web3.0

web3.0

Sui public chain launches MOVE value preservation agreement! Pledge SUI coins and burn them to redeem them

Sui public chain launches MOVE value preservation agreement! Pledge SUI coins and burn them to redeem them

Sui public chain launches MOVE value preservation agreement! Pledge SUI coins and burn them to redeem them

The cost of casting inscriptions is low, and community members often operate manually or use batch tools to quickly obtain multiple inscriptions.

Recently, an inscription project called MOVE appeared on the Sui public chain, with the total amount set at 10 billion. According to the official announcement, MOVE will be gradually distributed through 21,600 epochs. During each epoch, approximately 460,000 MOVEs will be produced, and these inscriptions will be evenly distributed to all participating addresses.

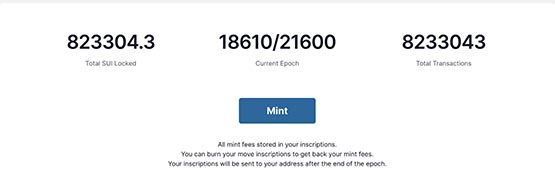

According to the official casting website data, the casting progress of MOVE inscription has exceeded 86%, and the number of SUI pledged in the project has exceeded 823,000. Based on SUI’s current market price of approximately US$0.89 per coin, the total pledged SUI value is approximately US$732,400.

In addition, the official recent announcement also pointed out that once MOVE is minted, it is expected to directly lock nearly one thousandth of the liquidity of Sui tokens.

MOVE casting mechanism

MOVE's mechanism is uniquely designed. Only one inscription can be cast per address per minute, and users only need to cast once per minute. operate. Each casting requires 0.1SUI to be pledged into the inscription.

Interestingly, the SUI staked by users is still stored within their own inscriptions. If the user decides not to hold the inscription anymore, he can get back the previously pledged SUI by burning the inscription. If transaction costs are not considered, this model can be regarded as the first inscription with a value-preserving function.

Four Steps to Mint MOVE

The process of minting MOVE can be divided into the following simple steps:

Install SUI Wallet

Transfer SUI tokens from Withdraw to the wallet

Enter the MINT website

Connect the wallet and perform mint

There are also community members who provide batch casting tools, but you need to import the private key or mnemonic phrase can be used, this part requires readers to make their own decisions.

The above is the detailed content of Sui public chain launches MOVE value preservation agreement! Pledge SUI coins and burn them to redeem them. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

What is the current price of Dajie Coin? Is it worth investing? ZEC Coin Price Forecast: 2025-2030

Aug 22, 2025 pm 07:30 PM

What is the current price of Dajie Coin? Is it worth investing? ZEC Coin Price Forecast: 2025-2030

Aug 22, 2025 pm 07:30 PM

Table of Contents Key Points ZEC Real-time Marketing Based on Technical Analysis Forecasting ZEC Price in 2025 2025 ZECUSD Long-term Trading Plan Analysts Forecasting ZEC Price in 2025 CoinCodexNameCoinNewsBitScreener Analysts Forecasting ZEC Price in 2026 CoinCodexNameCoinNewsBitScreener Analysts Forecasting ZEC Price in 2027 CoinCodexNameCoinNewsBitScreener Analysts Forecasting ZEC Price in 2027 CoinCodexNameCoinNewsBitScreener Analysts Forecasting 2

Wall Street Whale Devours Ethereum: Interpretation of the Pricing Power Battle Behind Purchase 830,000 ETH in 35 Days

Aug 22, 2025 pm 07:18 PM

Wall Street Whale Devours Ethereum: Interpretation of the Pricing Power Battle Behind Purchase 830,000 ETH in 35 Days

Aug 22, 2025 pm 07:18 PM

Table of Contents Two ancestry, two worldviews: The philosophical showdown between OG coins hoarding and Wall Street harvesting. Financial engineering dimensionality reduction strike: How BitMine reconstructs ETH pricing power in 35 days. New dealer spokesperson: TomLee and Wall Street narrative manipulation ecological reconstruction: How Wall Street Capital reshapes the ETH value chain. A small company that was originally unknown in Nasdaq increased its holdings from zero violence to 830,000 in just 35 days. Behind it is a survival philosophy showdown between the indigenous people in the currency circle and Wall Street Capital. On July 1, 2025, BitMine's ETH position was still zero. 35 days later, this family is unknown

The difference between fundamentals of cryptocurrencies and capital flows and how to choose

Aug 21, 2025 pm 07:39 PM

The difference between fundamentals of cryptocurrencies and capital flows and how to choose

Aug 21, 2025 pm 07:39 PM

Cryptocurrency investment needs to combine fundamentals and capital flows: long-term investors should pay attention to fundamental factors such as project technology and teams to evaluate intrinsic value, while short-term traders can rely on capital flow data such as trading volume and capital flow to grasp market opportunities. The two are used complementary and refer to authoritative data sources such as CoinMarketCap and Glassnode, which can more effectively reduce risks and improve decision-making quality.

Which Bitcoin website is better? Global Bitcoin website ranking 2025

Aug 22, 2025 pm 07:24 PM

Which Bitcoin website is better? Global Bitcoin website ranking 2025

Aug 22, 2025 pm 07:24 PM

Binance ranks first with its high liquidity, low handling fees and complete ecosystem. Ouyi ranks second with its derivatives and Web3 advantages, Huobi ranks third with its stable operation, Gate.io has become the first choice for altcoins with rich currencies, Coinbase has won the trust of novices for its compliance, Kraken attracts institutional users with its top security, and KuCoin is favored for its new coins and automation tools.

The top 10 recommended rankings of the most valuable virtual currency (2025 latest version)

Aug 22, 2025 pm 07:15 PM

The top 10 recommended rankings of the most valuable virtual currency (2025 latest version)

Aug 22, 2025 pm 07:15 PM

Bitcoin ranks first, followed by Ethereum, Solana, BNB, XRP, USDT, ADA, DOGE, SHIB, and AVAX, based on comprehensive rankings based on technology, ecology and market consensus.

Federal Reserve Hamak: Not supporting the rate cut in September for the time being, which may lead to short-term pressure on cryptocurrencies

Aug 22, 2025 pm 06:39 PM

Federal Reserve Hamak: Not supporting the rate cut in September for the time being, which may lead to short-term pressure on cryptocurrencies

Aug 22, 2025 pm 06:39 PM

Hamake, a member of the U.S. Federal Reserve (Federal) said recently that economic data has not shown that interest rate cuts are necessary, so there is no support for the rate cut in September. This statement has had a significant impact on global financial markets, especially cryptocurrency markets. Investors can obtain real-time market conditions through various channels and evaluate market volatility.

What is tokens? How to calculate tokens?

Aug 22, 2025 pm 07:00 PM

What is tokens? How to calculate tokens?

Aug 22, 2025 pm 07:00 PM

Tokens are the basic unit of AI models for processing text, which can be words, characters or punctuation; 1 word in English has about 1-2 tokens, and 1 word in Chinese has about 1-3 tokens, and 1 word in Chinese has about 1-3 tokens. Due to different word segmentation methods, the number of tokens in Chinese and English varies.

How to pronounce tokens in Chinese

Aug 22, 2025 pm 07:06 PM

How to pronounce tokens in Chinese

Aug 22, 2025 pm 07:06 PM

Tokens are digital credentials issued by existing blockchains, rely on main chains such as Ethereum, and do not have an independent network. Unlike native coins (such as BTC and ETH) that have independent blockchains, tokens are like applications running on the operating system and rely on the underlying network for transaction verification. Tokens are mainly divided into three categories: functional tokens are used to access specific services, securities tokens represent asset ownership and are regulated by finance, and governance tokens give projects voting rights.