The current token issuance structure promotes a "down but not up" model, in which the price of the token will be severely depressed.

Tokens are issued at high FDV, slowly drained as airdrop recipients sell, and then collapse as VCs are unlocked.

Mike Zajko always describes the worst case scenario of a team’s token trajectory as an ICP chart, if your token price looks like this , you will be in trouble in the long run.

Reflexivity can be a wonderful thing for a protocol, and price increases can help catalyze a true community/developer ecosystem

But the other way around It's also true, and it can be very cruel.

Before I go any further, let’s quickly define something, there are two main metrics for token supply:

Circulating Supply: Tokens in Circulation

Fully diluted supply: Maximum number of tokens

The circulating supply will increase over time until it equals fully diluted Supply

For example, if team tokens are locked at a TGE (Token Generation Event), they will be added to the circulating supply when they begin to vest on month 12. They are always part of the fully diluted supply.

Market capitalization = circulating token supply * price, fully diluted valuation (FDV) = fully diluted supply * price.

Market capitalization is a measure of demand, while FDV is only a measure of supply.

Market capitalization is the total value of public demand. It rises and falls with price changes and is a reliable indicator assuming good liquidity.

FDV increases with market cap as both metrics are based on current market token prices, however, rising market cap does not mean additional demand for these locked tokens.

Holders of locked tokens may actually be happy to sell at a much lower price, so FDV may not be a very accurate measure of the true network value.

There is a saying that FDV (fully diluted valuation) is actually a Meme, because the FDV trading of some tokens is very crazy (for example, Worldcoin’s FDV is 50 billion US dollars)

This Might make sense for retail investors because if you trade frequently in these assets, FDV may not be that important unless you get caught on unlock.

But FDV is absolutely important to VCs because they are the ones holding the locked tokens! Currently, the vast majority of financing agreements from VCs have a one-year lock-in period and then expire within the next 18-36 months.

VCs should value assets at expected FDV in 3-4 years as that is a true reflection of the return they can make to LPs, but sadly that is not how this market works.

Issue tokens at high FDV (fully diluted valuation)

No public token sale

Large-scale airdrop

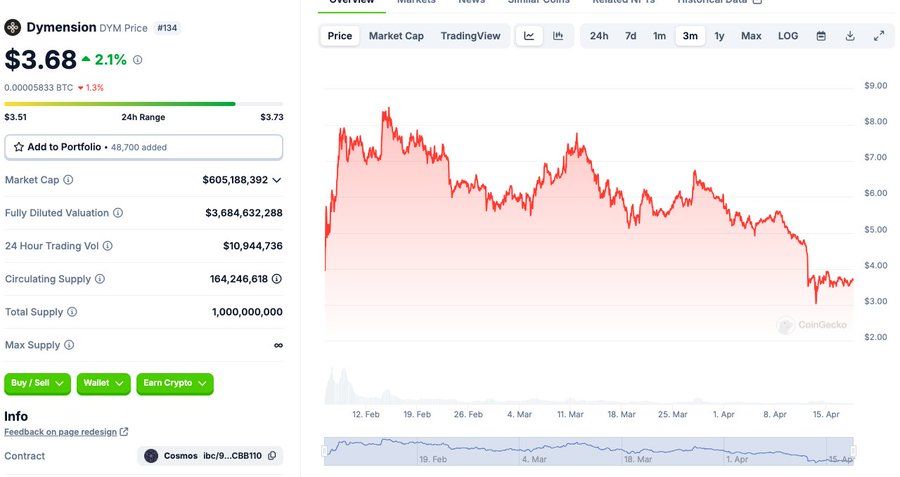

Dymension is an example of this, launching as high as 8 billion US dollars of FDV, 16% of circulation, no public sale, airdrop worth up to 9 figures.

I think once the airdrop paradigm started, this became a way to increase the dollar value of the airdrop without adding more tokens.

And it boosts the self-esteem of the team and the venture capitalists.

Yes, VCs and teams can sell locked tokens, but I'm not sure how big the demand is for locked tokens, so not sure how common this is.

But the above is not always how these projects are started! Most of today’s dominant L1 (first layer blockchain)

was issued with less than $1 billion FDV

The general unlocking method Similar, but typically with shorter vesting period

Retail investors can purchase at a relatively low price (

No Airdrop

Taking NEAR as an example, the circulation volume at the time of release was 20%, but community sales began to unlock immediately, and 50% was circulated within 1 year. The FDV at the time of release was 500-800 million US dollars. .

# About 20% of SOL was in circulation initially, but about 75% was in circulation after a year. Initial FDV ranges from $300 million to $500 million

You can buy $SOL for less than $5 for many, many months.

$LINK is issued for hundreds of millions of FDV, with FDV typically below $1 billion in the first 18 months of trading.

These tokens have strong communities and a solid base of token holders, and their costs are relatively low. What are these legendary crypto communities we always talk about?

IMHO: Community means making money with your netizens. In the cryptocurrency space, there are few strong communities that are not making money.

Thinking back to the ICP chart, do you really think there is a strong ICP community? Absolutely impossible.

The price of a token will only increase if there are more buyers than sellers.

So who are the buyers in today’s market? Definitely not an institutional investor!

Yes, there are some liquidity funds, and there are some crypto VC funds that buy tokens, but there really isn’t much capital flowing into the liquid market

Just put aside ETH/BTC , its absolute maximum annual inflow of funds is only US$10 billion to US$15 billion.

This week alone we have seen three token launches with a total supply of over $5 billion, and there is no chance that there will be enough institutional bids to eat up the supply on the market.

Ultimately, the end buyers of all these tokens are retail investors.

But the problem is that retail investors have extremely limited interest in high-valuation, low-circulation tokens. There are two existing problems:

First, these tokens are expensive. No one thinks buying something with ten-digit FDV is a good deal

Secondly, through these large airdrops, retail investors can get tokens for free! So why do they buy more?

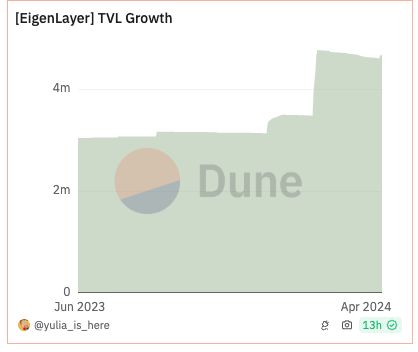

EigenLayer may be issued at a price of more than $10 billion in FDV. I bet that at least most ETH holders with a certain level of knowledge are already farming Eigenlayer

With over 3% of ETH already deposited, an ecosystem of over $5 billion has been formed around the airdrop narrative .

Thinking logically, if you want Eigenlayer’s airdrop, you most likely already own ETH.

If you have ETH, you are probably using it to earn Eigen tokens right now! So a large portion of potential buyers will get tokens for free

Of course, people can go buy more, and there will obviously be some non-zero buying behavior, but I am skeptical that it is a huge market

I personally have a fair amount of ETH on various LRT or Eigen, hoping to get a sizeable airdrop.

If it were 20 billion US dollars in FDV, would I buy more? The answer is obviously no.

So what is the other buyer’s market?

Retail investors want to gain access to Eigenlayer but are unable to purchase tokens for various reasons. Obviously, the number of buyers is not zero, but I don't believe there are a large number of retail investors wanting to buy $EIGEN at $25 billion in FDV.

So, we’ve determined that the buyer’s audience is limited.

Where is the seller?

If your FDV is high enough, VC will obviously sell!

If you have gone from a $100 million seed round to a $20 billion FDV, it makes perfect sense to take money off the table!

Retail investors are aware of this development and are tracking it! Token unlocking is well documented, click here to learn more.

Are airdrop participants selling? I haven't seen a ton of data on the percentage of sales in this airdrop, but there's an obvious psychological concept that you value something you get for free less than something you buy.

Most airdrops are also based on the nominal value of the asset you deposit/stake, so will not represent a large proportion of your portfolio, for example, if you deposit 1 eth in Eigen, you may Earn points worth 0.05-0.01 eth, so it doesn’t mean much to most people who play airdrops.

So that's why we're in a downward-only paradigm, I'm not trying to find fault with these projects. I don't know what they are doing, I think they all have good intentions and Eigen is a novel product.

I think the following three ways are needed to get out of the current model:

Linear Unlock

Public Token Sale

Create cool stuff

6MV did some great research and generally found that smaller unlock events have less impact on price than Large events.

I think the right direction should be to have 20-25% of the tokens in circulation during TGE and adopt a 36-month linear unlocking method.

Additionally, a public token sale should be adopted. Let retail investors buy into your project at scale. Demand for Near's token sales was so great that it crashed the CoinList website twice.

Obviously, there was a huge demand before TGE! Allowing the community to accumulate $5-25K in tokens outside of airdrops will buy even more loyalty.

Finally, it’s all about creating cool stuff. Projects that performed better this cycle tended to be super novel, like Ethena or Jito. Don't know if this applies to the rest of the cycle, but intuitively, it might be so.

Perhaps retail investors are tired of being pushed for the tenth parallel DA (data availability) modular solution.

Venture capitalists can complain that Meme coins are giving them trouble, but if they think the market structure of previous cycles will continue forever, then the problem actually lies with them.

I remain highly bullish and we are deploying aggressively. This is not a macro view of the market.

This is a warning, buying into the current token issuance structure is clearly not going to set you up for long-term success.

I have been bringing these protocols to market for the past decade and have witnessed dozens of times which protocols work and which don’t.

Stop listening to bad advice from VCs, advisors, or anyone else who tries to tell you that buying at the highest FDV is smart.

The above is the detailed content of Breaking the 'down but not up' curse of token issuance: Why is diamond trading not a good choice?. For more information, please follow other related articles on the PHP Chinese website!