According to news on February 14, according to the latest report released by market research firm IDC, the Indian smartphone market shipments for the whole of 2023 will be 146 million units, a nominal growth of 1% year-on-year.

PixaHive

PixaHiveThe Indian smartphone market experienced a sharp decline of 10% year-on-year in the first half of 2023, but grew 11% year-on-year in the second half of 2023. Shipments in Q4 2023 were 37 million units, a year-on-year increase of 26%, with shipments exceeding expectations.

The main contents of the Indian smartphone market in 2023 are summarized as follows:

Sales channels

Shipments in online channels fell by 6 percentage points. The share will fall from 53% in 2022 to 49% in 2023. Shipments in offline channels grew 8% year-on-year as vendors strengthened their retail presence by offering lucrative premium products and expanding into smaller towns.

5G mobile phone share

5G smartphone shipments will reach 79 million units in 2023, with a large number of products launched in the mass budget segment. In 2023, 5G average selling price will drop to US$374, a year-on-year decrease of 5%. Among 5G shipments, the mass budget ($100 Apple’s iPhone 13 and 14, Samsung’s Galaxy A14, vivo’s T2x and Xiaomi’s Redmi 12 are the 5G models with the highest shipment volume in 2023.

Situation of each price segment

Price segment below US$100

The entry-level (under US$100) market share increased by 12% year-on-year, from 18% a year ago to 20% . Xiaomi continues to lead, with POCO and Samsung ranking in the top three.

$100-$200 price segment

The proportion of shipments fell from 51% to 44%, a decrease of 7 percentage points. Vivo, Realme and Samsung together accounted for 53% of shipments.

$200-$400 price segment

This price segment remains basically stable, accounting for 21%. Vivo and OnePlus hold a large share, accounting for nearly 40% of overall shipments in this price segment.

$400-$600 price segment

The mid-to-high-end market share is 5%, a year-on-year increase of 27%. OnePlus continues to lead with a 35% share, followed by Samsung and vivo.

$600-$800 price segment

Share of the high-end market ($600 less than $800) reached 3%, growth driven by iPhone 13, Galaxy S23/S23 FE and OnePlus 11 twenty three%. While Apple's share declined, Samsung's share of the segment more than doubled.

$800+

The ultra-premium segment ($800+) saw the highest growth at 86%, rising from 4% to 7% share. iPhone14/13/14 Plus accounted for 54% of shipments, followed by Galaxy S23 /S23 / S22 /S23 Ultra, accounting for 22%. Overall, Apple leads the segment with 68% share, followed by Samsung with 30% share.

Brand:

Apple

Although Apple has the highest average selling price at $940, the company has sold 9 million units this year, mainly due to the Several generations of iPhone models and the push for localized production. Its iPhone 13/14 is one of the top five models shipped annually.

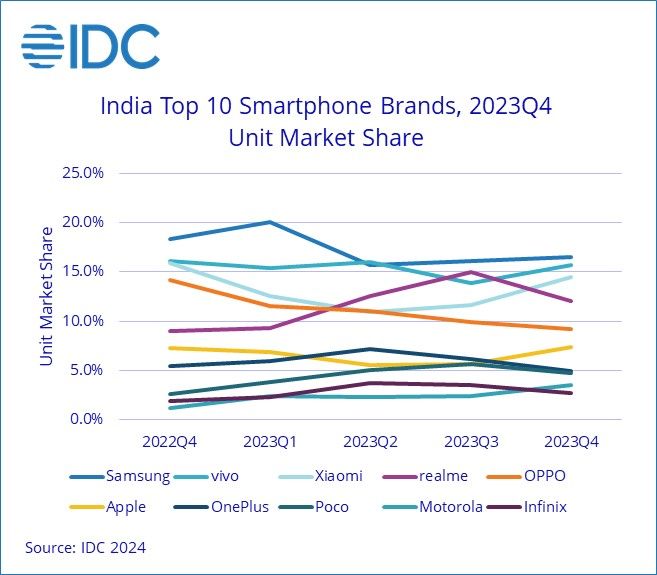

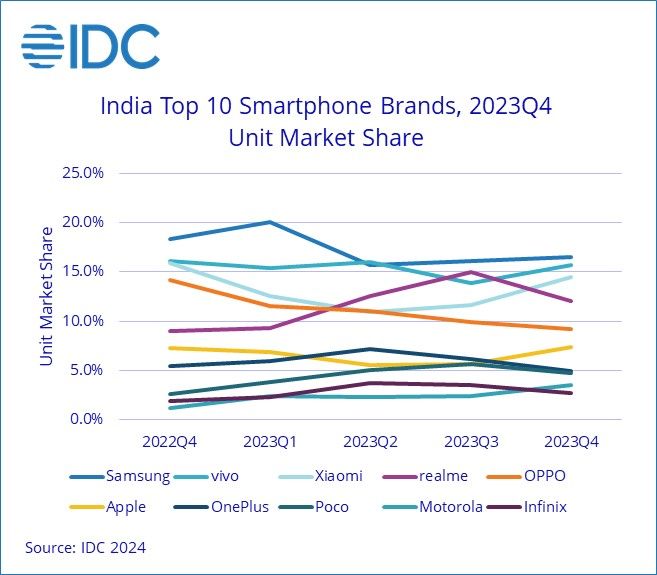

Samsung

As a brand, despite a 5% year-on-year decline in shipments, Samsung maintained its lead with a record average selling price of $338. Its Galaxy A14 is the most-shipped device of 2023.

vivo

vivo (excluding iQOO)’s shipments and average selling price increased by 8% and 9% respectively, jumping into second place. It was the only one of the top five brands to post growth.

realme真我

realme Although realme faced challenges in early 2023, it still maintained its third position, driven by affordable products.

Feature phones

After four consecutive years of decline, feature phone shipments reached 61 million units, an increase of 8% year-on-year. Samsung exits the feature phone market, with Transsion continuing to lead, followed by Lava. Reliance Jio's newly launched 4G feature phones drove growth in H2'23. Attached is the original address of the report. Interested users can read it in depth.

The above is the detailed content of 2023 Indian mobile phone battle report: Samsung fell by 5.3%. First, vivo rose by 8.2%. Second, Realme fell by 12.9%. Third, Xiaomi fell by 29.6%. Fourth, OPPO fell by 12.2%. Fifth.. For more information, please follow other related articles on the PHP Chinese website!

The main contents of the Indian smartphone market in 2023 are summarized as follows:

The main contents of the Indian smartphone market in 2023 are summarized as follows:  Mobile phone root

Mobile phone root

Projector mobile phone

Projector mobile phone

The phone cannot connect to the Bluetooth headset

The phone cannot connect to the Bluetooth headset

Why does my phone keep restarting?

Why does my phone keep restarting?

The difference between official replacement phone and brand new phone

The difference between official replacement phone and brand new phone

Why does my phone keep restarting?

Why does my phone keep restarting?

Why can't my mobile phone make calls but not surf the Internet?

Why can't my mobile phone make calls but not surf the Internet?

Why is my phone not turned off but when someone calls me it prompts me to turn it off?

Why is my phone not turned off but when someone calls me it prompts me to turn it off?