Blast is undoubtedly the most popular unreleased coin L2 at present. More than 3,000 projects have signed up to participate in the Big Bang event, which is unprecedentedly popular.

On March 22, Blast distributed the first gold points to mainnet dApps, with a total of 10 million. Among them, Bigbang award-winning projects received a total of 4 million additional gold points, and mainnet dApps received a total of 6 million. . This is the first phase of distribution. Calculated as once every 2-3 weeks, it is estimated that there will be a total of 5 distributions, and the total gold points are estimated to be 40 million.

Calculated based on Blast’s current off-site valuation of US$5 billion, assuming that the total amount of Blast’s final airdrop is 20%, which is US$1 billion. According to Blast’s rules, 10% of it will be given to Blast Points, and 10% will be given to Blast Points. Given Blast Gold:

Then we can roughly estimate: 1 Blast Gold is about 12U.

In order to obtain gold points, you must actively participate in dApp. Currently, many people's funds on the blockchain are underutilized, so players participating in dApps may receive significant additional benefits.

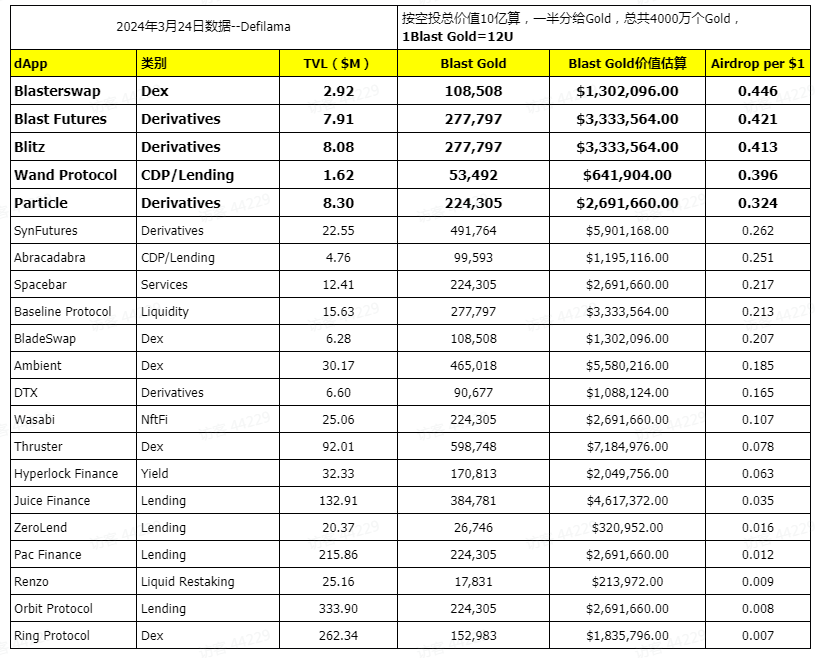

However, we also noticed that there is not a completely linear relationship between the gold points obtained by the project party and TVL. The project with the highest TVL received 200,000 points, while some projects with lower TVL but excellent performance also received tens of thousands or even 100,000 points.

Therefore, for projects that require financial support, the best strategy for obtaining gold points is to choose to participate in projects with higher gold allocations but that have not yet attracted large-scale capital inflows.

We compare the TVL and Blast Gold amounts obtained from these projects on Defilama, and we can estimate a cost-effective ranking.

This table is mainly for Defi projects. Simply use TVL as a rough basis for judgment. The top-ranked project in the above table can be divided into 0.4U if you deposit 1U. , very cost-effective.

The top five projects include three derivatives trading platforms, 1 Dex, and a CDP Lending protocol. This article will give a brief introduction to these five projects to help you choose a suitable gold points high-yield project to participate in.

First introduce the three derivatives trading platforms, Blast Futures, Blitz and Particle. Derivatives trading platforms have become the most competitive track besides Dex in this bull market. The transaction frequency of derivatives trading platforms is higher than that of Dex. An excellent project can contribute a huge number of users and transactions to the public chain platform, so public chain platforms often pay more attention to such projects.

Currently, the TVLs of these three derivatives trading platforms are quite close, all at around $8M, initiating fierce competition for Long Er’s position.

Particle

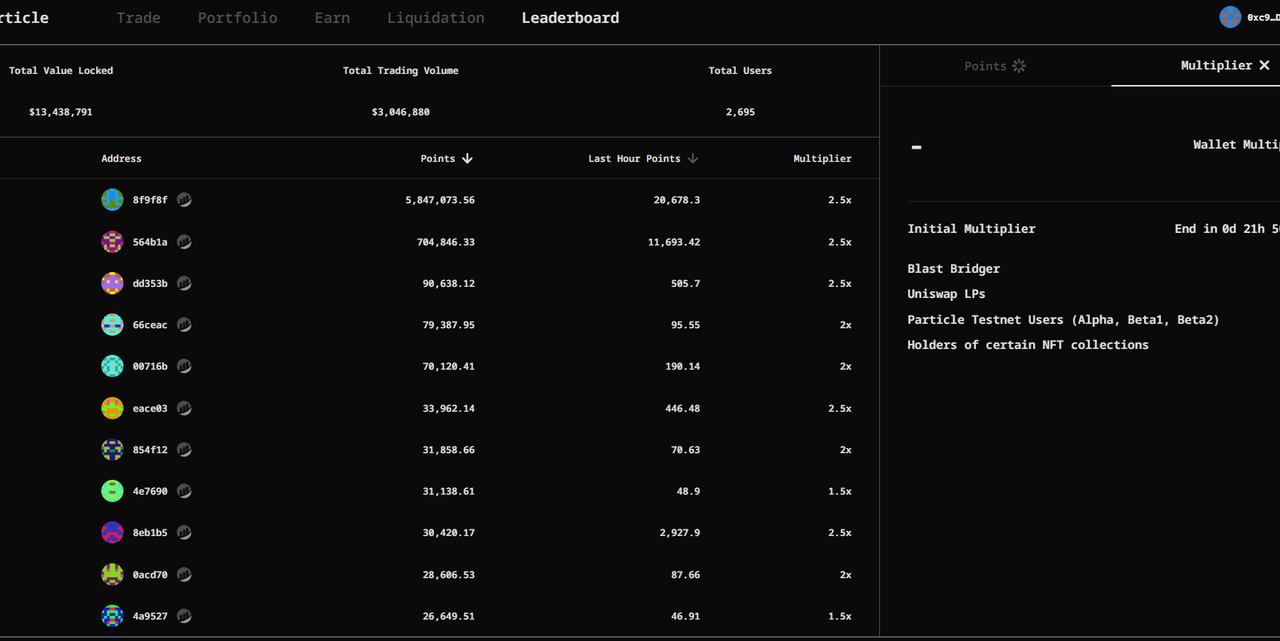

The TVL queried on Defilama is $8.3M, Particle’s official TVL data is $13M, the trading volume is $3M, and the ratio of trading volume to TVL is 0.23.

Particle currently has 8 trading pairs that can be used for spot trading and long and short leveraged trading. The depth of each trading pair and the size of the long and short orders determine the maximum multiple of leverage.

Paticle received 224,305 gold points in the first phase. According to the official announcement, these gold points will be distributed to users based on Paticle Points. The specific distribution details have not yet been announced, but the total Generally speaking, the higher the Particle Points obtained, the more gold points can be allocated.

Paticle’s Leaderboard page can check their own points. Users can obtain them through TVL contribution and transaction volume contribution. There is also a bonus coefficient, up to 2.5x. Blast cross-chain users, Particle testnet users, Uniswap users and some NFT holders can obtain bonus coefficients.

In terms of contract security, Particle provides a contract audit report: https://code4rena.com/reports/2023-12-particle, which has been running normally since its launch.

You need to pay attention when participating in the project. Whether it is the contribution of trading to liquidity or trading volume, there may be a certain amount of wear and tear. It is recommended to participate in deep trading pairs, such as USDB-WETH Trade pairs to minimize wear and tear.

Blitz

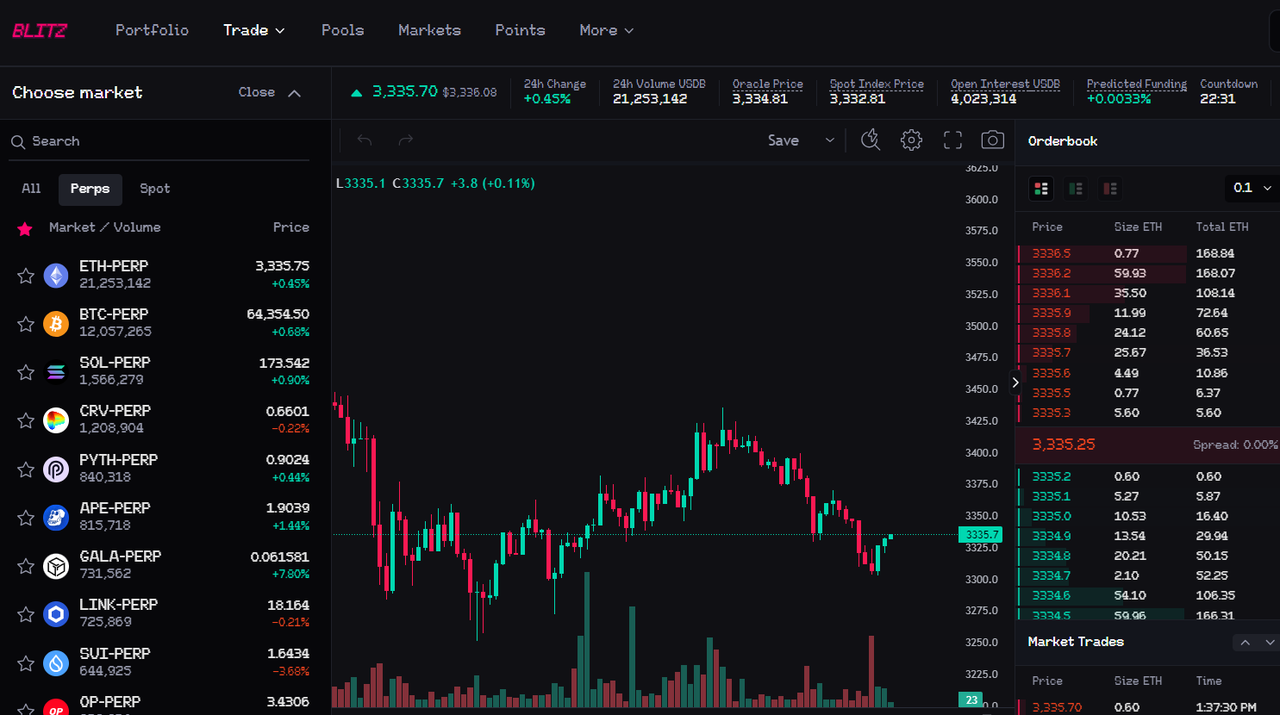

Blitz provides a large number of derivatives transactions, with more than 40 Token derivatives transactions, covering mainstream blue-chip projects, and can meet the more diverse needs of users. According to the query on Defilama, Blitz’s TVL is $8.08M, its 24-hour trading volume is $48M, and the ratio of trading volume to TVL is 5.94. From the data, Blitz has a high capital utilization rate and active trading.

Blitz uses the order book form of a centralized exchange. Users need to recharge to the Blitz platform before trading. Each derivative has a different leverage factor, which can be up to 20 times.

Blitz received 277,792 gold points in the first phase. Blitz needs to deposit at least 5USDB or 0.003WETH to enter the points system and obtain its own invitation link.

According to the prompts on the webpage, the current points display is not online, and the specific rules have not been announced yet, but it can be guessed that if you want to get Blitz points, It should and needs to contribute to liquidity and trading volume. In addition, Blitz’s activities on Galxe are still ongoing, and Blitz Community Points can be obtained through activities. For specific rules, please refer to the official instructions: https://docs.blitz.exchange/points-and-protocol-rewards/blitz-community- points

Blast Futures

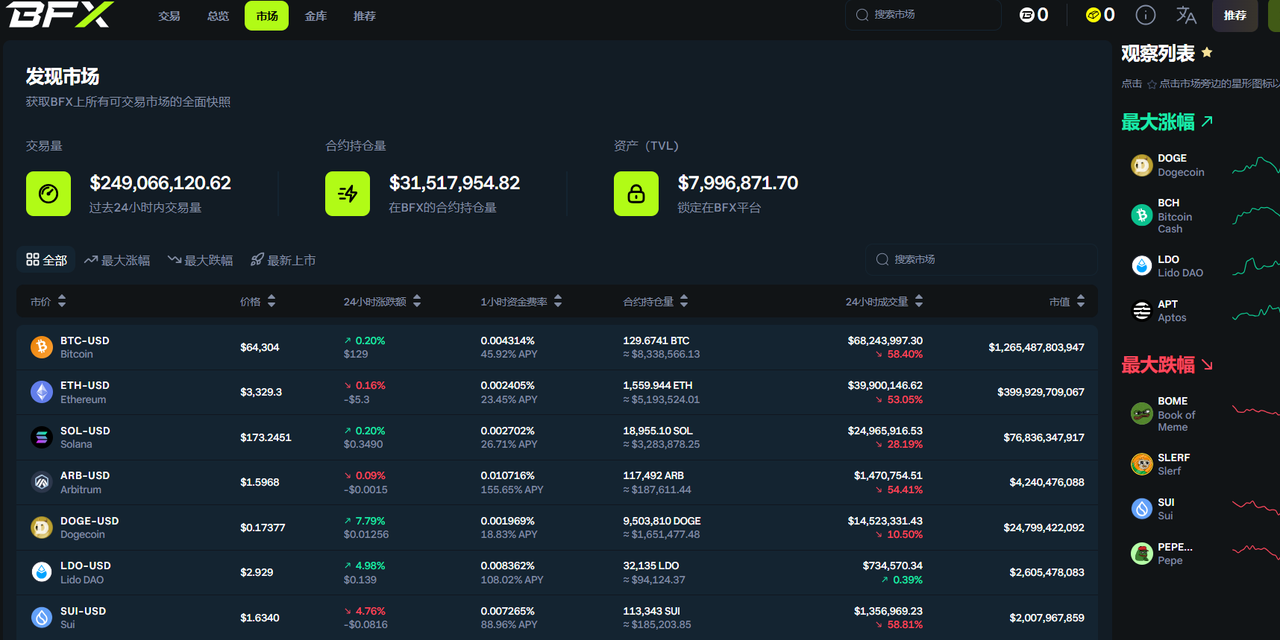

The TVL of Blast Futures is $7.91M, and the 24-hour trading volume is about $246M. The ratio of trading volume to TVL is 31.09, which is the highest among the three derivatives trading platforms. . This data is even higher than Longyi Synfutures (Synfutures’ TVL is $22M, and its 24-hour trading volume is $333M)

The Blast Futures platform now has 37 types of products that can be traded, which basically covers mainstream assets and current assets. Popular assets, good trading depth, and smooth user experience.

Blast Futures received 277,797 gold points in the first phase. The official announcement said that 100% of Blast Gold will be released to users, and that it will be released every day. According to our research, because Blast Gold is only distributed once every 2-3 weeks. It should record the Gold in the user's account and wait until the Gold is received before it can be distributed.

How can I get Blast Gold? According to the official documentation, users can use three methods: transaction volume, deposit assets and staking.

75% of Blast Gold will be distributed to users who deposit assets and treasury Staking. Blast Gold will be allocated according to the user's deposit amount and term. Simply put, the more money you deposit, the longer you will receive, the more you will receive. .

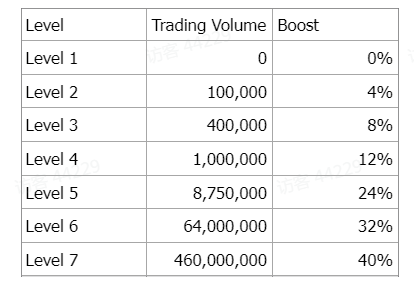

25% of Blast Gold will be distributed according to the transaction volume. The more the transaction volume, the more Gold you will get, and by upgrading, you can get a 40% bonus.

The level and bonus coefficient are as follows:

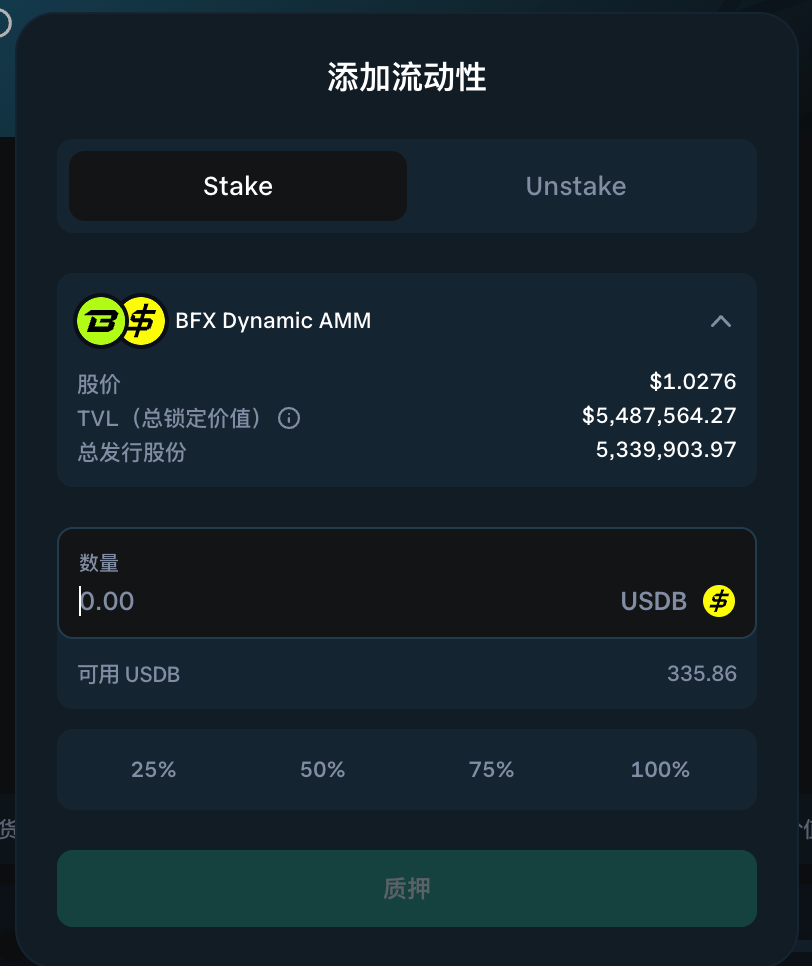

After understanding this mechanism, we can participate in the event by depositing into USDB:

The USDB deposited in the vault is used as the dynamic AMM fund of the agreement. The current funds still have an annualized return of 41.46%. Of course, this dynamic mechanism of BFX is also possible when the market is unilateral. There are risks and users need to know.

Another way is to increase the trading volume. The current contract transactions are all trading pairs of a certain asset and a stable currency. This depends on which asset our users are familiar with. Find a relatively stable asset. Brushing transactions is also a strategy, but it needs to minimize transaction friction costs.

The contract of Blast Futures has also passed the audit (https://github.com/BlastFutures/Blast-Futures-Exchange/blob/main/audits/bfx_audit_report_hats.pdf). The project party still pays more attention to security. of.

In addition, the project team’s tokens have not been made public yet, and they may also benefit users in the future.

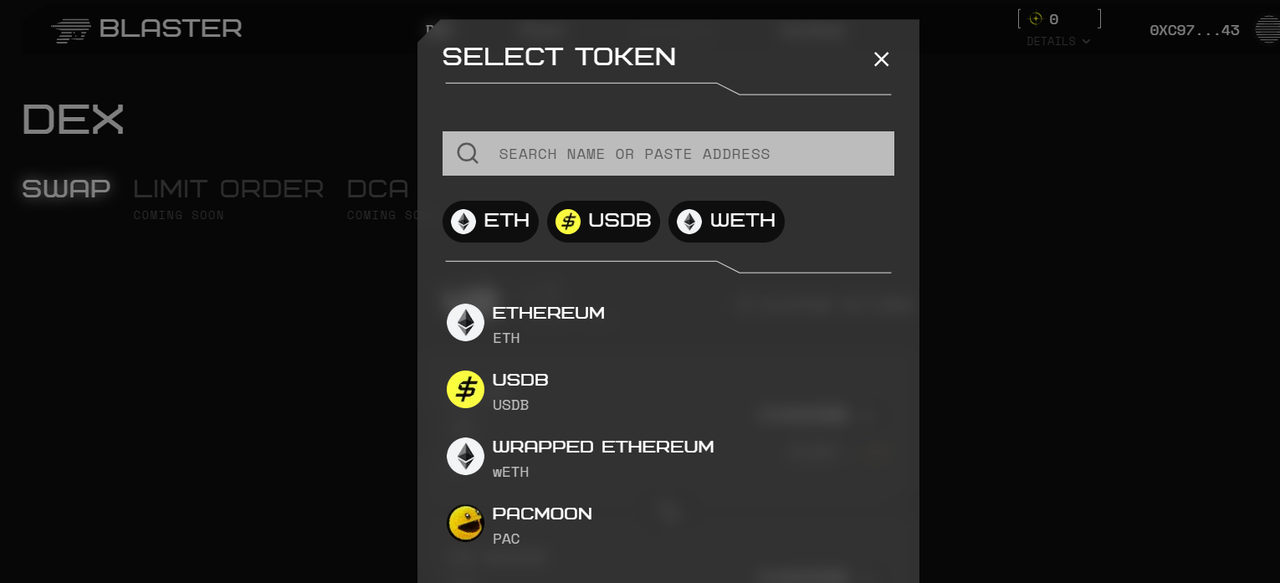

Blasterswap

Blasterswap is a Dex protocol. It is a fork protocol based on uniswap V2 and V3. The innovative function is to add Launchpad to allow users to easily issue coins and add limit order functions. and error-free execution of the Deployment Investment Strategy (DCA) function. However, in order to pursue the stability of the protocol, Blasterswap has chosen to only launch the most conservative basic functions of uniswap V2 at the current stage. Other innovative functions have not been launched. Looking at the priority display of the website, the focus of the next stage is Launchpad. The current Blasterswap TVL is $2.91M, ranking sixth on the dex track 'Blast', mainly because its product has just been launched and there are not many trading pairs currently available.

Such a project is relatively easy for everyone to understand, and there is no additional learning cost, so this article will not introduce too many project products. It is also friendly to users who come to earn points, because the uniswap V2 protocol has undergone market testing and will be safer. However, we should also remind you of the risks here: AMM's trading pairs will suffer impermanent losses if they are not stablecoin trading pairs. In addition, a pure fork protocol seems to have low technical content. We only observe its operational capabilities.

Blasterswap received 108,508 gold points in the first phase. Judging from the project’s documents and the introduction of the administrator in Discord, Blasterswap promises to release 100% of Blast Gold to users and partners. At press time, the project side has not announced the specific delivery ratio, and the details will be disclosed later. The rate of return in the above table is calculated assuming that it distributes 100% of the Gold to users. If the proportion of gold distributed to partners is not large, the deviation will not be much.

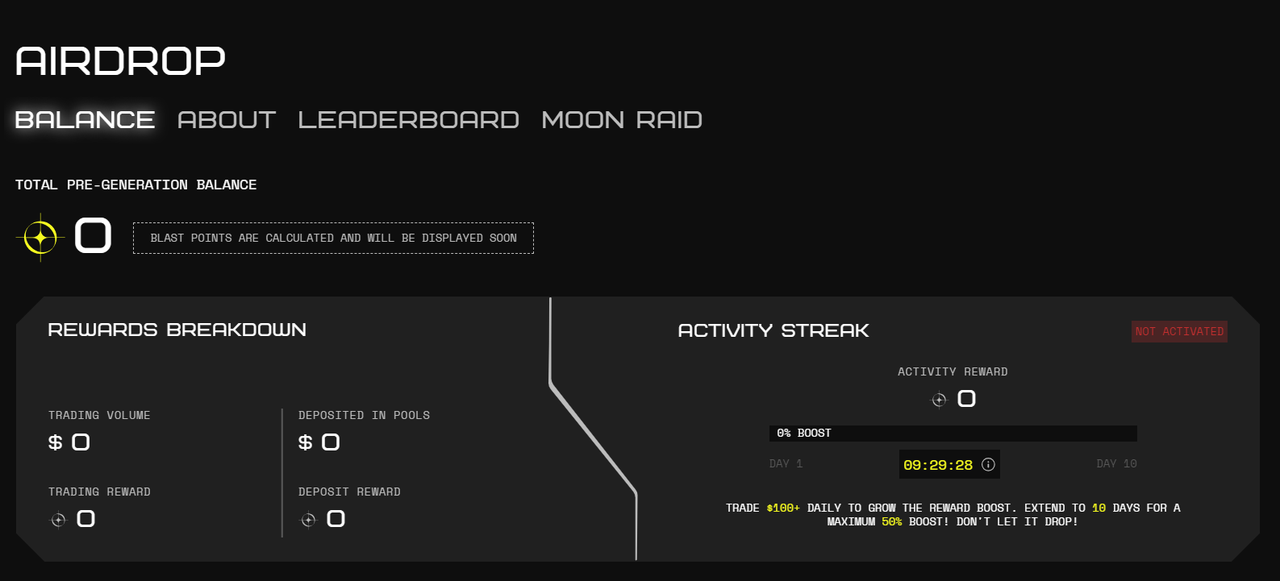

The specific way for users to participate is to participate in Blasterswap’s Pre-Generation event to earn its Pre-token and participate in the event. Currently, the early bird event has ended, so we can only participate in Pre-Generation.

The mechanism of the event is also relatively simple and is basically divided into four categories: transaction rewards, task rewards, liquidity provision rewards and promotion rewards.

Trading rewards: The user's trading volume on the platform will be recorded. A trading volume equivalent to $100 can earn 15 points, a trading volume of $1,000 can earn 200 points, and a trading volume of $10,000 can earn 3,000 points.

Task reward: Trading $100 worth of transactions every day can accelerate points, and the maximum bonus can be 50% for 10 consecutive days.

Liquidity provision rewards: Users can earn 10 points per day for depositing $100 worth of assets on the platform, 150 points for deposits exceeding $1,000, and 2,000 points for deposits exceeding $10,000.

Promotion rewards: Inviting users can get 10% of the invitee’s points rebate

Trading and providing liquidity are the main ways to obtain points. If you want to avoid impermanent losses, you can consider stabilization currency trading pairs to earn points.

In terms of contract security, Blasterswap submitted a contract audit report: https://github.com/blasterswap/blasterswap-core-v2/blob/main/AstraSec-AuditReport-BlasterSwap.pdf

In addition, its mechanism comes from the very mature uniswap V2, I think it should be relatively safe.

Blasterswap requires trading every day to earn more points, which is relatively energy-consuming, but its expected Gold points income is still worth participating. In addition, the platform’s own tokens should also be distributed to users, which will increase the profit potential.

Wand Protocol

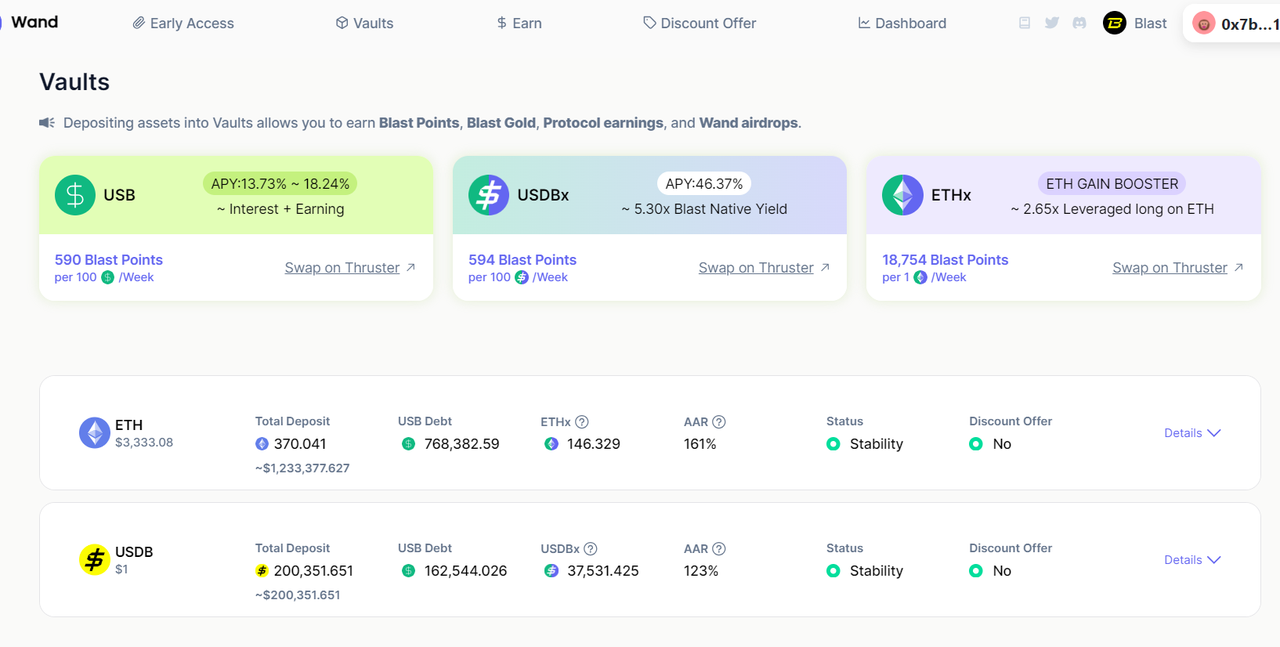

Wand Protocol is a CDP protocol. As you can see on Defilama, there are actually relatively few CDP protocols on Blast, and the native CDP protocol currently only has Wand Protocol. The so-called CDP is the abbreviation of over-collateralized debt warehouse, and the originator is MakerDao. The logic of the CDP model is very simple. Assume that the current price of $ETH is $3000. If you pledge 1 $ETH into MakerDao, you can probably exchange out 2500 $DAI. In this way, the mortgage loan on the chain is realized, and the extra $500 is It’s your overcollateralization portion.

The Wand protocol has made some innovations and proposed the Pooled-CDP model. In the Wand protocol, each asset corresponds to a shared CDP Vault. In this way, global liabilities are achieved, and the over-collateralization part is also global. In common, Wand also tokenizes the over-collateralized part and casts it into Margin Token, so that the over-collateralized part can be traded, so that the capital utilization rate is improved and more gameplay is derived.

This innovation has raised the learning threshold for users, so there has not yet been a large-scale influx of funds. The current TVL of the Wand protocol is $1.6M. The protocol has opened two pools, namely ETH and USDB, both of which are Blast’s native interest-bearing tokens. Users can deposit ETH or USDB into Vault, borrow the protocol’s stable currency $USB, and also obtain $ETHx and $ USDBx. $ETHx is equivalent to a leveraged token of ETH, while $USDBx is an equity token that amplifies the income of USDB several times.

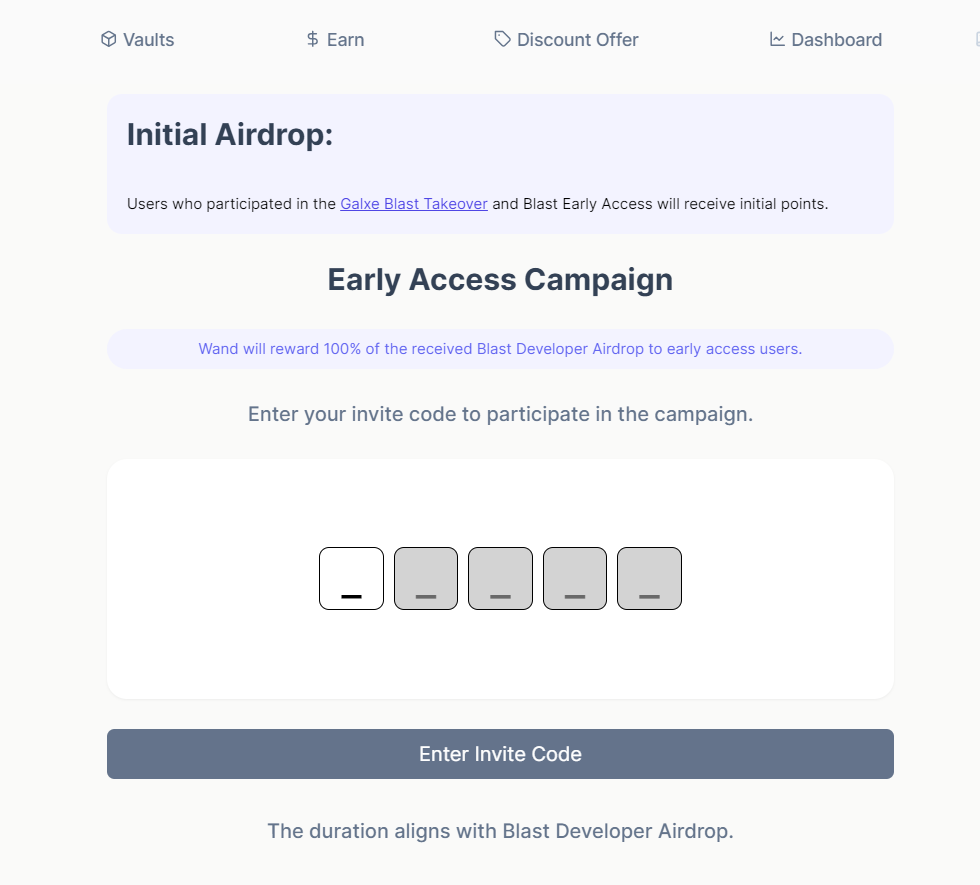

Wand received 53,492 gold points in the first phase. According to the official document announcement, these gold points will be distributed to Wand users. Wand has designed its own points system, which can be entered through Early Access. If you need an invitation code, you can find it in Wand discord.

For specific points earning rules, please refer to the official documentation: https://docs.wand.fi/early-access-campaign/blast-gold-developer-points

Those who have participated in Wand Galxe activities and addresses that have deposited money before Blast will have initial points (good news for white prostitutes), and then the rest will be distributed based on TVL contributions. It is recommended that you can choose to deposit ETH or USDB according to your own assets, or you can directly use the Swap Wand protocol token from Thruster. Users of stable currency financial management can choose to buy $USB (APY about 20%) or $USDBx (APY is about 50%), the APY of these two stablecoin financial management is quite good. ETH longs can directly buy $ETHx, which is equivalent to going long ETH with spot leverage.

In terms of contract security, Wand provides a third-party audit report: https://github.com/wandfi/wand-contract-blast/blob/main/audits/Beosin_202403081621.pdf. The oracle uses Redstone. .

CDP-type protocols are relatively mature, and the project has been operating normally since its launch. The security aspect is relatively reliable. While you can earn points with peace of mind, you can also look forward to Wand’s own platform token airdrop.

In addition to these Defi projects that are easier to participate in, it is recommended that everyone can also actively explore game and NFT projects. Blast’s official announcement stated that subsequent gold points will also be allocated to some ERC721 and ERC20 tokens. Holders, we will also continue to pay attention to the distribution of gold points and update you in a timely manner with better scoring strategies.

The above is the detailed content of An in-depth explanation of the value of Blast gold points and strategies for scoring points. For more information, please follow other related articles on the PHP Chinese website!