Recently, the robot industry has ushered in the dual benefits of technological breakthroughs and policy support. On the one hand, Tesla released a new demonstration video of the humanoid robot "Optimus Gen 2", which has made significant progress in aspects such as perception and movement, making people feel that "the future is here." On the other hand, the Ministry of Industry and Information Technology issued the "Guiding Opinions on the Innovation and Development of Humanoid Robots", proposing to achieve breakthroughs in key technologies such as the "brain, cerebellum, and limbs" of humanoid robots by 2025, ensuring the safe and effective supply of core components and other active industries. The goal has further boosted people's expectations for the accelerated development of the robot industry

So, how should investors seize the trend opportunities in the robotics industry? The National Securities Robot Industry Index focuses on my country's robot industry chain and has achieved better access to the breadth and depth of the industrial chain. It can be said to be a true robot index. E Fund National Securities Robot Industry ETF (subscription code: 159530) closely tracks the National Securities Robot Industry Index and will be publicly sold from December 18 to 29, 2023. It can be used as a high-quality investment opportunity for investors to lay out the rapid growth window of the robot industry. tool.

Strengthen the position of core enterprises in the industry and demonstrate the breadth and depth of the industrial chain

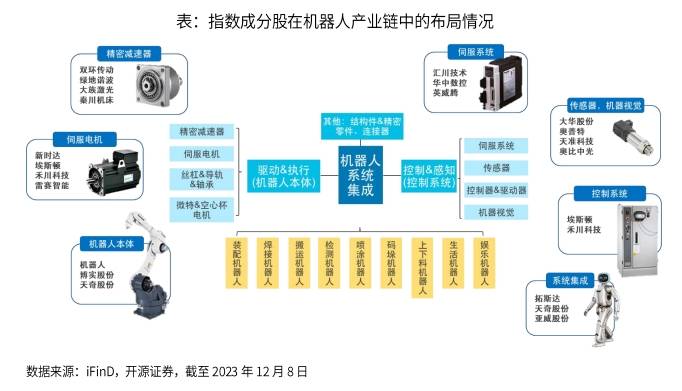

The National Securities Robot Industry Index is a scarce index that brings together leading enterprises in the upper, middle and lower reaches of my country's robot industry chain. According to the composition of the index, the first three industries are mechanical equipment, computers and electrical equipment, representing core areas such as robot body parts, AI algorithm control modules and battery power modules

The National Securities Robot Industry Index focuses on leading companies in the field of robots, including equipment suppliers in the upstream of the robot industry (such as double-ring transmission, Greenland Harmonic), and ontology manufacturers and integrators in the midstream (such as Robot, Topstar), and downstream brands (such as Stone Technology, Ecovacs). The index not only covers the current industry leaders (such as Inovance Technology, iFlytek), but also absorbs emerging forces in the early stages of growth, demonstrating the breadth and depth of the industry chain

This index is called the "real robot index" because it adopts an innovative weight stratification setting mechanism during the compilation process, which makes the leading stocks related to the robotics field account for a higher proportion in the index. Therefore, the index more accurately represents the status of the robotics industry. The specific preparation plan shows that the upper limit of the weight of component stocks is divided into two levels. The free circulation market value adjustment coefficient in the robotics field is 1 and the upper limit of the weight is 10%; the free circulation market value adjustment coefficient in other fields is 0.5 and the upper limit of the weight is 3%. This weight distribution mechanism allows leading stocks whose main business is in the field of robotics to account for a higher proportion in the index

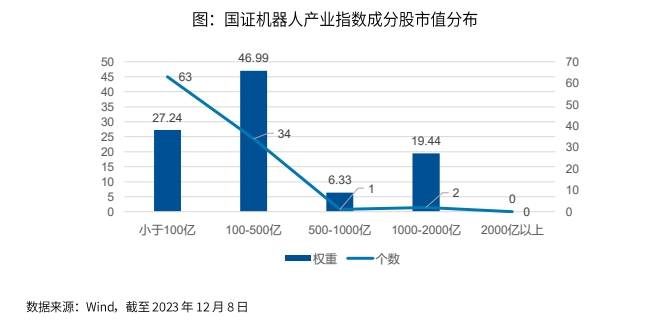

Small and medium-cap stocks have obvious characteristics, and their profit quality and growth are excellent

From the perspective of style characteristics, the weight of the National Securities Robot Industry Index is mainly concentrated in small and medium-sized companies, and the weight of component stocks with a market value of less than 50 billion accounts for more than 70%. At present, the robot industry is in a stage of vigorous development and rapid product launch, and there is very broad room for market value increase

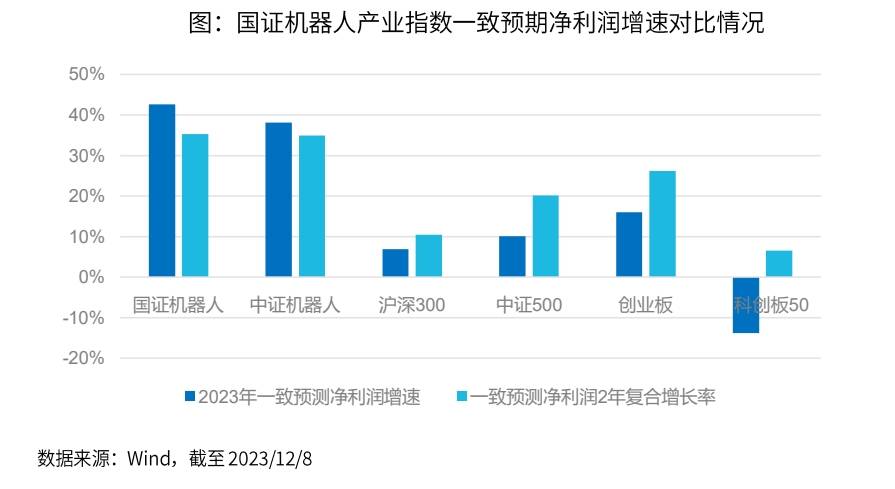

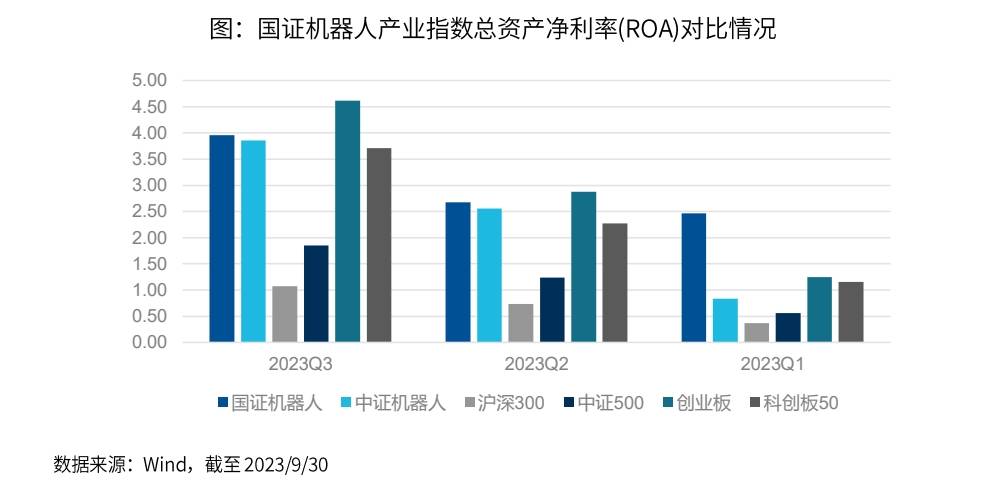

The robotics industry has shown strong quality and growth potential in terms of profitability. According to predictions, in the next two years, the compound growth rate of net profit of the robot industry is expected to be 35.3%, which is much higher than the mainstream broad-based index and growth sector index. According to the third quarter report of 2023, the net interest rate on total assets of the National Securities Robot Industry Index is 3.95%, and shows a continued upward trend

High returns, high flexibility, and sufficient growth momentum

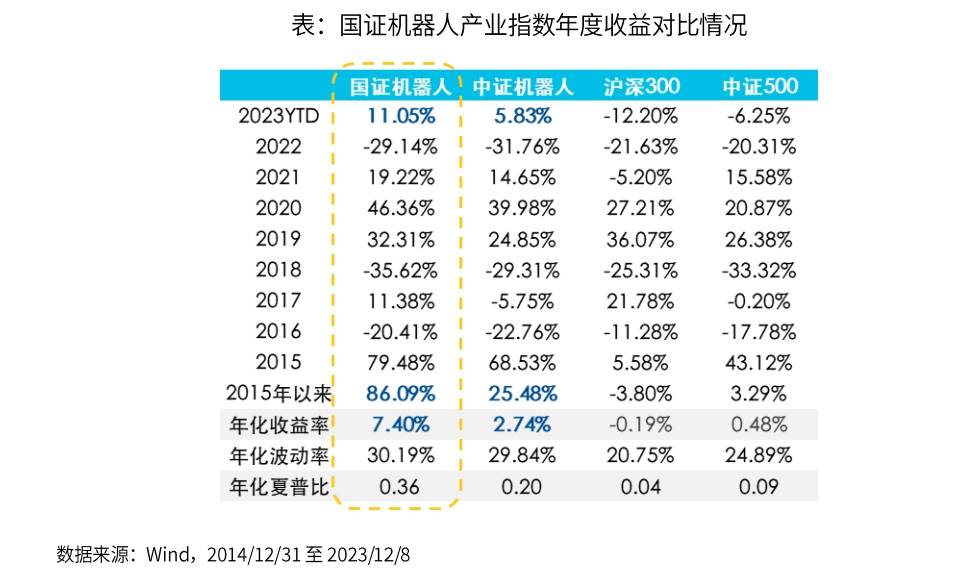

The historical performance of the National Securities Robot Industry Index is very good, fully demonstrating the characteristics of high returns and high flexibility. Since 2015, the index’s cumulative return rate has reached 86.09%, with an annualized return rate of 7.40%, far exceeding the mainstream broad-based index and similar indexes. At the same time, the annualized volatility rate since the base period has been 30.19%, and the annualized Sharpe ratio is 30.19%. 0.36, the trading attributes and risk-return characteristics are also more ideal than similar indexes

Driven by the dual benefits of continued breakthroughs in research and development and the implementation of industrial policies, the certainty of the upward trend of the robot industry has gradually been consolidated. E Fund National Securities Robot Industry ETF (Subscription Code: 159530) packages the leading enterprises in my country's robot industry chain with one click to help layout the industry growth stage, and will be publicly sold from December 18 to 29, 2023!

Please note that the source interface of this information is Lianyun. The content and data are for reference only and do not constitute investment advice. AI technology strategy provided by Youlianyun

The above is the detailed content of Learn about the Real Robotics Industry Index 100 ETF (ticker: 159530). For more information, please follow other related articles on the PHP Chinese website!