Original source: SynFutures

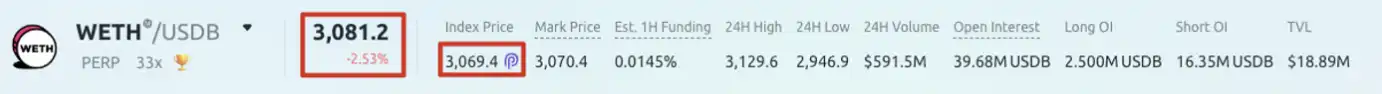

SynFutures is currently the most outstanding decentralized sustainability on Blast Contractual Agreement. The current TVL exceeds $5800w, the total trading volume exceeds $26B, and the daily trading volume is stable at $1B. All indicator data are very good.

Data source: https://info.synfutures.com/

Team won 2 rounds A total of $38m of financing was raised, including well-known institutions such as Pantera, Polychain, and Dragonfly. The protocol has been audited by Quantstamp.

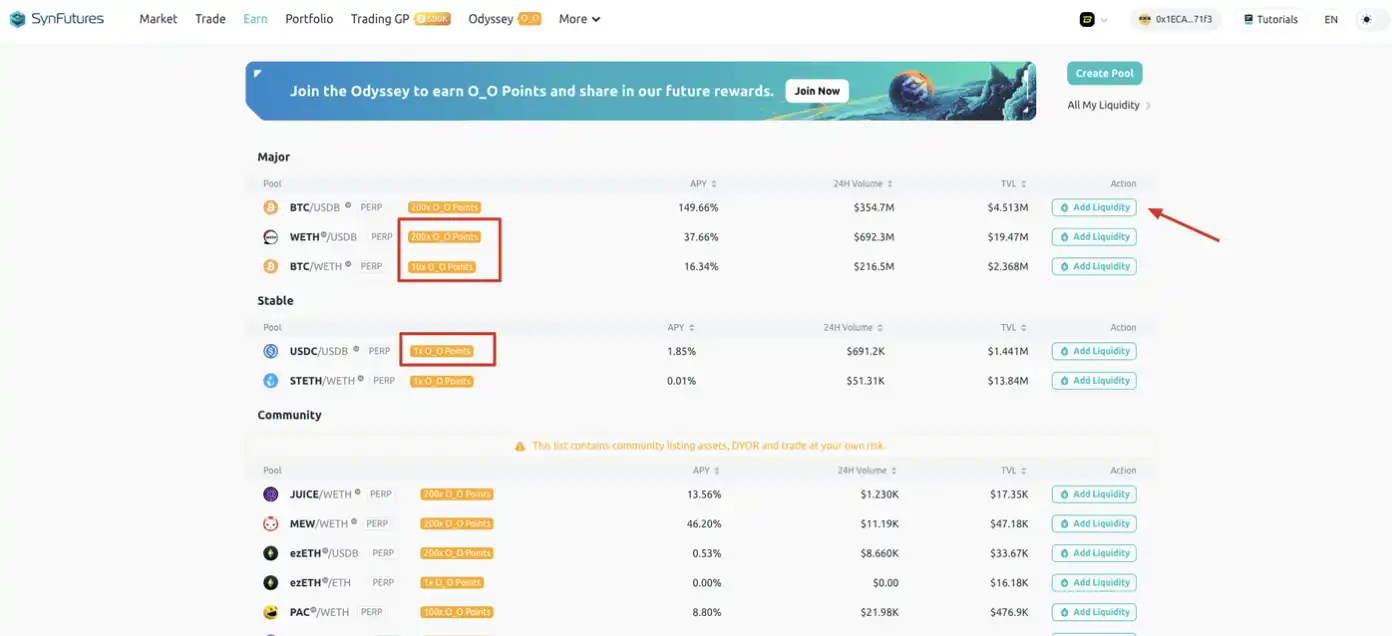

** SynFutures Airdrop Rewards: SynFutures has participated in the Blast Big Bang event and promised to use a certain proportion of tokens for airdrops , is a branded airdrop. **SynFutures has currently launched Epoch 3 activities. You can earn points by inviting friends, adding liquidity, making markets through limit orders, and conducting transactions to receive future airdrop rewards from SynFutures.

Blast Points rewards: ETH and USDB stored in SynFutures can receive Blast Points rewards and share 50% of Blast’s future airdrops. In addition, in projects supported by SynFutures’ Blast Multiplier activities, new users can receive double Blast Points rewards for their interactions.

** Blast Gold Rewards: Earn Blast Gold rewards by trading and providing liquidity in SynFutures, and **share 50% of Blast’s future airdrops.

** Blast native income: **ETH stored on SynFutures can earn **4% annualized rate,** USDB can earn 15% annualized rate.

Judging from my experience in mining Vertex, for this kind of derivatives project that earns points through trading volume, the return in the first phase is 10 times the transaction fee, which is still no problem. **Overall, the return is about Around 4 or 5 times. ** At the beginning, no one paid much attention to Vertex. It was the most interactive at that time. Later, I actually regretted not investing heavily in it.

If the valuation is aligned with $AEVO, then based on the calculation of 3 billion, and an airdrop of 5% to 10%, there will be approximately 150 to 300 million airdrops issued. Coupled with the rewards given by Blast, a conservative estimate of 3-5 times return should not be a big problem.

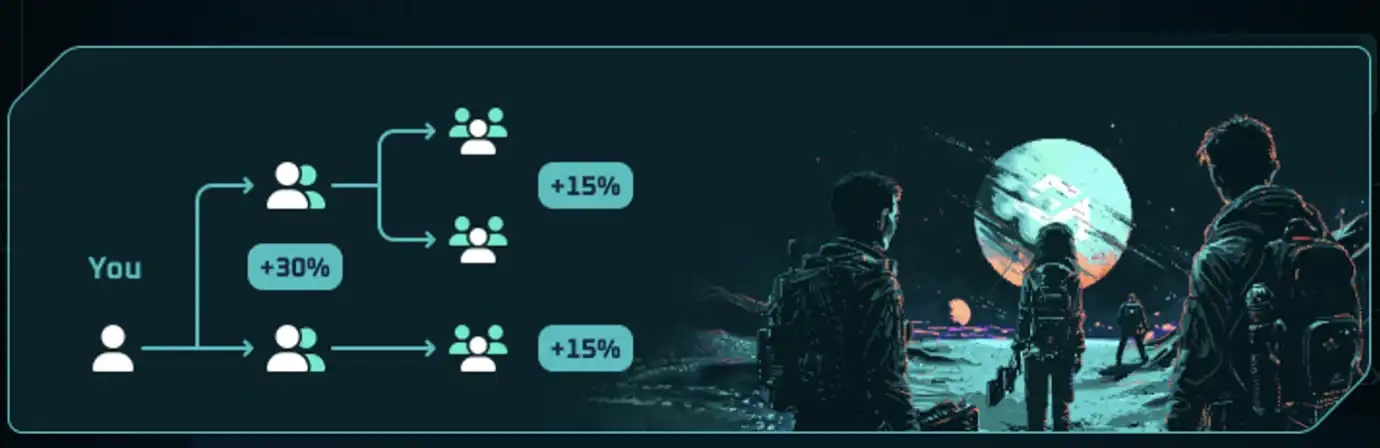

First create 2 alt accounts and establish a binding relationship with each other, so as to ensure that you get the most Points. The first account can use my invitation link and get an additional 30% bonus in the first 7 days.

Link: https://oyster.synfutures.com/#/odyssey/44Q2P

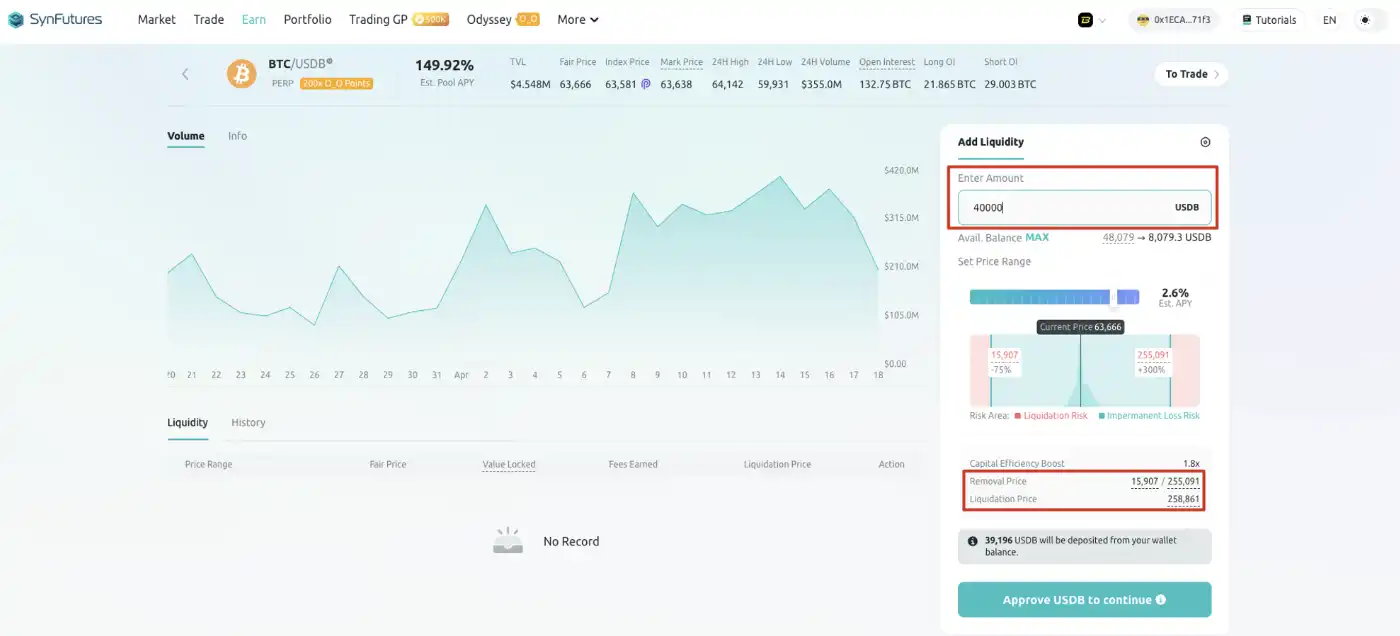

Similar to providing liquidity in UniSwap V3, adding liquidity** in SynFutures also requires selecting a price range. **The narrower the price range, the more handling fees and points you earn, but the corresponding impermanent losses are also higher. What the second red box means is, **If the market price exceeds the price range, your liquidity will be removed and you will be liquidated. **So in order to avoid this situation, we can choose a wider price range to avoid being liquidated. For example, the price range I chose in the picture above is 15,907 ~ 255,091. If you want to exceed this price range, the probability of ** is so small that it can be ignored. **Even in the most extreme situation, where it keeps falling, this price range allows me to calmly remove liquidity and avoid being liquidated.

In addition, by making markets within a wider range, the handling fees earned can more easily cover impermanent losses, and **become profitable,** especially since many users are currently trading frequently in order to earn points. Trading.

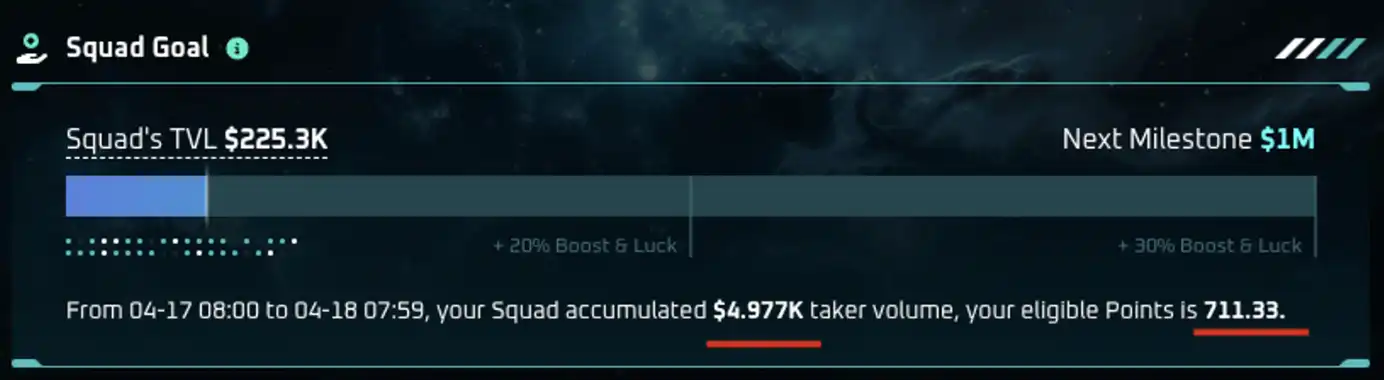

Considering that there is an invitation relationship, we only need to use the account that was last invited to interact with the protocol, so that the other two accounts can also get points. . **Currently, the trading volume is settled every 24 hours and the points reward is calculated. You can see the trading volume and points earned on the previous day on the team.

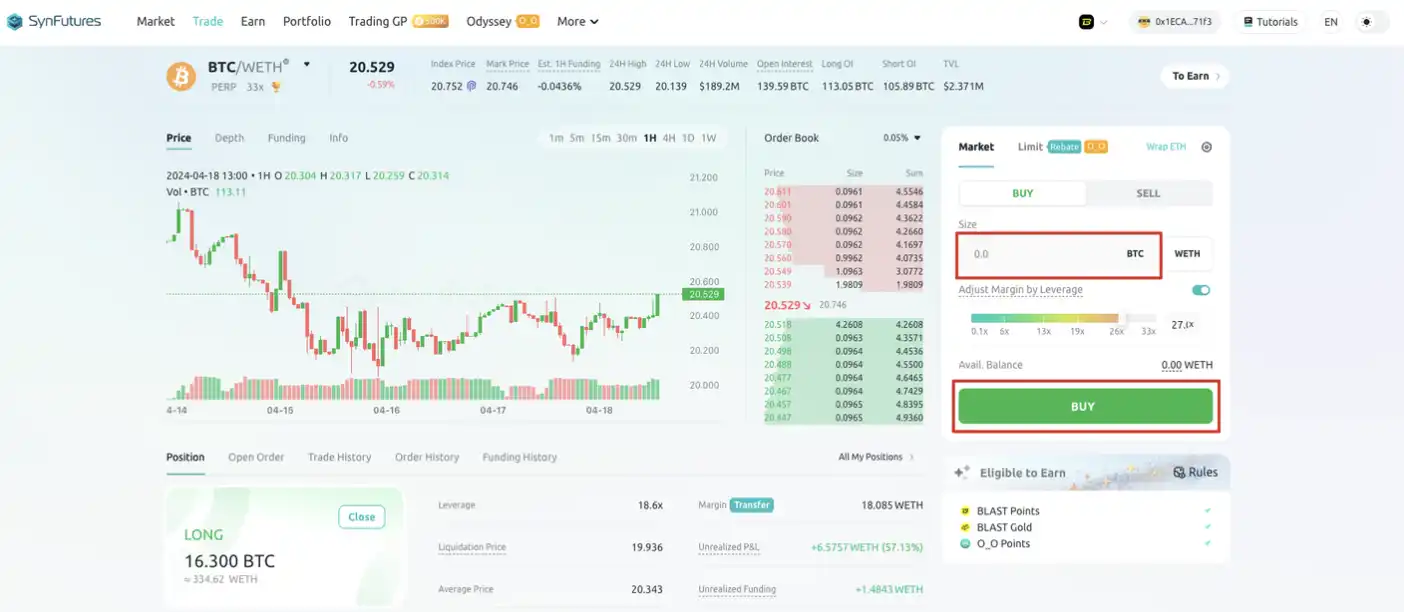

It is relatively simple to earn points through transactions, and the cost is also relatively controllable. Just keep buying and selling market orders. **Before large-amount transactions, you can try it with a small amount and understand it clearly before operating to avoid losses.

If you do it by hand, here is a little trick. I suggest you open two browsers, place a long order in browser A, and then click Buy. This The MetaMask confirmation pop-up window will pop up. **Do not click Confirm at this time. **Then go to another browser to open a short order, and then click Sell. At this time, the MetaMask confirmation pop-up window will also pop up. **Don't click confirm yet. **After both parties are ready, first click the confirmation button on the Buy pop-up window, and then click the confirmation button on the Sell pop-up window. This will ensure that your closing transaction follows your opening transaction and will not be arbitraged by others. The slippage needs to be set larger, otherwise it is easy to fail.

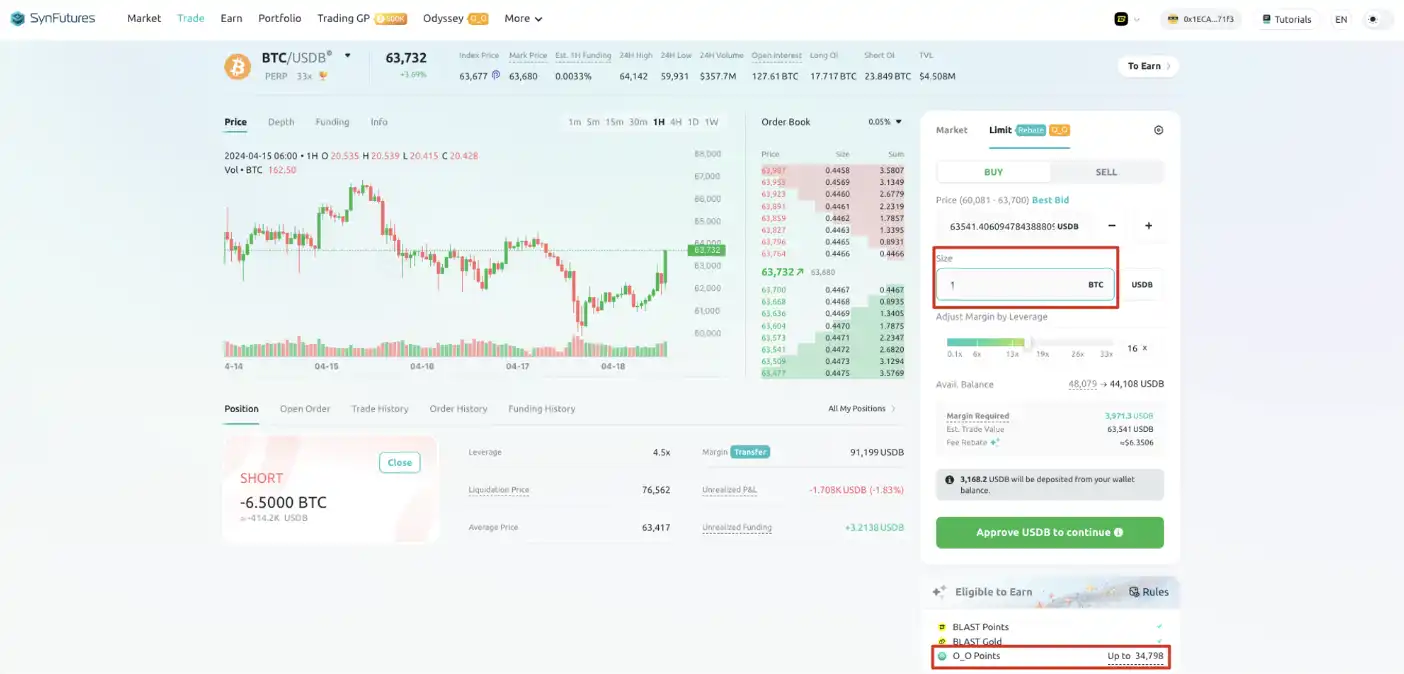

This is the same as the centralized exchange, just enter the price, quantity and confirm the order. The second You can see the maximum number of points you can earn from this limit order in the red box. The larger the order amount, the more points you earn accordingly. Another thing to note is that if the order is eaten within 12 hours, the points earned will be calculated based on 12 hours; if the order is eaten after 12 hours, the points will be calculated based on the actual duration, which will not exceed 7 days. .

Note that there is a 0.01% rebate for limit orders, which is equivalent to $1w of your transaction, and you can still earn $1. In addition, orders placed by oneself can be eaten by market orders placed by oneself. Combined with point 2, a lower-wear point-earning strategy can actually be achieved.

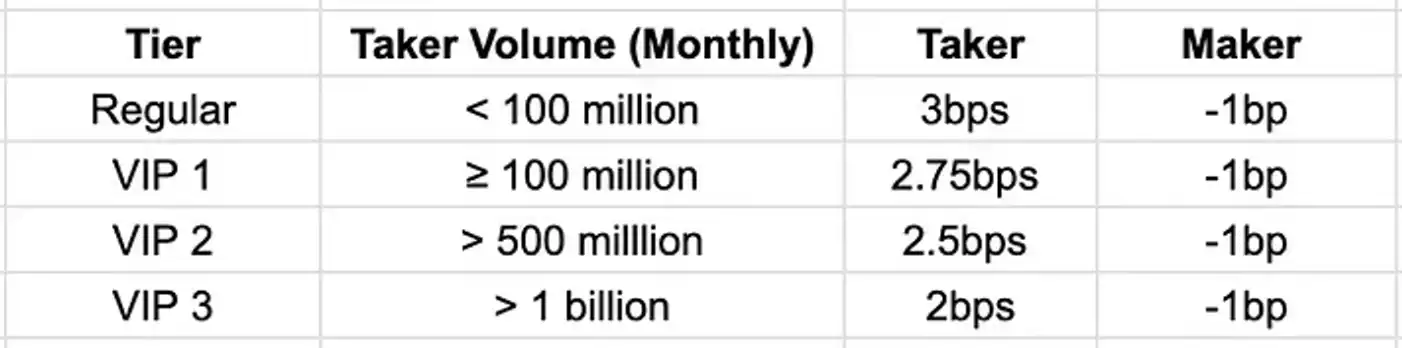

#No need to introduce this. Also combined with point 2, you can continue to reduce costs. The discounted fee will be paid directly to your address next month.

For more detailed information, please see the official article: https://medium.com/synfutures/v3-update-introducing-fee-tiering-and-institutional-tools-3d01462ce92c

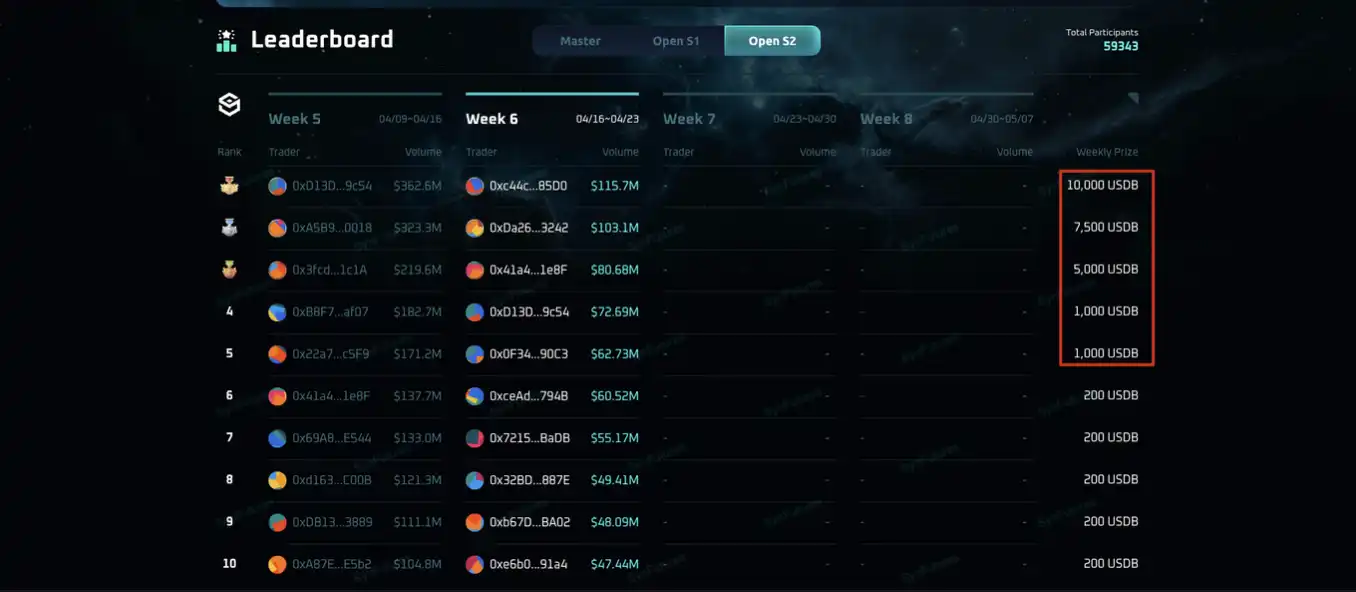

Need here Let me mention that its current trading competition is ranked according to weekly trading volume. The top 3 prizes are $10,000, $7,500 and $5,000 respectively. Strong players can combine this activity to continue to reduce interaction costs.

The official SDK is currently open, see here for details: https://www.npmjs.com/package/ @synfutures/oyster-sdk

If you have the technology and experience, you can use their SDK to implement automated arbitrage and trading, which is easier. In addition, there is often a price difference between its price and that of centralized exchanges. I have experienced a price difference of 3-5 points when it plummeted. Judging from the several market maker addresses I followed, the income is still good, but I can't help but say that I can't do it with Bot.

This should be the most detailed tutorial on the SynFutures airdrop on the entire Internet! ! !

I am personally more interested in projects related to decentralized derivatives, so if I encounter a good and reliable project, some of my transactions will be moved to these projects, and I will get some good gains from time to time. . The SynFutures project is currently undervalued. I think its TVL still has a lot of room for growth. It should be no problem to reach 100-200 million. **When others ignore it, it is an opportunity to take a heavy position. **This is a profound lesson Wormhole taught me.

If this article helps you, please use my invitation link to get 30% Boost: https://oyster.synfutures.com/#/odyssey/44Q2P

The above is the detailed content of SynFutures potential airdrop value analysis and interaction strategy. For more information, please follow other related articles on the PHP Chinese website!