Ethereum Kunkan Upgrade Technical Overview and Potential Market Impact

The Ethereum Dencun upgrade plan introduces "Proto-DankSharding" technology, aiming to improve the transaction efficiency of the L2 blockchain and solve scalability issues. This upgrade is a key component of Ethereum’s strategy to enhance user experience and reduce transaction costs. This article will briefly introduce the technical points, development progress, and potential impact on the Ethereum network’s transaction processing capabilities and cost efficiency of the Dencun upgrade.

Dencun Core Features: Proto-DankSharding

Proto-DankSharding is a key upgrade of Dencun designed to reduce transaction costs and data availability costs of L2 blockchain to solve scalability challenges. This initiative will lay the foundation for the eventual realization of “Danksharding” and further expand its benefits.

Development process

Dencun upgrade is the abbreviation of Cancun-Deneb, where Cancun focuses on the network scalability of the execution layer, and Deneb focuses on improving the consensus layer of Ethereum. In this upgrade, EIP-4844 is the core content, and improvement proposals such as EIP-1153, EIP-4788, EIP-6780 and EIP-7514 are also part of the upgrade.

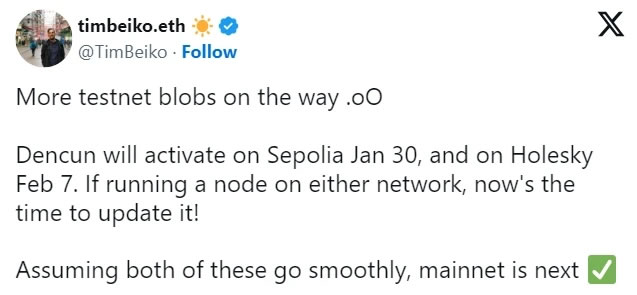

#The deployment process of Dencun upgrade includes activation on different test networks. At the end of January this year, it was successfully activated on the Goerli and Sepolia testnets, and then completed the final phase of testing on the Holesky testnet on February 7.

The final version of the Dencun-capable Ethereum client is expected to be released by February 22, which means validators will need to install the updated client version on their nodes within two weeks.

Currently, the developers of Ethereum have released the update to Geth V1.13.12, codenamed Edolus, and plan to launch it when the block height of the mainnet reaches 8626176 at 13:55 UTC on March 13 Dencun upgrade. This date requires developer approval and confirmation via open source software platform GitHub. This update will bring some key improvements and fixes to improve the performance and security of the Ethereum network. Developers encourage all parties involved to promptly update their node software to ensure they can successfully participate in new upgrades and continue to support the stable operation of the Ethereum network.

Technical innovation of Dencun upgrade

Dencun upgrade introduces a well-known technological innovation-"blob", which is designed to temporarily store and off-chain compress large amounts of transaction data through Ethereum nodes to Reduce storage and handling requirements. Blobs have the ability to store data for a short period of time, which is critical for transaction verification, but also have the ability to eventually delete data to prevent network storage from being overloaded. The security and validity of data processing are ensured by encryption technology to detect data changes.

According to previous reports, Proto-Danksharding plans to reduce the number of blobs in each block to 16 and ensure that the size of each blob does not exceed 128KB. This move is expected to increase block space by approximately 2MB. The additional data space will provide opportunities for optimistic and zero-knowledge rollups to publish proofs of transaction data on-chain. These proofs will provide actual data via blobs rather than "calldata". It is worth noting that the blob data will be deleted after two weeks, while the "calldata" will be permanently stored on the Ethereum blockchain.

Impact on transaction capabilities and costs

After implementation, the Dencun upgrade is expected to significantly improve Ethereum’s transaction processing capabilities, ultimately enabling the network to process 30,000-100,000 transactions per second. This enhancement is critical to Ethereum’s ability to support a growing ecosystem of DAPPs and users.

In addition, the Dencun upgrade will reduce Ethereum’s internal and rollup-related costs by 10 times, improving Ethereum’s scalability and cost-effectiveness. Specifically, the upgrade will reduce Ethereum transaction costs from the current average of $0.23 to $0.02, a change that could accelerate adoption of the Ethereum rollup roadmap. At the same time, lower costs will make L2 solutions more attractive and competitive.

Due to EIP-4844’s ability to reduce rollup block space fees by more than 10 times, the Dencun upgrade may reduce the Ethereum protocol’s fee income in the short term. The success of this upgrade can be measured by several metrics: L2 adopts the blob transaction type; L2 sorter fee payments are reduced; L2's transaction fees are reduced; blob fees are increased, making "spamming" data no longer economically viable; long-term Ethereum will be adopted for data availability (DA) instead of competing alternatives such as Celestia and others.

Impact on Validators and Staking Operators

Staking services like Lido and Rocketpool (as well as staking volumes from major players like Coinbase, Binance, and Kraken) have been scaling for Ethereum One of the most important areas of active research in the community to improve the security of the Ethereum network.

Ebunker believes that as the amount of ETH pledged increases, the consensus layer bears greater pressure. A large number of validators will lead to an increase in gossip messages and the size of the beacon state. The archived Lighthouse node currently takes up 16TB of space.

While it is possible to reduce the growth rate of message volume and beacon status by increasing the maximum effective balance (currently 32 ETH), introducing such changes requires a delicate balance, which will increase Solo Ethereum verification the threshold of the person.

Dencun upgrades are already working on solving this problem, and some solutions (such as EIP-7514 increasing the Max Epoch Churn limit) will reduce the rate at which new validators join the network.

Market impact of Dencun upgrade

Dencun upgrade may affect the market value of the Ethereum network, mainly in the following aspects:

Network function enhancement: Dencun upgrade can Significantly increase Ethereum’s transaction processing capabilities and reduce costs, and attract more developers and users into the Ethereum ecosystem. Increased efficiency and adoption of the Ethereum network will likely drive demand for ETH and have a corresponding impact on its price.

Investor Perception: The successful deployment of Dencun can strengthen investor confidence in the long-term viability of Ethereum and its development team’s ability to execute complex upgrades. This perceived reliability and forward momentum may impact the attractiveness of Ethereum as an investment, which may lead to an increase in the value of Ethereum investments.

Market Hype and Sentiment: Cryptocurrency markets are highly sensitive to investor sentiment. Anticipating positive market reactions to the Dencun upgrade or its successful implementation could lead to short-term price fluctuations, with traders and investors adjusting their positions based on the expected impact on Ethereum’s functionality and market position.

With the successful activation of the Dencun upgrade on the Ethereum test network and its full implementation on the main network in March, Ethereum’s transaction processing capabilities and efficiency will be greatly improved. Overall, the Dencun upgrade is a huge evolution for Ethereum, solving immediate and long-term scalability, security, and efficiency issues.

The EIP in this upgrade, designed to optimize data availability and staking operations, can significantly enhance the performance and user experience of the network. The Dencun upgrade addresses pressing challenges facing blockchain networks by implementing Proto-Danksharding and introducing blobs, and is a milestone in Ethereum’s ongoing efforts to improve its scalability and reduce transaction costs.

The above is the detailed content of Ethereum Kunkan Upgrade Technical Overview and Potential Market Impact. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

On-chain and market indicators: The approximation of the risk range determines whether Bitcoin is close to the top. On-chain data and market structure provide the signal closest to actual trading behavior. Many key indicators currently show that the market has entered the "potential risk range". MVRV indicators enter the "mild danger zone". According to Cointelegraph, Santiment's latest data shows that Bitcoin's MVRV (market value to realization value ratio) has reached 21%. This indicator reflects the overall investor profit and loss status. Historical experience shows that when MVRV is in the range of 15%-25%, the market enters a "mild danger zone", which means that a large number of coin holders are already in a profitable state and their motivation to take profits is enhanced. Although it does not constitute an immediate selling signal, the price has been short

Learn more about Huobi HTX C2C to create the first '0 freeze, 100% full compensation' dual insurance in the industry

Aug 29, 2025 pm 04:18 PM

Learn more about Huobi HTX C2C to create the first '0 freeze, 100% full compensation' dual insurance in the industry

Aug 29, 2025 pm 04:18 PM

Directory Huobi HTXC2C "Select" upgrade: escort users with high industry standards. Multiple guarantees: Freeze compensation follow-up team, quickly respond to the transaction of U, recognize Huobi HTX, and no longer worry about freezing cards! The benchmark security standards lead the industry. Huobi HTX's global crypto wave continues to heat up, digital asset dividends continue to be released, and C2C deposits and withdrawals have become a key step for users to enter the crypto world. However, ordinary investors often face two major problems: one is the risk of freezing of bank cards during transactions, and the other is that when problems occur, the platform lacks an effective compensation mechanism, which makes it difficult for users to make up for their losses in a timely manner. Huobi HTX always focuses on the core needs of users and continues to polish the deposit and withdrawal service experience. Following the previous announcement of "User 0 handling fee

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the OKB coin in the directory? What does it have to do with OKX transaction? OKB currency use supply driver: Strategic driver of token economics: XLayer upgrades OKB and BNB strategy comparison risk analysis summary In August 2025, OKX exchange's token OKB ushered in a historic rise. OKB reached a new peak in 2025, up more than 400% in just one week, breaking through $250. But this is not an accidental surge. It reflects the OKX team’s thoughtful shift in token model and long-term strategy. What is OKB coin? What does it have to do with OKX transaction? OKB is OK Blockchain Foundation and

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Fundstrat's TomLee predicts Ethereum bottoming, while BitMine bought another $21 million during the plunge, with a total holding of 1.72 million ETH. Fundstrat Global Advisors managing partner Tom Lee predicted Ethereum to reach a phased bottom on Tuesday amid a sharp decline in the crypto market. Meanwhile, BitMine, the ETH treasury company he founded, took the opportunity to increase its holdings of $21 million worth of Ethereum. "ETH is expected to finish the bottoming process in the next few hours," TomLee posted on the X platform on Tuesday, pointing out that the entire crypto market was in terror due to the liquidation of more than $200 billion in market value.

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

What is Lumoz (MOZ coin)? MOZ Token Economics and Price Forecast

Aug 29, 2025 pm 04:21 PM

Contents What is Lumoz (MOZ token) How Lumoz (MOZ) works 1. Modular Blockchain Layer Background and History of Lumoz Features of MOZ Token Practicality Price of MOZ Token History of MOZ Token Economics Overview Lumoz Price Forecast Lumoz 2025 Price Forecast Lumoz 2026-2031 Price Forecast Lumoz 2031-2036 Price Forecast L2 is widely recognized in expansion solutions. However, L2 does not effectively handle many hardware resources, including data availability, ZKP (zero knowledge proof)

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is Buy the dip? How to judge the bottom of the game? A detailed explanation of this article

Aug 26, 2025 pm 04:57 PM

What is bottom-buying? Buying the bottom, as the name suggests, refers to buying when the asset price experiences a sharp decline or approaches a temporary low, and expecting profits to be achieved when the price rebounds in the future. Since the market is often accompanied by panic selling during the decline, you can obtain assets at a lower cost when entering the market. As the saying goes, "Others are afraid of me, I am greedy." Therefore, before implementing the bottom-buying strategy, investors must be clear about their own operating logic and avoid falling into the dilemma of "others lose small losses and I lose huge losses." In English, there are usually two ways to express bottom-fishing: BottomFishing: a formal term, literally translated as "fishing at the bottom of the water", which means buying in an undervalued area. Buythedip: A more colloquial statement, commonly found on social media and news reports, meaning "buy while the price falls." in short

The crypto market pullback in September may be a buying opportunity. Analysis is why it is optimistic about Q4?

Aug 26, 2025 pm 05:03 PM

The crypto market pullback in September may be a buying opportunity. Analysis is why it is optimistic about Q4?

Aug 26, 2025 pm 05:03 PM

Table of Contents Historical Background The interest rate cut cycle is approaching (this time is indeed different). The signal of crypto companies continuing to absorb large-scale funds has not yet shown that my layout ideas The change in market sentiment is always intriguing. Not long ago, there was still a wave of optimism about ETH on CryptoTwitter, but overnight, many people quickly turned short. I would like to take this opportunity to share some observations and talk about possible trends in the future. Let's stretch the dimensions of time and find clues from the data. Historical Background This is the price trend chart of Bitcoin in previous bull market cycles: Looking back on past cycles, the top time points of BTC show amazing regularity: the peak of the bull market in 2021 appeared in November 2017, the top formed in December 2013, and the same in 12

Ethereum price forecast for September

Aug 26, 2025 pm 03:57 PM

Ethereum price forecast for September

Aug 26, 2025 pm 03:57 PM

Ethereum's September trend will be dominated by the game between spot ETF expectations and the "September effect". Historical data shows seasonal weakness, but ETF progress may become a key catalyst. With the intensification of price volatility, investors should focus on risk management and fundamental logic rather than single price prediction.