web3.0

web3.0

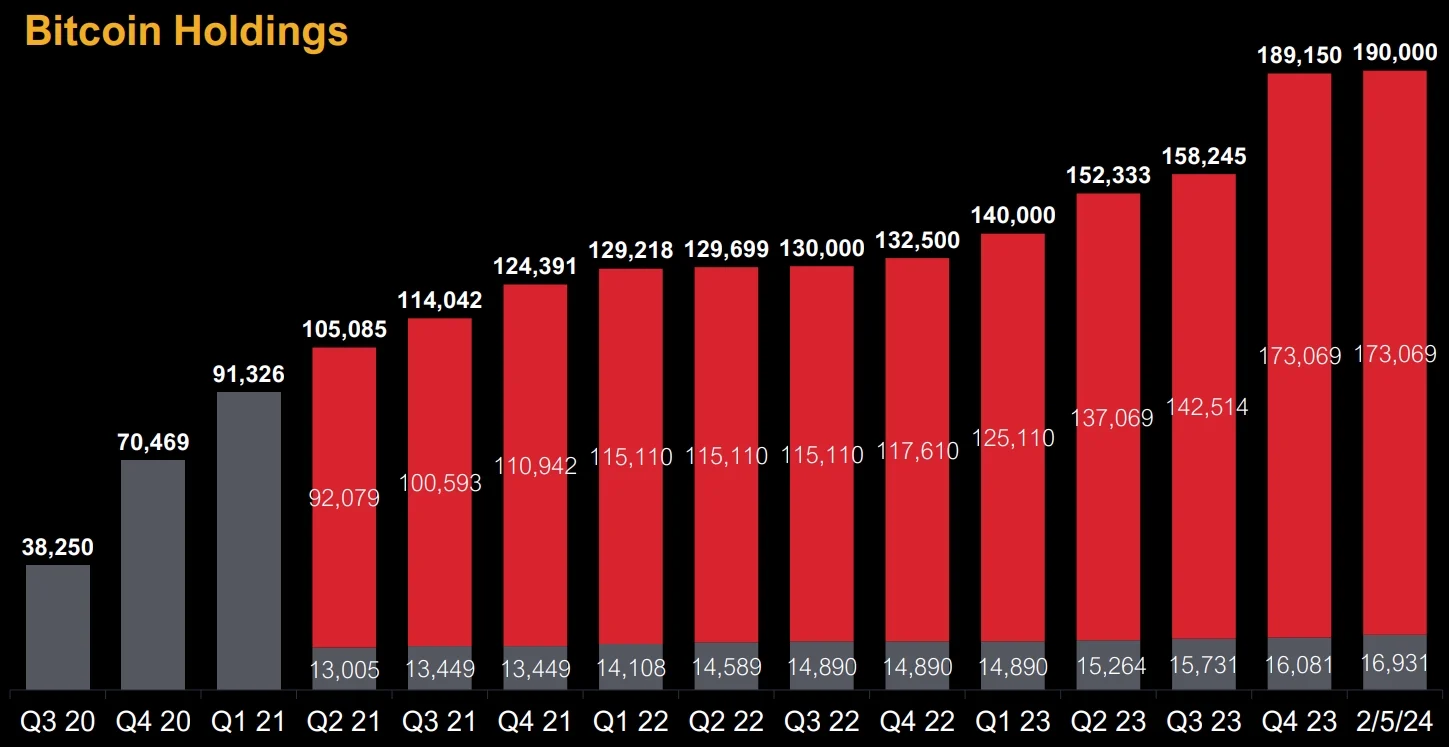

MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins

MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins

MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins

MicroStrategy, a listed company in the United States, announced its fourth quarter financial report yesterday, announcing that it purchased 30,555 Bitcoins through proceeds from capital market activities and used excess cash to purchase 350 Bitcoins, a total investment of US$1.2 billion. This move further solidifies MicroStrategy’s position in the Bitcoin market and demonstrates their long-term bullishness on Bitcoin. MicroStrategy, a leading company in data analytics and business intelligence, views Bitcoin as an important asset and includes it as part of an investment portfolio. The decision to purchase Bitcoin was based on their confidence in the long-term value of Bitcoin and concerns about the risk of depreciation of traditional currencies.

In early 2024, MicroStrategy invested another $37.2 million, purchasing 850 Bitcoins. Since the fourth quarter of last year, MicroStrategy has accumulated a total of 31,755 Bitcoins, which is the company’s largest quarterly increase in the past three years and the 13th consecutive quarter that it has added Bitcoin to its balance sheet.

How many BTC does MicroStrategy currently have?

As of February 5, 2024, according to data disclosed by MicroStrategy, the company held 190,000 Bitcoins, with an average purchase price of US$31,224 and a total purchase cost of US$5.93 billion. Currently, the market value of these Bitcoins has reached US$8.19 billion, equivalent to a floating profit of US$2.26 billion.

Overall, MicroStrategy’s net profit last year was US$89.1 million, with a loss of US$249.7 million, and revenue decreased by 6.1% year-on-year to US$124.5 million. Michael Saylor, executive chairman of MicroStrategy, said at the conference that the company's performance last year can be attributed to investors recognizing the "digital transformation" of assets. He believes that 2024 will be the year when Bitcoin is born as an institutional-grade asset class. This is the first brand-new asset class in modern times. The next 15 years will be a period when Bitcoin is regulated, institutionalized and grows rapidly. It will be different from the past. 15 years are very different. This view shows that MicroStrategy is optimistic about Bitcoin’s long-term prospects.

Optimistic about Bitcoin rising another 100 times

Michael Saylor believes that the listing of Bitcoin spot ETF will be an important moment, which will transform Bitcoin from a medium of exchange to a store of value means. This way, people will no longer face past criticism of Bitcoin’s failure to fulfill its role as a currency. As a store of value, Bitcoin has reason to continue to outperform the market and even rise another 100x.

Looking forward, Michael Saylor noted that MicroStrategy will continue to develop software and work with Bitcoin developers to develop Bitcoin-based L2, as well as other ecosystem players to add in the coming years. The company’s earnings, and the micro-strategy will continue to buy more Bitcoin.

The above is the detailed content of MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts

Aug 26, 2025 pm 05:15 PM

Bitcoin (BTC) climbs to 1.7% of global currency before Fed chairman hints at rate cuts

Aug 26, 2025 pm 05:15 PM

Against the backdrop of global central banks' continued expansion of balance sheets and the continued dilution of fiat currency purchasing power, Bitcoin's share in the global monetary system has steadily increased. According to the latest data released by Bitcoin financial company River, Bitcoin (BTC) currently accounts for about 1.7% of the global currency. This statistics cover the sum of M2 money supply in major countries, some minor currencies and the market value of gold. "After 16 years of development, Bitcoin has entered the global monetary structure, accounting for 1.7%," River pointed out. The company compared Bitcoin’s market value with a $112.9 trillion fiat pool and a $25.1 trillion hard currency asset, which only contains gold and does not include other precious metals such as silver, platinum and palladium. This ratio is based

Wall Street Whale Devours Ethereum: Interpretation of the Pricing Power Battle Behind Purchase 830,000 ETH in 35 Days

Aug 22, 2025 pm 07:18 PM

Wall Street Whale Devours Ethereum: Interpretation of the Pricing Power Battle Behind Purchase 830,000 ETH in 35 Days

Aug 22, 2025 pm 07:18 PM

Table of Contents Two ancestry, two worldviews: The philosophical showdown between OG coins hoarding and Wall Street harvesting. Financial engineering dimensionality reduction strike: How BitMine reconstructs ETH pricing power in 35 days. New dealer spokesperson: TomLee and Wall Street narrative manipulation ecological reconstruction: How Wall Street Capital reshapes the ETH value chain. A small company that was originally unknown in Nasdaq increased its holdings from zero violence to 830,000 in just 35 days. Behind it is a survival philosophy showdown between the indigenous people in the currency circle and Wall Street Capital. On July 1, 2025, BitMine's ETH position was still zero. 35 days later, this family is unknown

What is the current price of Dajie Coin? Is it worth investing? ZEC Coin Price Forecast: 2025-2030

Aug 22, 2025 pm 07:30 PM

What is the current price of Dajie Coin? Is it worth investing? ZEC Coin Price Forecast: 2025-2030

Aug 22, 2025 pm 07:30 PM

Table of Contents Key Points ZEC Real-time Marketing Based on Technical Analysis Forecasting ZEC Price in 2025 2025 ZECUSD Long-term Trading Plan Analysts Forecasting ZEC Price in 2025 CoinCodexNameCoinNewsBitScreener Analysts Forecasting ZEC Price in 2026 CoinCodexNameCoinNewsBitScreener Analysts Forecasting ZEC Price in 2027 CoinCodexNameCoinNewsBitScreener Analysts Forecasting ZEC Price in 2027 CoinCodexNameCoinNewsBitScreener Analysts Forecasting 2

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

Will Bitcoin peak in September? How should investors deal with it? Analysis of one article

Aug 26, 2025 pm 05:12 PM

On-chain and market indicators: The approximation of the risk range determines whether Bitcoin is close to the top. On-chain data and market structure provide the signal closest to actual trading behavior. Many key indicators currently show that the market has entered the "potential risk range". MVRV indicators enter the "mild danger zone". According to Cointelegraph, Santiment's latest data shows that Bitcoin's MVRV (market value to realization value ratio) has reached 21%. This indicator reflects the overall investor profit and loss status. Historical experience shows that when MVRV is in the range of 15%-25%, the market enters a "mild danger zone", which means that a large number of coin holders are already in a profitable state and their motivation to take profits is enhanced. Although it does not constitute an immediate selling signal, the price has been short

The top 10 recommended rankings of the most valuable virtual currency (2025 latest version)

Aug 22, 2025 pm 07:15 PM

The top 10 recommended rankings of the most valuable virtual currency (2025 latest version)

Aug 22, 2025 pm 07:15 PM

Bitcoin ranks first, followed by Ethereum, Solana, BNB, XRP, USDT, ADA, DOGE, SHIB, and AVAX, based on comprehensive rankings based on technology, ecology and market consensus.

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the reason for the rise of OKB coins? A detailed explanation of the strategic driving factors behind the surge in OKB coins

Aug 29, 2025 pm 03:33 PM

What is the OKB coin in the directory? What does it have to do with OKX transaction? OKB currency use supply driver: Strategic driver of token economics: XLayer upgrades OKB and BNB strategy comparison risk analysis summary In August 2025, OKX exchange's token OKB ushered in a historic rise. OKB reached a new peak in 2025, up more than 400% in just one week, breaking through $250. But this is not an accidental surge. It reflects the OKX team’s thoughtful shift in token model and long-term strategy. What is OKB coin? What does it have to do with OKX transaction? OKB is OK Blockchain Foundation and

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Tom Lee predicts Ethereum (ETH) will bottom out in the next few hours, and BitMine buys 4871 on dips

Aug 29, 2025 pm 03:51 PM

Fundstrat's TomLee predicts Ethereum bottoming, while BitMine bought another $21 million during the plunge, with a total holding of 1.72 million ETH. Fundstrat Global Advisors managing partner Tom Lee predicted Ethereum to reach a phased bottom on Tuesday amid a sharp decline in the crypto market. Meanwhile, BitMine, the ETH treasury company he founded, took the opportunity to increase its holdings of $21 million worth of Ethereum. "ETH is expected to finish the bottoming process in the next few hours," TomLee posted on the X platform on Tuesday, pointing out that the entire crypto market was in terror due to the liquidation of more than $200 billion in market value.

Bitcoin (BTC) $13.8 billion option expiration is imminent, bulls face key test

Aug 29, 2025 pm 04:15 PM

Bitcoin (BTC) $13.8 billion option expiration is imminent, bulls face key test

Aug 29, 2025 pm 04:15 PM

Key points of the catalog: The bullish Bitcoin strategy is weakly defending below $114,000. The Fed's trends and technology stock performance may dominate the future trend of Bitcoin. The Bitcoin option expiration date is approaching, and the technology sector is under pressure may reveal whether the current pullback is a suspension of a bull market or the beginning of a trend reversal. Key points: Bitcoin short side has an advantage below $114,000, and downward pressure may further increase as the option expiration date approaches. Market concerns about capital expenditure in the field of artificial intelligence (AI) have increased, aggravated volatility in the overall financial market and weakened the attractiveness of risky assets. The $13.8 billion Bitcoin (BTC) option will expire in a concentrated manner on August 29. The market is paying close attention to this node to determine whether the previous 9.7% drop is short.