US judge 'chooses side' SEC in Coinbase lawsuit, will it benefit Base ecology?

Written by: Kaori, BlockBeats

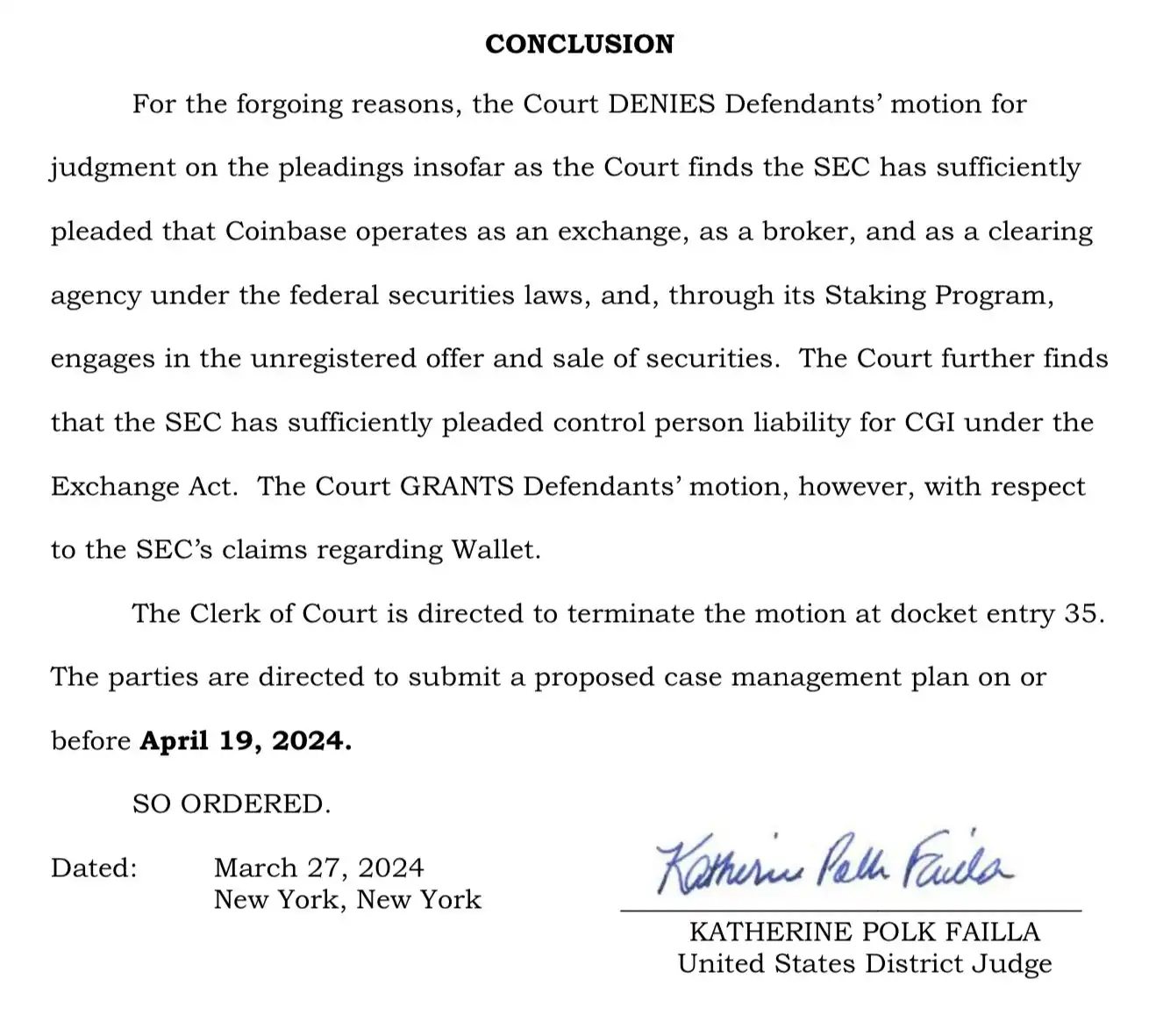

On March 27, the U.S. District Court for the Southern District of New York rejected Coinbase’s motion to dismiss, which was a case filed by the SEC against Coinbase for failing to register as a securities business. This ruling has a significant impact on the cryptocurrency market.

U.S. District Judge Katherine Failla wrote a ruling that the SEC made "reasonable" charges against Coinbase and allowed the SEC to continue to accuse Coinbase of operating as an unregistered trading platform, broker, clearing agency, and It "engaged in the issuance and sale of unregistered securities" through its pledge program and set an April 19 deadline for the parties to agree on a plan to arrange the case.

After the news was announced, Coinbase’s stock price fell by more than 10% as of writing.

Coinbase and SEC "Fight to the End"

In June last year, the SEC filed a lawsuit against Coinbase, accusing it of providing trading and staking services to the public and refuting federal securities laws. At the same time, the SEC also sued Binance, but the lawsuit was settled at the end of last year.

Coinbase filed a response document and a petition seeking to dismiss the case in its lawsuit against the SEC, responding to the regulator’s accusations that it illegally operated an unregistered stock exchange.

Coinbase Chief Legal Officer Paul Grewal has said that the company has completed its review with the SEC in early 2021, which marks Coinbase’s official response to the legal dispute and heralds the beginning of a long legal battle. . While the company has unlisted securities, it has conducted a comprehensive and consistent review with the SEC on the process used to list the tokens.

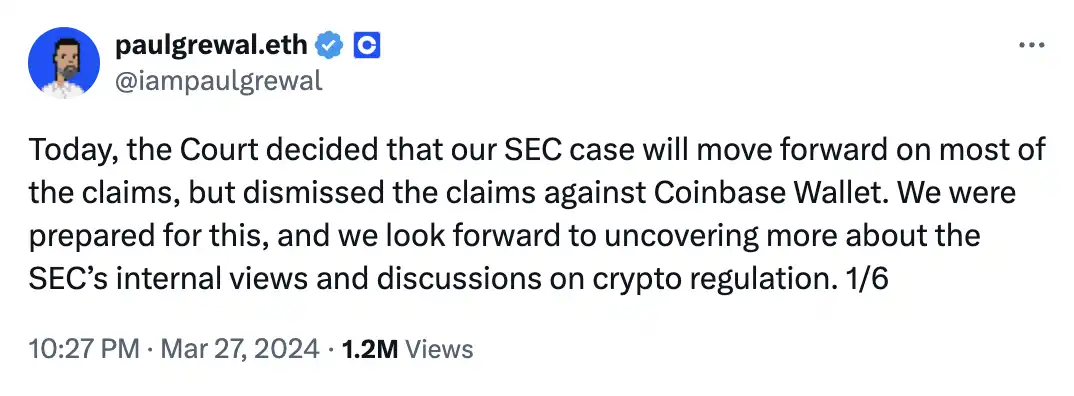

What happened last night is another key development in the battle between Coinbase and the SEC. Paul Grewal spoke yesterday evening, saying, “Today, the court decided that our SEC case will continue to advance most of the claims, but dismissed the claims against Coinbase Wallet. We are prepared for this and look forward to learning more about the SEC’s encryption Internal views and discussions on currency regulation.”

Meanwhile, an SEC spokesperson said, “We are pleased that another court has confirmed that while the term ‘cryptocurrency’ may be relatively Newer, but the framework that courts have used to identify securities for nearly 80 years still applies."

However, this is not entirely negative news for Coinbase or even cryptocurrencies.

In March of this year, during opening arguments submitted by the Third Circuit Court of Appeals, Coinbase asked the appeals court to direct the SEC to begin drafting cryptocurrency rules. Coinbase said the SEC violated the Administrative Procedure Act because it did not conduct a rulemaking and did not elaborate on why it rejected Coinbase’s rulemaking petition.

"The SEC does not have the legal authority to extend the current securities regime to digital assets, but if the SEC insists on moving forward without congressional authorization, the decision must be made and enforced through forward-looking rulemaking" Coinbase express.

Therefore, yesterday’s ruling is conducive to promoting clarity in cryptocurrency rulemaking. Like the Binance case, the judge may side with the SEC on specific cases and impose a fine on Coinbase. However, courts will challenge the lack of regulatory transparency and registration capabilities, pushing the SEC to seek more concrete solutions, which would be a boon for Coinbase.

The result may not be so bad

At the same time, there is another point worthy of attention in yesterday's court ruling, and the market also gave a good response, that is, in the ruling, Judge Failla dismissed SEC claims that Coinbase acted as an unregistered broker through its wallet app.

Coinbase believes that Wallet does not "conduct routing activities", "has no control over users' crypto assets or transactions conducted through Wallet", and that users "are the sole decision-makers for transactions" and Wallet "only provides users with access to the market." Technical infrastructure for arranging transactions on other DEXs." This ruling is a real endorsement of the technology discussed here, and therefore opens up more market possibilities for Base as well as on-chain DeFi.

Coinbase announced the launch of two new wallet solutions – smart wallets and embedded wallets – in late February this year, designed to make it easier for new users to get on-chain and overcome the user experience barriers to creating a crypto wallet. A solution will be added to the Coinbase Wallet SDK, allowing users to create and use wallets without the need for long seed phrases. And one of Base’s goals in its 2024 roadmap is to make smart wallets the default option.

After this ruling came out, the encryption KOL even bluntly stated that "Jesse (the person in charge of the Base protocol) is dancing a happy dance on Base."

On March 27, Max Branzburg, Vice President of Coinbase, posted on social media, “In the future, Coinbase will store more corporate and customer USDC balances on Base. This enables Coinbase to deliver lower fees and faster transactions. Settlement time management and protection of customer funds without impacting the Coinbase user experience. Coinbase is excited to continue moving operations on-chain and hopes other companies will follow Coinbase's lead."

With the entire Base ecosystem TVL As well as Coinbase's strong support for Base, the market is generally optimistic about the outcome of this case, believing that Coinbase will eventually win, and this is a catalyst for Base's narrative.

The above is the detailed content of US judge 'chooses side' SEC in Coinbase lawsuit, will it benefit Base ecology?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

How do ordinary people buy Litecoin? Where to buy it? A comprehensive introduction to 3 simple and practical methods

Aug 14, 2025 pm 01:45 PM

How do ordinary people buy Litecoin? Where to buy it? A comprehensive introduction to 3 simple and practical methods

Aug 14, 2025 pm 01:45 PM

As digital assets gradually enter the public eye, many people have begun to become interested in Litecoin (LTC). This article will introduce you in detail three practical methods for purchasing Litecoin that ordinary people can easily get started, helping you complete your first transaction safely and conveniently.

The world's largest Bitcoin exchange official website of Binance Exchange

Aug 14, 2025 pm 01:48 PM

The world's largest Bitcoin exchange official website of Binance Exchange

Aug 14, 2025 pm 01:48 PM

Binance is the world's largest cryptocurrency exchange. With its huge transaction depth, rich business ecosystem and high liquidity, it provides all-round services such as spot, contracts, financial management and BNB Chain public chains. At the same time, it strives to ensure the security of user assets and promote transparent development through multiple security measures and compliance efforts.

What is Ecocoin (EOS)? EOS Market Analysis and Price Forecast 2025-2030

Aug 14, 2025 pm 12:03 PM

What is Ecocoin (EOS)? EOS Market Analysis and Price Forecast 2025-2030

Aug 14, 2025 pm 12:03 PM

Table of Contents What is EOS? Project Background Project Category 1. Smart Contract Layer-1 Infrastructure 2. Delegated Proof of Stake (DPoS) Ecosystem 3. Web3dApp and Developer Ecosystem Strategies Outlook Market Analysis Price Analysis Price Forecast: EOS2025-203025 Forecast 2026 Forecast 2027 Forecast 2028-2030 Forecast Price Forecast Table Project Overview FAQ Conclusion Since its ambitious launch, EOS.IO is recognized as one of the most technologically advanced blockchain platforms, aiming to solve the scalability faced by traditional networks like Ethereum

What are the channels for issuing virtual currency_Summary of mainstream virtual currency issuing channels in the world

Aug 14, 2025 am 11:54 AM

What are the channels for issuing virtual currency_Summary of mainstream virtual currency issuing channels in the world

Aug 14, 2025 am 11:54 AM

This article systematically sorts out the global mainstream virtual currency issuance model, including seven methods: ICO, IEO, IDO, PoW, PoS, airdrop and STO, and introduces its operating mechanism, characteristics and risks respectively. 1. Initial token issuance (ICO) is a way for the project party to raise funds by publishing a white paper to sell to the public. The threshold is low but the risk is high. 2. The initial exchange issuance (IEO) is reviewed and issued by the exchange to improve security and credibility. 3. The first decentralized exchange issuance (IDO) is conducted on a decentralized platform, emphasizing fair start-up and community participation, with high transparency but at your own risk; 4. Proof of Work (PoW) generates new blocks through computing power competition and rewards tokens to ensure network security and decentralization; 5. Proof of equity

What is the golden ratio in the currency circle? How to use Fibonacci Gold Pocket?

Aug 14, 2025 pm 01:42 PM

What is the golden ratio in the currency circle? How to use Fibonacci Gold Pocket?

Aug 14, 2025 pm 01:42 PM

What is the golden ratio in the catalog? From Fei's to Gold Pocket: How to show the pattern How to use gold pockets in cryptocurrency trading How to use gold pockets Why the gold ratio works in financial marketsFebonacci Gold Pocket Trading Setting Example Combined with gold pockets and other technical indicatorsCommon errors When trading gold pockets: The gold ratio is not only aesthetically valuable, but also actionable Fibonacci Gold Zone FAQ 1. What is the Fibonacci Gold Zone? 2. Why is 0.618 important in cryptocurrency trading? 3. Is the golden ratio effective? 4. How to TradingVie

What is sentiment analysis in cryptocurrency trading?

Aug 14, 2025 am 11:15 AM

What is sentiment analysis in cryptocurrency trading?

Aug 14, 2025 am 11:15 AM

Table of Contents What is sentiment analysis in cryptocurrency trading? Why sentiment analysis is important in cryptocurrency investment Key sources of emotion data a. Social media platform b. News media c. Tools for sentiment analysis and technology Commonly used tools in sentiment analysis: Techniques adopted: Integrate sentiment analysis into trading strategies How traders use it: Strategy example: Assuming BTC trading scenario scenario setting: Emotional signal: Trader interpretation: Decision: Results: Limitations and risks of sentiment analysis Using emotions for smarter cryptocurrency trading Understanding market sentiment is becoming increasingly important in cryptocurrency trading. A recent 2025 study by Hamid

Lido DAO (LDO Coin) Price Forecast: 2025, 2026, 2027-2030

Aug 14, 2025 pm 01:39 PM

Lido DAO (LDO Coin) Price Forecast: 2025, 2026, 2027-2030

Aug 14, 2025 pm 01:39 PM

What is the directory Lido? Redefine the operating mechanism and technical architecture of staking experience of Lido LDO tokens: economic model and market statement Modern coin allocation and functions Latest market data Lido's competitive barriers and development risks core advantages Potential challenges LidoDAO (LDO) price forecast LidoDAO (LDO) price forecast: Bollinger band and EMA alignment LidoDAO (LDO) price forecast: Super Trend and SMC prospect LidoDAO (LDO) price forecast from 2025 to 2030 LidoDAO (LDO) price forecast from 2026 LidoDAO

What is the Overlay Protocol (OVL currency) that Binance will launch? OVL token economy and airdrop collection

Aug 14, 2025 am 11:18 AM

What is the Overlay Protocol (OVL currency) that Binance will launch? OVL token economy and airdrop collection

Aug 14, 2025 am 11:18 AM

Table of Contents What is OverlayProtocol What is OVLOverlayProtocol (OVL) Airdrop OverlayProtocol Pros and Disadvantages OverlayProtocol is a liquidity layer designed specifically for illiquid assets, aiming to solve the liquidity problems that are common in traditional trading methods. Its native token $OVL will be launched on Binance Alpha on August 14, attracting widespread attention from the market. This article will deeply analyze the core mechanism and potential value of OverlayProtocol and its token OVL. What is OverlayProtocolOverlayProtocol builds an inventories