Will Bitcoin surge sharply before and after the halving? Can Bitcoin rise to 10 digits after the halving? Just when BTC (Bitcoin) was making an upward move, breaking through the resistance line at the upper edge of the wedge (approximately $70,000), and once occupying the position above 72k, the short sellers suddenly came back and pushed the bulls back into the wedge below $70,000. The bulls' breakout failed. The confidence of short sellers can be summarized in the following points: first, the U.S. tax season is approaching; second, the Fed’s tightening policy; third, ETF inflows are sluggish and outflows are expanding.

The above picture shows the second halving, the third halving and the current This time the halving is a waterfall chart of a three-period retracement. As can be seen from the figure, the 2021 bull market cycle we have just experienced turned out to be a more "painful" cycle than before and after - if we link the magnitude of the retracement to the degree of "pain".

In the last halving cycle, we actually experienced two black swan "plunge" shocks, one was "312" in 2020 (with a retracement of over 60%), and the other was "519" in 2021 ( Retracement exceeds 50%)! How "lucky"!

Retracement is an expression of leverage fragility. When a sell-off causes prices to fall. The price drop causes leveraged positions to be liquidated. Leveraged positions were forced to unwind causing more selling. More selling caused prices to collapse. Such a feedback loop and chain reaction cause a price avalanche.

This halving cycle has been gentle until now. The maximum retracement range does not exceed 25%.

Common leverage multiples on the market include 2x, 3x, 5x, and 10x. To explode them, you need to retrace more than 50%, 33%, 20%, and 10% respectively. A 10% retracement and 10 times leverage should be commonplace. A 20% retracement and a 5x leverage explosion should be done from time to time to reduce the burden. Retracement of 33%, explosion of 3 times leverage, should be seen occasionally, like the sword of Damocles hanging high. It is rare to retrace 50% and explode 2 times the leverage. However, it is encountered twice in one halving cycle in 2020, which is considered "historic".

The phoenix travels on the phoenix platform, and the phoenix leaves the platform and the Kongjiang River flows by itself.

The flowers and plants of Wu Palace are buried in the secluded path, and the clothes of Jin Dynasty become ancient hills.

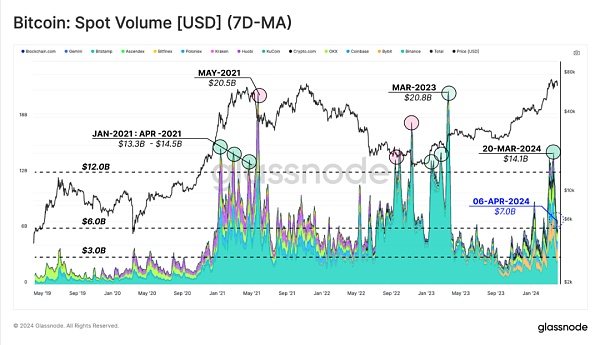

Looking back at the BTC spot volume and price chart since 2019 (below), it goes without saying how many historical hooks there are.

It can be seen at a glance from the volume and price chart that the trading volume at the top of the bull market and the bottom of the bear market will be enlarged, and the trading volume will be reduced during the bull market recession and bear market recovery period.

Price is a leading indicator of trading volume. The price moves first, and the trading volume is slow to catch up.

At the beginning of the bull market, there was an immeasurable rise. When the price rises to the point where most people start to react and rush in to grab a handful, the bull market has basically peaked. So these people who rush in after the fact take over the market from a high position and then hold on.

The reason for the unlimited increase is that the seller was reluctant to sell at a low price and did not release too many chips. The buyer has accumulated enough grain and suddenly actively buys it. Without taking in too much, the price goes up.

Pull up and increase the volume, which will reach the top. It's not because people who are waiting for the wind rush in, but because the coin hoarders who are belatedly start to wake up and take advantage of the high prices to "reduce their positions" and ship a large amount of goods.

When the bull market just ended, it fell immeasurably. By the time the price drops to the point where most people are leaving the market, the bear market will have basically bottomed out. Those who carry it to the end can no longer hold it anymore. The slower they run, the lower they cut, and the more they lose.

The reason for the immeasurable decline is that the buyer has used the excessively high price to exhaust the purchasing power at hand after taking over the market at the top of the bull market. He has run out of ammunition and food and is unable to stop the seller from selling. The seller can drive the price down by just a small amount.

If the market falls and the volume increases, it means it has bottomed out. Because at the lowest price and the biggest loss, most talents finally can't bear it and end up cutting their flesh. And their selling at this time, because the price is too low, has very limited lethality.

From the color layered chart, we can see the rise and fall of each platform.

The largest area of turquoise tells us that station B is obviously the one that will benefit most from the bull and bear journey in 2021-2023. The disappearance of purple is a portrayal of station H’s retreat and decline. A generation’s ups and downs, the past has become empty.

At the end of 2023, as the American iron fist struck hard at the dominant station B, the previously tepid O station, Bb station and the US-compliant station C began to expand the color area. The other waxes and wanes. It’s really you who sings and I come on stage.

The platform is easy to collapse, but BTC will last forever.

The above is the detailed content of Will Bitcoin surge before and after the halving? A simple analysis before and after the Bitcoin halving. For more information, please follow other related articles on the PHP Chinese website!