web3.0

web3.0

The compulsory course for novices in the currency circle to win with stability: grid trading

The compulsory course for novices in the currency circle to win with stability: grid trading

The compulsory course for novices in the currency circle to win with stability: grid trading

Table of contents

- 1. What is grid transaction?

- 2. What are the advantages of grid trading compared to traditional manual trading?

- 3. The principle of grid transaction

- 4. Grid trading can be adapted to various market conditions

- 5. Grid trading operation teaching

- 6. Newcomer parameter setting sharing (does not constitute investment advice)

- 7. Exclusive benefits for newcomers in this site·Blockchain Channel

- 8. Preview of the exclusive content in the future

1. What is grid transaction?

Grid trading is an automated trading tool that executes buying and selling behaviors according to preset logic to realize systematic, programmatic and regular trading methods. Compared with traditional manual trading, grid trading does not require frequent manual operations, which can significantly improve transaction efficiency, reduce operational risks, and free up your time.

2. What are the advantages of grid trading compared to traditional manual trading?

The myth of benefiting high-leverage manual trading is everywhere on the Internet, but it is difficult to distinguish between true and false. In fact, most of the high-leverage manual trading end up with zero liquidation. The reason is that manual trading has the following disadvantages:

1. Manual ordering is difficult to cover all transaction periods

The virtual currency market is a 7×24-hour continuous transaction with severe fluctuations (a single-day increase or decrease of more than 10% is common), and it is difficult to cover all trading periods manually - traders need to rest and handle other transactions, and are prone to missing arbitrage opportunities in price fluctuations.

2. Manual ordering is very likely to be affected by emotions

When the price plummets, you may not dare to buy because of fear, and when the price surges, you may chase high because of greed.

3. Manual order execution speed is slow

The price of virtual currency fluctuates rapidly (especially when the market breaks out or breaks out), there is a delay in placing a manual order from observing the price, judging, and operating to transactions, and you may miss the best buying and selling point (for example, planning to buy at $100, the hand speed is slower for a few seconds, and the price has risen to $105).

4. Manual ordering is too dependent on point judgment

Manual ordering often depends on the judgment of the "specific price point" (such as "I think $100 is the low point, so buy it here"). If the judgment is wrong (such as the actual low point is $90), it may lead to a significant loss.

In summary, manual trading has the disadvantages of easily missing trading opportunities, being affected by human nature of chasing highs and selling downs, slow execution speed, and relying on subjective judgment. We believe that newcomers should not try it easily, especially manual trading with high leverage. Grid trading can perfectly solve the shortcomings of manual trading and is more suitable for newcomers to enter the market.

1. Adapt to market characteristics and operate all day

Grid trading is fully automated through preset strategies (such as setting high and low orders within the price range), and can respond to price changes regardless of day and night, and miss the opportunity for buying and selling in short-term fluctuations.

2. Avoid emotional interference and maintain rational decision-making

Grid trading completely follows pre-set rules (such as "buy automatically after falling below a certain price, and sell automatically after rising above a certain price"), and is not affected by emotions such as greed and fear, ensuring the consistency and objectivity of trading behaviors, and reducing losses caused by irrational operations.

3. Improve execution and capture instant opportunity

Grid transactions monitor prices in real time through programs, and once they touch the preset point, they will automatically place orders and close transactions. The execution ability is much higher than manual, and can accurately capture short-term price difference.

4. Spread risks and reduce single decision-making dependencies

Grid trading forms a grid of "buy low and sell high" by setting multiple buying and selling points within a price range (such as from $90 to $110, and placing one order for every $2 rise/fall). It can not only build positions/close positions in batches during price fluctuations, spread the risks of single price judgments, but also accumulate returns through multiple small transactions.

Comparison dimensions |

Manual transaction |

Grid Transactions |

Operation difficulty |

High, you need to watch the market and choose the time |

Low, automatic operation |

Time cost |

High, requires frequent operation |

Low, one-click execution |

Profit stability |

High volatility, severe FOMO |

Stable compound interest |

User psychological pressure |

High, anxious to watch the market |

Automatically run to relieve emotional anxiety |

Learning curve |

Long-term experience, indicators, and sense of the market |

Sustainable use after initial understanding |

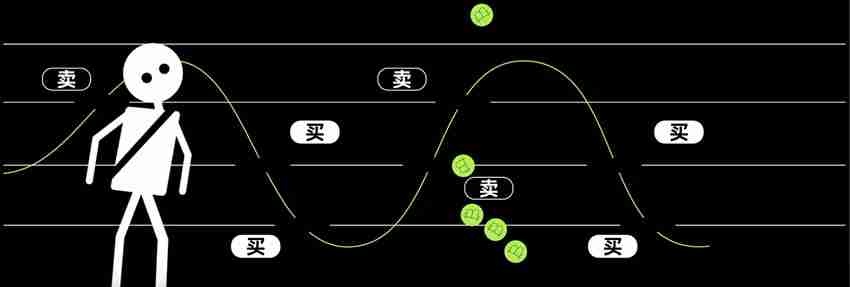

3. The principle of grid transaction

The grid is to automatically buy low and sell high in the range, and eat the money that fluctuates back and forth in the market. When you set the parameters, the system divides the range into multiple small grids and automatically puts orders, and executes low buy and high sell as market fluctuations, thereby capturing the profits of price fluctuations. You can understand that you hired a little black worker to watch the market every moment and automatically sell high and low according to the range you set. According to the existence or not of leverage, it is divided into spot grid and contract grid:

Whether leverage is supported |

Is there a risk of liquidation |

User Risk |

Revenue Characteristics |

|

Spot grid |

❌ |

❌ |

Medium low |

Medium profits, stable |

Contract Grid |

✅ |

✅ |

Medium and high (depending on the leverage multiple) |

High volatility and high yield |

4. Grid trading can be adapted to various market conditions

The market in the currency circle is unstable, the bull market is fluctuating and the bear market is rapidly transforming, manual orders are always easy to take over at high levels, and grid trading can continue to operate in most markets, providing stable and unaffected long-term "after-sleep gains"

Market stage |

Recommendation strategy |

reason |

Oscillating sideways |

Spot grid |

Capture volatility arbitrage returns |

Bull market explodes |

Contract Grid |

Amplify returns and catch fluctuations |

High volatility |

Contract Grid |

High frequency hedging and steady arbitrage |

5. Grid trading operation teaching

It takes only four steps to complete the operation, and take ten minutes to complete the study, and you will master scientific trading tools that 90% of users in the currency circle do not have.

Step 1: Select the grid type

Market horizontal fluctuations: choose neutral grid

Market fluctuations and rises: Choose to go long grid

Market fluctuations and declines: Choose to short the grid

Step 2: Fill in the price range

Based on the price high and low points in the cycle and the expectations of future trends. For example, the target ETH spot price is 3,981. Based on your judgment of the highest and lowest points of the price in the short and medium term, fill in it, for example, 3,000 to 5,000. In this range, you will automatically help you buy low and sell high, and if you exceed the range, the strategy will be suspended.

Step 3: Fill in the number of grids

The number of grids refers to the price range you set in the second step. According to the number of grids you fill in, the price range is equal to the grid with equal price ranges. For example: For example, the price range is 3,000 to 5,000, which is a price range of 2,000. If the number of grids is set to 100 grids, the system will automatically divide the price range of 2,000 points by 100 grids, and each grid is 20 (2,000 divided by 100 grids = 20), and the system will automatically help you buy for you when the current price falls by 20. The price increase by 20 is automatically sold for you. In this cycle, buy low and sell high, achieving stable and passive returns. But be aware of:

The number of grids should not be set too high: the transaction frequency will lead to more transaction fees

The number of grids should not be set too low: if it is too low, the trading conditions cannot be triggered.

Step 4: Fill in the leverage multiple (only applicable to contract grids), and the investment amount

The leverage ratio is only applicable to contract grids, and the spot grid does not have leverage. If you choose a contract grid, please control your own leverage ratio. It is recommended to be between 5x-10x. The investment amount is your investment principal. It is recommended that newcomers should not invest excessive amounts when trying for the first time.

6. Newcomer parameter setting sharing (does not constitute investment advice)

For ETH: The price range is set to 200 up to 200, and the number of grids is 50. For example, the current ETH price is 4,000, the upper limit of the grid is 4,200, the lower limit is 3,800, the number of grids is set to 50, and the leverage multiple does not exceed 10x.

For BTC: The price range is set to 5000 up or down the current price, and the number of grids is 50. For example, the current BTC price is 120,000, the upper limit of the grid is 125,000, the lower limit is 115,000, the number of grids is set to 50, and the leverage multiple does not exceed 10x.

It doesn't matter if you don't know how to fill in the parameters. OKX (official registration and official download) has an intelligent creation mode. The system backtests based on the historical market data of the currency pair and gives recommended parameters for the operation of the strategy. Although it is not a real benefit or guarantee, it is also a relatively excellent strategy parameter after the system is constantly backtesting, which can provide users with the convenience of placing orders with one click.

7. Exclusive benefits for newcomers in this site·Blockchain Channel

In order to help newcomers get started quickly and strive to give users of this channel a good first experience, this website, blockchain channel and OKX Ouyi have exclusively customized limited-time exclusive newcomer grid transaction benefits, benefits highlights:

Preset optimized parameter configuration: Based on the massive market data of this channel and the official data of OKX, grid parameters were jointly modulated, and the robust parameters ensured that most new users had stable income and did not overturn their positions.

10U compensation guarantee: If a loss occurs after opening an order, the losses within the 10U range shall be borne by OKX

Easy to operate: Complete order opening in 30 seconds

first step |

Click on the activity link: If you do not register an OKX account, you must first complete the registration according to the process in the link: [Note: The link is online simultaneously with the article publishing] |

Step 2 |

Choose one of BTC/ETH/SOL grids and receive a 10U deductible. New users who have not opened grid transactions before can receive them. |

Step 3 |

Fill in the deposit amount, no other parameters need to be filled in, it has been preset |

Step 4 |

Click to create a policy |

Note: Please carefully read the activity terms and conditions of the activity link content

8. Preview of the exclusive content in the future

This channel plans to launch a series of exclusive teaching articles "Compulsory Courses for Novice in Currency Circle to Win Stable" to help users establish scientific and stable trading concepts and practical technologies, as well as exclusive benefits tailored for new users of this channel. Stay tuned.

The above is the detailed content of The compulsory course for novices in the currency circle to win with stability: grid trading. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

How do ordinary people buy Litecoin? Where to buy it? A comprehensive introduction to 3 simple and practical methods

Aug 14, 2025 pm 01:45 PM

How do ordinary people buy Litecoin? Where to buy it? A comprehensive introduction to 3 simple and practical methods

Aug 14, 2025 pm 01:45 PM

As digital assets gradually enter the public eye, many people have begun to become interested in Litecoin (LTC). This article will introduce you in detail three practical methods for purchasing Litecoin that ordinary people can easily get started, helping you complete your first transaction safely and conveniently.

The world's largest Bitcoin exchange official website of Binance Exchange

Aug 14, 2025 pm 01:48 PM

The world's largest Bitcoin exchange official website of Binance Exchange

Aug 14, 2025 pm 01:48 PM

Binance is the world's largest cryptocurrency exchange. With its huge transaction depth, rich business ecosystem and high liquidity, it provides all-round services such as spot, contracts, financial management and BNB Chain public chains. At the same time, it strives to ensure the security of user assets and promote transparent development through multiple security measures and compliance efforts.

What is the golden ratio in the currency circle? How to use Fibonacci Gold Pocket?

Aug 14, 2025 pm 01:42 PM

What is the golden ratio in the currency circle? How to use Fibonacci Gold Pocket?

Aug 14, 2025 pm 01:42 PM

What is the golden ratio in the catalog? From Fei's to Gold Pocket: How to show the pattern How to use gold pockets in cryptocurrency trading How to use gold pockets Why the gold ratio works in financial marketsFebonacci Gold Pocket Trading Setting Example Combined with gold pockets and other technical indicatorsCommon errors When trading gold pockets: The gold ratio is not only aesthetically valuable, but also actionable Fibonacci Gold Zone FAQ 1. What is the Fibonacci Gold Zone? 2. Why is 0.618 important in cryptocurrency trading? 3. Is the golden ratio effective? 4. How to TradingVie

How to call up the laptop without sound? Steps to restore the soundlessness of Apple laptop with one click

Aug 14, 2025 pm 06:48 PM

How to call up the laptop without sound? Steps to restore the soundlessness of Apple laptop with one click

Aug 14, 2025 pm 06:48 PM

Laptop silent? Easy troubleshooting and solving! Laptops are a must-have tool for daily work and study, but sometimes they encounter silent troubles. This article will analyze in detail the common causes and solutions for laptop silence. Method 1: Check the volume and audio equipment connection First, check whether the system volume setting is normal. Step 1: Click the taskbar volume icon to confirm that the volume slider is not muted and the volume is appropriate. Step 2: In the volume control panel, check the "Main Volume" and "Microphone" volume settings to ensure that the volume of all applications has been adjusted correctly. Step 3: If you are using headphones or external speakers, please check that the device is correctly connected and turned on. Method 2: Update or reset audio that is outdated or damaged by the audio driver

Bitcoin (BTC) briefly surpasses Google's market value and becomes the fifth largest asset in the world

Aug 16, 2025 pm 12:51 PM

Bitcoin (BTC) briefly surpasses Google's market value and becomes the fifth largest asset in the world

Aug 16, 2025 pm 12:51 PM

Bitcoin once surpassed Google's parent company Alphabet's market value of up to US$2.4 trillion, becoming the fifth largest asset in the world, arousing widespread heated discussion and optimistic expectations from investors. On Thursday, the price of Bitcoin broke through the $124,000 mark, setting a record high of $124,457, igniting market enthusiasm. Many investors are beginning to look forward to their market value being expected to get closer to Apple's current $3.4 trillion scale. This breakthrough allowed Bitcoin to briefly surpass Alphabet to become the fifth highest-cap asset in the world, marking a significant improvement in the position of crypto assets in the global financial market. "Bitcoin hits an all-time high - and that's just Wednesday," Gemini co-founder Tyler Winklevoss posted a message on X platform

The compulsory course for novices in the currency circle to win with stability: grid trading

Aug 14, 2025 pm 01:33 PM

The compulsory course for novices in the currency circle to win with stability: grid trading

Aug 14, 2025 pm 01:33 PM

Contents 1. What is grid transaction? 2. What are the advantages of grid trading compared to traditional manual trading? 3. Principles of grid trading 4. Grid trading can be adapted to various market conditions 5. Grid trading operation teaching 6. Newcomer parameter setting sharing (does not constitute investment advice) 7. Exclusive newcomer benefits of this site·Blockchain Channel 8. Follow-up exclusive content preview 1. What is grid trading? Grid trading is an automated trading tool that executes buying and selling behaviors according to preset logic to realize systematic, programmatic and regular trading methods. Compared with traditional manual trading, grid trading does not require frequent manual operations, which can significantly improve transaction efficiency, reduce operational risks, and free up your time.

Analysis of the possibility that ETH will surpass BTC a hundred times

Aug 14, 2025 pm 01:36 PM

Analysis of the possibility that ETH will surpass BTC a hundred times

Aug 14, 2025 pm 01:36 PM

Table of Contents First of all, BTC is the only basic layer that does not require trust. Secondly, BTC runs on PoW computing power of about 1 Zehh per second. (Teaching link note: 1 ZettaHash per second is equal to 1000 Ehash ExaHash per second, about 10^21H/s) Third, Proof of Stake PoS is essentially artificial governance. Fourth, ETH changes the rules many times. Fifth, winner-takes all: the network effect is a foregone conclusion. Sixth, the currency premium is indivisible. Seventh, BTC is capture-resistant. Recently, TomLee of FundstratCapital stated in a public live broadcast that BMNR has accumulated more than 800,000 ETHs, building the world's largest

List of transaction fees for currency exchanges Comparison of transaction fees for mainstream exchanges

Aug 16, 2025 pm 12:45 PM

List of transaction fees for currency exchanges Comparison of transaction fees for mainstream exchanges

Aug 16, 2025 pm 12:45 PM

In 2025, the average spot fee rate of mainstream exchanges is 0.1%-0.2%, and the contract fee rate is 0.01%-0.06%; Binance, OKX, etc. provide up to 30% discount through VIP levels and platform tokens (such as BNB and OKB); the fee rate of decentralized exchanges is still 3-5 times higher; high-frequency traders can save 80% of fees; Maker orders enjoy preferential or even negative rates; cash withdrawal fees may be increased by 300%-500% due to network congestion; hidden costs include fiat currency spread (up to 1.5%), inactive account fees and cross-chain surcharges; fee reduction strategies include holding tokens, market makers trading, and improving VIP levels, saving more than $3,000 per month for combined use; industry trends are zero-rate rates for specific transactions, decentralized platform fees and capital rate optimization