Akash Network is a project in the field of blockchain and cloud computing. Essentially, it is a decentralized cloud computing marketplace designed to make cloud computing more accessible and less expensive.

Written by: Teahouse Xiaoer

1. Project Introduction

Akash Network is a project in the field of blockchain and cloud computing. Essentially, it is a decentralized cloud computing marketplace designed to make cloud computing more accessible and less expensive. The network runs on a blockchain-based platform that allows users to rent out unused computing power or purchase computing resources at competitive prices. The model encourages more efficient utilization of global computing resources, potentially reducing waste and lowering costs for both cloud service providers and consumers.

Akash Network was founded in 2015, launched the mainnet in the Cosmos ecosystem in 2020, and began supporting the GPU cloud market on August 31, 2023, thus further expanding its scope of services.

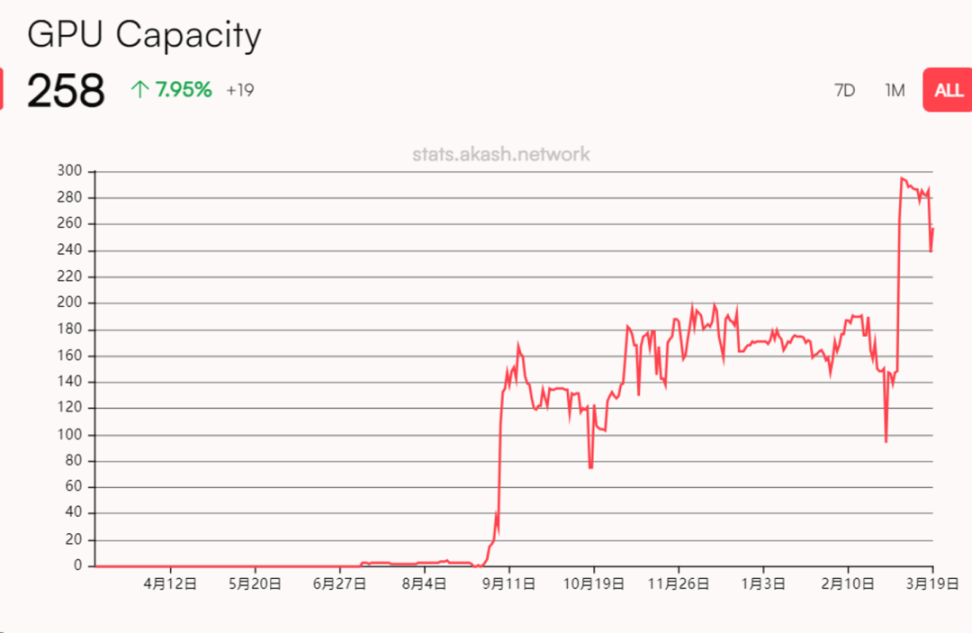

The supply side of Akash Network comes from data centers, miners and consumer computing power. Especially after mainstream public chains shift to the PoS (Proof of Stake) mechanism, the idle computing power of a large number of mines has become a problem to be solved. Akash Network effectively utilizes these idle resources by cooperating with multiple large miners. Currently, there are over 17,700 CPUs and 258 GPUs in the Akash network, and the number is still growing.

On the demand side, Akash Network is committed to attracting more developers to join its open source community and actively seeking cooperation with other decentralized AI protocols to expand its service range and improve the competitiveness of the platform. For example, Akash has entered into partnerships with decentralized layer 1 protocols such as Gensyn and Bittensor, which have brought a lot of fixed demand to Akash.

#Akash uses a reverse auction mechanism to match supply and demand. Its computing power is mainly used for data preprocessing and model reasoning. It is also currently trying model training. By developing tools such as Cloudmos Deploy and Akash Console, Akash Network has taken a series of measures to reduce user difficulty, including integrating Cosmos Swap on Metamask and supporting stablecoin payments, etc., which greatly lowers the entry barrier for users.

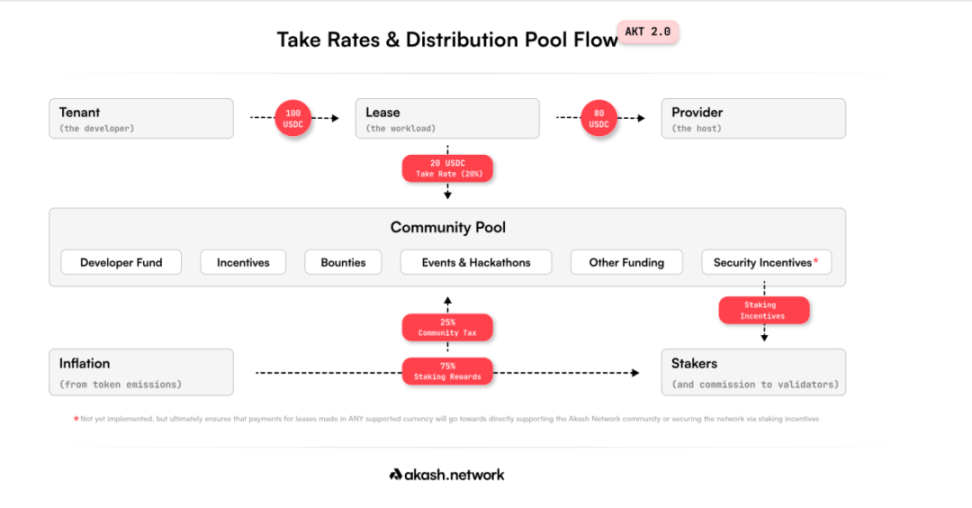

In terms of token economics, the AKT token plays a key role in the Akash ecosystem, including serving as a staking medium to enhance network security, governance, lease settlement units, and a benchmark for market pricing. Supply and demand are regulated by setting different handling rates and inflation rates, while allocating a portion of the revenue to the community pool for incentives and possible token destruction to ensure the sustainable development of the ecosystem.

2. Core Mechanism

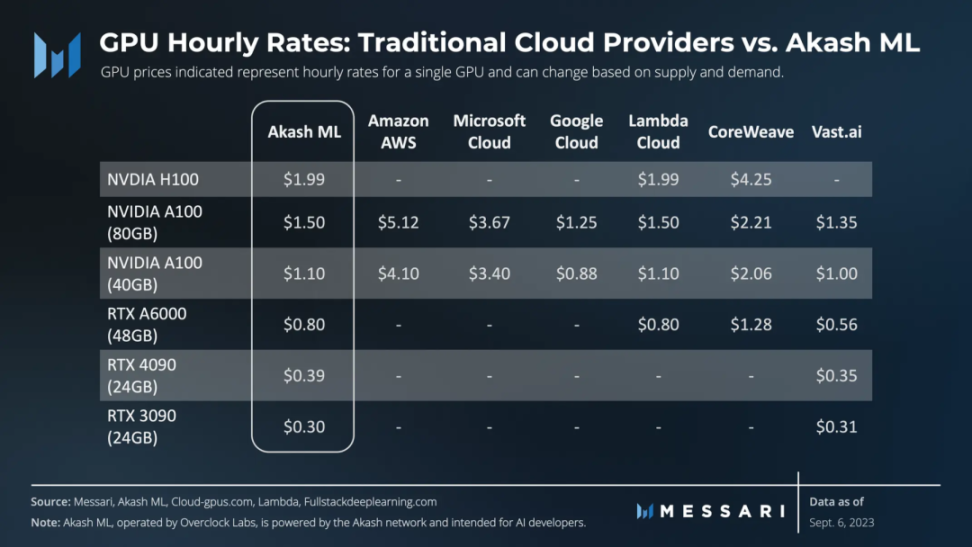

Simply put, Akash’s cloud computing market concentrates and reallocates idle computing processing power to customers in need. Akash's "super cloud" connects customers and providers through transparent distributed leasing services and retains the advantages of decentralized computing through the Akash blockchain. By establishing an open and transparent market, users can freely publish resource requirements and allow global resource providers to bid in real time, reducing the cost of cloud services. According to Messari's report, Akash's cost for the same hardware is much lower than that of other cloud providers.

The flexibility of the protocol allows movement between providers while delivering the performance benefits that come from global deployments. In turn, providers can earn profits from unused capacity.

Through the virtualization process, computer resources are split into containerized applications. These "containers" are then leased to "tenants," buyers of cloud services on the network. Providers bid on these requests after they are validated as orders, and the lowest bidder for the requested resource wins the lease.

Through this process, each market participant receives a financial incentive to use the network. Providers profit by monetizing idle resources, while tenants benefit from lower costs. Market transactions all occur on the Akash blockchain.

The Akash blockchain is secured by the Delegated Proof of Stake (DPoS) consensus mechanism. Therefore, the network relies on a system of validators and delegators. Validators on the Akash network submit new blocks to the blockchain through a voting process using tokens staked to them by delegators. Delegators stake their tokens to validators of their choice based on public information available on the platform.

The protocol also implements the Tendermint algorithm to improve speed and scalability. With its transparent and permissionless process, Akash represents the first open source, decentralized cloud platform.

Akash Network main features:

Decentralized Cloud Computing: Akash Network is built on a blockchain-based framework, eliminating dependence on centralized cloud providers, providing higher security, transparency, and enhanced security for user data and transactions. Scalability.

Permissionless Marketplace: Akash Network provides an open marketplace that allows anyone with computing resources to become a cloud provider. Users can rent out their unused computing power, promoting competition and thus lowering prices.

Flexibility and security: Developers can easily deploy applications and workloads, and the platform provides high security by using the native AKT token to ensure the integrity and authenticity of network transactions.

Staking and Incentives: AKT token holders can participate in the network by staking their tokens, which not only helps secure the network but also earns them rewards.

Interoperability Ecosystem: Akash Network is designed to be blockchain agnostic and built on the Cosmos SDK, allowing easy integration with other blockchain networks and promoting cross-chain cooperation.

Environmentally friendly: Compared with traditional cloud services, Akash Network is more energy-efficient. The network’s consensus mechanism is based on proof of stake, which is greener than the proof of work used by many other blockchain networks.

Graphics Processing Units (GPUs)

One of Akash Network’s unique strengths is its GPU (Graphics Processing Unit) marketplace, a transformative feature for AI hosting. Through its decentralized cloud, Akash Network provides a platform where individuals and enterprises can rent out their idle GPU resources to those in need, especially AI developers and researchers.

This feature is groundbreaking mainly because of:

Cost-effectiveness: Traditional cloud services are expensive to rent GPUs for AI processing. Akash Network’s open marketplace promotes competition and reduces GPU rental costs, making them affordable for AI researchers and developers.

Scalability and performance: AI developers can easily scale their operations and computing power without the limitations of traditional cloud infrastructure, which means AI models can be trained and deployed faster.

Security and Privacy: AI applications need to handle sensitive data. Akash Network’s blockchain framework ensures data is processed securely and transparently without the vulnerabilities of centralized systems.

Democratizing AI: By lowering cost and accessibility barriers, Akash Network enables a wider range of individuals and organizations to participate in AI development and hosting, fostering innovation and technological advancement.

Environmentally Friendly Resource Utilization: By efficiently utilizing idle GPU resources through its marketplace, Akash Network significantly reduces environmental impact, significantly lowering the ecological footprint compared to building and maintaining dedicated data centers.

3. AKT Token

AKT is the native cryptocurrency token of the Akash network, and its contracts are built on the Cosmos blockchain and count as an automated market maker (AMM). It is essential for securing the network, executing transactions and contracts, and incentivizing community participation through staking and rewards. As the ecosystem grows, AKT is expected to play an important role in supporting and protecting decentralized cloud services.

Main features and uses of AKT:

1. Network Security and Governance

AKT token serves as a staking medium, enhancing the network security. By staking AKT, users can participate in the governance of the Akash Network, with voting weight determined by the number and duration of their staked tokens, which promotes the network’s decentralized decision-making process.

2. Lease settlement unit

AKT is the payment unit for leasing cloud resources. Akash has set different handling fees to regulate supply and demand. For example, the handling fee charged for AKT payment is 4%, while the handling fee for USDC payment is 20%. Such a strategy not only regulates market supply and demand, but also increases the practical value of AKT.

3. Inflation and Token Distribution

Akash has set an annual inflation rate of up to 13%, part of the inflation income and fee income Are allocated to community pools for use such as public funds, incentives, and possible token burning. Such a mechanism aims to ensure the sustainable development and value circulation of the ecosystem.

4. Market pricing benchmark

AKT tokens also serve as the benchmark for market pricing, determining the cost of resource leasing. This role emphasizes AKT’s central position in the Akash ecosystem and is an important consideration for both resource providers and consumers.

5. Circulation and supply situation

As of March 20, 2024, the circulating supply of AKT is approximately 231 million. All tokens have been fully unlocked and no longer face higher prices. of unlocking selling pressure. The current main increase in circulation comes from inflationary incentives, with the maximum supply being approximately 389 million coins. The pledge ratio is relatively high, with approximately 133 million AKT used for pledge, accounting for approximately 57.8%.

6. Liquidity

AKT is mainly traded on central exchanges such as KuCoin, Kraken and Gate. It is worth noting that AKT has not yet been listed on first-tier large exchanges such as Binance, which may affect its popularity and liquidity in specific regions. However, AKT is already listed on Coinbase, which may enhance its market appeal and investment potential.

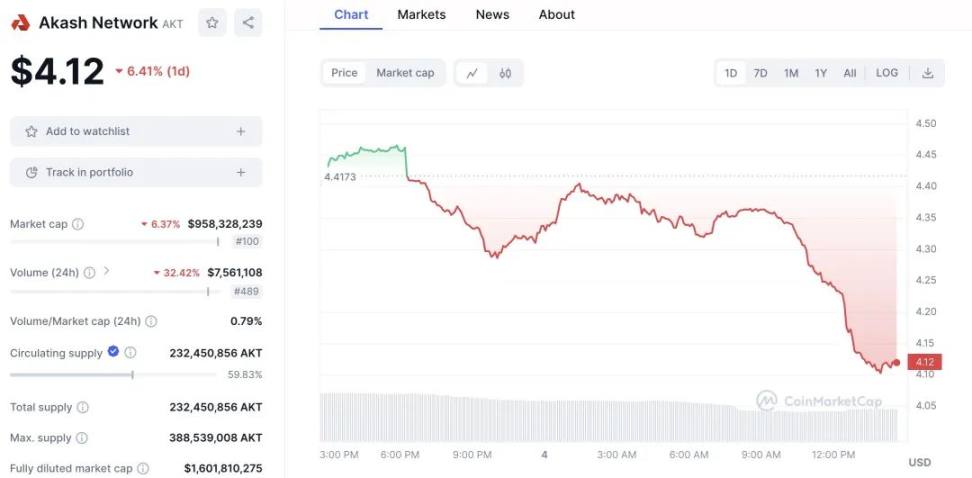

As of now, the price of AKT tokens is $4.12 each, down 6.59% in the past 24 hours. The market capitalization is $958 million, ranking it at 100th place. The 24-hour trading volume is approximately $7.59 million, and the ratio to market capitalization is 0.79%. The circulating supply of AKT is 232 million, accounting for 59.83% of the total supply. The total supply and maximum supply are both 232 million AKT. When considering maximum supply, AKT's fully diluted market cap is approximately $1.6 billion.

Looking from the chart, AKT has experienced price fluctuations in the recent period and is currently in a downward trend. Such market performance may be related to fluctuations in the overall crypto market, news events or updates specific to Akash Network. Investors and users should consider these market dynamics and engage in appropriate risk management when considering purchasing or holding AKT tokens.

AKT Price Forecast:

2024 Forecast: AKT’s price forecast for late 2024 varies from $4.43 to $7.33 according to different sources.

2025 Forecast: By 2025, forecasts indicate that the price of AKT may reach $8.60, with some predictions going as high as $8.13.

Long-Term Forecast to 2030: For longer-term expectations, AKT’s price forecasts range from $2,033 to $4,860 through 2030.

Forecast Key Factors Affecting Price:

Market Sentiment: Positive market sentiment towards Akash Network, continued development and potential partnerships can be viewed as a bullish scenario, with expectations that AKT may Reaching around $5 in the next few months.

Broad Market Dynamics: If the market experiences a bull run, AKT may benefit; however, if the market collapses, AKT may also decline significantly.

Akash Network Internal Developments: Successful product launches, new partnerships and increased user adoption may drive price increases.

Regulatory Environment: Changes in the regulatory environment may affect the adoption and use of cryptocurrencies and, in turn, the price of AKT.

Competition: Competition from other cloud computing platforms (whether centralized or decentralized) may limit AKT's growth.

4. Current situation analysis and future prediction

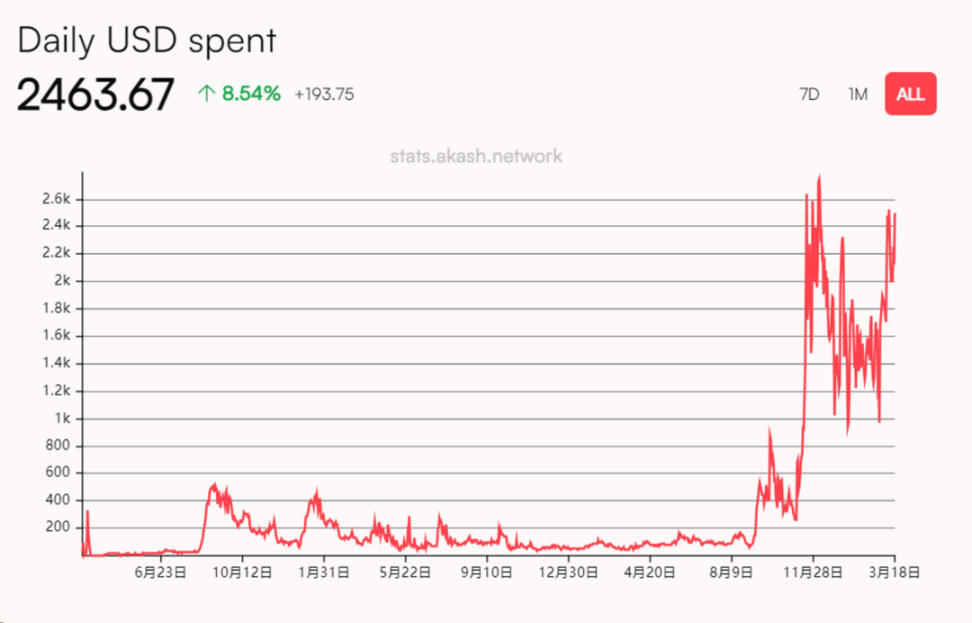

Akash currently has abundant computing resources, including a large number of CPUs and GPUs, which provides a stable and efficient foundation for processing complex computing tasks. In addition, Akash's GPU usage remains at a high level, indicating that its computing resources are fully utilized, reflecting strong market demand and platform attractiveness. By building an open source community and collaborating with other decentralized protocols, Akash has also attracted developers and projects, further enhancing the vitality and innovation of its ecosystem.

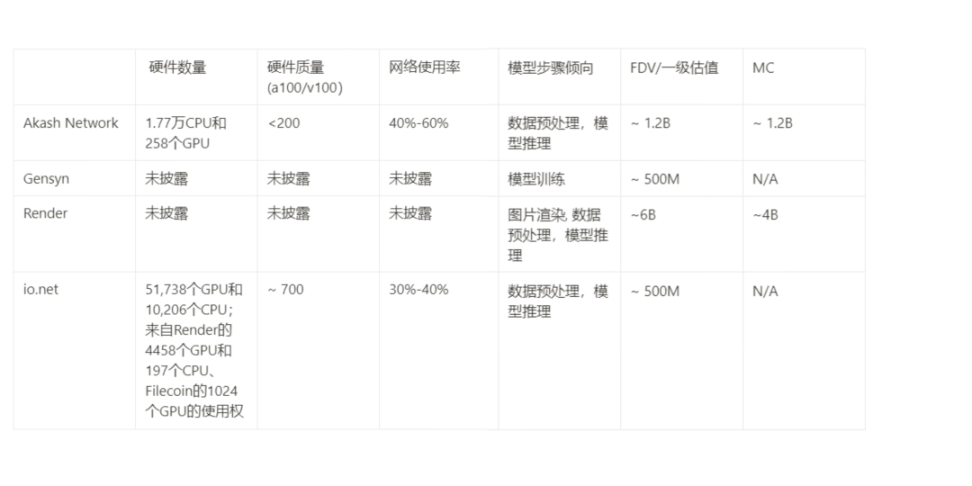

However, the decentralized computing power market is highly competitive, and Akash Network faces challenges from competitors such as Render, io.net, and Gensyn.

Specifically, Render and io.net have more or higher-quality computing power resources than Akash in some aspects. In particular, io.net far exceeds Akash in both quantity and quality of computing resources, in part by attracting computing resources through attractive airdrop incentives. Gensyn focuses on AI model training, which is different from Akash in business direction, but still forms a competitive relationship.

Source @Metrics Ventures

Akash Network Competitive advantages and challenges

Advantages: Akash’s advantage lies in its stable computing resources supply, high usage, and actively built developer community and ecological cooperation. Together, these factors strengthen Akash's market position and competitiveness.

Challenges: Competitors such as io.net are rapidly increasing computing resources through incentive mechanisms, and Akash needs to compete with other projects in the field of GPU computing power. In addition, the continued growth and demand verification of the decentralized computing power market are also important challenges facing Akash.

Conclusion and Outlook

As the core target of the decentralized computing power track, Akash Network has a strong market due to its advantages in computing power resources, usage rate and ecosystem construction. Competitiveness. However, in the face of fierce market competition and a rapidly changing technological environment, Akash still needs to continue to optimize its platform, enhance the quality and quantity of computing resources, and expand its service scope in order to maintain and enhance its market leadership. At the same time, Akash should continue to invest in developer friendliness and ease of use of the platform to attract more users and developers and further consolidate its competitive advantage in the decentralized computing power market.

The above is the detailed content of Akash Network: Decentralized cloud computing market under the AI boom. For more information, please follow other related articles on the PHP Chinese website!