According to news on the morning of May 2, Beijing time, eBay today released its first quarter financial report for fiscal year 2024: net revenue was US$2.556 billion, a year-on-year increase of 2%, excluding the impact of exchange rate changes, a year-on-year increase of 2%; from Net profit from continuing operations was US$439 million, a year-on-year decrease of 23%. Not in accordance with U.S. GAAP, eBay's net profit from continuing operations in the first quarter was US$648 million, a year-on-year increase of 8%.

eBay's first-quarter revenue and diluted earnings per share both exceeded Wall Street analysts' previous expectations, and its outlook for second-quarter revenue also exceeded expectations. However, its stock price still fell more than 3%. As analysts, we can see that investors have certain concerns about eBay's future growth.

eBay’s net performance in the fiscal quarter ended March 31 Profit was US$439 million, compared with net profit of US$569 million in the same period last year, a year-on-year decrease of 23%; diluted earnings per share was US$0.85, compared with US$1.05 in the same period last year, a year-on-year decrease of 19%. Despite the decline in earnings, eBay continued to operate its business and worked hard to reduce diluted earnings per share.

eBay's first quarter net profit from continuing operations was US$648 million, an increase of 8% compared with US$600 million in the same period last year; diluted earnings per share from continuing operations was 1.25 USD, up 13% from USD 1.11 in the same period last year, a performance that exceeded analysts’ expectations. According to data provided by Yahoo Finance Channel, 23 analysts had previously expected eBay's adjusted earnings per share to reach $1.12 in the first quarter.

eBay’s first quarter net revenue was US$2.556 billion, an increase of 2% compared with US$2.510 billion in the same period last year. Excluding the impact of exchange rate changes, it was also an increase of 2%. This performance also exceeded analysts' previous expectations. According to data provided by Yahoo Finance, 23 analysts had previously expected eBay's first-quarter revenue to reach $2.36 billion on average.

eBay’s total merchandise volume (GMV) in the first quarter was US$18.623 billion, an increase of 1% compared with US$18.410 billion in the same period last year. Excluding the impact of exchange rate changes, it was flat year-on-year. By region, eBay's total U.S. merchandise transaction volume in the first quarter was US$8.974 billion, which was basically the same as US$9.010 billion in the same period last year; total international merchandise transaction volume was US$9.649 billion, an increase compared with US$9.400 billion in the same period last year. 3%.

In the first quarter, eBay had 132 million active buyers, down 1% from 133 million in the same period last year. Excluding the GittiGidiyor and TCGplayer platforms, eBay has 131 million active buyers, which is the same as the 131 million people in the same period last year.

eBay’s first quarter net revenue was $700 million, which was flat compared with $700 million in the same period last year. eBay's first-quarter gross profit (calculated as net revenue minus net revenue costs) was $1.856 billion, an increase from $1.810 billion in the same period last year.

eBay’s total first-quarter operating expenses were $1.225 billion, down from $1.252 billion in the same period last year. Among them, sales and marketing expenses were US$541 million, an increase from US$511 million in the same period last year; product development expenses were US$351 million, basically the same as US$352 million in the same period last year; general and administrative expenses were US$238 billion, down from $297 million in the same period last year. Provision for trading losses was $91 million, up from $84 million in the same period last year; amortization expense for acquired intangible assets was $4 million, down from $8 million in the same period last year.

eBay’s first-quarter operating profit was $631 million, up from $558 million in the same period last year. Excluding certain one-time items (non-GAAP), eBay's first-quarter adjusted operating profit was $774 million, up from $744 million in the same period last year.

eBay’s first-quarter operating margin was 24.7%, up from 22.2% in the same period last year. Excluding certain one-time items (non-GAAP), eBay's adjusted operating margin in the first quarter was 30.3%, up from 29.6% in the same period last year.

eBay’s effective tax rate from continuing operations was 18.1% in the first quarter, down from 22.1% in the same period last year. Excluding certain one-time items (non-GAAP), eBay's adjusted effective tax rate from continuing operations in the first quarter was 16.5%, which was unchanged from 16.5% in the same period last year.

eBay’s first-quarter operating cash flow from continuing operating activities was $615 million, down from $841 million in the same period last year. eBay's first-quarter free cash flow was $472 million, down from $709 million in the same period last year.

During the first quarter, eBay repurchased a total of approximately 10 million shares of its common stock for a total repurchase value of approximately $499 million. As of March 31, 2024, eBay's remaining approved repurchase shares were worth approximately $2.9 billion. Separately, eBay paid out a cash dividend worth $139 million during the first quarter.

As of March 31, 2024, eBay held $4.9 billion in cash and cash equivalents and non-equity investments.

eBay’s Board of Directors announced that it has approved a cash dividend of $0.27 per share of common stock, which will be payable on June 14, 2024 to shareholders of record as of May 31.

eBay expects the company’s net revenue in the second quarter of fiscal 2024 to be between US$2.49 billion and US$2.54 billion, excluding The impact of changes in foreign exchange rates fell by 1% year-on-year to an increase of 1% year-on-year, with an average value of US$2.515 billion. This performance outlook exceeded analyst expectations. According to data provided by Yahoo Finance Channel, 22 analysts had expected eBay's second-quarter revenue to reach $2.39 billion.

In terms of profit outlook, eBay expects that in the second quarter of fiscal year 2024, in accordance with U.S. GAAP, diluted earnings per share from continuing operations is expected to be between US$0.76 and US$0.81; not in accordance with US GAAP US GAAP diluted earnings per share from continuing operations is expected to be between US$1.10 and US$1.15, with an average of US$1.125, exceeding analysts' expectations. According to data provided by Yahoo Finance, 22 analysts had expected eBay to earn $1.07 per share in the second quarter.

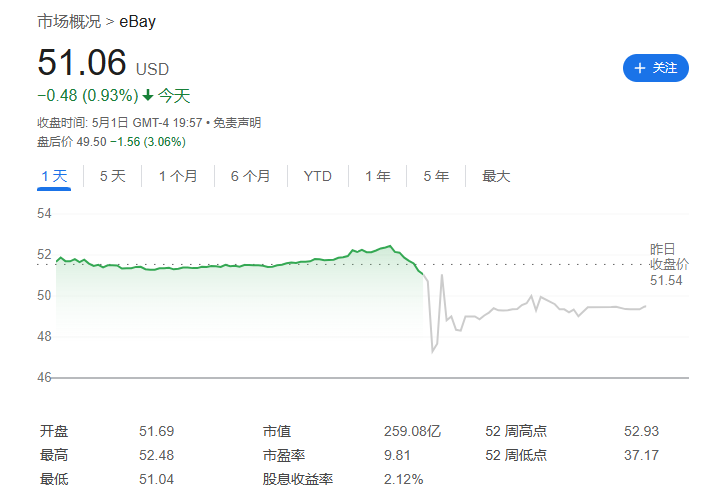

On the same day, eBay's stock price fell by $0.48 in regular trading on Nasdaq, closing at $51.06, a decrease of 0.93%. In subsequent after-hours trading as of 6:08 pm Eastern Time on the 1st (6:08 am Beijing time on the 2nd), eBay's stock price fell again by $1.54 to $49.52, a decrease of 3.02%. Over the past 52 weeks, eBay's highest price was $52.93 and its lowest price was $37.17.

The above is the detailed content of eBay's first-quarter revenue increased 2% year-on-year to US$2.556 billion, while net profit fell 23% year-on-year to US$439 million.. For more information, please follow other related articles on the PHP Chinese website!

Build your own git server

Build your own git server

The difference between git and svn

The difference between git and svn

git undo submitted commit

git undo submitted commit

How to undo git commit error

How to undo git commit error

How to compare the file contents of two versions in git

How to compare the file contents of two versions in git

Sublime input Chinese method

Sublime input Chinese method

How to clear the WPS cloud document space when it is full?

How to clear the WPS cloud document space when it is full?

Mysql import sql file error report solution

Mysql import sql file error report solution