web3.0

web3.0

The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States

The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States

The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States

This site (120bTC.coM): 6 Bitcoin and Ethereum spot ETFs (Boshi International, China Asset Management, Harvest International) approved by the Hong Kong Securities Regulatory Commission yesterday (30) It was officially listed on the Hong Kong Stock Exchange on the same day, but it immediately encountered currency price headwinds. Early this morning, BTC once fell to 59,177 US dollars, and is still trying to stabilize at the 60,000 mark.

The trading volume of the six ETFs on the first day was HK$87.58 million.

According to statistics from the Hong Kong Stock Exchange, the total trading volume of the six ETFs on the first day was HK$87.58 million (approximately US$11.2 million). According to the transaction The order of volume is:

China Bitcoin ETF (3042.HK) reached HKD 37.16 million

China Ethereum ETF (3046.HK) Reaching HK$12.66 million

Harvest Bitcoin Spot ETF (3,439.HK) reached HK$17.89 million

Boshi HashKey Bitcoin ETF (3008.HK) HK) The transaction amount was approximately HK$12.44 million

Harvest Ethereum Spot ETF (3179.HK) reached HK$4.95 million

HashKey Ether ETF (3009.HK) reached HK$2.48 million

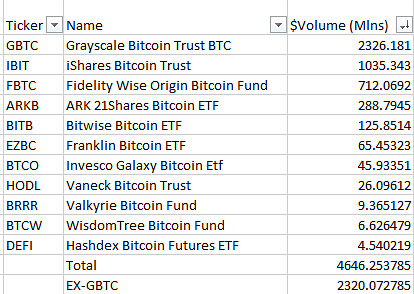

Compared to the total trading volume of the 11 U.S. Bitcoin spot ETFs on the first day of official trading (1/11) exceeding US$4.6 billion , less than 1% of it.

However, at that time, Grayscale’s GBTC trading volume accounted for about half (2.32 billion U.S. dollars, mostly due to profit-taking selling pressure), and BlackRock’s IBIT ranked second with 1 billion U.S. dollars. , Fidelity’s FBTC ranked third with a trading volume of US$710 million.

First-day trading volume of 11 Bitbit spot ETFs in the United States

Now it seems that although Hong Kong’s ETFs can adopt physical delivery, they do not seem to be able to become A very big incentive to buy. On the other hand, investors in mainland China are currently not allowed to invest in Hong Kong’s cryptocurrency spot ETFs. Will there be corresponding regulatory adjustments in the future to bring more incremental funds? Continuous observation is also required.

The current prices of the six ETFs

According to data from the Hong Kong Stock Exchange, the current prices of the six ETFs as of the time of publication are as follows:

Boshi Ethereum ETF ( 3009.HK) is currently quoted at HKD 24.8

Boshi Bitcoin ETF (3008.HK) is currently quoted at HKD 49.58

Harvest Ether ETF ( 3179.HK) is currently quoted at HK$7.7

Harvest Bitcoin ETF (3439.HK) is currently quoted at HK$7.95

China Ethereum ETF( 3046.HK) is currently quoted at HK$7.77

China Bitcoin ETF (3042.HK) is currently quoted at HK$7.95

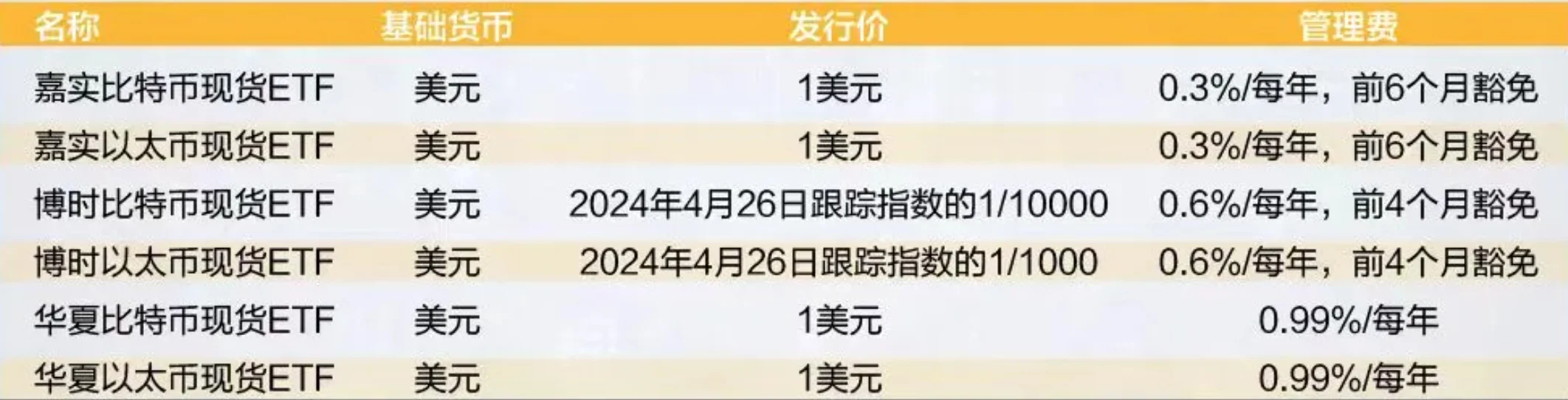

Differences in the issuance mechanism of the six spot ETFs

In terms of management fees:

The annual management fee for Harvest Bitcoin and Ethereum spot ETFs is 0.3 of the net asset value %, exempted for the first 6 months from the listing date

The annual management fee of Boshi Bitcoin and Ethereum spot ETFs is 0.6% of the net asset value, starting from the listing date on April 30 The fees will be temporarily reduced until August 2024

The annual management fee for China Bitcoin and Ethereum spot ETFs is 0.99%

In terms of issuance price :

Harvest International and Huaxia (Hong Kong)’s products are issued at US$1 per share

The initial issuance of Boshi Bitcoin and Ethereum spot ETFs The prices are basically consistent with 1/10000 and 1/1000 of the tracking index on April 26, 2024. That is, the converted net value of fund shares corresponds to the price of approximately 0.0001 Bitcoins and the price of 0.001 Ethereums, which means that holding 10,000 shares is approximately Equivalent to 1 Bitcoin, 1,000 shares are approximately equivalent to 1 Ethereum.

From the perspective of trading units:

Harvest International’s Bitcoin/Ethereum Spot ETF 1 The primary market application is at least 100,000 shares (or multiples thereof), and the minimum trading unit in the secondary market is 100 shares

The primary market application for Boshi Bitcoin Spot ETF is 50,000 shares (or Its multiple), the minimum buying and selling unit in the secondary market is 10 shares, the Ethereum spot ETF is a primary market application is 100,000 shares (or its multiple), the minimum buying and selling unit in the secondary market is also 10 shares.

The above is the detailed content of The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts

Aug 26, 2025 pm 05:15 PM

Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts

Aug 26, 2025 pm 05:15 PM

Against the backdrop of global central banks' continued expansion of balance sheets and the continued dilution of fiat currency purchasing power, Bitcoin's share in the global monetary system has steadily increased. According to the latest data released by Bitcoin financial company River, Bitcoin (BTC) currently accounts for about 1.7% of the global currency. This statistics cover the sum of M2 money supply in major countries, some minor currencies and the market value of gold. "After 16 years of development, Bitcoin has entered the global monetary structure, accounting for 1.7%," River pointed out. The company compared Bitcoin’s market value with a $112.9 trillion fiat pool and a $25.1 trillion hard currency asset, which only contains gold and does not include other precious metals such as silver, platinum and palladium. This ratio is based

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

On-chain and market indicators: The approximation of the risk range determines whether Bitcoin is close to the top. On-chain data and market structure provide the signal closest to actual trading behavior. Many key indicators currently show that the market has entered the "potential risk range". MVRV indicators enter the "mild danger zone". According to Cointelegraph, Santiment's latest data shows that Bitcoin's MVRV (market value to realization value ratio) has reached 21%. This indicator reflects the overall investor profit and loss status. Historical experience shows that when MVRV is in the range of 15%-25%, the market enters a "mild danger zone", which means that a large number of coin holders are already in a profitable state and their motivation to take profits is enhanced. Although it does not constitute an immediate selling signal, the price has been short

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the OKB coin in the directory? What does it have to do with OKX transaction? OKB currency use supply driver: Strategic driver of token economics: XLayer upgrades OKB and BNB strategy comparison risk analysis summary In August 2025, OKX exchange's token OKB ushered in a historic rise. OKB reached a new peak in 2025, up more than 400% in just one week, breaking through $250. But this is not an accidental surge. It reflects the OKX team’s thoughtful shift in token model and long-term strategy. What is OKB coin? What does it have to do with OKX transaction? OKB is OK Blockchain Foundation and

Bitcoin (BTC) $13.8 billion option expiration is imminent, bulls face key test

Aug 29, 2025 pm 04:15 PM

Bitcoin (BTC) $13.8 billion option expiration is imminent, bulls face key test

Aug 29, 2025 pm 04:15 PM

Key points of the catalog: The bullish Bitcoin strategy is weakly defending below $114,000. The Fed's trends and technology stock performance may dominate the future trend of Bitcoin. The Bitcoin option expiration date is approaching, and the technology sector is under pressure may reveal whether the current pullback is a suspension of a bull market or the beginning of a trend reversal. Key points: Bitcoin short side has an advantage below $114,000, and downward pressure may further increase as the option expiration date approaches. Market concerns about capital expenditure in the field of artificial intelligence (AI) have increased, aggravated volatility in the overall financial market and weakened the attractiveness of risky assets. The $13.8 billion Bitcoin (BTC) option will expire in a concentrated manner on August 29. The market is paying close attention to this node to determine whether the previous 9.7% drop is short.

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

Contents What is Lumoz (MOZ token) How Lumoz (MOZ) works 1. Modular Blockchain Layer Background and History of Lumoz Features of MOZ Token Practicality Price of MOZ Token History of MOZ Token Economics Overview Lumoz Price Forecast Lumoz 2025 Price Forecast Lumoz 2026-2031 Price Forecast Lumoz 2031-2036 Price Forecast L2 is widely recognized in expansion solutions. However, L2 does not effectively handle many hardware resources, including data availability, ZKP (zero knowledge proof)

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is bottom-buying? Buying the bottom, as the name suggests, refers to buying when the asset price experiences a sharp decline or approaches a temporary low, and expecting profits to be achieved when the price rebounds in the future. Since the market is often accompanied by panic selling during the decline, you can obtain assets at a lower cost when entering the market. As the saying goes, "Others are afraid of me, I am greedy." Therefore, before implementing the bottom-buying strategy, investors must be clear about their own operating logic and avoid falling into the dilemma of "others lose small losses and I lose huge losses." In English, there are usually two ways to express bottom-fishing: BottomFishing: a formal term, literally translated as "fishing at the bottom of the water", which means buying in an undervalued area. Buythedip: A more colloquial statement, commonly found on social media and news reports, meaning "buy while the price falls." in short

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Fundstrat's TomLee predicts Ethereum bottoming, while BitMine bought another $21 million during the plunge, with a total holding of 1.72 million ETH. Fundstrat Global Advisors managing partner Tom Lee predicted Ethereum to reach a phased bottom on Tuesday amid a sharp decline in the crypto market. Meanwhile, BitMine, the ETH treasury company he founded, took the opportunity to increase its holdings of $21 million worth of Ethereum. "ETH is expected to finish the bottoming process in the next few hours," TomLee posted on the X platform on Tuesday, pointing out that the entire crypto market was in terror due to the liquidation of more than $200 billion in market value.

What is DuckChain (DUCK)? DUCK Price Forecast 2025-2030

Aug 29, 2025 pm 04:24 PM

What is DuckChain (DUCK)? DUCK Price Forecast 2025-2030

Aug 29, 2025 pm 04:24 PM

Directory What is DuckChain(DUCK)? DuckChain's Goals and Vision DUCK Token Economics DUCK Token Release Plan $DUCK Token Usage The factors that affect the price of Duckchain (DUCK) Duckchain (DUCK) 2025-2030 Price Forecast 1. 2025 Price Forecast 2. 2030 Price Forecast Duckchain (DUCK) 2025-2030 Price Forecast Table Conclusion DuckChain (DUCK) is a block