In November, the price of Bitcoin exceeded $71,000, setting a new all-time high and bringing joy to the cryptocurrency market. However, the market crash of March 12, 2020 is still fresh in investors’ minds.

Looking back on March 12, 2020, starting at 6:30 in the evening, Bitcoin began to experience a waterfall-like plunge, starting from US$8,000 and falling to US$6,800. , then 6,500 US dollars, 6,000 US dollars, 5,000 US dollars, and 4,500 US dollars, with a falling rate of up to 5%/minute...

This price drop is closely related to the liquidation of a large number of long positions, and the price of the contract market has been low for a long time. in the spot market, causing market confusion and suspicion. While the price continued to drop, the stampede led to a series of liquidation events. Within 24 hours, more than 100,000 people liquidated their positions across the entire network. The community recalled that at that time, the market was caught off guard, and screenshots were even taken. Can't keep up with the rate of decline.

In fact, in 2020, as the expectations of the U.S. economic stimulus policy failed, and the market panic about the spread of the new coronavirus spread, not only crypto In the currency market, the U.S. stock market also experienced a rare historic moment of "triggering the circuit breaker mechanism twice in a single week." Global stock markets were affected, and the three major European stock indexes and Asia-Pacific stock markets also experienced varying degrees of decline. Stock indexes in at least 10 countries have triggered circuit breaker mechanisms...

Recently, the outlook for the U.S. economy has become more optimistic after experiencing exciting economic data in January. The active economic activities show the strong momentum of recovery. Against the background of economic recovery, inflationary pressure gradually emerges and becomes a major challenge for economic policy. Although the Federal Reserve faces the problem of controlling inflation at the 2% policy target, the overall economy is very different from the environment in 2020.

Returning to the cryptocurrency market itself, in the past four years, the cryptocurrency market has experienced countless ups and downs. From collapse to rebirth, Bitcoin still continues to convince the market to believe in it. Under the continuous construction of the market, various The track is also blooming, and the exchange is more sound.

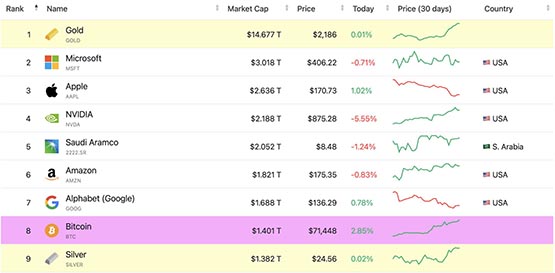

Now, after the adoption of the Bitcoin spot ETF in January, it has attracted a large number of funds from the traditional financial market. Institutions with assets of hundreds of billions of dollars have opened the door to invest in BTC through compliance channels. Over the past few months, it has brought 959 million US dollars of funds to BTC, and Bitcoin has surpassed silver to become the 8th largest asset in the world.

Holding the two sharp edges of Wall Street funds and the halving narrative, it will be Bitcoin’s turn to take revenge on 312 in 2024. Will it make a big move to hit a new high?

Bitcoin becomes the eighth largest asset in the world

The above is the detailed content of Today Bitcoin has become the eighth largest asset in the world! The fourth anniversary of the Bitcoin 312 incident. For more information, please follow other related articles on the PHP Chinese website!