web3.0

web3.0

The Blast mainnet is about to be launched, and its security risks and potential opportunities are analyzed from a technical perspective

The Blast mainnet is about to be launched, and its security risks and potential opportunities are analyzed from a technical perspective

The Blast mainnet is about to be launched, and its security risks and potential opportunities are analyzed from a technical perspective

php editor Xinyi recently discovered that the Blast mainnet is about to be launched, which has attracted widespread attention. However, the security risks that come with it have also attracted much attention, and it is necessary for us to conduct an in-depth analysis of its technical aspects. At the same time, potential opportunities cannot be ignored. Let us explore the challenges and opportunities in this emerging field.

Recently, Blast has once again become a hot topic in the market. With the end of its "Big Bang" developer competition, its TVL has continued to soar, exceeding 2 billion US dollars in one fell swoop, occupying the top spot on the Layer 2 track. Have a place.

At the same time, Blast also announced that it will launch its mainnet on February 29, causing the public to continue to pay attention to it. After all, the "anticipation of airdrop" has successfully attracted most participants to watch. However, with the development of its ecology, various projects emerge one after another, which also leads to the frequent occurrence of various security risks. Today Beosin will explain to you the security risks and potential opportunities behind Blast’s strong start and the surge in TVL.

Blast development history

Blast is a new project launched by Blur founder Pacman on November 21, 2023, which quickly attracted attention in the encryption community. extensive attention. In just 48 hours of launch, the network has reached a total value locked (TVL) of $570 million and attracted over 50,000 users.

Blast received US$20 million in financing from major backers such as Paradigm and Standard Crypto last year, followed by another US$5 million investment from Japanese cryptocurrency investment company CGV in November last year.

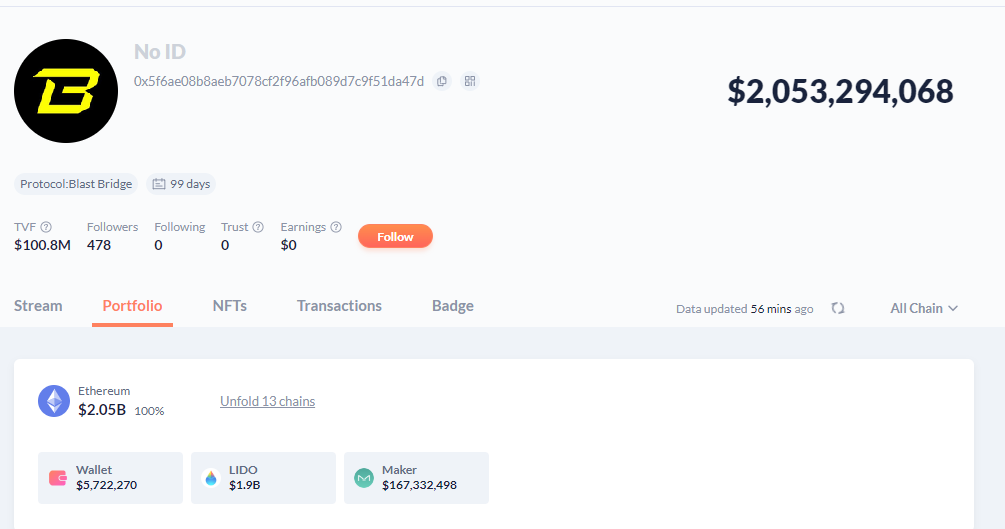

According to DeBank data, as of February 25, the total value of assets in the Blast contract address has exceeded US$2 billion, of which approximately US$1.8 billion of ETH is deposited in the Lido protocol, and more than US$160 million of ETH is deposited in the Lido protocol. DAI is deposited into the MakerDAO protocol. This shows that Blast is extremely active in the market.

DeBank数据

Why is Blast so popular?

Blast is unique in providing native yields on ETH and stablecoins, a feature not found in other Layer2 solutions. When users transfer ETH to other Layer2, these Layer2 will only lock the ETH into the smart contract and map the corresponding Layer2 ETH; while Blast will deposit the user's ETH into Lido to earn interest, and introduce a new interest-bearing stable currency USDB (the stable currency The currency will be used to purchase U.S. Treasury bonds through MakerDAO (the proceeds will be earned) to the Blast network.

Layer2 launched by the Blur team has unique traffic advantages. Blur has previously issued over $200 million in airdrops to users of its platform, so it has a large community base. At the same time, Blast is attracting users to participate in staking through airdrop rewards and using traffic fission marketing strategies to attract more users to join Blast. This method of organically combining traffic and airdrop incentives helps attract more users to participate and provides a stable user base for the development of Blast.

Blast Security Risks

Blast has been criticized and questioned since its launch. On November 23, 2023, Jarrod Watts, a developer relations engineer at Polygon Labs, tweeted that Blast’s centralization may pose serious security risks to users. At the same time, he also questioned Blast’s classification as a layer 2 (L2) network because Blast does not meet the L2 standard and lacks functions such as transactions, bridging, rollup, or sending transaction data to Ethereum.

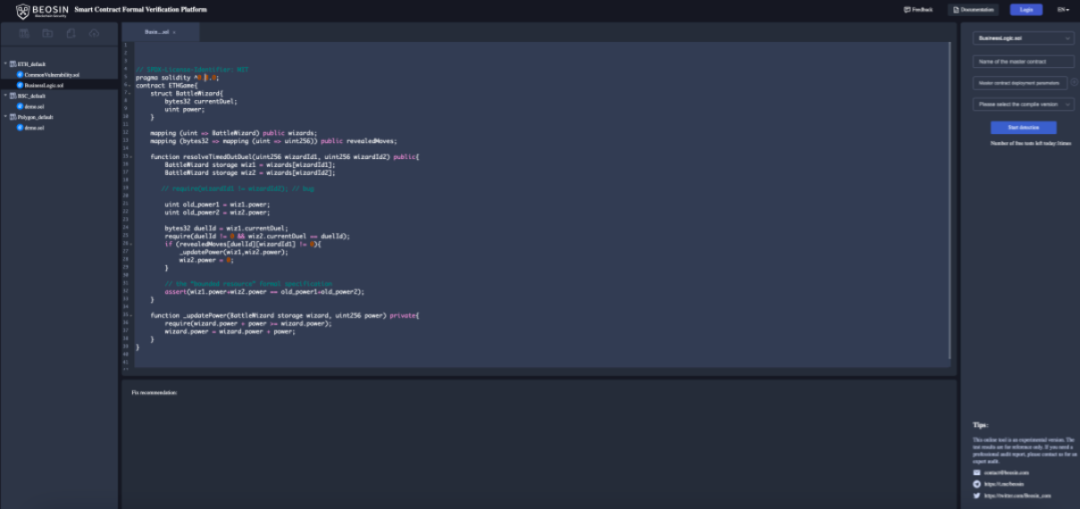

How safe is Blast? What security risks exist? This time we used the BeosinVaaS tool to scan the Blast Deposit contract and combined it with the analysis of Beosin security experts to interpret the Blast Deposit contract code.

##

##

BeosinVaaSThe Blast Deposit contract is an upgradeable contract. Its proxy contract address is 0x5F6AE08B8AeB7078cf2F96AFb089D7c9f51DA47d. Its current logical contract address is 0x0bD88b59D580549285f0A207Db5F06bf24a8e561. The main risk is Click as follows: 1. Centralization riskBlast Deposit The most important enableTransition function of the contract can only be called by the admin address of the contract. In addition, this function takes the mainnetBridge contract address as a parameter, and the mainnetBridge contract can access all pledged ETH and DAI. function enableTransition(address mainnetBridge) external onlyOwner { if (isTransitionEnabled) { revert TransitionIsEnabled(); }_pause(); _setMainnetBridge(mainnetBridge); isTransitionEnabled = true;LIDO.approve(mainnetBridge, type(uint256).max); DAI.approve(mainnetBridge, type(uint256).max);}code:https://etherscan.io/address/0x0bd88b59d580549285f0a207db5f06bf24a8e561# code#F1#L230In addition, the Blast Deposit contract can be upgraded at any time through the upgradeTo function. This is mainly used to fix contract vulnerabilities, but there is also the possibility of doing evil. At present, Polygon zkEVM has done a relatively complete job in upgrading the contract. Modifying the contract in non-emergency situations generally requires a 10-day delay, and contract modifications need to be decided by the 13-member Agreement Council.

function upgradeTo(address newImplementation) public virtual onlyProxy { _authorizeUpgrade(newImplementation); _upgradeToAndCallUUPS(newImplementation, new bytes(0), false); }

code:https://etherscan.io/address/ 0x0bd88b59d580549285f0a207db5f06bf24a8e561#code#F2#L78

2. Multi-signature dispute

Looking at the Blast Deposit contract, we can see that the permissions of the contract are controlled by a Gnosis Safe 3/5 multi-signature wallet 0x67CA7Ca75b69711cfd48B44eC3F64 Controlled by E469BaF608C. These 5 signature addresses are:

0x49d495DE356259458120bfd7bCB463CFb6D6c6BA

0xb7c719eB2649c1F03bFab68b0AAa35AD538a7cC8

0x1f97306039530ADB4173C 5 All addresses are new addresses created 3 months ago, and their identities are unknown. Since the entire contract is actually an escrow contract protected by a multi-signature wallet and not a Rollup bridge, Blast has been questioned by many from the community and developers.

Blast acknowledged this set of security risks and said that while immutable smart contracts are considered secure, they may hide undetected vulnerabilities. Upgradeable smart contracts also bring their own risks, such as contract upgrades and easily exploitable time locks. In order to mitigate these risks, Blast will use a variety of hardware wallets for management to avoid centralization risks.

However, Blast has not yet announced whether wallet management can avoid centralization and phishing attacks, and whether there is a complete management process. In the two previous security incidents of Ronin Bridge and Multichain, although the project parties used multi-signature wallets or MPC wallets, the centralization of private key management resulted in user asset losses.

On February 19, the Blast team made an update to the Deposit contract. This update mainly adds the Predeploys contract and introduces the IERC20Permit interface to prepare for the mainnet launch.

Blast Ecological Risk

On February 25, the Beosin KYT anti-money laundering analysis platform detected a suspected RugRull in the Blast Ecological GambleFi project Risk (@riskonblast), resulting in a loss of approximately 500 ETH. At present, its official X account does not exist. Investors such as

MoonCat2878 also shared their personal losses. MoonCat2878 recounts how they initially viewed RiskOnBlast as a promising investment opportunity after seeing reputable projects and partners from within the Blast ecosystem. However, the subsequent public sale turned into an uncapped financing round, which aroused their doubts about Risk as a GameFi project.

The above is the detailed content of The Blast mainnet is about to be launched, and its security risks and potential opportunities are analyzed from a technical perspective. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts

Aug 26, 2025 pm 05:15 PM

Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts

Aug 26, 2025 pm 05:15 PM

Against the backdrop of global central banks' continued expansion of balance sheets and the continued dilution of fiat currency purchasing power, Bitcoin's share in the global monetary system has steadily increased. According to the latest data released by Bitcoin financial company River, Bitcoin (BTC) currently accounts for about 1.7% of the global currency. This statistics cover the sum of M2 money supply in major countries, some minor currencies and the market value of gold. "After 16 years of development, Bitcoin has entered the global monetary structure, accounting for 1.7%," River pointed out. The company compared Bitcoin’s market value with a $112.9 trillion fiat pool and a $25.1 trillion hard currency asset, which only contains gold and does not include other precious metals such as silver, platinum and palladium. This ratio is based

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

On-chain and market indicators: The approximation of the risk range determines whether Bitcoin is close to the top. On-chain data and market structure provide the signal closest to actual trading behavior. Many key indicators currently show that the market has entered the "potential risk range". MVRV indicators enter the "mild danger zone". According to Cointelegraph, Santiment's latest data shows that Bitcoin's MVRV (market value to realization value ratio) has reached 21%. This indicator reflects the overall investor profit and loss status. Historical experience shows that when MVRV is in the range of 15%-25%, the market enters a "mild danger zone", which means that a large number of coin holders are already in a profitable state and their motivation to take profits is enhanced. Although it does not constitute an immediate selling signal, the price has been short

Learn more about Huobi HTX C2C to create the first '0 freeze, 100% full compensation' dual insurance in the industry

Aug 29, 2025 pm 04:18 PM

Learn more about Huobi HTX C2C to create the first '0 freeze, 100% full compensation' dual insurance in the industry

Aug 29, 2025 pm 04:18 PM

Directory Huobi HTXC2C "Select" upgrade: escort users with high industry standards. Multiple guarantees: Freeze compensation follow-up team, quickly respond to the transaction of U, recognize Huobi HTX, and no longer worry about freezing cards! The benchmark security standards lead the industry. Huobi HTX's global crypto wave continues to heat up, digital asset dividends continue to be released, and C2C deposits and withdrawals have become a key step for users to enter the crypto world. However, ordinary investors often face two major problems: one is the risk of freezing of bank cards during transactions, and the other is that when problems occur, the platform lacks an effective compensation mechanism, which makes it difficult for users to make up for their losses in a timely manner. Huobi HTX always focuses on the core needs of users and continues to polish the deposit and withdrawal service experience. Following the previous announcement of "User 0 handling fee

How to identify current trends/narratives in the crypto market? Methods for identifying current trends in crypto markets

Aug 26, 2025 pm 05:18 PM

How to identify current trends/narratives in the crypto market? Methods for identifying current trends in crypto markets

Aug 26, 2025 pm 05:18 PM

Table of Contents 1. Observe the tokens with leading gains in the exchange 2. Pay attention to trend signals on social media 3. Use research tools and institutional analysis reports 4. Deeply explore on-chain data trends 5. Summary and strategic suggestions In the crypto market, narrative not only drives capital flow, but also profoundly affects investor psychology. Grasping the rising trend often means higher returns potential; while misjudgment may lead to high-level takeovers or missed opportunities. So, how can we identify the narrative that dominates the market at present? Which areas are attracting a lot of capital and attention? This article will provide you with a set of practical methods to help you accurately capture the hot pulse of the crypto market. 1. The most intuitive signal of observing the leading tokens on the exchange often comes from price performance. When a narrative begins

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the OKB coin in the directory? What does it have to do with OKX transaction? OKB currency use supply driver: Strategic driver of token economics: XLayer upgrades OKB and BNB strategy comparison risk analysis summary In August 2025, OKX exchange's token OKB ushered in a historic rise. OKB reached a new peak in 2025, up more than 400% in just one week, breaking through $250. But this is not an accidental surge. It reflects the OKX team’s thoughtful shift in token model and long-term strategy. What is OKB coin? What does it have to do with OKX transaction? OKB is OK Blockchain Foundation and

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Fundstrat's TomLee predicts Ethereum bottoming, while BitMine bought another $21 million during the plunge, with a total holding of 1.72 million ETH. Fundstrat Global Advisors managing partner Tom Lee predicted Ethereum to reach a phased bottom on Tuesday amid a sharp decline in the crypto market. Meanwhile, BitMine, the ETH treasury company he founded, took the opportunity to increase its holdings of $21 million worth of Ethereum. "ETH is expected to finish the bottoming process in the next few hours," TomLee posted on the X platform on Tuesday, pointing out that the entire crypto market was in terror due to the liquidation of more than $200 billion in market value.

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

Contents What is Lumoz (MOZ token) How Lumoz (MOZ) works 1. Modular Blockchain Layer Background and History of Lumoz Features of MOZ Token Practicality Price of MOZ Token History of MOZ Token Economics Overview Lumoz Price Forecast Lumoz 2025 Price Forecast Lumoz 2026-2031 Price Forecast Lumoz 2031-2036 Price Forecast L2 is widely recognized in expansion solutions. However, L2 does not effectively handle many hardware resources, including data availability, ZKP (zero knowledge proof)

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is bottom-buying? Buying the bottom, as the name suggests, refers to buying when the asset price experiences a sharp decline or approaches a temporary low, and expecting profits to be achieved when the price rebounds in the future. Since the market is often accompanied by panic selling during the decline, you can obtain assets at a lower cost when entering the market. As the saying goes, "Others are afraid of me, I am greedy." Therefore, before implementing the bottom-buying strategy, investors must be clear about their own operating logic and avoid falling into the dilemma of "others lose small losses and I lose huge losses." In English, there are usually two ways to express bottom-fishing: BottomFishing: a formal term, literally translated as "fishing at the bottom of the water", which means buying in an undervalued area. Buythedip: A more colloquial statement, commonly found on social media and news reports, meaning "buy while the price falls." in short