Software Tutorial

Software Tutorial

Computer Software

Computer Software

How to supplement the details in the personal income tax withholding and payment system - How to supplement the details in the personal income tax withholding and payment system

How to supplement the details in the personal income tax withholding and payment system - How to supplement the details in the personal income tax withholding and payment system

How to supplement the details in the personal income tax withholding and payment system - How to supplement the details in the personal income tax withholding and payment system

php editor Zimo will introduce to you the detailed operation method of supplementary entry in the personal income tax withholding and payment system. In daily operations, you may encounter situations where you need to enter additional personal income tax details. In this case, you need to follow the steps specified by the system. Through the correct method of supplementing the details, the accuracy and completeness of the personal income tax withholding and payment system can be ensured and errors can be avoided. Next, we will introduce in detail the operation process of supplementary registration details in the personal income tax withholding and payment system to help you successfully complete the supplementary registration work.

Enter declaration

Select "Tax Declaration" - "Personal income tax withholding and payment supplementary record details" under the currently approved tax declaration, as shown in the figure below.

Additional registration details

The system pops up the "Individual Income Tax Withholding and Payment Details Supplementary Information" form. Select the summary voucher number you want to supplement and click the "Supplement Details" button in the corresponding operation column.

Import file(1)

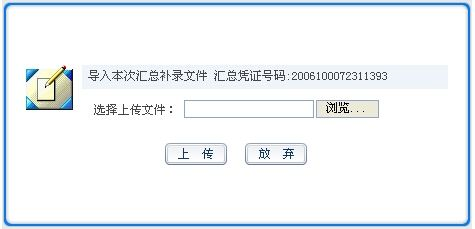

The "Import this supplementary recording file" dialog box will pop up. If you want to import a supplementary recording file, select "Browse" and specify the file upload path.

Import file(2)

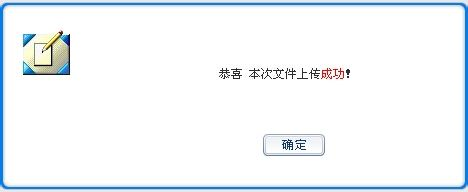

Click the "Upload" button, and the file will be successfully uploaded as shown below.

Query processing results

After the supplementary enrollment detailed file is successfully uploaded, you must go to the "Individual Income Tax Detailed Declaration Document Processing Query" in the document "Individual Tax Checker" to check the processing results of the supplementary enrollment detailed declaration file. Successful processing means that the supplementary enrollment is successful.

The above is the detailed content of How to supplement the details in the personal income tax withholding and payment system - How to supplement the details in the personal income tax withholding and payment system. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

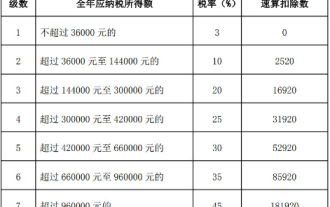

With the continuous development of the times, personal income tax rates are also constantly adjusted. The latest personal income tax rate table for 2024 has been released, which is an important reference for every taxpayer. Let us take a look at the latest personal income tax rate table for 2024! The latest personal income tax rate table for 2024 I, tax rate table 1, comprehensive income tax rate table 2, salary and salary tax rate table 3, transitional salary and salary tax rate table 4, withholding and prepayment tax rate for residents’ personal labor remuneration income table 2, annual personal income tax Calculation formula 1. Personal income tax payable = taxable income × applicable tax rate - quick calculation deduction 2. Taxable income = annual income - allowed deduction 3. Allowed deduction = basic deduction fee of 60,000 yuan + special items

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

The calculation of personal income tax is very complicated. Most players do not know how to calculate personal income tax. Click on the link https://www.gerensuodeshui.cn/ to enter the tax rate calculator. Next, the editor will bring it to users. Personal income tax rate calculator online calculation portal, interested users come and take a look! Personal Income Tax App Tutorial Personal Income Tax Rate Calculator Tax Rate Calculator Entrance: https://www.gerensuodeshui.cn/ 1. Personal tax calculation formula 1. Payable income = pre-tax salary income amount - five insurances and one fund (individual Payment part) - expense deduction amount 2. Tax payable = payable income × tax rate - quick calculation deduction number two

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

The Personal Income Tax App is an official app that facilitates users to conduct tax enquiries, payments, registrations and even business transactions. In our lives, this app can help us understand our tax situation in real time. So if we use the Personal Income Tax App If an error is found in the declaration record, how to correct it? This tutorial guide will provide you with a detailed step-by-step guide. First of all, we first enter the personal income tax app, click on the handle & check option, and then in the handle & check option, you can see the query of the declaration record and find it in the record. Click on the record we want to correct and pull the page to You can see the correction button at the bottom, click Correction to make corrections

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax on the app? Personal Income Tax is a very practical mobile software. Users can declare some businesses on this software, and can also make tax refunds on this software. As long as the user downloads this software, he or she does not have to wait in line offline, which is very convenient. Many users still don’t know how to use personal income tax software to file returns. The following editor has compiled the reporting methods of personal income tax software for your reference. Personal income tax app declaration method 1. First, open the software, find and click the "I want to file taxes" button on the homepage; 2. Then, find and click "Annual Comprehensive Income Summary" in the tax declaration here.

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

In the process of filing personal income tax, special additional deductions are an important policy measure, which provide taxpayers with more opportunities for tax reduction and exemption. Therefore, in this article, the editor has prepared the step-by-step process for filing special additional deductions for personal income tax. Let’s learn together. Steps and procedures for claiming special additional deductions for personal income tax 1. Open the personal tax APP, select [Common Business] on the homepage, and then select [Fill in special additional deductions] 2. Scope of special deduction items: children’s education, continuing education, serious illness medical treatment, housing loan interest , housing rent and support for the elderly, infant and child care. According to the relevant policies and regulations of the national tax department, the Personal Income Tax Law determines the scope of the following special deduction items: Children’s Education 3. At the bottom of the page, you can select [One-click import], so that you can fill in last year’s declaration with one click.

What should I do if I can't log in to the Personal Income Tax app?

Oct 30, 2023 pm 04:30 PM

What should I do if I can't log in to the Personal Income Tax app?

Oct 30, 2023 pm 04:30 PM

Failure to log in to the Personal Income Tax app is caused by network problems, APP problems, account problems, system or environmental problems and other reasons. The solutions are as follows: 1. Network problem, make sure the network environment is good, refresh the web page, or try another network environment; 2. APP problem, try to uninstall the old version and reinstall the latest version; 3. Account problem, register an account, and Make sure the account is activated, check the account password, and make sure it is entered correctly; 4. System or environment problems, try to repair system files, or reinstall the operating system, etc.

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the personal income tax refund application? Personal income tax is a very popular mobile phone software. The functions on this software are very powerful. Users can perform many operations in this software. For example, they can declare on this software, and then they can also do it on this software. For tax refunds or a series of other operations, many users want to know how to cancel a declaration on this software. The editor below has compiled the methods for canceling a declaration for your reference. Personal Income Tax App Tax Refund Declaration Cancellation Process 1. Enter the Personal Income Tax Mobile App and click to declare annual income calculation. 2. A declaration prompt pops up on the page, click on the declaration details. 3. Then click Done. 4. Click on the submitted withdrawal

Personal income tax rate table latest in 2024

Mar 05, 2024 pm 12:20 PM

Personal income tax rate table latest in 2024

Mar 05, 2024 pm 12:20 PM

Each resident pays different taxes every year, but most users don’t know what the personal income tax rate table is. Next is the latest personal income tax rate table for 2024 brought to users by the editor. Interested users should hurry up Come and take a look! Personal Income Tax App Tutorial: Personal Income Tax Rate Table 2024 Latest 1, Tax Rate Table 1, Comprehensive Income Tax Rate Table 2, Wage and Salary Tax Rate Table 3, Transitional Wage and Salary Tax Rate Table 4, Resident Personal Income Tax Withholding and Prepayment Tax Rate Table 2. Annual personal income tax calculation formula 1. Personal income tax payable = taxable income × applicable tax rate - quick calculation deduction 2. Taxable income = annual income - allowed deduction 3. Allowed deduction = basic deduction expense 60,000 Yuan + special project