Written by: Michael Nadeau

Compiled by: Luffy, Foresight News

People They say you should follow the smart money in investing, and the beauty of public blockchains is that we can easily do this using on-chain data.

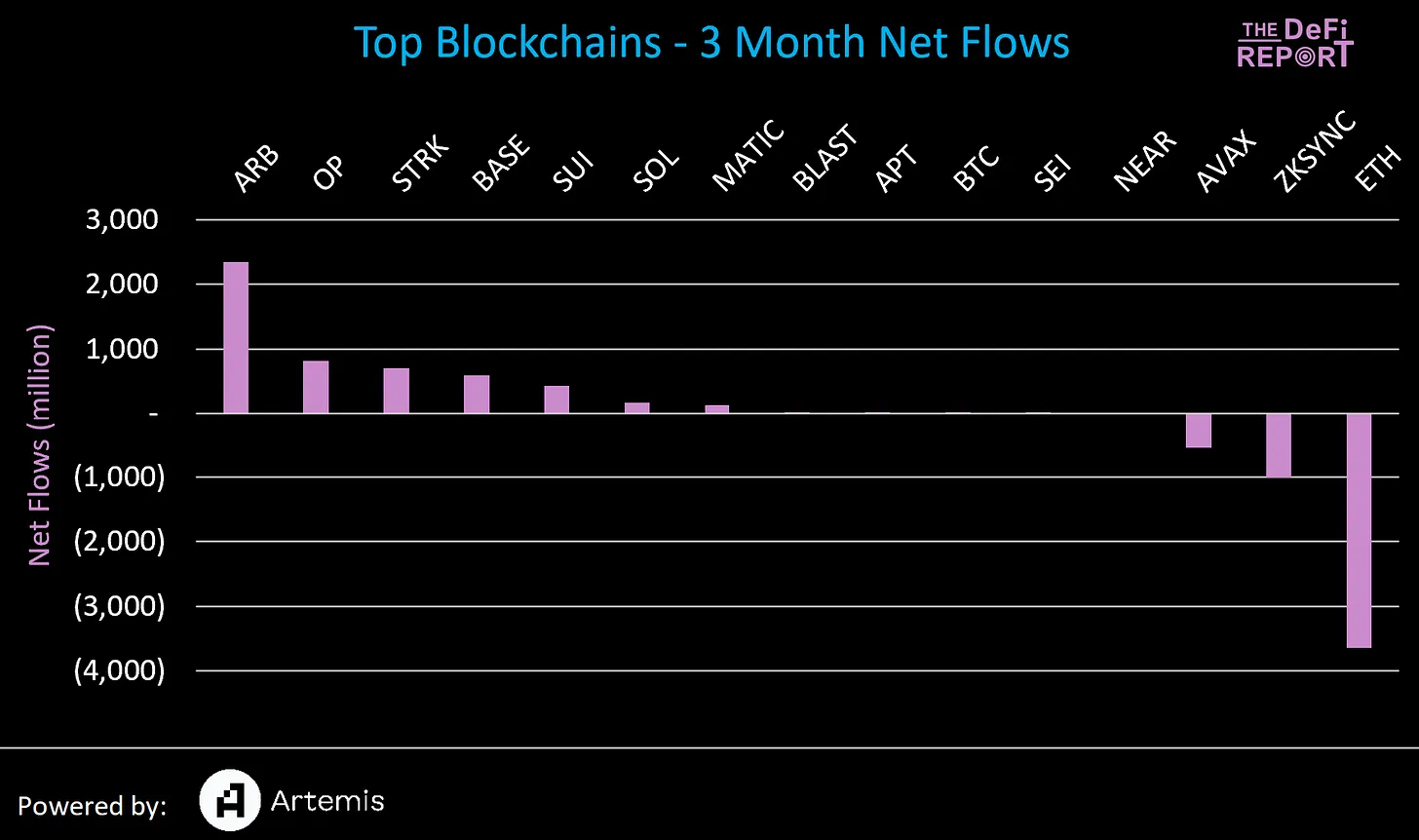

As the infrastructure connecting blockchains improves, network effects and economic moats within any single network may become increasingly difficult to achieve. Therefore, we have been studying the net fund flows of the top 15 L1s and L2s to reveal exactly where value flows in public blockchain networks, and now it is time to share our findings with you.

Winner:

Losers:

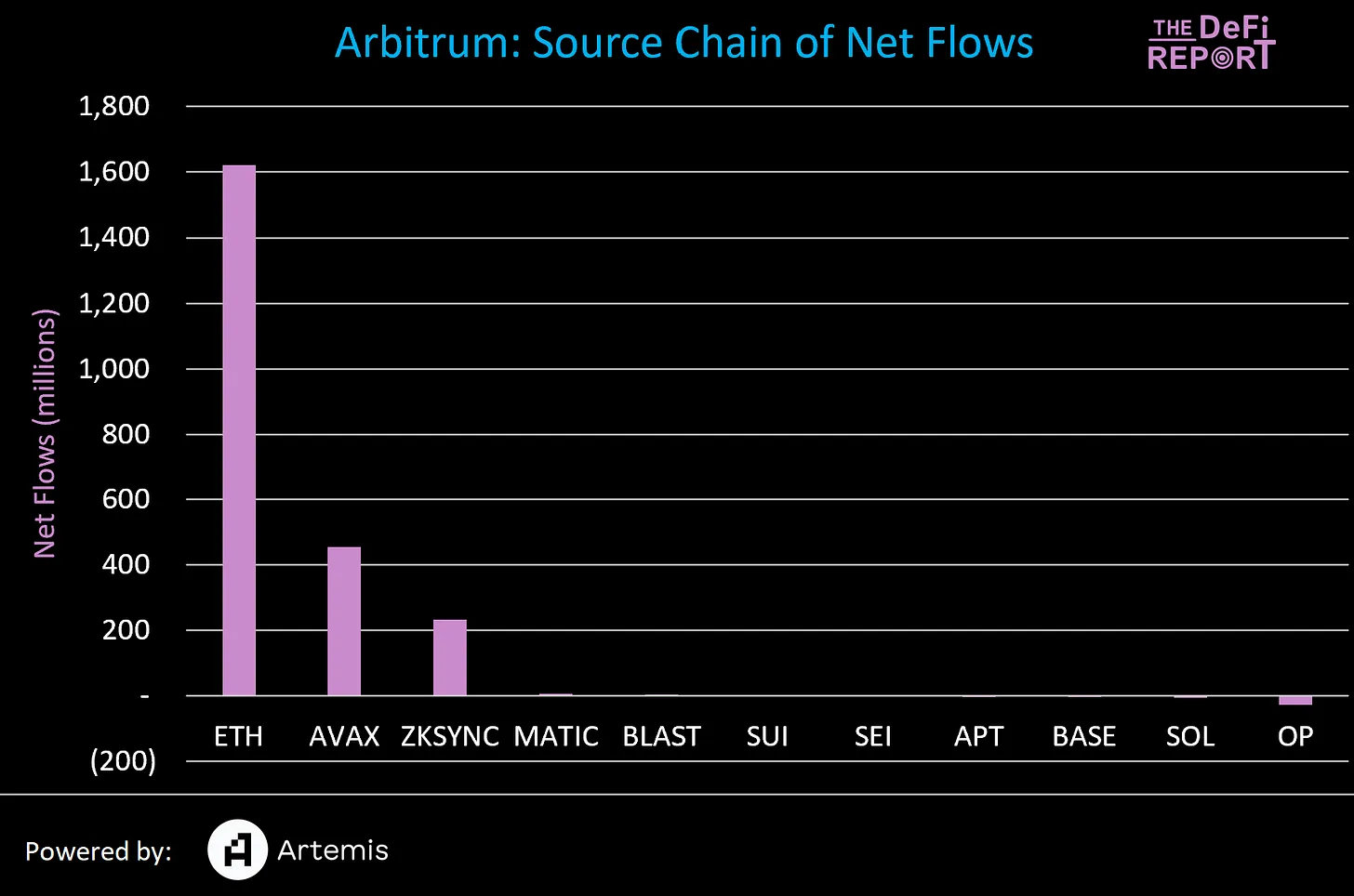

We can see that the vast majority of Arbitrum’s inflows (70%) come from Ethereum L1. About 25% of the inflows are stablecoins, with other tokens accounting for 75%. We expect funds to continue to leave Ethereum L1 and flow into the most popular L2 instead.

But unexpectedly, nearly $500 million in funds left the Avalanche ecosystem and flowed to Arbitrum. If we revisit the first chart, Avalanche was one of the biggest losers of the group, with $543 million leaving the ecosystem last quarter, 84% of which went to Arbitrum.

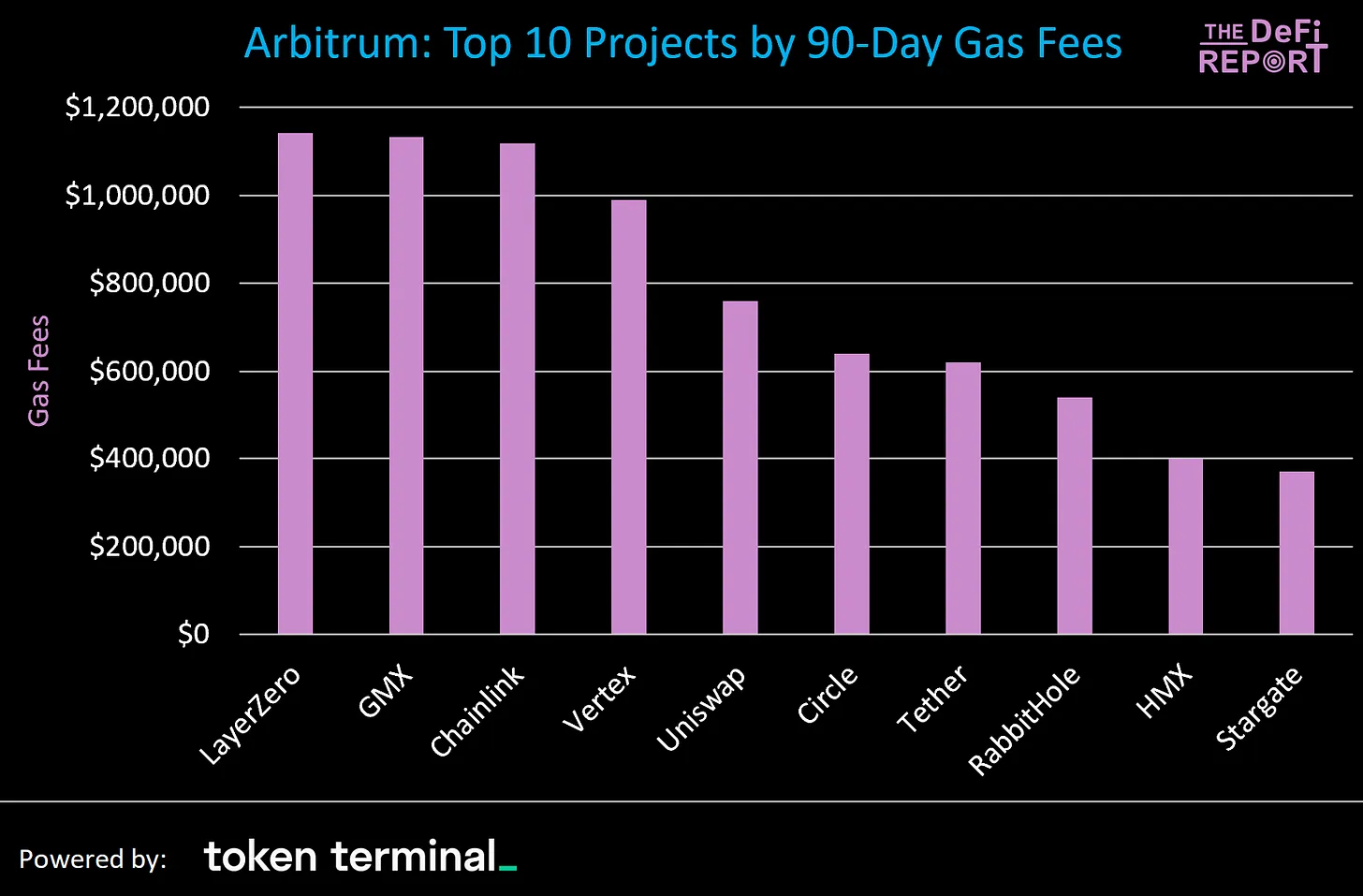

We can’t say with certainty which projects on Arbitrum are capturing these inflows, but the projects mentioned above accounted for the most gas consumption on Arbitrum over the past quarter.

When we look at 90-day trends, RabbitHole (one game) stands out as its gas consumption rose 1,147% over the past quarter.

Another interesting observation about Arbitrum is that Pyth Network (the leading data oracle within Solana) has experienced a 600% increase in gas consumption in the past quarter after supporting Arbitrum.

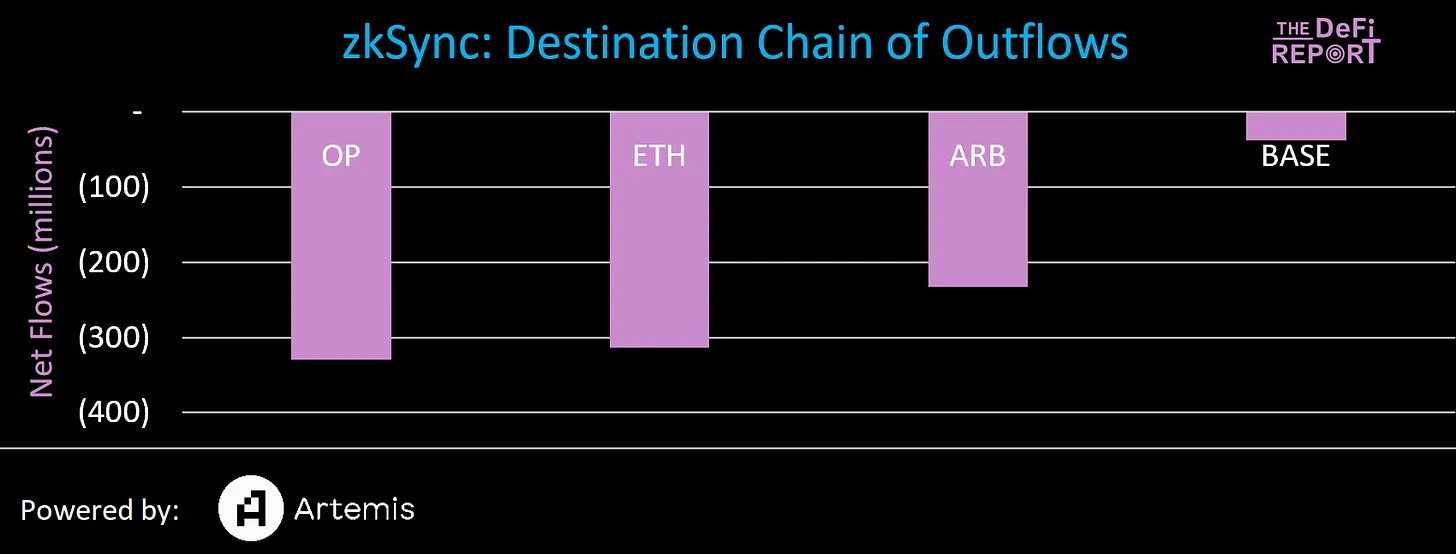

We talked about Avalanche, but beyond that, zkSync (Ethereum L2) has lost over $1 billion in funds in the past 90 days. Where did the money go?

Key points: All funds flowing out of zkSync remain within the Ethereum ecosystem.

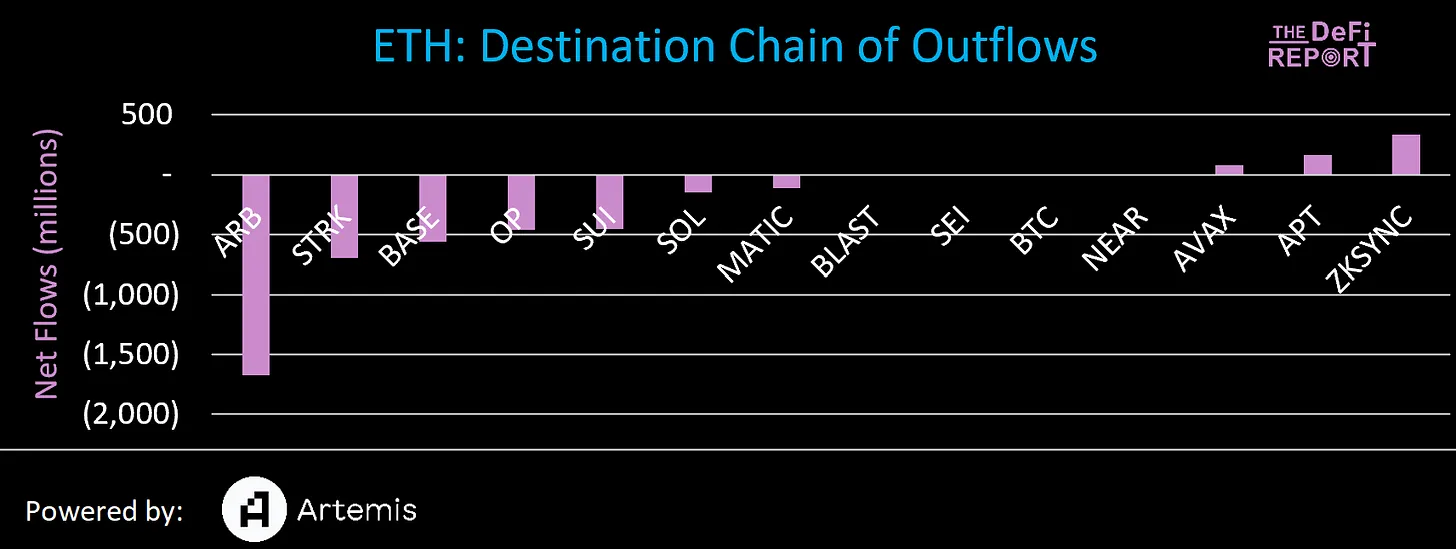

What about Ethereum? We know Arbitrum received $1.6 billion from Ethereum, but where did the rest of the money go?

The vast majority of Ethereum’s net outflows also remain within the Ethereum ecosystem, flowing to Starknet, Base and Optimism.

Sui was the largest non-EVM beneficiary of Ethereum outflows, receiving $452 million. Additionally, Solana received $152 million in inflows from Ethereum.

As public blockchain networks mature, we expect the amount of funding in the technology stack to rise.

We also expect that there will eventually be 3-5 major L1s (and possibly a series of less important L1 blockchains).

But as cross-chain infrastructure and account abstraction mature, we expect value to flow freely across various networks and ecosystems, making impenetrable network effects and economic moats more difficult to achieve.

Having said that, we have drawn some key conclusions from analyzing the flows in the main L1 and L2.

The largest L1 has lost a lot of money, but it has recovered at the L2 level. In my opinion, this is good for Ethereum. It would be a red flag if we saw funds leaving L1 instead of going to L2, but leaving the Ethereum ecosystem entirely. To be clear, we are not seeing this today.

Additionally, Ethereum’s TVL is up 60% in the past 3 months despite over $3 billion in outflows. This highlights the shortcomings of TVL as a KPI (the underlying asset price is highly volatile and easily manipulated).

Over the past 3 months, Solana’s net inflows across the 15 largest L1s and L2s were only $169 million. During the same period, Solana's TVL grew from $1.4 billion to $4.5 billion (a 221% increase).

So how did this happen?

Solana’s growth in TVL is largely organic within the ecosystem.

Sui is the biggest winner in the new era of "high throughput" blockchain. It received $423 million in net inflows, the vast majority of which came from Ethereum. This appears to have been the main catalyst that drove Sui TVL from $220 million to $660 million today.

As mentioned above, as cross-chain infrastructure matures, the flow of value across various networks is likely to accelerate, driving value out of any given L1, and Possibly to the cross-chain bridge itself. To be clear, we are not currently seeing this happening but are still monitoring it.

Wormhole is one of the largest cross-chain bridges today. It provides interoperability between Solana, Ethereum, Arbitrum, BNB, Avalanche, Optimism, Near and Polygon. The team recently launched its token, with FDV briefly exceeding $10 billion. This number is close to that of Ethereum L2, which is a market signal that cross-chain infrastructure is strong and worth paying attention to.

The above is the detailed content of Ethereum saw an outflow of $3.6 billion in the first quarter, where did the money go?. For more information, please follow other related articles on the PHP Chinese website!