This site (120bTC.coM): The Bitcoin re-pledge project BounceBit announced that the Liquid Custody protocol (Liquid Custody) will be launched together with the main network. This product has great impact on its ecology. What help? How is it different from existing Liquid Staking?

BounceBit Introduction

BounceBit is a re-pledge project built in the Bitcoin ecosystem, with the goal of "allowing BTC to generate organic staking rewards." By creating a new ecological BounceBit Chain, it is expected that network income can be used as the native income of Bitcoin.

Currently, BounceBit is still in the early access stage and only allows users to deposit assets into cooperative CeFi institutions. And just yesterday when the team announced that it would launch the mainnet in the future, it would also cap the liquidity custody service, which is the core fund entrance of the BounceBit ecosystem.

What problem does BounceBit liquidity custody service want to solve

The assets deposited in CeFi lack liquidity

Now when a user When investing in assets, they usually choose among a series of CeFi strategies and products. In this structure, users lose direct control over the assets, whether it is for general investors or third-party fund managers.

Even if users use OTC settlement solutions with on-chain proofs, the ability to transfer and liquidate positions is still subject to many limitations. For example, assets placed in investment institutions cannot have liquidity and more applications. Users are effectively sacrificing any further possibility of leveraging their assets for staking and liquidity to provide profits.

Users need to make a choice between "putting assets into a cold wallet to gain control" and "putting assets into CeFi to gain investment income".

Of course, DeFi is also a feasible solution to this problem, but certain assets (especially Bitcoin) usually cannot have sustainable and considerable returns in the existing DeFi structure, that is BTC’s unique dilemma.

The security of assets deposited in CeFi is not transparent

In addition, since the control of assets invested in CeFi is in the hands of the institution, transactions are usually This comes with higher counterparty risk and the financial products offered by most centralized exchanges come with a certain level of complexity. User funds are lost in the event of a default, as has been seen with FTX and other exchanges in recent years.

The BounceBit team stated that its partners Ceffu, Copper and other over-the-counter settlement (Off-exchange Settlement, OES) solutions can reduce this type of risk, but these institutions are only available to hedging traders and ordinary cryptocurrencies. Unavailable to traders and high barrier to entry.

Based on the above two major issues, BounceBit proposes a new product that combines the individual advantages of Cefi and DeFi—Liquid Custody.

BounceBit Liquidity Custody Introduction

The BounceBit team stated that with the Liquid Custody solution, CeFi assets can be made liquid and the threshold for using the service can be significantly lowered.

Liquid Custody is a variant of Liquidity Staking

The concept of Liquid Custody is named after Liquid Stake, which is Lido on Ethereum The mechanism introduced above provides users with LSD (such as stETH) as pledge liquidity to solve the problem of insufficient liquidity caused by users pledging ETH to the network to maximize the benefits of user assets.

Liquid Custody is similar to liquid pledge, in that it increases the liquidity of assets by casting derivative tokens that are bound to the value of the underlying asset. However, the former does not mortgage the assets to the Ethereum network, but hands the assets to a custodian, and will receive a proof token, which the BounceBit team calls Liquid Custody Tokens (LCT).

Liquidity custody combines the advantages of CeFi and DeFi. Not only can it ensure that assets are held safely by users (guaranteed by smart contracts), but it can also keep assets easily accessible or circulated.

BounceBit implements liquidity custody agreement

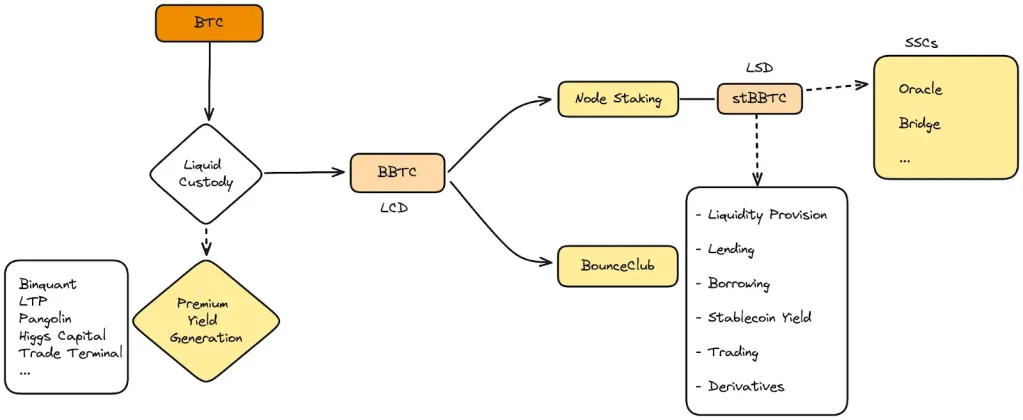

BounceBit currently accepts assets including BTC, USD, ETH and other tokens. When users deposit assets into the BounceBit Liquidity Custody Agreement, they will receive an LCT as proof. The above-mentioned assets will generate BBTC, BBUSD, and BBETH corresponding to the users who place the assets in custody.

These tokens can be cross-chained to BounceBit Chain for further utilization. For example, BBTC can be pledged to the network’s dual-token PoS module and receive stBBTC for staking; or directly participate in the network ecosystem DApp within.

The user’s original assets will be able to obtain custody benefits from CeFi’s products and strategies.

The Liquidity Custody Agreement is the asset entrance to the BounceBit ecosystem

When users need to withdraw funds, they also need to use the same amount of LCD to cancel custody and redeem the assets.

Liquid Custody is expected to support many different blockchains, currently supporting Ethereum and BNB Chain. The early access phase has not yet been launched and is expected to be launched along with the mainline.

BounceBit Liquidity Custody Protocol Opportunities and Challenges

Ecological Opportunities

Liquid Custody is actually the concept of CeDeFi, allowing users The process of depositing into an institution is simpler and liquidity is maintained. As the capital entrance for BounceBit's ecological operations, it is the most important foundation for its development.

If it can indeed solve the asset transparency and security issues of CeFi in the past, coupled with the characteristics of releasing liquidity, it may be able to attract a lot of investors in the context of the Bitcoin ecosystem’s recent pursuit of maximizing asset benefits. look. However, it should be noted that long-term development still needs to test more factors, such as whether the cooperating organizations can operate in the long term.

Potential risks

The liquidity custody agreement implemented by BounceBit this time is essentially to increase the leverage of assets, so if it is stacked layer by layer If there is a problem in one link of the structure, such as a contract error, the user's assets may be damaged.

In addition, if the backend structure of the custodian is not completely controlled by smart contracts, or the control of the contract is still opaque, it will still be of limited help to user asset control and security. Specific details still need to wait for the team to release more information.

Therefore, we should still think rationally to see the long-term development of this product.

The above is the detailed content of Bitcoin re-pledge project BounceBit announced that the Liquid Custody protocol will be launched along with the mainnet. For more information, please follow other related articles on the PHP Chinese website!