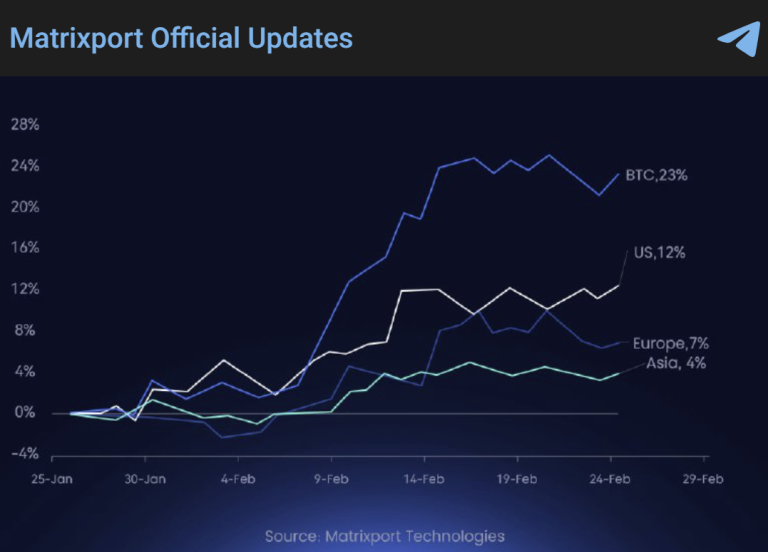

Bitcoin continues to rise, reaching a maximum of $57,073. According to Matrixport’s analysis, since the end of January, Bitcoin has increased by 23%, of which 12% is U.S. time. Contributed, this also represents the influence of Bitcoin ETF on the price of BTC. In addition, the net outflow of Grayscale GBTC decreased yesterday, and the trading volume of Bitcoin ETF hit a new high, which seems to verify this statement.

Bitcoin ETF contributed to more than half of the rise in BTC

Bitcoin suddenly rose rapidly from 51K yesterday evening, reaching a maximum of $54,910. According to Matrixport’s analysis, since the end of January, Bitcoin has The increase was 23%, of which 12% was contributed by US time, which also represents the influence of Bitcoin ETF on the price of BTC.

Bitcoin continued to surge this morning, reaching a maximum of $57,073, and was trading at $56,140 at the time of writing.

Bitcoin ETF trading volume hit a new high

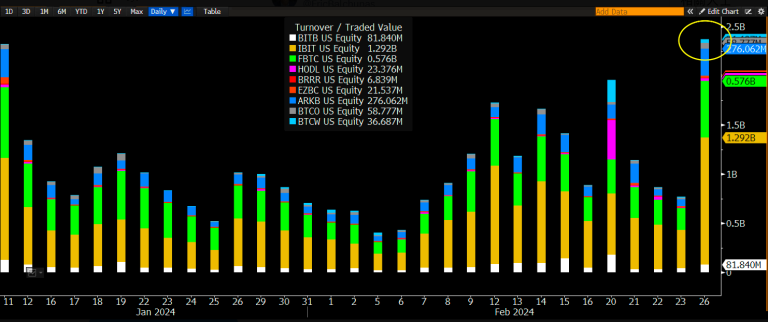

According to Bloomberg’s ETF analyst Eric Balchunas, yesterday (2/26), nine Bitcoin spot stocks The ETF’s trading volume hit an all-time high, exceeding $2.4 billion, exceeding the trading volume on its first day of listing. Among them, the trading volume of BlackRock’s IBTC reached US$1.3 billion. This data shows that investors are increasingly interested in Bitcoin ETFs and market demand continues to heat up.

Balchunas said that IBIT’s trading volume ranks 11th among all ETFs (top 0.3%) and 25th among stocks, which is a very crazy number for novices. He also said that trading volume is different from capital flow, but in the long run, having good liquidity reduces friction and costs, which is why large institutions often only use ETFs with high trading volumes.

GBTC net outflow hits record low, Bitcoin ETF continues to grow

According to Lookonchain data, as of 2/26, Grayscale’s GBTC has decreased 1,090 BTC (approximately $56.4 million). The other eight ETFs added 5,369 BTC (approximately US$278 million), of which BlackRock’s IBTC added 3,281 BTC (approximately US$169.88 million).

Currently, together with GBTC and other nine ETFs, there are 737,381 Bitcoins, and Grayscale’s net outflow of funds seems to be slowly decreasing.

The above is the detailed content of Grayscale GBTC net outflow hits record low! Bitcoin ETF trading volume hits record high, currency price surges by $57,000. For more information, please follow other related articles on the PHP Chinese website!