Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts

Against the backdrop of global central banks' continued expansion of balance sheets and the continued dilution of fiat currency purchasing power, Bitcoin's share in the global monetary system has steadily increased.

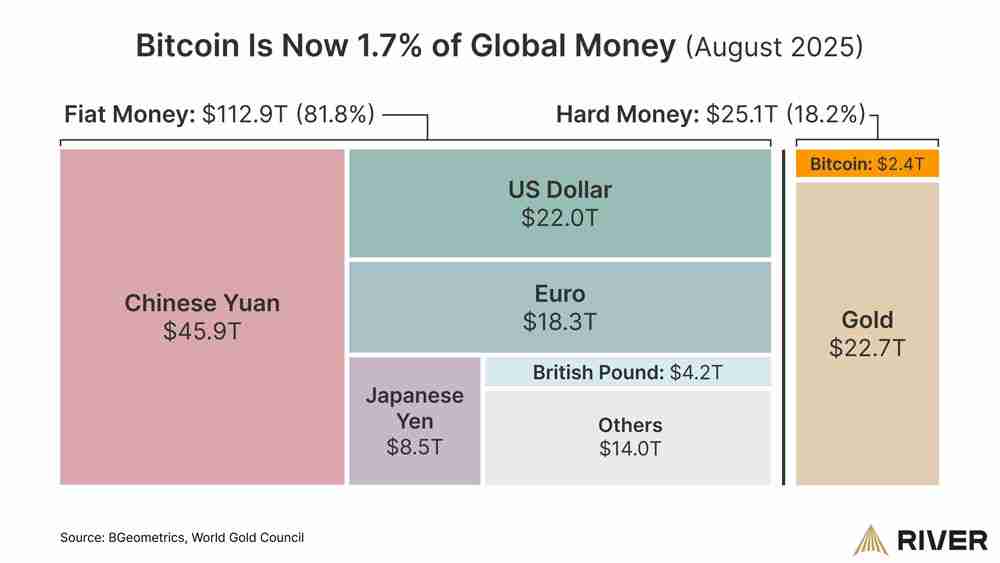

According to the latest data released by Bitcoin financial company River, Bitcoin (BTC) currently accounts for about 1.7% of the global currency. This statistics cover the sum of M2 money supply in major countries, some minor currencies and the market value of gold.

"After 16 years of development, Bitcoin has entered the global monetary structure, accounting for 1.7%," River pointed out. The company compared Bitcoin’s market value with a $112.9 trillion fiat pool and a $25.1 trillion hard currency asset, which only contains gold and does not include other precious metals such as silver, platinum and palladium.

The ratio is based on the peak value of Bitcoin’s market value of $2.4 trillion - a figure that occurred in early August. As of now, Bitcoin's market value has fallen to about US$2.29 trillion, bringing its share of global currency to about 1.66%.

Comparison chart of Bitcoin market value and global currency total. Source: River

As central banks in various countries depreciate currencies through large-scale printing of money, weakening public confidence in fiat currencies, more and more investors turn to anti-inflation assets. Against this background, Bitcoin and gold are continuing to absorb value from the traditional monetary system and occupy a larger market share.

Fed chairman sends out a signal of interest rate cuts, indicating a new round of monetary easing begins

Federal Reserve Chairman Jerome Powell delivered a speech at the Jackson Hall Economic Policy Seminar in Wyoming on Friday, clearly sending signals of an upcoming rate cut and further expansion of money supply. Powell said:

"The current policy interest rate is close to the neutral level of 100 basis points (BPS) compared to a year ago. The stable performance of the labor market, including indicators, including unemployment, gives us greater flexibility in adjusting our policy stance."

Affected by this remark, the price of Bitcoin responded quickly, rising more than 2% on the same day, once hitting a historical high of US$116,000 per coin.

Federal Reserve Chairman Jerome Powell delivered a speech at the Jackson Hall conference. Source: Kansas City Federal Reserve

Historical data show that Bitcoin and other crypto assets usually perform strongly in the liquidity expansion cycle, and their price trends are highly positively correlated with the degree of global monetary easing.

According to the Fed's observation tool of the Chicago Mercantile Exchange (CME), up to 75% of market participants are currently expected to announce a 25 basis point rate cut at the September interest rate meeting.

The above is the detailed content of Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1668

1668

276

276

What is USDH currency? Is it a good investment? Analysis of Hyperliquid native stablecoin

Sep 20, 2025 pm 01:57 PM

What is USDH currency? Is it a good investment? Analysis of Hyperliquid native stablecoin

Sep 20, 2025 pm 01:57 PM

Directory What is USDH What is HyperliquidNetwork Mission Why USDH stands out Why Hyperliquid Why Should Launch Stable Coins How many USDH Tokens USDH Do What USDH and the Technical Team Behind USDCUSDH Important News and Events Is USDH a Good Investment Is USDH a good investment FAQ Conclusion USDH is a native stablecoin for Hyperliquid, aiming to enhance the platform's ecosystem by acquiring reserve income and reducing dependence on external stablecoins such as USDC. USDH by NativeMarkets

Learn more about Standard Chartered Venture Capital Division plans to raise $250 million for cryptocurrency funds

Sep 20, 2025 pm 01:06 PM

Learn more about Standard Chartered Venture Capital Division plans to raise $250 million for cryptocurrency funds

Sep 20, 2025 pm 01:06 PM

SCVentures, a subsidiary of Standard Chartered Bank, announced that it will launch a cryptocurrency investment fund of US$250 million in 2026, aiming to seize investment opportunities in the global digital asset field. According to Bloomberg on Monday, the bank's venture capital arm SCVentures plans to set up an investment fund focusing on digital assets related to financial services. Operations partner Gautam Jain said in an interview that the new fund will mainly attract capital from the Middle East and is expected to be officially launched in 2026. This move conforms to the industry trend of corporate financial companies gradually building long-term asset accumulation strategies, and further enhances the market's expectations for the continued flow of institutional funds into the crypto field. It is not clear which crypto assets the fund will allocate. C

What is FOMC? How does it affect cryptocurrency? Explain the article in detail

Sep 20, 2025 pm 02:06 PM

What is FOMC? How does it affect cryptocurrency? Explain the article in detail

Sep 20, 2025 pm 02:06 PM

Table of Contents What is the Federal Open Market Committee What does the Federal Open Market Committee do? Why is the Federal Open Market Committee important How does the Federal Open Market Committee affect cryptocurrency traders How does the FOMC affect cryptocurrency Fed interest rate changes What is the monetary policy why is the important How does the investor sentiment change FOMC policy impact scenario What happens in hawkish scenarios (more tighter policies, such as raising Fed interest rates) What happens in a dovish scenario (loose policies, such as lowering Fed interest rates) What happens in neutral situations What other key economic indicators are prepared for economic data release monitoring consensus forecast analysis historical response tracking Fed policy FOMC events

BTC is 'digesting future market trends ahead of time': 5 most noteworthy Bitcoin points this week

Sep 20, 2025 pm 01:39 PM

BTC is 'digesting future market trends ahead of time': 5 most noteworthy Bitcoin points this week

Sep 20, 2025 pm 01:39 PM

Table of Contents As traditional financial markets recover, Bitcoin volatility has risen significantly. The Fed's interest rate cut expectation has become the focus of the market. The peak of Bitcoin bull market may be "only a few weeks left". Binance has seen a large-scale buy signal. ETFs continue to absorb newly mined BTC. Bitcoin (BTC) investors are closely following market trends as crypto assets enter the Fed's key interest rate decision window. At the beginning of this week, bulls need to break through the important resistance level of $117,000 to continue their uptrend. Global attention is focused on Wednesday's Federal Reserve meeting, and it is generally predicted that it will usher in the first rate cut in 2025. A past accurate BTC price model shows that all-time highs may be born in the next few weeks. Binance Order Book reveals signs of large buying influx over the weekend. Last week, the amount of BTC purchased by institutions through ETFs reached miners

What factors really determine the read and write speed of mechanical hard disks?

Sep 20, 2025 am 08:18 AM

What factors really determine the read and write speed of mechanical hard disks?

Sep 20, 2025 am 08:18 AM

The read and write speed of mechanical hard disks is determined by the speed, data density, cache size, interface type and seek time. High speed shortens latency, high density improves linear speed, large cache optimizes random read and write, while fragmentation and background programs slow down the actual experience.

What is Velora (VLR) currency? How is Velora project overview, introduction to token economy and future development

Sep 20, 2025 pm 01:48 PM

What is Velora (VLR) currency? How is Velora project overview, introduction to token economy and future development

Sep 20, 2025 pm 01:48 PM

Catalog Velora (VLR) Latest News What Velora Is Velora How Velora Function Governance From ParaSwap to Velora: Next Generation Cross-chain DeFi Protocol Team and Founder Investors and Partners What VLR Tokens Use Field VLR Token Economic Economy and Function Features Velora Roadmap Velora is a multi-chain DeFi protocol created by the ParaSwap team, committed to providing users with an efficient, fast and user goals-centric trading experience. Its newly built Delta infrastructure is capable of resisting MEV (maximum extractable value) attacks, supports zero gas transactions, and implements advanced price execution mechanisms.

New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction

Sep 20, 2025 pm 02:00 PM

New user trading guide: OKX C2C launches new and friendly merchants to easily complete the first transaction

Sep 20, 2025 pm 02:00 PM

1. OKXC2C launched the "novice-friendly" merchant mechanism and successfully completed its first transaction. Facing the huge potential of the crypto market with a scale of nearly US$4 trillion, many new users are eager to try it, but often encounter setbacks when making the first C2C transaction. It is common for merchants to frequently reject or directly cancel orders after placing an order. The smooth buying process that was originally expected has become tortuous. This "order card" phenomenon not only consumes patience, but also makes many people choose to give up before they actually enter the market. To solve this pain point, OKXC2C officially launched the "novice-friendly" merchant mechanism, committed to providing a one-stop solution for first-time transaction users to ensure that the first order is no longer "stuck". The core advantages of this mechanism are first reflected in the high transaction rate. The platform strictly screens high-quality merchants and

The folder or file has been opened in another program

Sep 20, 2025 am 08:24 AM

The folder or file has been opened in another program

Sep 20, 2025 am 08:24 AM

When the file is occupied, first check and close the relevant programs and try to restart the computer; if it is invalid, use task manager, resource monitor or ProcessExplorer to locate the occupied process, and forcefully terminate it by ending the task or taskkill command; for prevention, you need to develop good operating habits, avoid previewing or directly operating on mobile/network drives, and keep software updated.