Written by Nian Qing, ChainCatcher

After the recent deadline for filing first-quarter 13F reports with the SEC (May 15), a total of about 1,000 institutions held about $11.55 billion in Bitcoin spot ETFs.

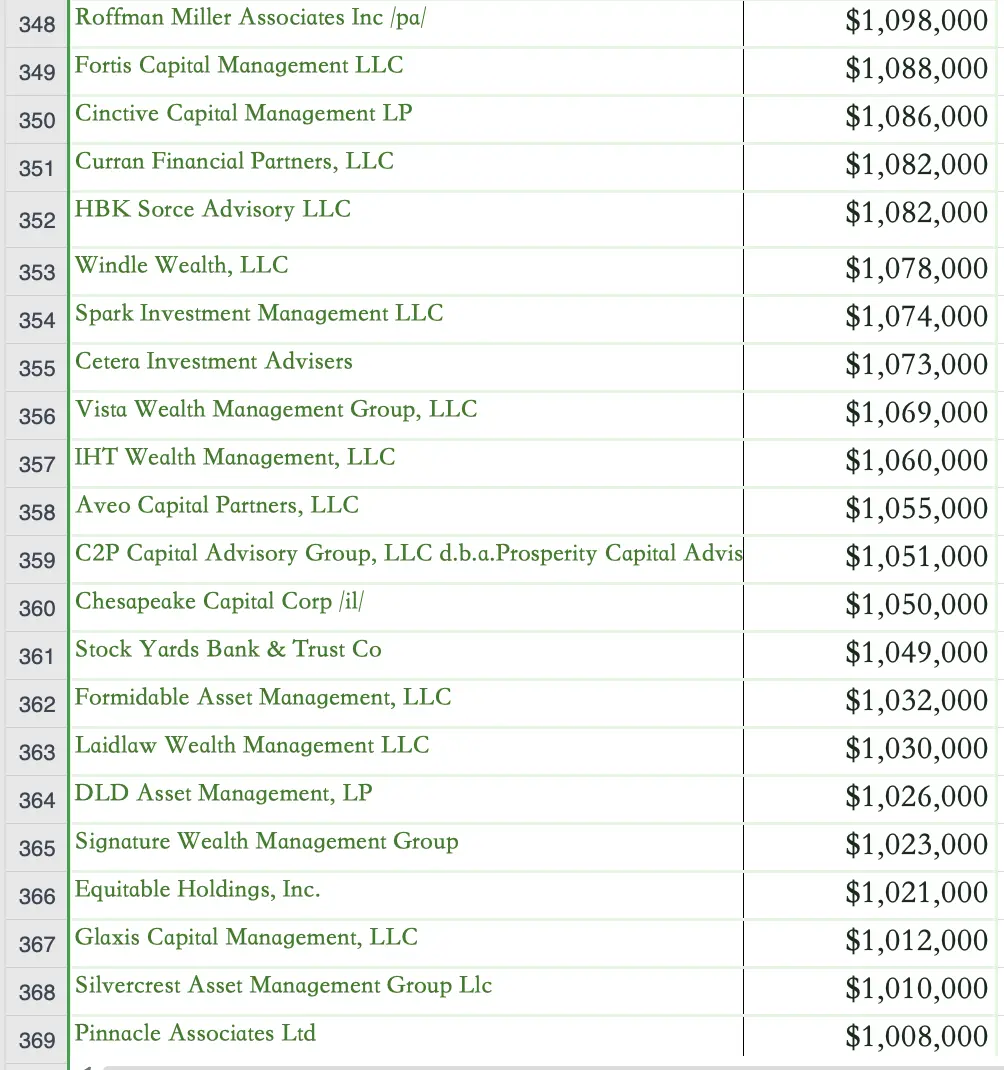

Institutional investment levels in Bitcoin ETFs vary. Among them, a total of 18 institutions hold related assets of more than 100 million U.S. dollars, a total of 102 institutions hold related assets of more than 10 million U.S. dollars, and a total of 102 institutions hold related assets of more than 100 U.S. dollars. A total of 371 institutions accounted for US$10,000. The BTC ETF assets held by most institutions only account for a small part of their total asset management.

Most of the 18 institutions holding more than US$100 million in related assets are well-known hedge funds and asset management companies, such as Millennium Management (Millennium), Jane Street Group, Schonfeld Strategic Advisors, etc. Similarly, large institutions’ investment in crypto assets Investments account for only a small portion of its total asset management.

In addition, although 13F filings have become an important bellwether in the investment community, these institutions’ holdings of spot Bitcoin ETFs do not mean they are bullish on Bitcoin. For high-frequency trading, cryptocurrency is only a volatile asset. Most institutions purchase Bitcoin for speculative trading strategies and do not fully recognize any fundamental value of Bitcoin. Does this mean that after the United States officially passed the BTC spot ETF in January this year, the market still lacks long-term holders of Bitcoin?

But overall, as of the first quarter, the asset size of the spot BTC ETF exceeded $11 billion, making it the most successful ETF issuance in history. The BTC ETF elevates Bitcoin as a recognized financial asset and opens up avenues for professional investors, hedge funds, family offices and institutions to participate in Bitcoin investments. Institutional interest in BTC ETFs is growing.

About 13F file

The full name of 13F is SEC Form 13F. The U.S. Securities and Exchange Commission (SEC) stipulates that investment institutions or advisors with assets under management exceeding US$100 million must submit it within 45 days after the end of each quarter. Quarterly reports disclose its common stocks (including ETFs), options, American depositary receipts (ADRs), convertible bonds, etc., and provide detailed descriptions based on security types, stock names and quantities, total market value, etc.

The institution’s 13F filing should be submitted to the SEC within 45 days after the end of the quarter of the calendar year, usually before February 15th, May 15th, August 15th, and November 15th each year (the deadline is if it falls on a holiday The date is the next working day), and the report will be made public in the SEC's database (EDGAR) after it is submitted. Most institutions wait until close to the deadline to submit in order to conceal their investment strategy from competitors. The data in Q2’s 13-F file deserves more attention from the encryption market, and ChainCatcher will continue to pay attention.

In this article, ChainCatcher compiled a complete list of institutions in descending order of investment amount based on the BTC ETF holders list in the 13F document released by ccn.com. Let’s first take a look at the ten institutions holding the most spot BTC ETFs. Who——

Keywords: Hedge Funds

Millennium Management is a global investment company led by Israel Englander Founded in 1989. The firm is best known for its multi-strategy hedge funds. Millennium had about $2 billion invested in several ETFs as of the first quarter, including BlackRock's iShares Bitcoin Trust (IBIT.O), Grayscale Bitcoin Trust and funds from issuers such as Bitwise Investments and ARK Investment Management. Total assets in Q1 were $234 billion, with crypto investments accounting for less than one percent.

Keywords: market maker, asset management, venture capital fund

SIG was founded in 1987, and its business scope covers securities investment, trading, financial services, etc. , whose best-known expertise is the pricing and trading of financial derivatives, particularly stock options. It is also the "designated market maker" for approximately 600 stock options and 45 stock index options on the Chicago Board Options Exchange, the American Stock Exchange, the Philadelphia Stock Exchange, and the International Stock Exchange. It is responsible for including Google, Goldman Sachs, JPMorgan Chase, General Motors, Electric, PepsiCo, Microsoft and other big-name stocks. Haina Asia owns about 15% of ByteDance.

Although SIG invested $1.326 billion in BTC ETFs, this investment represents only a small part of its portfolio. The company’s assets under management at the end of the first quarter were $576 billion, and crypto investments accounted for only one thousandth of two.

Keywords: hedge funds, asset management

Horizon Kinetics Co., Ltd. was established in May 2011 and is a subsidiary of Horizon Asset Management Co., Ltd., which was established in 1994 , and merged with Dynamic Asset Management Co., Ltd. established in 1996. As early as 2016, Flat Earth Dynamics allocated 1% of its share to invest in the Grayscale Bitcoin Trust Fund. In 2020, the share of the Grayscale Bitcoin Trust held ranked fifth. The company also issued a "Blockchain Development ETF" , which primarily invests in equity securities, American depositary receipts and global depositary receipts of listed blockchain development companies.

The company’s AUM at the end of the first quarter was $5.3 billion, with 17.8% of the $946 million invested in BTC ETFs.

Keywords: hedge fund, market maker

Jane Street is a quantitative trading company and liquidity provider. Many founders of the crypto circle such as SBF are from Jane Street. Although Jane Street announced the reduction of its crypto business in May last year when U.S. policy tightened after the FTX incident, it has actually been providing market making for the crypto industry. Jane Street Capital is also still investing in the crypto space. In addition, Jane Street is also an authorized dealer of Bitcoin spot ETFs designated by Grayscale, Fidelity, and WisdomTree.

The company’s assets under management at the end of the first quarter were $478 billion, with the $634 million invested in BTC ETFs representing just one-thousandth.

Keywords: Hedge Fund

Schonfeld Strategic Advisors is a New York-based hedge fund founded in 2015. The predecessor of Schonfeld’s consulting business was the family office run by Mr. Steven Schonfeld. Schonfeld invested $248 million in IBIT and $231.8 million in FBTC in the first quarter, for a total of $479 million.

The firm’s AUM at the end of the first quarter was $15 billion, with $480 million invested in BTC ETFs accounting for 3.2%.

Keywords: Hedge Fund

Bracebridge Capital is a hedge fund headquartered in Boston, USA. Established in 1994 to manage funds from the endowments of Yale and Princeton universities.

Bracebridge Capital has been big on Bitcoin spot ETFs this year, including $300 million of Ark 21Shares’ ARKB and $100 million of BlackRock IBIT, as well as $26.52 million of Grayscale GBTC, accounting for 86% of its total assets. The ARKB it bought accounted for 9.94% of the total outstanding shares, even higher than the 6.68% held by Ark itself.

Keywords: Hedge Fund

Boothbay Fund Management is an institutional investment company located in New York City. It was established at the end of 2011 and is run by the famous fund manager Ari Glass. It manages two global multi-strategy funds. manager fund. Boothbay Fund Management has been investing in cryptocurrencies since 2013.

Boothbay Fund Management disclosed $377 million in spot BTC ETF investments, including $149.8 million in IBIT, $105.5 million in FBTC, $69.5 million in GBTC, and $52.3 million in BITB. Its Q1 assets under management were US$5.2 billion.

Keywords: hedge funds, asset management

Morgan Stanley is an international financial services company established in New York, USA, providing services including securities, asset management, corporate mergers and reorganizations and financial services such as credit cards. As of March 31, Morgan Stanley held nearly $270 million in GBTC. It opened allocations to the underlying ETF to clients shortly after the BTC spot ETF was approved in January, so it’s likely that the underlying investments were made on behalf of clients rather than the bank’s own bets on Bitcoin.

Its Q1 asset management scale is as high as US$1.2 trillion, and crypto investments account for a very small proportion.

Keywords: investment funds, asset management

ARK Invest is an asset management company headquartered in New York, USA, founded in 2014 by "Sister Wood" Cathie Wood. The assets held in Q1 were approximately US$14 billion, and the stocks with the largest holdings were COIN (Coinbase) and TSLA (Tesla).

In January this year, 21Shares and ARK Invest officially launched Bitcoin spot ETF. Shortly after the issuance of the relevant ETF, one of Ark Investment's ETF products, ARK Next Generation Internet ETF, sold its $16 million position in the Bitcoin futures ETF, ProShares Bitcoin Strategy ETF, to purchase 365,427 shares of ARK issued by Ark Investment. The 21 Shares Bitcoin ETF has expanded in size, and after buying into the ETF, the ARK 21 Shares Bitcoin ETF now accounts for approximately 1% of ARKW's total position.

Keywords: investment advisor

Pine Ridge Advisers is an American investment advisory company established in 2014. With current AUM of $855 million, the firm has $205 million in IBIT, FBTC and BITB, accounting for 23% of its total AUM. According to analysts, Pine Ridge Advisers may be doing arbitrage trading rather than allocating a quarter of its clients' portfolios to Bitcoin as some investment advisers do.

The above is the detailed content of List of 1,000 Bitcoin spot ETF buyers disclosed: total investment scale exceeds US$11.5 billion, with hedge funds accounting for the majority. For more information, please follow other related articles on the PHP Chinese website!