Foreign media Blockworks lists the top five DeFi protocols with the highest revenue in 2023 based on DeFiLlama data. As the total value locked (TVL) is increasingly criticized, perhaps revenue is the measure. A key indicator of whether a protocol is feasible?

Maker will gradually involve U.S. government bonds and RWA assets starting in 2022, trying to earn more additional income as the U.S. continues to raise interest rates.

This decision seems to be quite correct based on the benefits alone, but it also brings related risks.

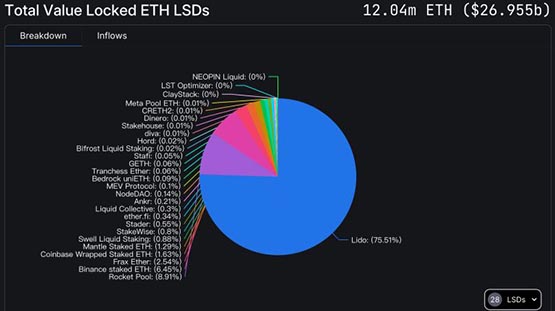

Lido is among the top protocols in terms of TVL and revenue. The market value of Lido Staked Ether (StETH) exceeds US$20 billion, ranking No. 1 on CoinGecKo Nine major cryptocurrencies.

Tree nature also attracts wind. Lido has always suffered from concerns such as excessive staking market share, centralization, and even cooperation with regulatory sanctions.

Lido staking market share

In terms of transaction volume, PancakeSwap is second only to Uniswap The second largest decentralized exchange (DEX).

PancakeSwap not only launched the v3 version this year (forked from Uniswap v3 after the license expired), but also modified its governance model and launched a game market.

Curve is the second largest DEX on Ethereum after Uniswap, and Convex is closely involved in the ecology of Curve, allowing users to trade on Convex Lock in CRV and earn revenue.

The perpetual contract agreement GMX emerged in the bear market and performed brilliantly. It is the agreement with the highest TVL on Arbitrum and has been able to generate actual income since its launch. Arthur Hayes, the founder of BitMEX, once said: As we all know, the trading volume of derivatives should be several orders of magnitude higher than that of spot. No matter which DEX monopoly will obtain a large amount of fee income, this is a future bull market case in a single field. GMX is by far the best I've seen.

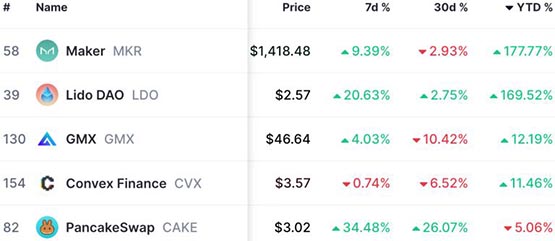

According to CoinMarketCap, the first and second place MKR and LDO have the same annual growth rate as the protocol revenue ranking, while GMX, CVX, and CAKE perform poorly, especially CAKE, whose token economic model The shift has yet to bring immediate benefits to prices.

Protocol currency price

The above is the detailed content of 2023 DeFi platform revenue ranking: Maker, Lido, PancakeSwap, GMX, and Convex are shortlisted. For more information, please follow other related articles on the PHP Chinese website!