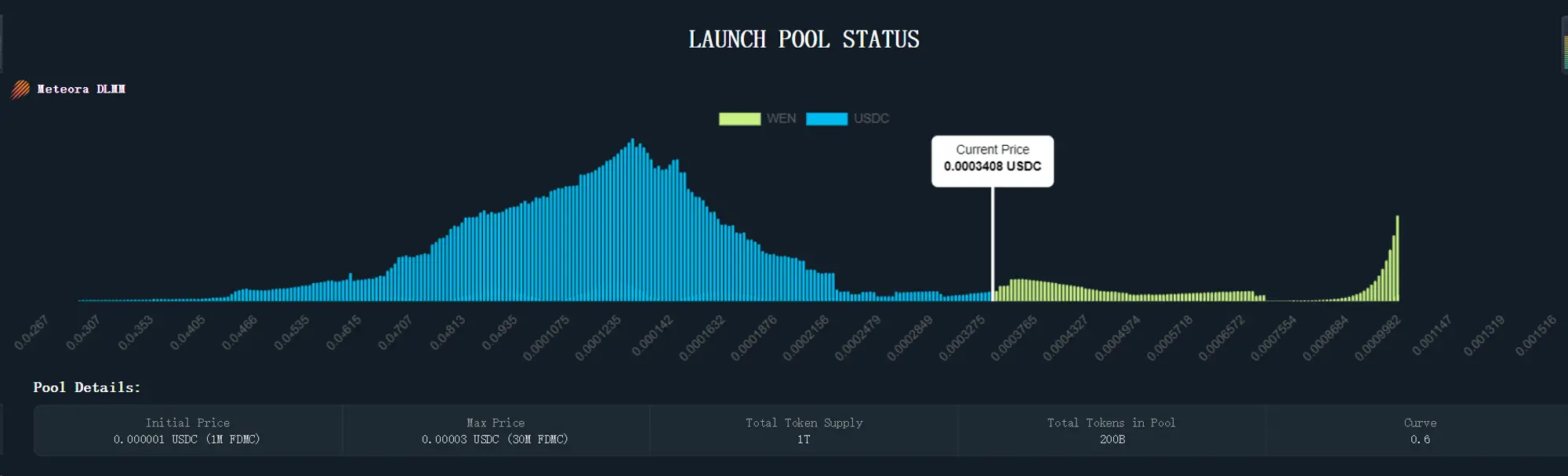

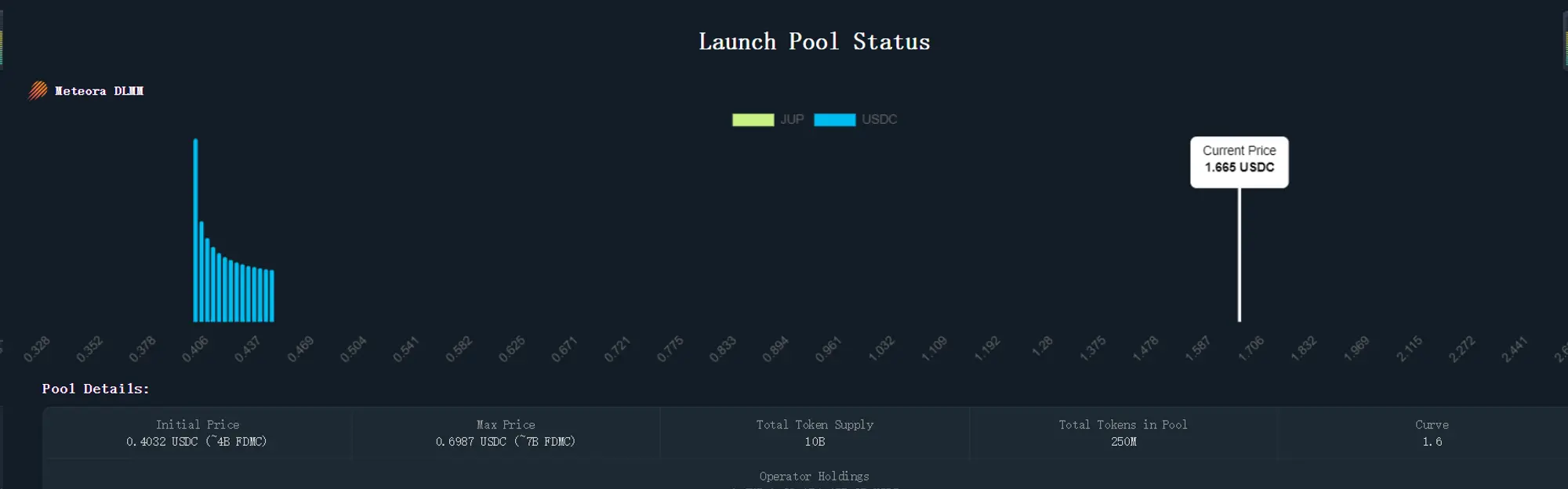

Jupiter launched the Beta version of Launchpad in January 2024 and has completed the JUP , WEN, ZEUS token issuance. Launchpad’s participants are mainly divided into three categories: project parties, JUP community, and users who purchase tokens.

For the project party, Jupiter is the largest traffic entrance on Solana. Choosing Jupiter as the launchpad will greatly capture Solana ecological users. At the same time, projects participating in Launchpad need to provide a certain amount of Tokens (generally 1% of the tokens) are used to incentivize the JUP community and team.

JUP Community Voters who own and stake JUP decide the next project to be launched on Jupiter through voting and receive corresponding rewards. In terms of voting rules, many users lock a certain number of JUPs to obtain a corresponding number of voting rights. There is no minimum token requirement for voting, but each wallet can only vote for 1 project. It takes 30 days to unlock the tokens. During the unlock countdown , users can still vote, but their voting rights will be reduced accordingly. After voting, the two projects that will currently be launched on Jupiter are Zeus Network and Sharky. For JUP holders, the benefits brought by choosing to pledge and vote include:

- Launchpad project airdrop: For example, Zeus Network announced an airdrop to 181,889 addresses participating in the Jupiter LFG Launchpad vote. In order to attract JUP votes, It may be inevitable for the project to airdrop to voters;

- Jupiter governance rewards: 100 million JUPs and 75% of Launchpad fees will be used for governance incentives. The rewards will be distributed quarterly. The rewards for this quarter will be 50 million JUPs. JUP and Launchpad fees for this quarter, the remaining 50 million JUP will be used as rewards in the next quarter. Launchpad’s fee is 0.75% of the total token supply paid by the project to JUP DAO.

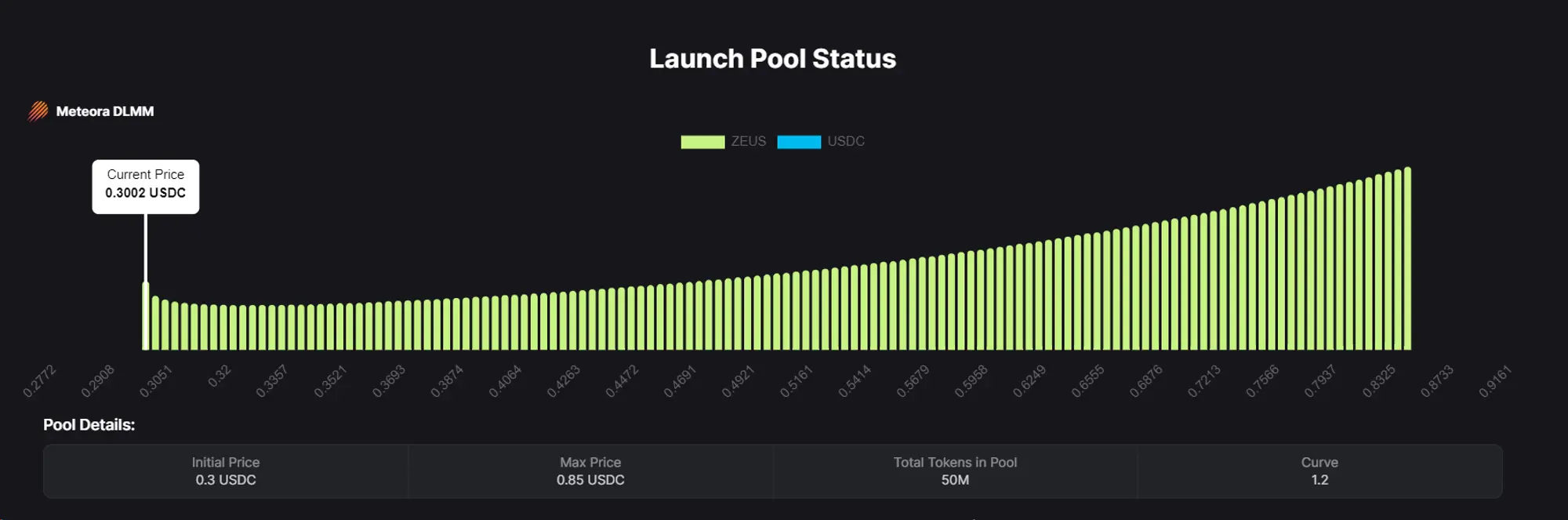

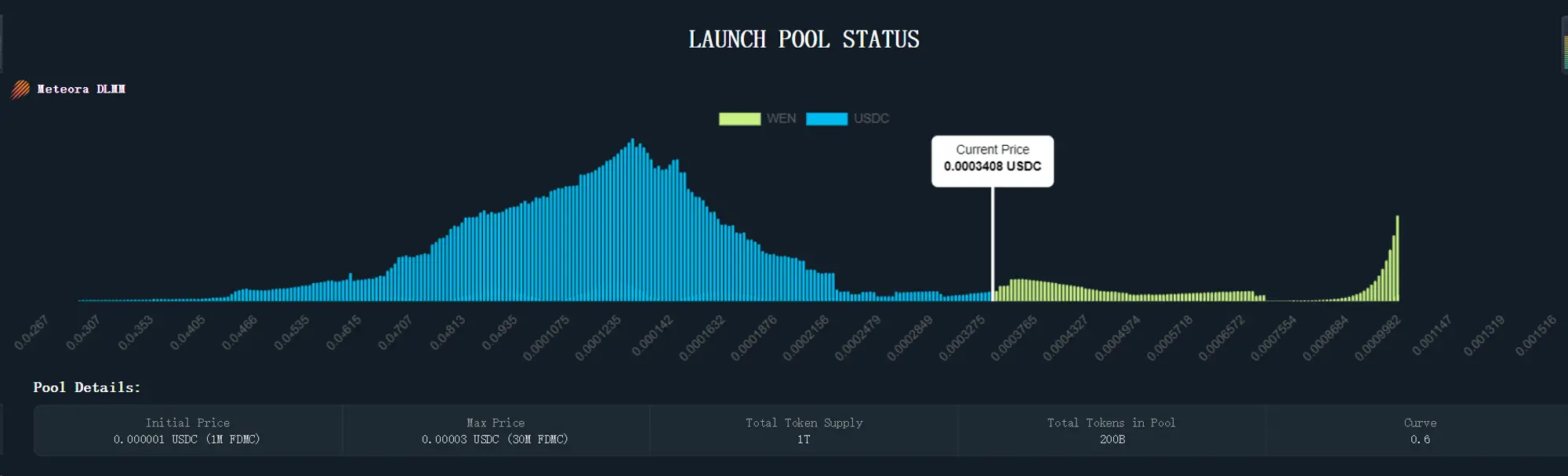

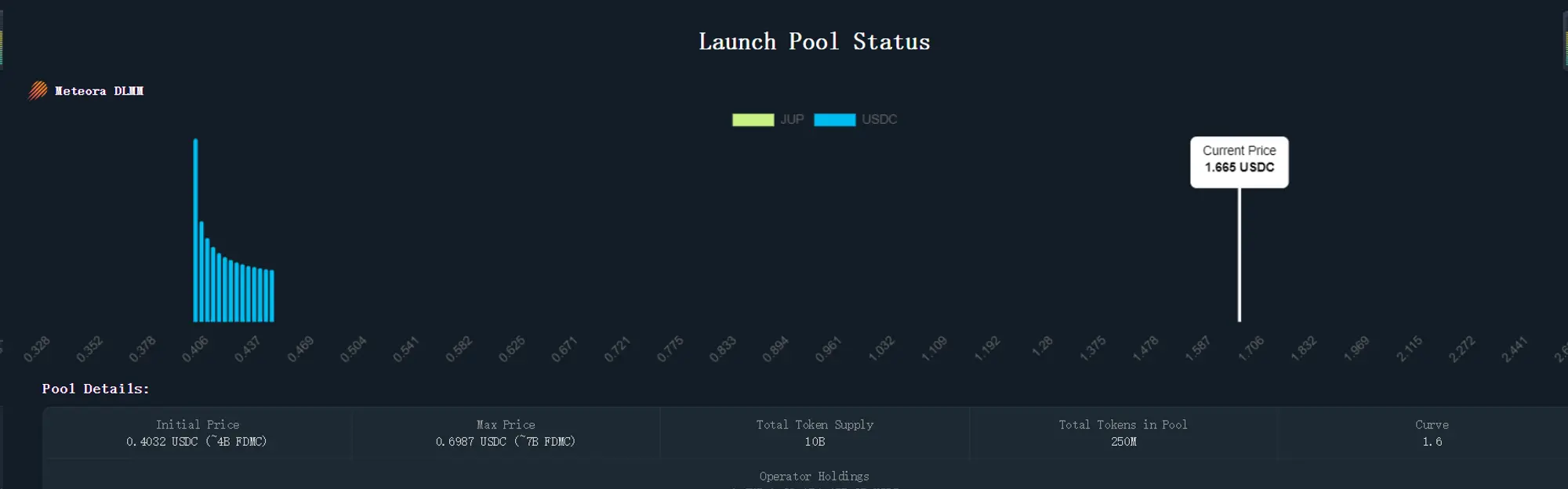

For token buyers, JUP Launchpad uses the DLMM (Dynamic Liquidity Market Maker) model for token sales. The DLMM model subdivides a price range into multiple discrete price ranges. The team mainly provides Token liquidity, and users provide USDC liquidity, completing the token sale in the process. In addition, in order to reduce the impact of complex mechanisms on users, Jupiter still provides DCA and limit order functions, allowing users to complete token purchases relying on appropriate strategies during the token sale period.

Currently Jupiter Launchpad’s first unofficial project, Zeus Network, is on sale. The starting price range of ZEUS on Launchpad is $0.3- $0.85, the highest price reached $1.11, and the current price is $0.83 (data on April 11). At this price, the total airdrop value shared by JUP voters is $8,300,000 (1% ZEUS). In addition, in the issued JUP and WEN, the vast majority of participants have obtained more than 3 times the return:

2.6 Summary

Based on the above analysis, we believe that Jupiter’s product advantages are as follows:

- Jupiter provides a full set of basic tools for trading, creating an excellent user trading experience: **From the most basic spot and Perps transactions, to DCA and limit orders, almost all necessary tools are provided for users. Basic functions, while benefiting from the liquidity aggregation function, DCA and limit orders also connect to wider liquidity.

- The business development direction from trading infrastructure to Launchpad is reasonable: **The trading infrastructure captures a large number of users, making Jupiter the traffic center of Solana, which naturally meets the needs of Launchpad, and multiple trading functions It also lowers the threshold for users to participate in the token sale; the function of Launchpad makes the binding between Jupiter and Solana ecosystem deeper, strengthens Jupiter's infrastructure and leading position, and increases JUP's token empowerment.

3 Token Economics and Fund Analysis

3.1 Token Economics Analysis

Jupiter’s total supply is 10B, and the token distribution is as follows: the Jupiter team will manage 50% of the tokens, and the remaining 50% will be distributed to the community.

Among them, of the 50% tokens belonging to the team, 20% will be distributed to team members, but the distribution will not begin after two years, and 20% will enter Strategic reserve, held in the 4/7 Team Cold Multisig wallet. These tokens will be locked for at least one year. The community must be notified at least six months in advance before any liquidity event. The remaining 10% of JUP tokens will be used Provide liquidity and keep it in the Team Hot Multisig wallet.

Of the 50% of tokens vested in the community, 40% will be distributed through four separate airdrops, which will take place on January 31st of each year, and the remaining 10% of tokens will be provided through grants. Community Contributor.

In the Genesis issuance, a total of 1.35B (13.5%) tokens entered circulation, including 10% of the separate airdrop (1B), 250 million tokens were allocated to Launchpad, and 50 million were used as market makers of loans, 50 million is used to provide liquidity.

Therefore, according to the token supply plan, there will be no large-scale unlocking of JUP before 2025, and 50% of the tokens belonging to the team will not be unlocked in the next year, and the unlocking The community will be informed six months in advance. The next large-scale unlock will come from the 1B airdrop on January 30, 2025.

In terms of token empowerment, the current main use is to pledge voting to obtain governance incentives and Launchpad project airdrops. As of April 4, 2024, a total of 269,290,321 JUPs have participated in the pledge, accounting for 10% of the current circulation. About 20%. However, it is worth noting that Jupiter’s founder Meow believed in a Reddit AMA that the JUP token was not designed for practicality and believed that JUP’s price growth will come from value rather than actual utility.

3.2 Funding analysis

JUP’s market capitalization is $2,101,677,968, and its FDV is $15,567,984,945 (data on April 11). Since it does not exist in the next year Large-scale unlocking, so the market value has a stronger reference significance than FDV.

JUP’s transactions are mainly concentrated on Binance, followed by OKX, Bybit and Gate. According to the trading data on Binance, JUP has maintained a price of around 0.5 for a long time, and completed a large number of changes of hands at a price of 0.5-0.7, which is the intensive cost range of JUP and has become a strong Support, the price of JUP began to break through the bottom cost range after settling for 2 months, and has now entered a new price range.

4 Competitive Product Analysis: Who is Solana’s best leveraged target?

Jupiter is in a unique position in the Solana ecosystem as a transaction aggregator. With its unique functions and large capture of transaction volume, there is currently no trading protocol in the Solana ecosystem that can be compared with Jupiter. direct competition. Therefore, what we need to consider is, if we need to choose a leveraged target in the Solana ecosystem, is JUP a good choice?

There are many options for leveraging the Solana ecosystem: infrastructure (such as JUP), leading MEME (such as WIF) and other ecological projects (such as AI, DePIN projects), but the benefits obtained by different categories are different. MEME has greater uncertainty, while other ecological projects have a greater relationship with their own narratives (for example, RNDR will benefit from the growth of AI narratives rather than the growth of Solana’s ecosystem), so the projects that resonate most with Solana It is the infrastructure protocol of the Solana ecosystem, such as transaction infrastructure (Raydium/Orca/Jupiter), liquidity staking protocol (Jito), and oracle (Pyth). Compared with these projects, Jupiter's advantages mainly lie in:

- From the basic business, Jupiter captures more users and traffic of the Solana ecosystem. Among all businesses, the most basic business required by users is transaction. In particular, the Solana ecosystem has recently focused on Memecoin as its core demand, further strengthening the importance of transaction. According to Jupiter's monopoly on the front-end of Solana transactions, users who enter the Solana ecosystem will naturally become Jupiter users. Jupiter will become the first stop for users in the Solana ecosystem and has the strongest and most direct binding relationship with the Solana ecosystem. It is also the strongest representative of the Solana ecology;

- From the airdrop of the new ecology, Jupiter's launchpad function allows JUP holders to obtain airdrop rewards for new projects, while Raydium/Orca and Jito are the It has not yet shown strong competitiveness. A project that can also capture potential airdrops is Pyth, and multiple projects have already provided airdrop rewards for Pyth stakers (such as Wormhole). It is necessary to continue to pay attention to the advancement speed of Jupiter's launch board and the wealth creation effect of the token sale. If Jupiter uses its traffic advantage to attract a large number of high-quality projects to launch, JUP holders will receive higher returns and capture more Solana ecological innovations. The value of the project.

5 Conclusion

Jupiter is regarded by many as the Uniswap and Solana ecology with its trading portal and Launchpad functions. Golden shovel, JUP is also regarded as BNB. Based on the above analysis, we believe that Jupiter’s bullish advantage lies in:

- It has built a complete product matrix related to transactions, which greatly improves the user’s trading experience. Jupiter's trading volume has increased rapidly and has become the second largest trading infrastructure after Uniswap.

- Backed by the strong traffic and user groups captured by Jupiter, Jupiter established Launchpad to capture more of the value of new projects in the Solana ecology and provide numerous new project airdrop rewards for JUP token stakers. Several projects currently launched All projects achieved good price performance.

- In terms of funding, JUP tokens will not face large-scale unlocking and selling pressure in the next three quarters, and the chip structure is relatively stable. Judging from the price performance, JUP has stepped out of the bottom cost range and entered a new growth space.

- Jupiter can be regarded as Solana’s leverage target due to its close connection with Solana’s ecosystem. Solana will be as important as Ethereum in this cycle as a public chain and ecosystem. As Solana's market value has reached a new high, a better way to be long on Solana may be to choose JUP as an amplifier.

Risks in Jupiter may include:

- Solana ecological growth is not as expected;

- The improvement of a large number of Trading bots or other trading front-ends will challenge Jupiter’s status as the first trading entrance;

- Jupiter’s token Lack of practicality, token price growth may be hindered;

- Jupiter Launchpad’s effects (including the quantity, quality and wealth creation effects of projects) do not meet expectations.

#

The above is the detailed content of Metrics Ventures Research Report: Is Jupiter an Amplifier for Solana Investment?. For more information, please follow other related articles on the PHP Chinese website!