On-chain information exhibits Bitcoin has been shifting to Coinbase from different exchanges. Right here’s what this has traditionally meant for the asset.

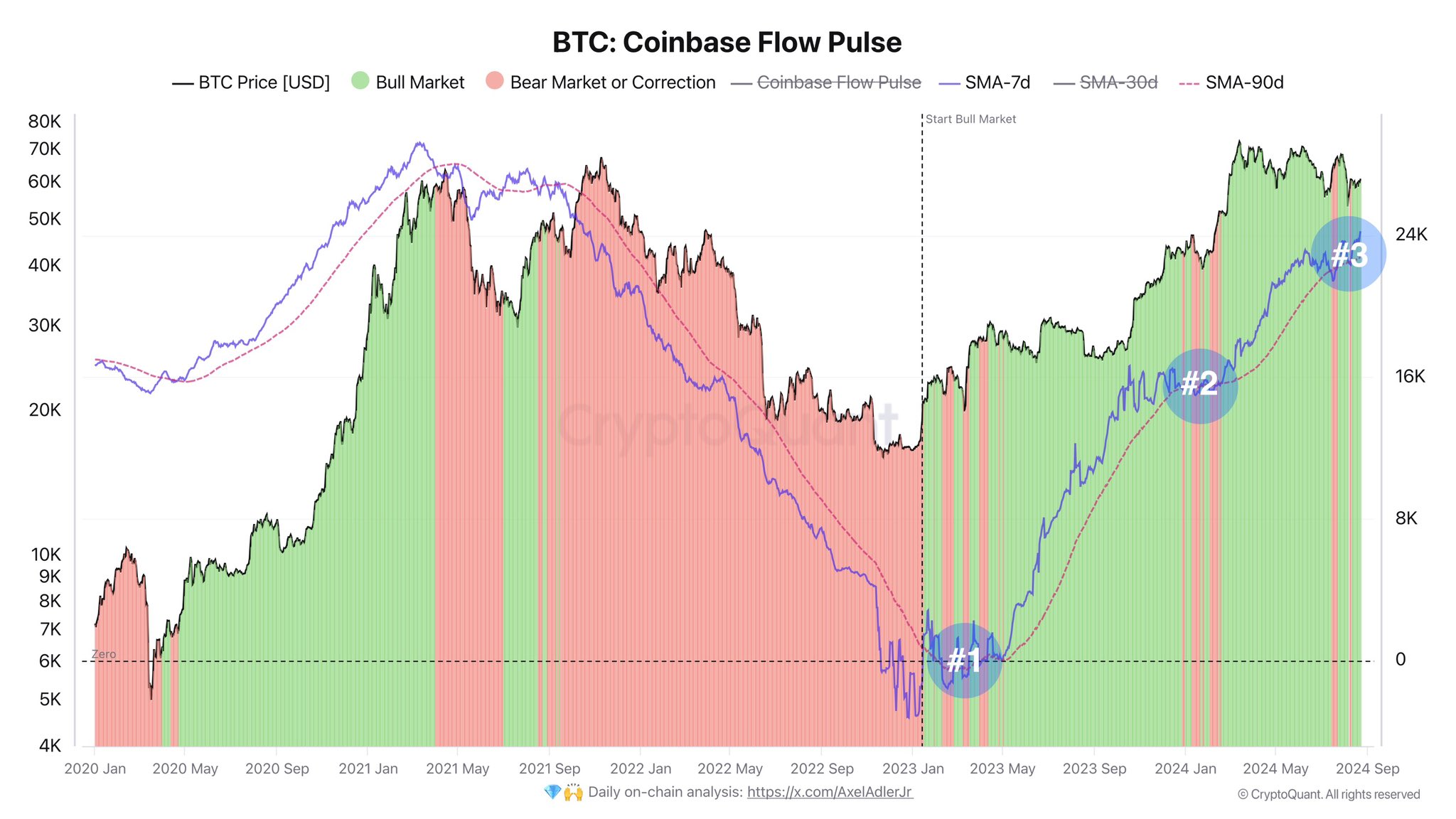

Bitcoin has as soon as once more began seeing inflows from different exchanges, in keeping with the Coinbase Movement Pulse indicator. Traditionally, this indicator has pointed to intervals of bullish worth motion for the cryptocurrency.

Bitcoin noticed large inflows from different exchanges final 12 months, because the indicator remained constructive all through 2023. The indicator’s development about its 90-day shifting common is especially necessary to observe.

Associated Studying: Bitcoin Open Curiosity Hits All-Time High, But Leverage May Be A Concern

As defined by CryptoQuant, intervals the place the 7-day shifting common of the indicator falls under the 90-day MA are categorized as “Bear Market or Correction.” Alternatively, durations the place the 7-day MA crosses above the 90-day MA are known as “Bull Market.”

The final time the 7-day MA fell under the 90-day MA for Bitcoin, the cryptocurrency noticed a interval of consolidation earlier than rallying once more.

Now, the 2 shifting averages have crossed again, indicating that demand for shifting cash to Coinbase has picked again up. The final time this sample fashioned for the cryptocurrency was simply earlier than the rally in direction of the brand new all-time excessive (ATH).

Coinbase is the recognized vacation spot of American institutional entities. As such, a stream of cash from different exchanges into Coinbase might point out demand from these US-based whales.

Bitcoin institutional demand stays muted in keeping with one metric

Whereas the market outlook seems constructive from the attitude of the Coinbase Movement Pulse, one other indicator from the on-chain analytics agency CryptoQuant is probably not so brilliant.

As CryptoQuant Head of Analysis Julio Moreno has defined in an X publish, Bitcoin demand continues to be muted when contemplating the “Obvious Demand” metric.

The Obvious Demand metric strives to estimate the demand current in the whole market and never only a part of it just like the Coinbase Movement Pulse. It achieves this by multiplying the day by day buying and selling quantity with the day by day worth change for Bitcoin.

Whereas the demand for Bitcoin was at vital ranges earlier within the 12 months, it appears to have fallen off exhausting after the lengthy consolidation streak. The Obvious Demand is presently at roughly impartial values.

Associated Studying: Bitcoin Price Analysis: Rally Stalls, Is BTC Doomed For Another Retest?

The metric was within the unfavorable zone throughout a lot of final 12 months, indicating a scarcity of demand out there. Nevertheless, as Bitcoin began rallying, the metric crossed into constructive territory.

The best ranges of demand had been seen in March and April of final 12 months, throughout Bitcoin’s rally to the earlier ATH. Now, the metric appears to be like to have fallen off as soon as once more, regardless of the cryptocurrency hitting a brand new ATH.

Bitcoin was seen buying and selling at round $61,000 on the time of writing, up over 5% previously week.

The above is the detailed content of Bitcoin (BTC) Coinbase Movement Pulse Has Turned Again Inexperienced Just Lately. For more information, please follow other related articles on the PHP Chinese website!