On March 19, local time, the U.S. Securities and Exchange Commission (SEC) issued two notification documents and once again postponed the decision-making time of two Ethereum spot ETFs, respectively deciding on the application of the Hashdex Nasdaq ETH ETF. The time has been extended to May 30, 2024, and the decision on the ARK 21Shares Ethereum ETF application has been postponed to May 24, 2024.

The SEC said in the notice: “The Commission believes that it would be appropriate to specify a longer period for issuing a decision to approve or disapprove the proposed rule changes to ensure that the Commission has sufficient time to review the proposed rule changes. Changes and related issues will be fully considered.”

Previously reported that on March 4, the SEC postponed its decision on BlackRock’s application for iShares ETH Trust and Fidelity’s application for its Ethereum ETF .

Although the market was not surprised by this postponement, it still had a certain impact on market sentiment and prices. According to RootData market data, the price of Ethereum fell below $3,200, a drop of more than 10% on the day.

According to social media messages from Bloomberg ETF analyst James Seyffart, at least three more Ethereum ETFs are expected to be delayed in the next two days. VanEck, Ark/21Shares, Hashdex, and Grayscale will all have delayed releases over the next approximately 12 days. Previously, he had said that the postponement of all ETF reviews may last until May 23.

He also added that his stance on Ethereum exchange-traded funds (ETFs) has changed somewhat in recent months. He believes that the current situation may cause these ETF applications to be rejected in the May 23 round. He noted that the U.S. Securities and Exchange Commission (SEC) has not yet communicated with issuers about specific issues with the Ethereum ETF. This is in sharp contrast to the situation when the Bitcoin spot ETF was filed last fall.

Over the past few weeks, market optimism about the approval of the Ethereum spot ETF application has continued to decline. Bloomberg ETF analyst Eric Balchunas also recently lowered the likelihood of an Ethereum spot ETF being approved in May to 30% from about 70%. Data shows that Ethereum’s one-month bullish-bearish skew has turned negative, suggesting relative strength in put options. Previously, Ethereum’s 60-day indicator also had a bearish bias, while the 90-day and 180-day indicators remained positive. In its latest market insight article, QCP Capital explains that investor interest in near-term Ethereum put options may stem from the diminishing likelihood of the U.S. SEC approving an Ethereum spot ETF in May.

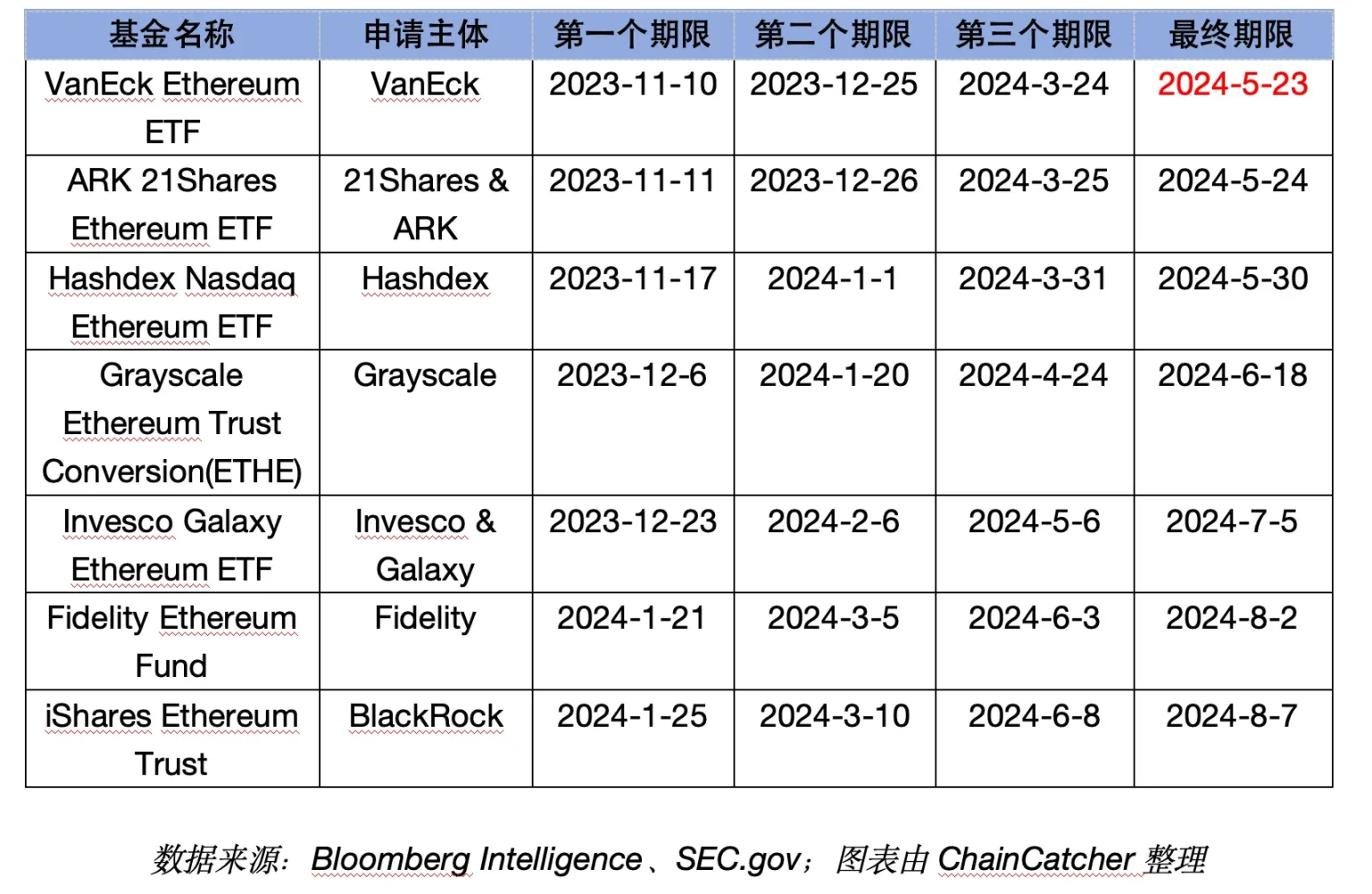

It is understood that Ethereum spot ETF has four review periods (45 days, 45 days, 90 days and 60 days). Once an institution submits a new ETF application, the SEC will register the application in the federal registration On the Federal register, the 240-day cycle starts from the day of registration. When the deadline for each stage comes, the SEC must respond: pass, deny, or delay review. If there is no resolution on the first date, it will be postponed to the second, until the deadline is reached and the SEC must make a final resolution. In other words, May 23, the deadline for the Ethereum spot ETF that was the earliest VanEck application, will be a key date, and whether it is passed or not will also directly affect the resolution of other applications.

Currently, seven entities are applying for Ethereum ETFs, namely: BlackRock, Fidelity, Invesco&Galaxy, Grayscale, VanEck, 21Shares &Ark and Hashdex. The SEC approval period for each fund is as shown in the following table:

Although other sources such as Bitwise global head of research Matt Hougan have previously predicted that the probability of the Ethereum spot ETF being approved in May is close to 50% or even higher, but and has already been listed. Compared with the Bitcoin spot ETF, the Ethereum spot ETF still has certain "risks". In public documents, the SEC has said: “There are unique concerns about whether certain characteristics of Ethereum and its ecosystem, including its proof-of-stake consensus mechanism and the concentration of control or influence of a few individuals or entities, make Ethereum susceptible to fraud and manipulation. Point?"

As BloFin recently released "Should we prepare for Ethereum spot ETF rejection? "As mentioned in "Compared with spot Bitcoin ETFs, the negative impact of the PoS mechanism, price manipulation risks and securitization risks have significantly reduced the probability of approval of spot ETH ETFs.

The continuous rise in the crypto market some time ago may have raised our expectations for this result. This decline can somewhat allow us to return to calmness, and at least be prepared for the rejection of the Ethereum spot ETF.

The above is the detailed content of Multiple review decisions have been postponed again, will the Ethereum spot ETF be "stillborn"?. For more information, please follow other related articles on the PHP Chinese website!