How much is Binance's handling fee?

Binance transaction fee: 1. Zero threshold, no platform currency is used for deduction, 0.1% for pending orders, 0.1% for taker orders; 2. Zero threshold, platform currency is used for deduction, 0.075% for pending orders, 0.075 for taker orders %; 3. Contract transaction fees are 0.02% for placing orders and 0.03% for taking orders.

Binance transaction fee

1. Zero threshold, no platform currency deduction required

Binance Handling fee: 0.1% for placing orders, 0.1% for taking orders;

2. Zero threshold, use platform currency to deduct

Binance handling fees: 0.075% for placing orders, 0.075% for taking orders;

3. Contract transaction fees

Binance: 0.02% for pending orders and 0.03% for takers; (higher-level fees are lower)

1. Handling fees for currency transactions

Coin-to-crypto trading refers to spot trading, which does not involve derivatives or leverage. The first thing to explain is that transactions are divided into makers and takers.

- Pending party: Issue a transaction order on the pending order, and the transaction will not be completed immediately. Later, the exchange will wait for the taker to send a transaction request for matching, and the handling fee is cheaper

- Taker: Issue the transaction After the request, the system matches the transaction issued by the placing order, and then the transaction is completed. The handling fee is relatively expensive

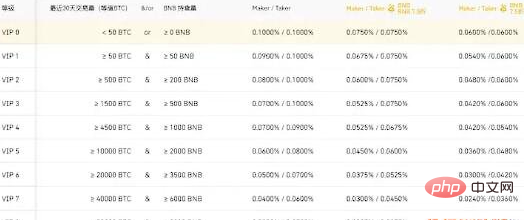

In addition, the higher your membership level, the lower the handling fee.

From VIP 0 to VIP 9, there are respective Maker/Taker rates. For details, please see the figure below:

In addition, if you hold With a certain amount of BNB, you can use BNB to offset the handling fee.

BNB is a cryptocurrency issued by Binance itself. When you use BNB to pay the handling fee, you can get a 25% discount.

Therefore, assuming that the original handling fee is 0.1%, using BNB becomes into 0.075%.

2. Handling fees for margin trading

Leveraged trading means that you pledge a margin to borrow currency from Binance to do a transaction. The so-called leveraged lending interest rate refers to what you have to pay when pledging the margin. Interest. (Interest on Binance is calculated hourly, and fractions of an hour are calculated as one hour)

Taking USDT as an example, the hourly interest rate is 0.0027%, which translates into a one-day interest rate of approximately 0.066%.

Taking BTC as an example, the daily interest rate is approximately 0.03%.

In addition, the leverage rate is floating and will be adjusted according to the market, so you need to pay more attention.

The rest of the transaction fees are similar to currency transactions, starting from Maker / Taker = 0.1000% / 0.1000%.

3. Handling fees for contract transactions: U-based, coin-based and mixed margin

The so-called contract trading refers to the purchase and sale of "a contract", and you will not obtain actual assets.

In Binance, there are two modes of contract trading, one is U-based and the other is currency-based.

- U standard: In the "USDT contract" mode, you must use USDT as a margin asset to conduct contract transactions.

- Coin Standard: In the "Coin Standard Contract" mode, you must use BTC or other cryptocurrencies supported by Binance as a margin to conduct contract transactions (just like you need to use various foreign currency settlements abroad) Account is the same).

The calculation of the two handling fees is the same as that of currency-to-crypto transactions, divided into maker and taker.

The slight difference is that basically the handling fees for currency-based transactions will be a little cheaper.

- Under the U standard, the lowest level of Maker/Taker is 0.0200%/0.0400%, which can also be discounted with BNB, and the discount is 9%.

- Under the currency standard, the lowest level of Maker/Taker is 0.0150%/0.0400%, but it cannot be discounted with BNB.

It can be seen that the cost of contract transactions will be higher than that of ordinary transactions, and the risks will also be relatively high.

In addition, there will be mixed margins in contract transactions. In the U-standard mode, you can mortgage your currency and borrow USDT from Binance to do transactions. For those who do not hold USDT, this is a possibility to consider. The way.

The hybrid margin mode allows you to directly mortgage cryptocurrency to conduct contract transactions without exchanging USDT first!

Currently, there are only two types of mortgage assets supported by hybrid margin: BTC and BUSD. In terms of interest rates, the lowest-level lending daily interest rate is 0.36%.

The above is the detailed content of How much is Binance's handling fee?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Learn more about Huobi HTX C2C to create the first '0 freeze, 100% full compensation' dual insurance in the industry

Aug 29, 2025 pm 04:18 PM

Learn more about Huobi HTX C2C to create the first '0 freeze, 100% full compensation' dual insurance in the industry

Aug 29, 2025 pm 04:18 PM

Directory Huobi HTXC2C "Select" upgrade: escort users with high industry standards. Multiple guarantees: Freeze compensation follow-up team, quickly respond to the transaction of U, recognize Huobi HTX, and no longer worry about freezing cards! The benchmark security standards lead the industry. Huobi HTX's global crypto wave continues to heat up, digital asset dividends continue to be released, and C2C deposits and withdrawals have become a key step for users to enter the crypto world. However, ordinary investors often face two major problems: one is the risk of freezing of bank cards during transactions, and the other is that when problems occur, the platform lacks an effective compensation mechanism, which makes it difficult for users to make up for their losses in a timely manner. Huobi HTX always focuses on the core needs of users and continues to polish the deposit and withdrawal service experience. Following the previous announcement of "User 0 handling fee

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the OKB coin in the directory? What does it have to do with OKX transaction? OKB currency use supply driver: Strategic driver of token economics: XLayer upgrades OKB and BNB strategy comparison risk analysis summary In August 2025, OKX exchange's token OKB ushered in a historic rise. OKB reached a new peak in 2025, up more than 400% in just one week, breaking through $250. But this is not an accidental surge. It reflects the OKX team’s thoughtful shift in token model and long-term strategy. What is OKB coin? What does it have to do with OKX transaction? OKB is OK Blockchain Foundation and

What is Binance's one-way/two-way position? What is the difference between one-way holdings? How to set it up?

Aug 29, 2025 pm 02:51 PM

What is Binance's one-way/two-way position? What is the difference between one-way holdings? How to set it up?

Aug 29, 2025 pm 02:51 PM

Directory What is a one-way position? What is a two-way position? Operation example: One-way vs two-way situation assuming one-way positions two-way positions one-way positions vs two-way positions: under what circumstances should we use which position model to use? Things to note when switching Binance’s two-way holdings Advantages and risks of two-way holdings 1. Advantages 2. Risk Conclusion Most people give you a "one-way holding" under the preset situation when Binance opens a contract. This is also the most commonly used and intuitive way for everyone to use. If you just look bullish, you go long and short when you look bearish. The direction is relatively simple. But in addition to one-way holdings, Binance also provides another position model called "two-way holdings". This gameplay allows you to hold it at the same time

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Fundstrat's TomLee predicts Ethereum bottoming, while BitMine bought another $21 million during the plunge, with a total holding of 1.72 million ETH. Fundstrat Global Advisors managing partner Tom Lee predicted Ethereum to reach a phased bottom on Tuesday amid a sharp decline in the crypto market. Meanwhile, BitMine, the ETH treasury company he founded, took the opportunity to increase its holdings of $21 million worth of Ethereum. "ETH is expected to finish the bottoming process in the next few hours," TomLee posted on the X platform on Tuesday, pointing out that the entire crypto market was in terror due to the liquidation of more than $200 billion in market value.

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

Contents What is Lumoz (MOZ token) How Lumoz (MOZ) works 1. Modular Blockchain Layer Background and History of Lumoz Features of MOZ Token Practicality Price of MOZ Token History of MOZ Token Economics Overview Lumoz Price Forecast Lumoz 2025 Price Forecast Lumoz 2026-2031 Price Forecast Lumoz 2031-2036 Price Forecast L2 is widely recognized in expansion solutions. However, L2 does not effectively handle many hardware resources, including data availability, ZKP (zero knowledge proof)

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is bottom-buying? Buying the bottom, as the name suggests, refers to buying when the asset price experiences a sharp decline or approaches a temporary low, and expecting profits to be achieved when the price rebounds in the future. Since the market is often accompanied by panic selling during the decline, you can obtain assets at a lower cost when entering the market. As the saying goes, "Others are afraid of me, I am greedy." Therefore, before implementing the bottom-buying strategy, investors must be clear about their own operating logic and avoid falling into the dilemma of "others lose small losses and I lose huge losses." In English, there are usually two ways to express bottom-fishing: BottomFishing: a formal term, literally translated as "fishing at the bottom of the water", which means buying in an undervalued area. Buythedip: A more colloquial statement, commonly found on social media and news reports, meaning "buy while the price falls." in short

The crypto market pullback in September may be a buying opportunity. Analysis is why it is optimistic about Q4?

Aug 26, 2025 pm 05:03 PM

The crypto market pullback in September may be a buying opportunity. Analysis is why it is optimistic about Q4?

Aug 26, 2025 pm 05:03 PM

Table of Contents Historical Background The interest rate cut cycle is approaching (this time is indeed different). The signal of crypto companies continuing to absorb large-scale funds has not yet shown that my layout ideas The change in market sentiment is always intriguing. Not long ago, there was still a wave of optimism about ETH on CryptoTwitter, but overnight, many people quickly turned short. I would like to take this opportunity to share some observations and talk about possible trends in the future. Let's stretch the dimensions of time and find clues from the data. Historical Background This is the price trend chart of Bitcoin in previous bull market cycles: Looking back on past cycles, the top time points of BTC show amazing regularity: the peak of the bull market in 2021 appeared in November 2017, the top formed in December 2013, and the same in 12

What is WLFI token? What is the price after the token is unlocked? WLFI token price prediction

Aug 26, 2025 pm 05:00 PM

What is WLFI token? What is the price after the token is unlocked? WLFI token price prediction

Aug 26, 2025 pm 05:00 PM

Contents World Liberty Financial (WLFI) What is WLFI token trading heats up before the market platform WorldLiberty Financial In the unlocking of the huge valuation day before the community’s forecast of WLFI price WorldLiberty Financial’s unique launch strategy Recent development and market positioning WLFI continued to rise above $0.2 before the market, and attracted the attention of the cryptocurrency community as it reached a US$40 billion FDV and approached the token unlocking stage.