Ethereum revenue dropped by 75%, debate on bull market ecological transformation

In the past two days, the hottest debate in the crypto-twitter circle is the fierce confrontation around Ethereum's revenue situation.

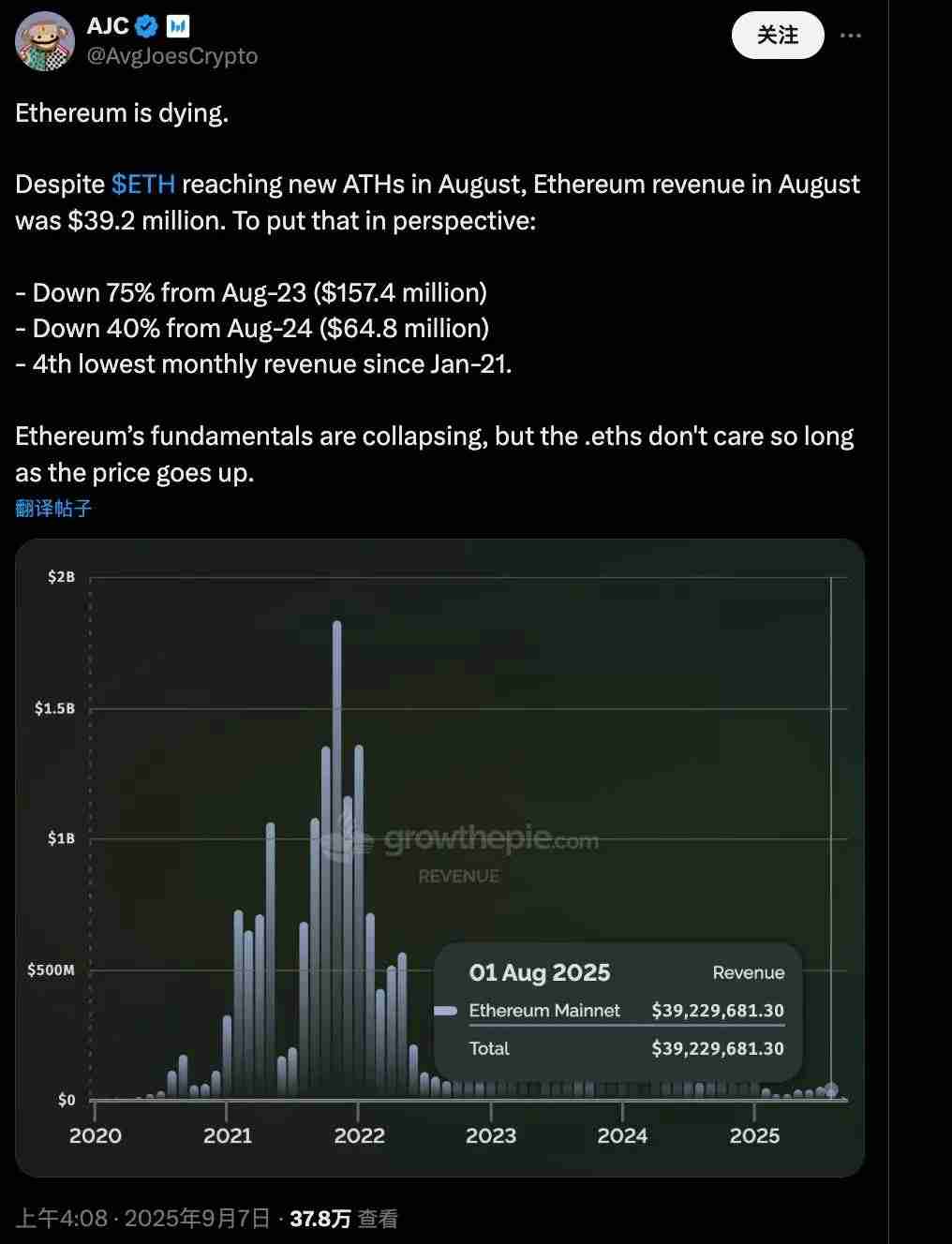

On September 7, AJC, head of corporate research at Messari, released a tweet that caused an uproar, bluntly saying that Ethereum is sliding to the brink of "death". He pointed out that although ETH prices hit a temporary high in August, the network's total revenue for the month was only $39.2 million.

This figure plummeted 75% from US$157.4 million in the same period in 2023, and fell 40% from US$64.8 million in August 2024. At the same time, this is also the fourth time since January 2021 that Ethereum has recorded its lowest monthly revenue at its all-time low.

AJC lamented that the market only focuses on the soaring ETH price, but ignores the health of the underlying network. The tweet has received nearly 380,000 views and about 300 comments within two days of its release, quickly igniting community sentiment.

Why is the discussion of Ethereum fundamentals so sensitive at this time?

The timing is intriguing. ETH is currently in a bull market boom, and prices are constantly breaking records, but its ecological structure and positioning are quietly reconstructing.

Since the upgrade of Dencun in 2024, L2 such as Base and Arbitrum have developed rapidly, and a large number of transactions have migrated from the main network, resulting in a sharp drop in main chain Gas fees and revenue has also shifted to the second-layer network; at the same time, with the rise of the concept of "coin stocks", institutions such as SBET and BMNR have increased their holdings in ETH, and Wall Street is using ETH as a financial leverage tool.

Today, Ethereum seems to have become a banner of selfless dedication - guiding the direction for the entire crypto ecosystem and promoting innovation, but its own profits are becoming increasingly thin?

Revenue declines are already a fact, but does this mean a recession in the Ethereum ecosystem? Community opinions are polarized.

Pro: Income is lifeblood, the alarm bell has sounded

The core view of AJC and its supporters is clear: income is a key indicator for measuring the health of L1 public chains.

Specifically, on-chain revenue mainly comes from transaction fees and block space consumption, which directly reflects users' real needs for the network.

As the world's largest smart contract platform, Ethereum's core competitiveness lies in its "block space demand" - it can efficiently execute smart contracts and decentralized applications, which is a key narrative that distinguishes it from Bitcoin's "store of value".

But now revenue is approaching zero, indicating that the demand for mainnet use shrinks. Even if L2 blooms in full bloom, AJC believes that lacking sufficient end-user support will still make the entire ecosystem hollow.

Some people may ask: Why is revenue related to Ethereum fundamentals?

The logic of the original post is that ETH revenue is collected and partially destroyed in the form of native tokens, thereby strengthening the deflation mechanism. Once income collapses, destruction decreases, inflationary pressure rises, and long-term value foundations will be shaken.

More importantly, in the last bull market, the community was proud of its high on-chain income, emphasizing the "block space premium", proving that the market demand is strong. The reversal today is by no means accidental, but a signal that real demand is ebbing.

Although the view is pessimistic, there are also neutral voices pointing out that the Internet is the asset itself. Prices can be pulled up from speculation in the short term, but if they leave the basic market, they will eventually return to reality - several infrastructure projects have previously verified this rule.

From a bystander perspective, AJC's income theory does reveal the hidden dangers behind the ETH bull market. However, if other indicators such as on-chain activity are ignored, this judgment may be slightly one-sided.

The opposition is fully engaged in fire: Is it a good thing to lose income?

After AJC published the article, the comment section instantly evolved into a battlefield, and opponents fought back, refusing to accept the "recession theory".

Unlike the traditional "E Guard", these opponents examine Ethereum from a higher dimension, the core rebuttal is:

To regard Ethereum as a technology company that pursues profit maximization is itself a cognitive misalignment. Ethereum is more like a crypto-native currency, a commodity with inelastic supply, or an emerging digital economy.

Under this framework, the decline in revenue is not a crisis, but a manifestation of success—because it promotes larger user adoption and ecological expansion.

For example, Bankless co-founder David Hoffman compared Ethereum to early Singapore or Shenzhen, an open special zone that encourages business freedom. When evaluating such economies, we should not only look at the tax amount, but also pay attention to the overall economic vitality and infrastructure development they drive.

Vivek Raman, a former Wall Street trader and founder of Etherealize, asked back: Bitcoin has almost no income, and no one said it has declined. Why does Ethereum have to use income to measure success or failure?

Their theoretical roots can be traced to Vitalik Buterin's original intention: Ethereum is a "digital commodity" with fixed supply, and its valuation is based on supply and demand dynamics, rather than quarterly financial reports. Excessive income (gas fees) will actually produce anti-network effects and scare away users.

Therefore, in their view, the decline in mainnet revenue is actually a positive signal.

After the Dencun upgrade in 2024, L2 took over the main network load, resulting in a shrinking main chain revenue. But this lowers the threshold for use and allows more ordinary users to participate in DeFi, NFT and even institutional-level applications.

Some commentators pointed out that Tom Dunleavy, head of risk at Varys Capital, bluntly said: "L1 revenue is a stumbling block to ecological expansion."

Trader Ryan Berckmans even came up with data: 60% of the stablecoin market value is still anchored to Ethereum, the US Treasury Secretary publicly stated that he attached importance to it, and all active indicators on the chain continue to improve - how can this be said to be a "recession"?

The next crossroads of Ethereum

Although this debate is very lively, it actually touches on a fundamental question: How should we price Ethereum?

Judging from the comments, opponents generally believe that Ethereum is transforming from the "execution layer" to the "global settlement layer". If you apply the logic of technology stocks and only value it based on revenue, it would be too rigid.

According to the tech stock thinking, income is crucial. If revenue declines are indeed due to weak demand, there is a risk of bubble bursting in the current bull market.

The widespread rebuttal of the community represents a multi-dimensional valuation narrative: emphasizing ecological health and strategic transformation, believing that income is not the core, and the real value comes from the strength of consensus and the dependence of the entire crypto world on Ethereum.

The debate may come to an end, but the story of Ethereum continues.

From a technology platform to a global economic system, there is inevitable pain in the process: revenue reduction, L2 diversion share...

But this transformation may be the only way to maturity.

Just as the Internet has entered the era of free broadband from the era of dial-up charging, operators' single-user revenue has declined, but the overall digital economy has achieved explosive growth.

Today's Ethereum is at a similar turning point: the decline in main network revenue may make room for a larger ecological prosperity. The rise of L2 is not to "cannibalize" Ethereum's value, but to amplify its strategic position as the underlying settlement layer.

More importantly, this debate itself demonstrates the uniqueness of Ethereum - no one will argue over Bitcoin's "revenue decline" because its positioning has long been clear.

The reason why Ethereum has sparked heated discussion is precisely because it carries a more complex and grand vision.

If Ethereum is healthy, everyone will benefit. Who can assert that the turning point of the next bull market will not begin?

This article about the debate on the sharp drop in Ethereum revenue by 75%, and the bull market ecological transformation is introduced here. For more related content about the sharp drop in Ethereum revenue by 75%, please search for previous articles of this site or continue to browse the related articles below. I hope everyone will support this site in the future!

The above is the detailed content of Ethereum revenue dropped by 75%, debate on bull market ecological transformation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Win10 Blue Screen: Kernel

Sep 25, 2025 am 10:48 AM

Win10 Blue Screen: Kernel

Sep 25, 2025 am 10:48 AM

Everyone knows that there are many types of blue screen phenomena in Windows 10. When blue screen occurs, many people often don’t know how to deal with it. Since most of the code displayed on the blue screen is obscure and difficult to understand, many users are confused and difficult to solve the problem on their own. Today, let’s talk about how to effectively deal with Kernel_Security_check_Failure blue screen code. This blue screen code usually indicates that there are problems with the driver, and the most common errors are network cards and graphics drivers. The reasons for the KERNEL-SECURITY-CHECK-FAILURE blue screen may be as follows: There are compatibility issues with network card drivers. The graphics card driver version does not match or is damaged. In response to this situation,

How to adjust the reading direction of the comic reading app? Free switching tutorial for page turn mode of the comic reading app

Sep 26, 2025 am 11:27 AM

How to adjust the reading direction of the comic reading app? Free switching tutorial for page turn mode of the comic reading app

Sep 26, 2025 am 11:27 AM

Answer: Most comics apps support switching reading directions and modes according to comic types. Tencent Anime, Kuaikan Comics, etc. can choose from left to right, from right to left or scroll mode in the reading settings, which can be adapted to different needs of Japanese cartoons, Chinese cartoons, etc. It is recommended to match the page turn method according to the content type, and use gesture prompts, double page modes, etc. to improve the experience.

How to deal with network connection errors of 360 Speed Browser_360 Speed Browser common network error code solutions

Sep 26, 2025 pm 12:30 PM

How to deal with network connection errors of 360 Speed Browser_360 Speed Browser common network error code solutions

Sep 26, 2025 pm 12:30 PM

1. Use the "browser doctor" built in 360 Speed Browser to fix network problems with one click; 2. Clear cache and cookies to resolve loading exceptions; 3. Switch to compatibility mode to avoid rendering conflicts; 4. Repair LSP components through 360 Security Guard; 5. Change the DNS to 101.226.4.6 and 8.8.8.8 to improve the resolution success rate; 6. Check whether the firewall or antivirus software prevents the browser from being connected to the Internet, and add a whitelist if necessary.

Microsoft sends errors to users again Windows 10 update

Sep 26, 2025 pm 01:06 PM

Microsoft sends errors to users again Windows 10 update

Sep 26, 2025 pm 01:06 PM

Microsoft once again embarrassed users because it pushed the wrong Win10 update again. Last month, Microsoft launched an update that was originally designed to improve the quality of Windows Autopilot configuration devices. However, this update deviates from its original intention, not only covering devices through Autopilot, a device setting tool in a business environment, but also unexpectedly pushed to all Windows 10 users, including Windows 10 home version users. --Win10 Professional vs. Windows 10 Home -- Windows 10X leak shows it not only works on dual-screen devices -- check out the best Windows tablet history we picked seems to be repeating, Microsoft commits the same again

How to uninstall 360 Speed Browser cleanly_360 Speed Browser thoroughly uninstall and residual cleaning guide

Sep 26, 2025 pm 12:42 PM

How to uninstall 360 Speed Browser cleanly_360 Speed Browser thoroughly uninstall and residual cleaning guide

Sep 26, 2025 pm 12:42 PM

First, uninstall the main program through the system settings, and then use 360's own uninstall tool to clean the residue; then manually delete %AppData%, %LocalAppData% and related folders in the installation directory; then enter the registry editor for backup and clear the 360-related items in HKEY_CURRENT_USER and HKEY_LOCAL_MACHINE; then use third-party tools such as GeekUninstaller to deeply scan the residue; finally repeat the above steps in safe mode to ensure complete clearance.

How to modify the background image when logging in in win10?

Sep 26, 2025 pm 01:18 PM

How to modify the background image when logging in in win10?

Sep 26, 2025 pm 01:18 PM

The specific steps for replacing the background image of the login interface in win10 system are as follows: Replacing the background image of the login interface requires certain adjustments to the system files. It can be divided into the following two steps: The first step: Generate a file named Windows.UI.Logon.pri. The specific steps for generating the file are: Download the PowerShell tool and decompress the file after downloading. After decompression, you will get a file named Login.ps1 and save it to your desktop. Prepare a picture you want to use as the background of the login interface and place it on the desktop, such as name gezila.jpg. Right-click the Login.ps1 file you just saved on the desktop and select "Edit". This will open PowerShel

How to check whether the password is leaked by Chrome browser_Introduction to the password security check function of Chrome browser

Sep 26, 2025 pm 12:51 PM

How to check whether the password is leaked by Chrome browser_Introduction to the password security check function of Chrome browser

Sep 26, 2025 pm 12:51 PM

Chrome provides built-in security checking, which automatically compares saved passwords with known leaked databases. Users can perform security checks through the "Security" option in the settings. If a leaked password is found, a red warning will be displayed and they can be directly redirected to the password-changing page. Additionally, when viewing a specific account manually in the Password Manager, a risky password will mark an exclamation mark. In order to achieve continuous protection, it is recommended to enable "Password Breach Notification". When a new leak occurs, the system will actively push an alarm to remind users to modify their passwords in time and enable two-factor verification to ensure the security of their account.

Ten years of hard work to make domestic systems run smoothly Windows applications

Sep 26, 2025 pm 01:24 PM

Ten years of hard work to make domestic systems run smoothly Windows applications

Sep 26, 2025 pm 01:24 PM

In the previous article "After going around, I began to study Windows systems again", it analyzed that Microsoft has been deeply engaged in Windows for many years and has long built a solid moat that cannot be broken. Even under the tide of domestic substitution, we still cannot do without Windows applications. In order to make Windows applications run on domestic systems, there are many solutions, and the most common solution is Wine. What is WineWine is an open source project that re-implements some of the features of Microsoft's Windows operating system on top of various Unix variants. Wine is mainly aimed at Linux and macOS, but can also run on FreeBSD, NetBSD, and So