Home > Article > Technology peripherals > AI craze helps Nvidia's revenue double, analysts' concerns about overvaluation gradually dissipate

Every time Nvidia releases a new quarterly financial report, investors' concerns about its overvaluation will be alleviated - because each time its guidance for the next quarterly performance will far exceed analysts' expectations

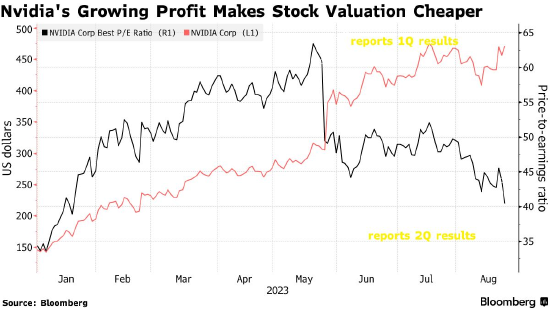

This time is no exception. In the early hours of this morning, after giving jaw-dropping guidance for the next fiscal quarter, Nvidia's expected price-to-earnings ratio has fallen to about 40 times, down from 63 times in May. A low P/E ratio means that the stock price is undervalued and has greater room for growth.

People have been skeptical about Nvidia's ability to reach its valuation levels, but now it looks like the chances of doing so are quite good, according to Michael Kirkbride, a portfolio manager at Evercore Wealth Management. Nvidia's stock price isn't very high considering its current extraordinary growth rate

For nearly a year, bulls have been betting on Nvidia's stock price To defend the high valuation, they believe that Nvidia's actual profits are higher than current expectations, so the stock price is not high. Now, Nvidia's strong performance has confirmed this view. When it comes to growth, no other technology giant is expected to match Nvidia. Of course, Nvidia's stock price is not low either. Its price-to-earnings ratio is still higher than that of companies like Apple, Microsoft and Meta. Currently, the Nasdaq 100 is trading at about 24 times forward earnings. After a blowout in May, Nvidia has become the first-ever semiconductor company to reach a $1 trillion market capitalization. Since then, investors have been looking for evidence that its growth momentum will remain strong in the fiscal second quarter.

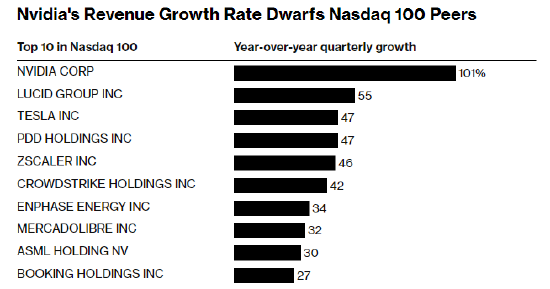

Nvidia’s revenue for this fiscal quarter was US$13.51 billion, an increase of 88% from the previous fiscal quarter and an increase of 101% from the same period last year.

Even Tesla’s revenue growth in the second quarter was less than half of Nvidia’s, and in stark contrast to Nvidia, Tesla’s profits are expected to decline this year.

In addition, the current artificial intelligence boom has just begun. Analysts generally believe that Nvidia can continue to maintain its growth momentum and reach its valuation level.

Today, Nvidia also announced it would buy back an additional $25 billion in stock, giving bulls another reason to cheer.

Quincy Krosby, chief global strategist at LPL Financial, said: "This makes Nvidia different from other startups. It is a mature company, and in this period of industry development, that needs to be noted."

The above is the detailed content of AI craze helps Nvidia's revenue double, analysts' concerns about overvaluation gradually dissipate. For more information, please follow other related articles on the PHP Chinese website!