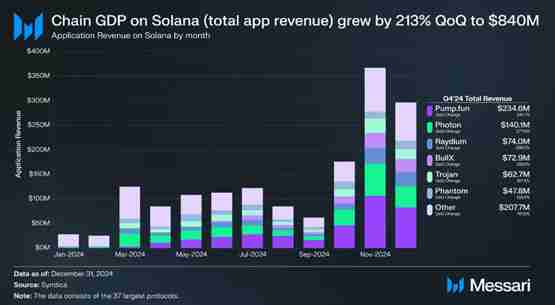

Solana's on-chain application revenue achieved amazing growth in the fourth quarter of 2024 (Q4), with a surge of 213%! From $268 million in the third quarter to $840 million, of which it peaked at $367 million in November. This strong wave of growth is mainly due to the Meme coin craze that has swept the market.

Meme coin craze ignited the Solana DeFi ecosystem, and Pump.fun leads the revenue list

According to a report by crypto research firm Messari, Meme coins will become the main driver of Solana's decentralized application (DApp) growth in 2024. Meme coin issuing platform Pump.fun's revenue in Q4 reached US$235 million, a month-on-month increase of 242%, ranking first on Solana DApp revenue.

Other DeFi trading platforms also performed well, with Photon and Raydium hitting Q4 revenue of US$140 million and US$74 million respectively, with a month-on-month increase of more than 250%. Messari pointed out that the rapid growth of these DApps is closely related to the Q4 Meme coin speculation boom and the issuance of AI-related tokens.

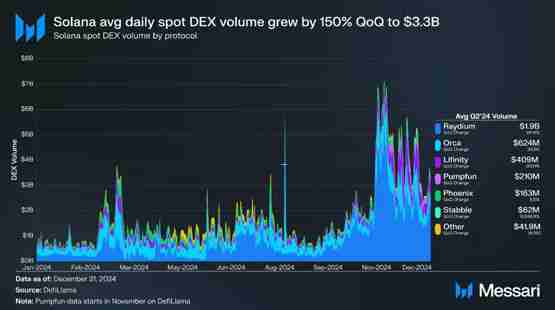

Solana DEX trading volume surged, with an average daily trading volume exceeding US$3.3 billion

The average daily trading volume of Solana Decentralized Exchange (DEX) increased by 150% to $3.3 billion in Q4. As the main automatic market maker DEX on Solana, Raydium's average daily trading volume is as high as US$1.9 billion, directly benefiting from the Meme coin boom.

Solana's total lock-in volume (TVL) has grown strongly, jumping to second place in the world

In addition to the significant increase in transaction activity, Solana also attracted a large amount of capital inflows in Q4, with a total locked position (TVL) reaching US$8.6 billion, becoming the second largest blockchain in the world. This is mainly due to the rapid growth of lending platforms and DEXs, such as Jupiter's average daily trading volume reached US$873 million, a 73% increase from the previous month. The Meme coin boom has further boosted Solana DApp's revenue and market activity.

At the same time, the liquidity pledge rate on Solana increased by 33% month-on-month to 11.2%, indicating that more and more users are making profits by pledging SOL, enhancing the profitability of Solana ecosystem. Although Ethereum still tops the TVL list with a locked position of about $57.5 billion, Solana's growth rate shows that its competitiveness in the DeFi field is rapidly increasing.

The above is the detailed content of The good news Meme coin boom has driven the explosion of the DeFi ecosystem! Solana Q4 DApp revenue surged 213%. For more information, please follow other related articles on the PHP Chinese website!