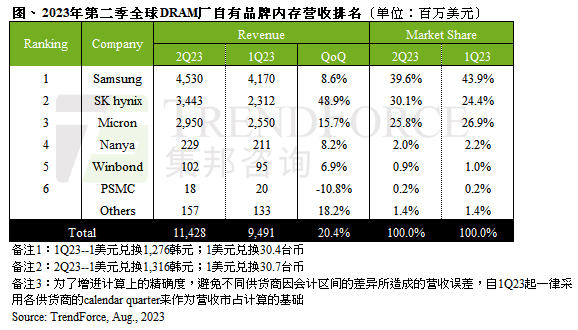

News from this site on August 24, TrendForce’s latest research shows that the DRAM industry revenue in the second quarter was approximately US$11.43 billion, a month-on-month increase of 20.4%, ending three consecutive quarters of decline.

Analysts said that the growth in this quarter was due to the increase in demand for artificial intelligence servers, which promoted the growth of high-bandwidth memory (HBM) shipments, coupled with the rush of client DDR5 stocking, leading to three major reasons. The shipments of manufacturers have increased

Among them, SK Hynix's shipments have increased by more than 35% month-on-month, and the shipment proportion of DDR5 and HBM with higher average prices (ASP) has increased significantly. Therefore, Bucking the trend, it grew by 7~9%. Q2 revenue increased by nearly 50% month-on-month to reach US$3.44 billion (note on this site: currently about 25.043 billion yuan), returning to second place. Rewritten content: As SK Hynix's shipments increased by more than 35% month-on-month, and the shipment proportion of DDR5 and HBM with higher average prices (ASP) increased significantly, it bucked the trend and grew by 7~9%. Revenue in the second quarter increased by nearly 50% from the previous quarter, reaching US$3.44 billion (approximately RMB 25.043 billion), returning it to the second position

Samsung Electronics’ current DDR5 process is relatively backward and its share is limited. In addition, ASP fell by about 7~9%. However, thanks to Q2 module factory stocking and AI server construction demand, shipments increased slightly. , therefore Q2 revenue increased by 8.6% month-on-month, with revenue reaching US$4.53 billion (currently approximately 32.978 billion yuan), ranking first

Although Micron lags behind in the development of HBM technology, DDR5 still occupies a certain The proportion of shipments keeps the average selling price stable. Driven by shipments, Micron's revenue was approximately US$2.95 billion (approximately 21.476 billion yuan), a month-on-month increase of 15.7%. However, the market shares of Samsung and Micron have shrunk

In addition, Nanya and Winbond also experienced slight growth, while Power Semiconductor Manufacturing Co., Ltd. was affected by the lackluster demand, its manufacturing process was relatively backward, and there was a lack of bidding. Advantages: DRAM revenue fell by about 10.8%, making it the only original manufacturer to decline this quarter. If foundry revenue is included, it fell by 7.8%.

Related recommendations:

"Samsung Electronics' DRAM memory market share hits a new low in nearly 9 years, but still ranks first in the world"

According to Omdia's report, Samsung's DRAM market share occupies a leading position in China, with a market share of 42.8%, but revenue fell by 61.2% year-on-year

Advertising statement: External jump links contained in the article (including but not limited to hyperlinks, QR codes, passwords, etc.) ), used to convey more information and save selection time. The results are for reference only. All articles on this site contain this statement.

The above is the detailed content of TrendForce: DRAM memory industry revenue rebounded in the second quarter, growing 20.4% quarter-on-quarter. For more information, please follow other related articles on the PHP Chinese website!