web3.0

web3.0

New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction

New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction

New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction

1. OKX C2C launches the "novice-friendly" merchant mechanism and successfully completes the first transaction

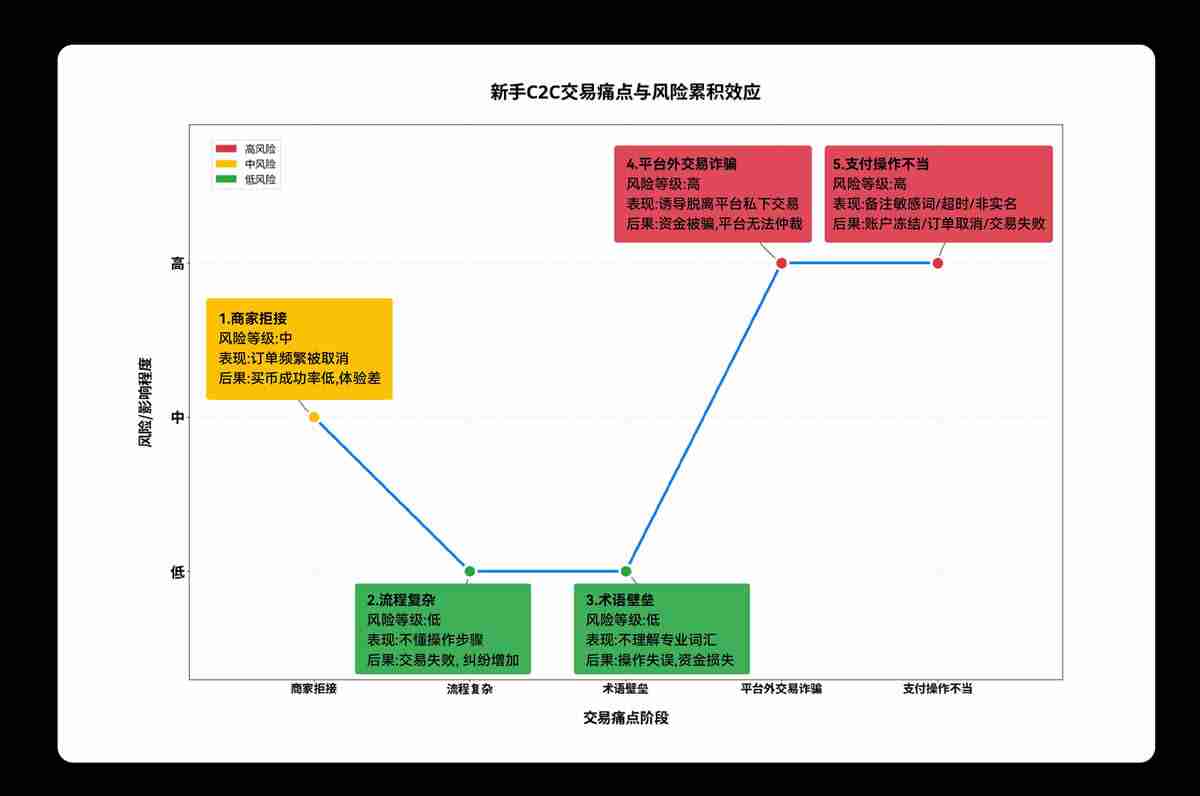

Faced with the huge potential of the crypto market with a scale of nearly $4 trillion, many new users are eager to try it out, but often encounter setbacks when making their first C2C transaction. It is common for merchants to frequently reject or directly cancel orders after placing an order. The smooth buying process that was originally expected has become tortuous. This "order card" phenomenon not only consumes patience, but also makes many people choose to give up before they actually enter the market.

To solve this pain point, OKX C2C officially launched the "novice-friendly" merchant mechanism, committed to providing a one-stop solution for first-time transaction users to ensure that the first order is no longer "stuck".

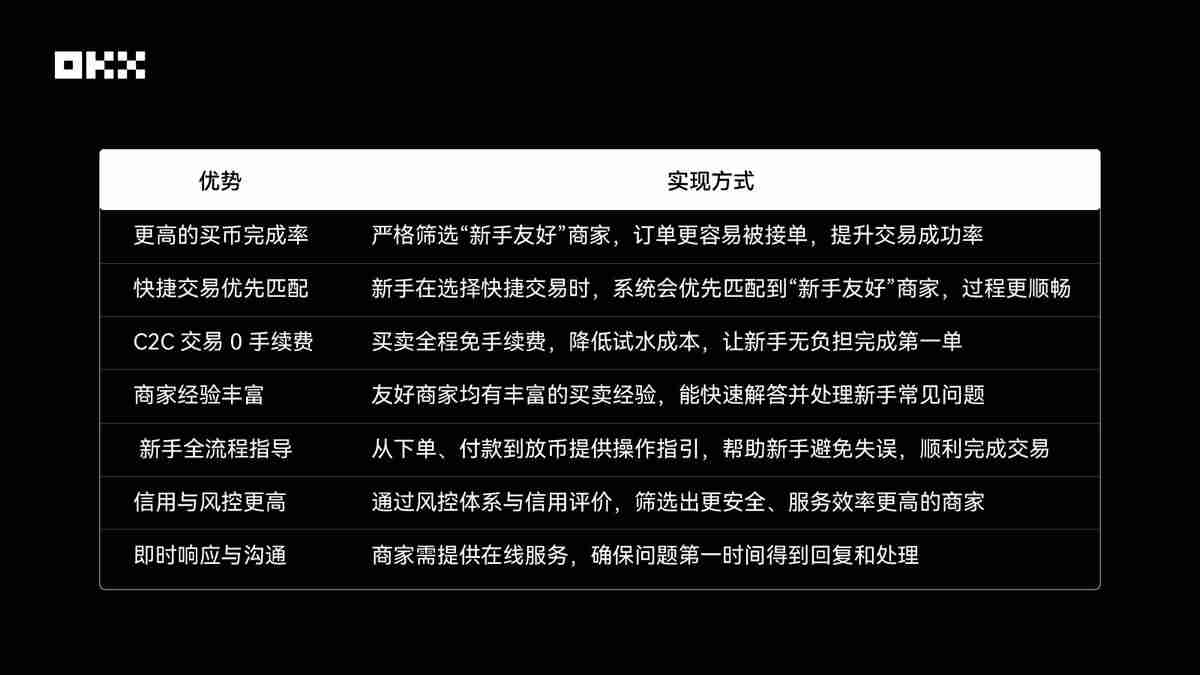

The core advantages of this mechanism are first reflected in the high transaction rate . The platform has strictly screened high-quality merchants and recommended these merchants to new users in the fast trading model, which significantly increases the probability of orders being accepted and makes the entire transaction process more efficient and smooth.

Secondly, breakthroughs have also been achieved in cost control . OKX C2C is free of charge throughout the entire process, allowing novices to complete their first attempt without additional expenses, effectively lowering the threshold for participation. At the same time, these certified "novice-friendly" merchants generally have rich experience and can provide clear guidance in all aspects of ordering, payment and coin release, helping newcomers avoid common operational mistakes and successfully complete the entire transaction process.

In terms of security and service guarantee , OKX relies on its powerful risk control system and credit evaluation system to select merchants that are responsive and have good reputations to create a more secure transaction environment. Once you encounter problems, users can also receive timely feedback and processing support to ensure that the first transaction is both safe and reliable.

2. How do new users complete C2C transactions? The operation guide is here

So, how should new users find and use the "novice-friendly merchant" in OKX C2C to complete the transaction?

Please first upgrade the OKX APP to the latest version (v6.136 and above), then enter the "C2C Coin Buying" function from the homepage, select the "Quick Transaction" method to deposit, and you can transfer money directly to the merchant. In this mode, the system will automatically identify the identity of a new user and give priority to matching sellers marked as [Newbie Friendly Merchant], which will greatly improve the order transaction speed and success rate.

In addition, users can also manually enter the "C2C Buy Coins" page and directly click on the [Newbie Friendly Merchant] section to initiate a transaction; or check the "Newbie Friendly" tab through the filter function and select the appropriate merchant to place an order.

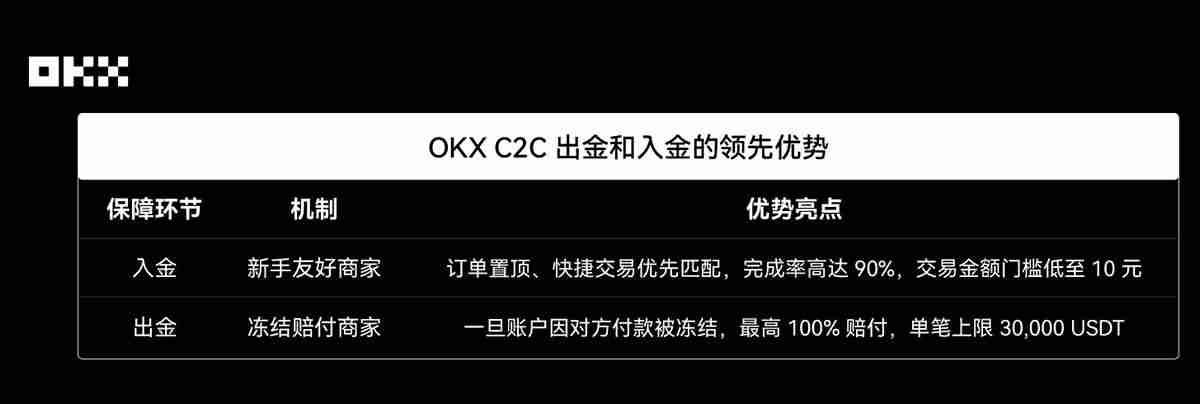

It is worth mentioning that the system will also intelligently identify new users and automatically top them when they visit the C2C transaction page to display a group of high-quality merchants specially designed for beginners. Compared with other platforms, OKX's design has more humane advantages: the order success rate of these merchants generally exceeds 90%, and the transaction threshold is extremely low. The first transaction can be completed at least 10 yuan, which greatly improves the convenience of entry. In the fast transaction path, the platform will also force priority to match such merchants to further ensure rapid transactions.

Not only that, OKX also has special optimizations for common problems for novices. For example, some new users are easily rejected due to lack of historical records, so the platform gives priority to recommending friendly merchants who are willing to take on novice orders; for those who forgot to click the "Paid" button after payment and mistakenly think that the system will automatically release coins, the merchant will take the initiative to remind and assist in completing the operation; as for problems such as difficulty in uploading payment vouchers and unknown pop-up prompts during payment, there are also corresponding process guidance and risk control support. It is these details that make the first coin buying experience of newbies smoother and worry-free.

Through the above mechanism design, OKX not only significantly lowers the deposit threshold for new users, but also provides comprehensive support in terms of operational guidance and security guarantees. For users who are first exposed to cryptocurrencies, this means reducing anxiety and uncertainty and increasing confidence and confidence to complete the transaction smoothly.

3. Create a full-link security barrier for C2C transactions: from "buy with confidence" to "sell with confidence"

Now on the OKX C2C platform, whether you are a novice deposit or an old user withdrawing funds, you can enjoy the corresponding level of security guarantee. OKX is building a safe closed loop covering the entire transaction cycle - truly achieving "buy in and out with stability".

In addition to launching "novice-friendly merchants", OKX has previously launched an innovative "freeze compensation" mechanism . This system allows users to enjoy industry-leading protection when withdrawing funds: transactions are free of charges, and if the collection account is frozen, they can also enjoy a maximum of 100% compensation within the limit. The maximum compensation limit for a single block transaction can reach USD 30,000.

Unlike the traditional model of relying solely on merchants to pay deposits, OKX's compensation funds are jointly borne by the platform and merchants. Even if large amounts of compensation occur, they can be guaranteed, completely avoiding the embarrassing situation of "unable to compensate". The compensation rules are clear and transparent:

- Small orders (≤500 USDT): All 100% full compensation will be enjoyed;

- Large orders (>500 USDT) are divided into two categories:

- Ordinary certification compensation merchants: The excess is 20%, with a minimum compensation of 500 USDT and a maximum compensation of no more than 2,000 USDT;

- Bulk compensation merchants: 100% full compensation can be achieved within the compensation limit, with a minimum of USDT and a maximum of USDT of 30,000.

This compensation amount basically covers the daily withdrawal needs of most users and fully reflects the platform's responsibility.

It should be emphasized that not all merchants support "freeze compensation". Only merchants with the [Frozen Payment] logo can provide this service. These merchants need to meet strict access conditions - either pay high deposits, or pass the platform's multiple certifications, and promise to strictly implement the compensation agreement. OKX has actually carried out a round of risk screening for users in advance, keeping potential hidden dangers out of the door.

4. Reshape the C2C introductory ecosystem with user experience as the core

In the C2C trading scenario, many novices’ first failure does not stem from market fluctuations, but from a poor operating experience. Frequently rejected orders, interrupted process, and not knowing what to do next after payment... These "non-market risks" are the real culprits to persuade them to retreat. Currently, most platforms still focus on matching efficiency or price competition, ignoring the true feelings of novices.

The "novice-friendly merchant" mechanism launched by OKX takes a different approach and takes "whether the first order can be successfully completed" as its core goal.

It is not just a simple transaction matching tool, but does two key things: one is to comprehensively improve the user experience - by automatically identifying the identity of a new user, displaying high-quality merchants on the top of the homepage, and forcing priority matching in quick transactions, the success rate of the first order is increased to more than 90%; the other is to actively adapt to user behavior - merchants will actively remind users to click on key steps such as "paid" and uploading vouchers, and the system will automatically pop up the window warning when a high-risk payment method is detected.

This sends an important signal: OKX no longer requires users to adapt to complex system logic, but allows the system to actively adapt to user habits.

What is more profound is that OKX's optimization has not stopped at "buying coins smoothly". During the withdrawal process, the platform simultaneously launched the "freeze compensation merchant" mechanism to establish a rare dual guarantee system in the industry. The maximum compensation ratio can be up to 100%, with a single compensation limit of up to USDT, and the funds are jointly borne by the platform and merchants, rather than relying solely on merchant margins. This means that even in extreme situations, the platform is still able to fulfill its compensation commitment and eliminate the dilemma of "inability to compensate".

In contrast, the compensation limit for most platforms on the market is much lower than this, making it difficult to meet the users' large-scale capital circulation needs.

The results of this combination strategy are obvious: deposits are no longer worried about order rejection, and withdrawals are not afraid of account freezing . For users, this is a smoother and lower-voltage entry path; for the industry, it is an innovation in service concepts - C2C is gradually evolving from a cold matchmaking channel to a warm and guaranteed trading ecosystem.

In the long run, this "user-centric" strategy may trigger the industry's Matthew effect. As the experience of novices continues to improve and user trust continues to accumulate, OKX is expected to further widen the gap with similar platforms. The once criticized C2C trading experience may be an opportunity to move towards a wider mass market due to such innovative designs.

Disclaimer

This article is for reference only. This article only represents the author's views and does not represent the position of OKX. This article is not intended to provide (i) investment advice or investment recommendation; (ii) offer or solicitation for the purchase, sale or holding of digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Digital assets held (including stablecoins and NFTs) are involved in high risks and may fluctuate significantly. Historical returns do not represent future returns, and past performance does not represent future results. You should carefully consider whether trading or holding digital assets is right for you based on your financial situation. For your specific situation, please consult your legal/tax/investment professional. Please be responsible for understanding and complying with relevant local applicable laws and regulations.

The above is the detailed content of New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1667

1667

276

276

What is USDH currency? Is it a good investment? Analysis of Hyperliquid native stablecoin

Sep 20, 2025 pm 01:57 PM

What is USDH currency? Is it a good investment? Analysis of Hyperliquid native stablecoin

Sep 20, 2025 pm 01:57 PM

Directory What is USDH What is HyperliquidNetwork Mission Why USDH stands out Why Hyperliquid Why Should Launch Stable Coins How many USDH Tokens USDH Do What USDH and the Technical Team Behind USDCUSDH Important News and Events Is USDH a Good Investment Is USDH a good investment FAQ Conclusion USDH is a native stablecoin for Hyperliquid, aiming to enhance the platform's ecosystem by acquiring reserve income and reducing dependence on external stablecoins such as USDC. USDH by NativeMarkets

What is FOMC? How does it affect cryptocurrency? Explain the article in detail

Sep 20, 2025 pm 02:06 PM

What is FOMC? How does it affect cryptocurrency? Explain the article in detail

Sep 20, 2025 pm 02:06 PM

Table of Contents What is the Federal Open Market Committee What does the Federal Open Market Committee do? Why is the Federal Open Market Committee important How does the Federal Open Market Committee affect cryptocurrency traders How does the FOMC affect cryptocurrency Fed interest rate changes What is the monetary policy why is the important How does the investor sentiment change FOMC policy impact scenario What happens in hawkish scenarios (more tighter policies, such as raising Fed interest rates) What happens in a dovish scenario (loose policies, such as lowering Fed interest rates) What happens in neutral situations What other key economic indicators are prepared for economic data release monitoring consensus forecast analysis historical response tracking Fed policy FOMC events

Learn more about Standard Chartered Venture Capital Division plans to raise $250 million for cryptocurrency funds

Sep 20, 2025 pm 01:06 PM

Learn more about Standard Chartered Venture Capital Division plans to raise $250 million for cryptocurrency funds

Sep 20, 2025 pm 01:06 PM

SCVentures, a subsidiary of Standard Chartered Bank, announced that it will launch a cryptocurrency investment fund of US$250 million in 2026, aiming to seize investment opportunities in the global digital asset field. According to Bloomberg on Monday, the bank's venture capital arm SCVentures plans to set up an investment fund focusing on digital assets related to financial services. Operations partner Gautam Jain said in an interview that the new fund will mainly attract capital from the Middle East and is expected to be officially launched in 2026. This move conforms to the industry trend of corporate financial companies gradually building long-term asset accumulation strategies, and further enhances the market's expectations for the continued flow of institutional funds into the crypto field. It is not clear which crypto assets the fund will allocate. C

What is Velora (VLR) currency? How is Velora project overview, introduction to token economy and future development

Sep 20, 2025 pm 01:48 PM

What is Velora (VLR) currency? How is Velora project overview, introduction to token economy and future development

Sep 20, 2025 pm 01:48 PM

Catalog Velora (VLR) Latest News What Velora Is Velora How Velora Function Governance From ParaSwap to Velora: Next Generation Cross-chain DeFi Protocol Team and Founder Investors and Partners What VLR Tokens Use Field VLR Token Economic Economy and Function Features Velora Roadmap Velora is a multi-chain DeFi protocol created by the ParaSwap team, committed to providing users with an efficient, fast and user goals-centric trading experience. Its newly built Delta infrastructure is capable of resisting MEV (maximum extractable value) attacks, supports zero gas transactions, and implements advanced price execution mechanisms.

New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction

Sep 20, 2025 pm 02:00 PM

New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction

Sep 20, 2025 pm 02:00 PM

1. OKXC2C launched the "novice-friendly" merchant mechanism and successfully completed its first transaction. Facing the huge potential of the crypto market with a scale of nearly US$4 trillion, many new users are eager to try it, but often encounter setbacks when making the first C2C transaction. It is common for merchants to frequently reject or directly cancel orders after placing an order. The smooth buying process that was originally expected has become tortuous. This "order card" phenomenon not only consumes patience, but also makes many people choose to give up before they actually enter the market. To solve this pain point, OKXC2C officially launched the "novice-friendly" merchant mechanism, committed to providing a one-stop solution for first-time transaction users to ensure that the first order is no longer "stuck". The core advantages of this mechanism are first reflected in the high transaction rate. The platform strictly screens high-quality merchants and

BTC is 'digesting future market trends ahead of time': 5 most noteworthy Bitcoin points this week

Sep 20, 2025 pm 01:39 PM

BTC is 'digesting future market trends ahead of time': 5 most noteworthy Bitcoin points this week

Sep 20, 2025 pm 01:39 PM

Table of Contents As traditional financial markets recover, Bitcoin volatility has risen significantly. The Fed's interest rate cut expectation has become the focus of the market. The peak of Bitcoin bull market may be "only a few weeks left". Binance has seen a large-scale buy signal. ETFs continue to absorb newly mined BTC. Bitcoin (BTC) investors are closely following market trends as crypto assets enter the Fed's key interest rate decision window. At the beginning of this week, bulls need to break through the important resistance level of $117,000 to continue their uptrend. Global attention is focused on Wednesday's Federal Reserve meeting, and it is generally predicted that it will usher in the first rate cut in 2025. A past accurate BTC price model shows that all-time highs may be born in the next few weeks. Binance Order Book reveals signs of large buying influx over the weekend. Last week, the amount of BTC purchased by institutions through ETFs reached miners

The folder or file has been opened in another program

Sep 20, 2025 am 08:24 AM

The folder or file has been opened in another program

Sep 20, 2025 am 08:24 AM

When the file is occupied, first check and close the relevant programs and try to restart the computer; if it is invalid, use task manager, resource monitor or ProcessExplorer to locate the occupied process, and forcefully terminate it by ending the task or taskkill command; for prevention, you need to develop good operating habits, avoid previewing or directly operating on mobile/network drives, and keep software updated.

Good news: China's largest currency holding company plans to increase its position in Bitcoin through additional issuance of US$500 million in stocks

Sep 20, 2025 pm 01:03 PM

Good news: China's largest currency holding company plans to increase its position in Bitcoin through additional issuance of US$500 million in stocks

Sep 20, 2025 pm 01:03 PM

Key information of the catalog: NextTechnology has become the 15th largest enterprise-level Bitcoin holder in the world. Strategy has firmly ranked first in the global corporate currency holding list with 636,505 BTC. NextTechnologyHolding - China's listed company with the most Bitcoin holdings, plans to raise up to US$500 million through the public issuance of common shares to further increase its holdings in BTC and support other companies' strategic layout. Key information: NextTechnology plans to raise $500 million for financing