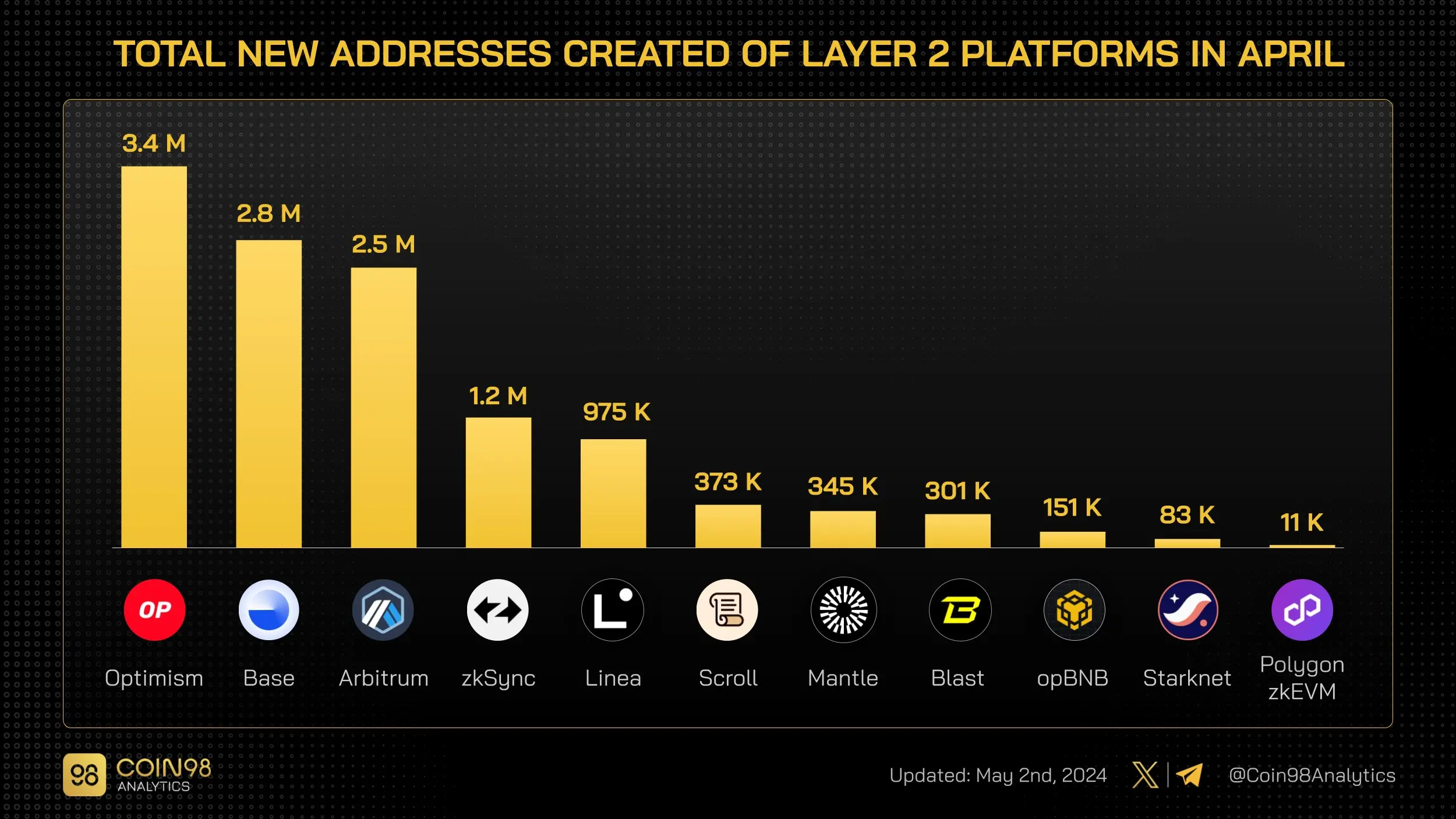

The ranking of the number of addresses on the chain in April is as follows:

Optimism has reached an all-time high in the number of daily new addresses on certain days - more than 450,000 new addresses per day.

Meanwhile, Arbitrum and Base also experienced significant growth later in the month.

The highest monthly growth rate of all header L2s in April was Blast, with a monthly growth rate of 42% .

Optimism continues to maintain its dominance, with the largest number of newly created addresses this month at 3.4 million.

Followed by Base (2.8 million new addresses) and Arbitrum (2.5 million new addresses).

At the beginning of this month, Linea once set a surprising daily number. The number of transactions - which reached more than 4.6 million transactions on April 1, has gradually declined since then.

The highest monthly growth rate of transactions in L2 in April is Blast, which is as high as 112% .

In April, opBNB’s total number of transactions hit a record, reaching nearly 146 million transactions.

The top three popular projects this month: opBNB, Base, Arbitrum.

Among them, this month’s chain There is a significant change in the capital flow situation - Blast and Base alternately occupy the second place, and in terms of TVL, they are both behind Arbitrum.

Arbitrum's TVL decreased by more than $371 million, while Base's monthly revenue increased by 24% to over 2.84 One hundred million U.S. dollars.

In addition, the TVL of Mode and Linea has been doubled.

Throughout April, Arbitrum maintained its lead among L2 solutions with the highest daily cross-chain deposits, averaging over $10.5 billion per day.

The total net inflow/outflow of the L2 platform in April is shown in the figure below. The largest inflow is zkSync (2.65 billion), and the largest outflow was Optimism (USD 579 million).

Top three with the highest TVL on Arbitrum Segmented industries: lending, DEX and derivatives.

Starting in mid-April, a new area of Restaking emerged, with TVL approaching $90 million by the end of the month.

At the same time, the head protocols of each subdivision category in the Arbitrum ecosystem are as follows:

Blast’s TVL has changed significantly, mainly affected by the lending sector. In addition, other sectors within the Blast ecosystem have not yet experienced significant fluctuations.

The head protocols for each segment in the Blast ecosystem are as follows:

In the Base ecosystem, the DEX field has attracted the most capital inflows:

In April, Base’s DEX field TVL increased by more than $233 million, driving the overall TVL growth of the Base ecosystem.

Base ecosystem are as follows:

The TVL of the Optimism project in April decreased by more than $143 million, which is broken down as follows:

The head protocols for each segment in the Optimism ecosystem are as follows:

In early April, Linea with its daily output of more than 2 million new NFTs issuance volume leads other L2 solutions.

However, this number dropped significantly soon after, with Base leading the way with an average of more than 454,000 new NFTs issued per day.

Base is far ahead, with a total of 14 million new NFTs minted.

Percent change in total new NFT volume compared to last month:

The most significant growth in L2 is reflected in Base: 2.8 million new addresses were created, a total of 83 million transactions were conducted, and TPS reached an all-time high (36.99) on April 8. , TVL increased by $284 million (attributable to increased inflows from the DEX space).

Other noteworthy L2 platforms in April include:

The above is the detailed content of 18 pictures, an overview of Ethereum L2's 'minimalist data report” in April. For more information, please follow other related articles on the PHP Chinese website!