%After Bitcoin (BTC) broke through the historical high of US$69,000 in the 2021 bull market in March, it hit a new historical high of US$73,777, sounding the bull market horn. Despite the recent continuous shock and correction, it hit US$870,000 again in the early hours of this morning, temporarily falling by US$569,648, ushering in a 24-hour increase of 0.3%.

With the Bitcoin halving approaching in the middle of the month, the market is currently paying close attention to which stage of this bull market BTC is currently in? In this regard, @_Checkɱate, an analyst at the cryptocurrency analysis agency Glassnode, posted on X earlier today (8th) that this may be a clue from the "positions of long-term holders."

Glassnode Analyst: Looking at the progress of the bull market from the supply of long-term holders

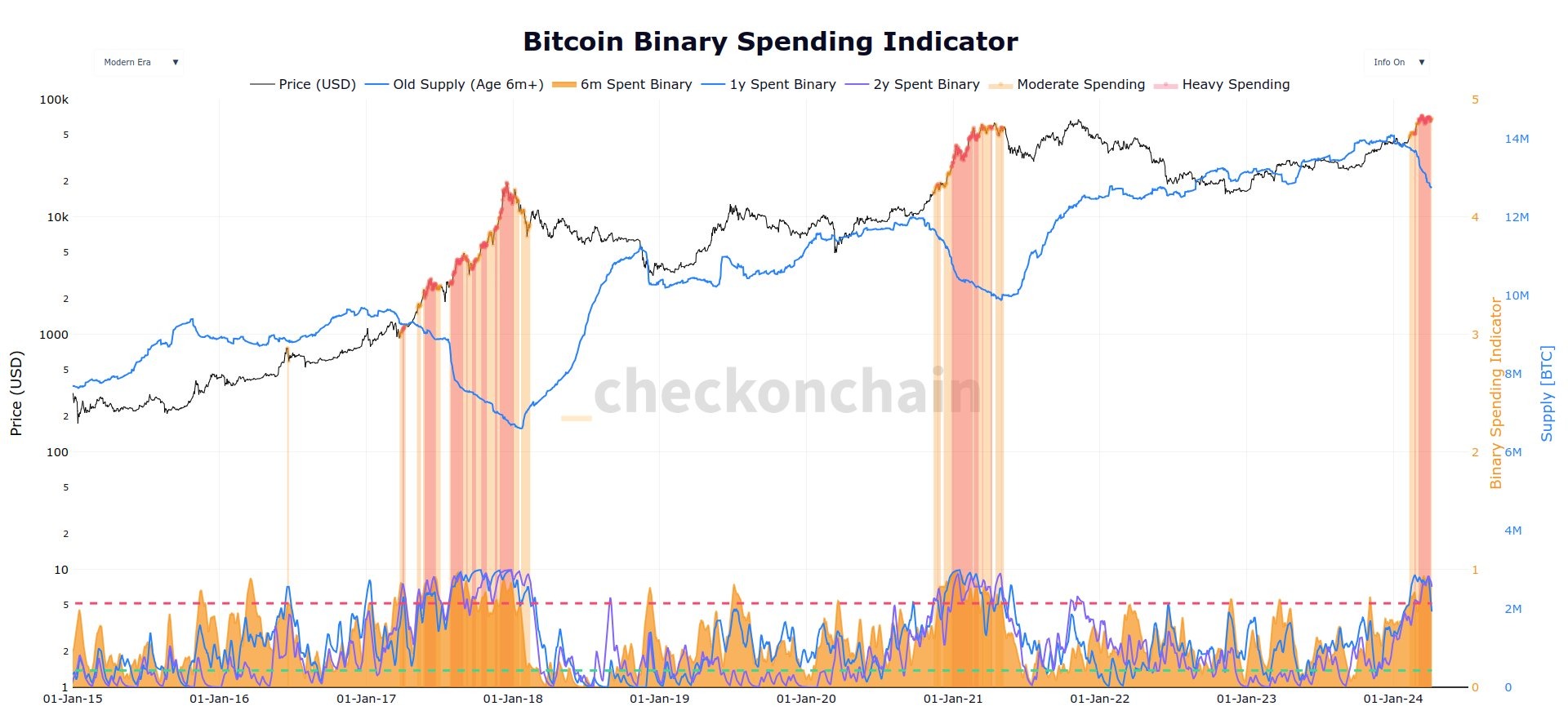

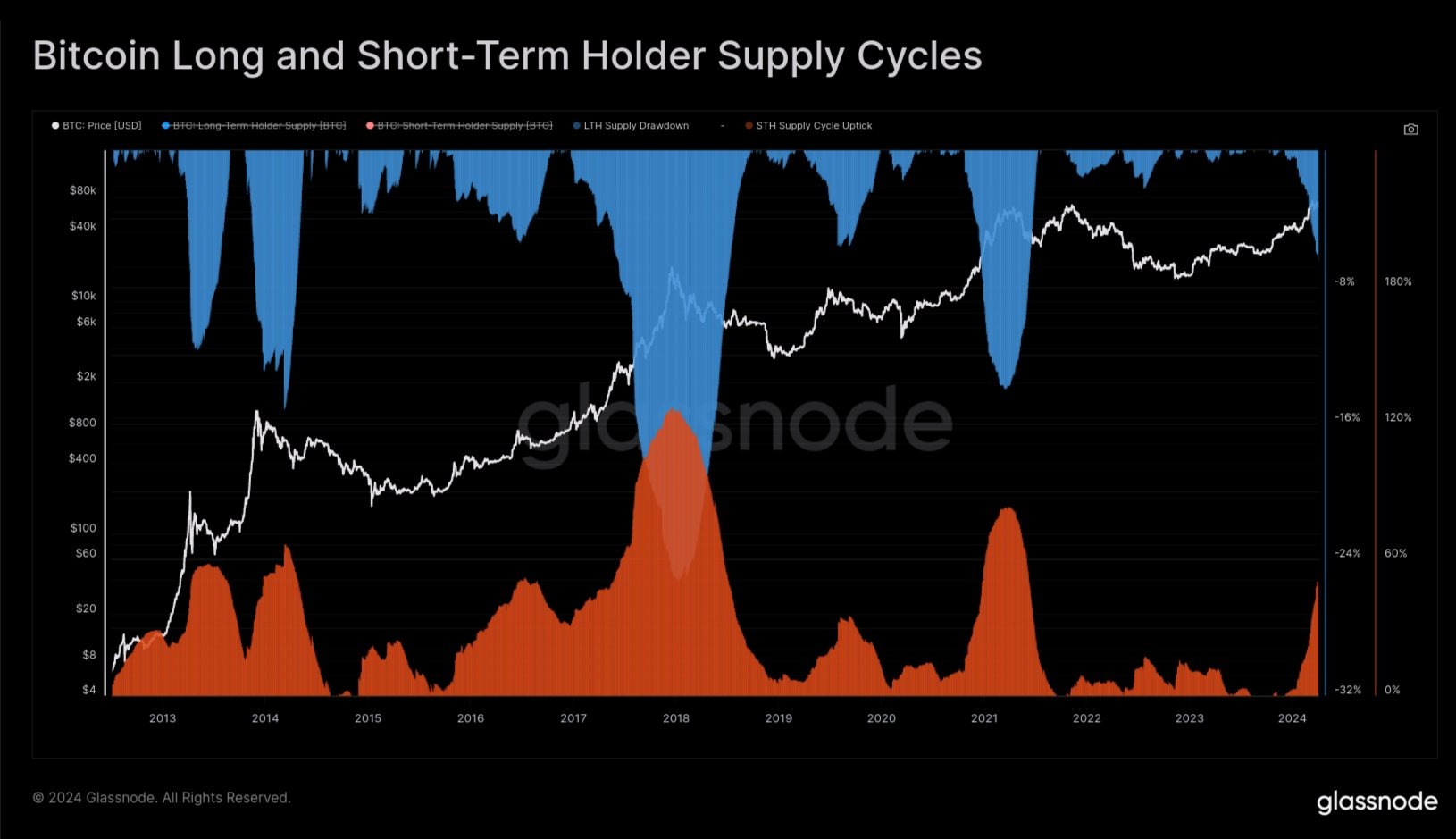

@_Checkɱate pointed out that this time Bitcoin broke through the historical high, it was almost the same as the previous ATH, and the long-term �%

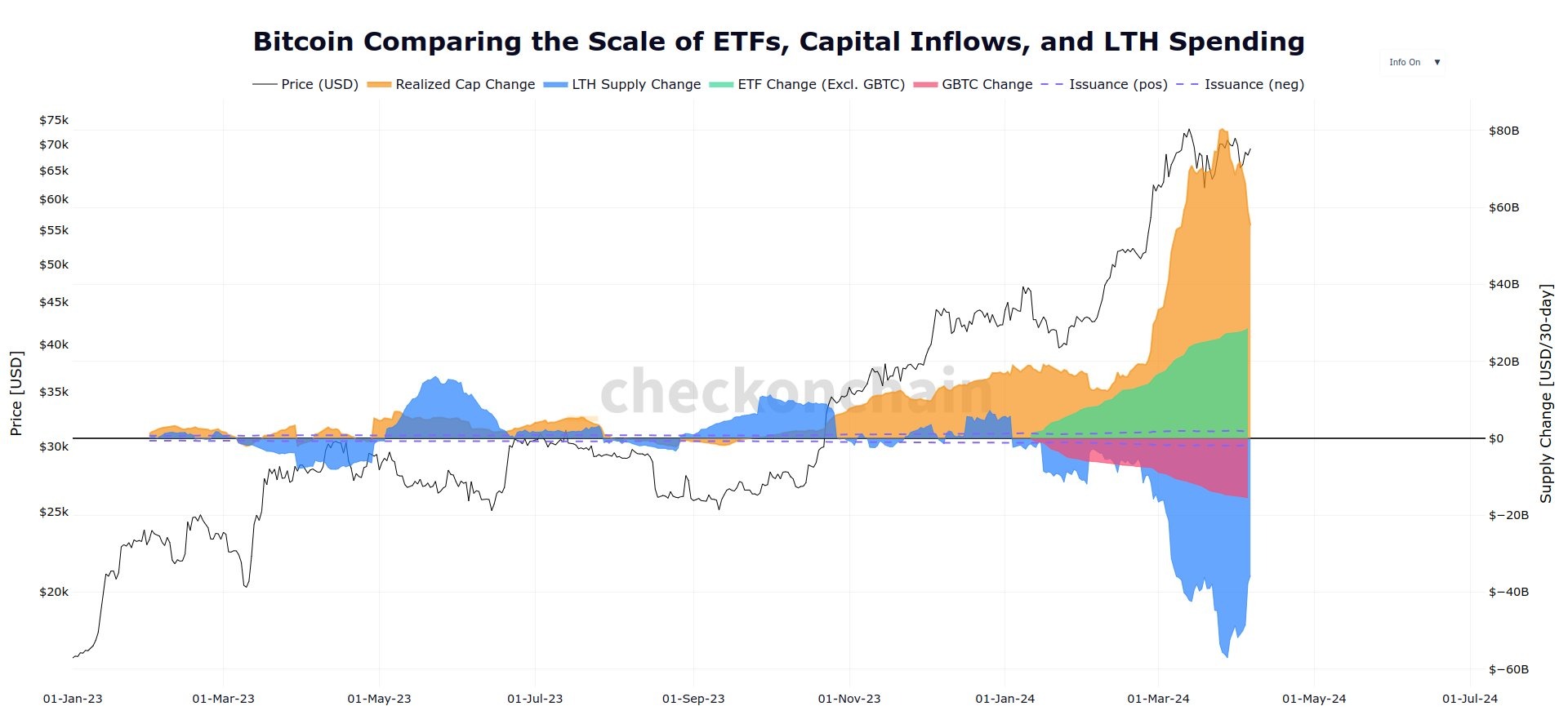

In the last two weeks, new demand for Bitcoin has been able to absorb sellers of holders (LTH) in about 6-8 months, while also recommending price growth. Considering that typical LTH supply drops by 14%, I would estimate that we are currently about 40% of the way through this process.

##If @_Checkɱate’s judgment is correct, plus spot ETF funds continue Driven by net inflows and the halving narrative, BTC prices are expected to hit new highs.

##If @_Checkɱate’s judgment is correct, plus spot ETF funds continue Driven by net inflows and the halving narrative, BTC prices are expected to hit new highs.

The above is the detailed content of Glassnode Analyst: Looking at the progress of the Bitcoin bull market from the supply of long-term holders. For more information, please follow other related articles on the PHP Chinese website!