Double currency win is an investment and financial management method that has attracted much attention in recent years. It makes profits by investing in two different currencies of assets at the same time. However, this approach is not without risks. In this article, PHP editor Youzi will reveal the risks of double currency winning and conduct detailed analysis for you. The risks of Dual Currency Win mainly include market risk, exchange rate risk and policy risk. When investing in Double Currency Win, investors must fully understand and appreciate these risks in order to make informed investment decisions.

Double Currency Win is a financial derivative, similar to traditional financial options. Investors select a cryptocurrency and set three parameters: underlying, expiry date and pegged price. On the expiration date, settlement will be based on the settlement price of the cryptocurrency, and investors will receive interest income regardless of whether the pegged price is reached. The tutorial for participating in Dual Currency Win on the Ouyi Exchange is as follows:

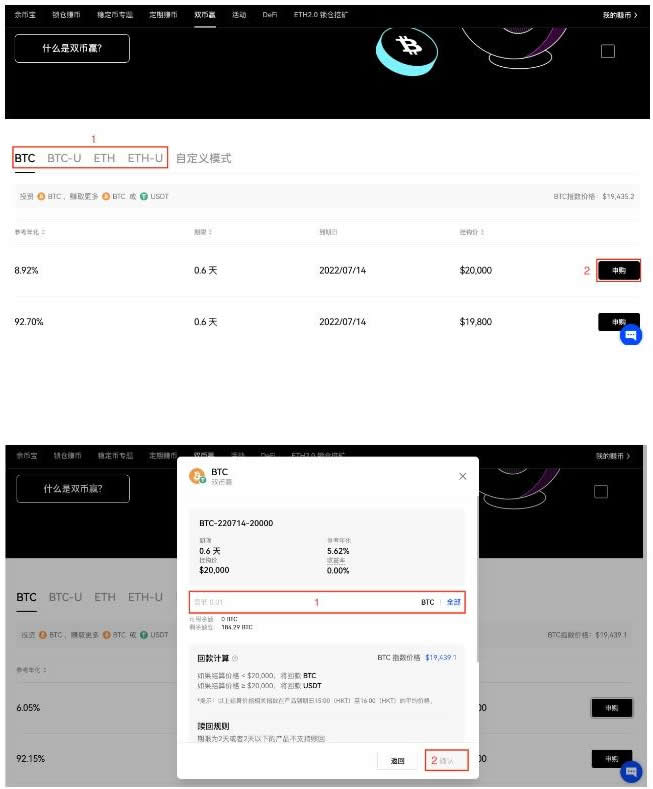

1. Log in to the Ouyi official website (click here to register), click [Finance] - [Double Currency Win]

2. Select the product type, investment assets and specific dual-coin win products, click [Subscription] - enter the investment amount - [Confirm], and complete the operation as required.

The risk of Dual Currency Win mainly lies in price losses caused by factors such as market fluctuations, wrong choices, etc. The following is a specific analysis:

The cryptocurrency market is highly volatile, and prices may fluctuate in the short term. Significant changes occur within a period of time, increasing the risks faced by investors. Global factors such as regulatory changes, macroeconomic conditions and technological vulnerabilities can have an impact on the overall market. These factors not only affect specific digital assets, but also create volatility in the market as a whole. Therefore, investors need to pay close attention to market dynamics and take appropriate risk management measures to reduce the impact of rapid fluctuations in portfolio value.

2. Wrong choice: Investing in the wrong digital assets may lead to losses. Some projects may fail due to technical problems, team turmoil, lack of market demand, etc. Investors need to evaluate projects carefully and avoid investing in assets that are not well thought out or lack fundamental support. Holding low-liquidity digital assets may expose you to liquidity risks. During times of market volatility, it may be difficult to buy or sell at a desired price, which may result in an inability to complete a transaction in a timely manner.

3. Black swan events: Unexpected and unpredictable events (such as cyber attacks, regulatory changes, market manipulation, etc.) may have a great impact on the digital asset market. These unexpected events may result in losses.

4. Digital assets and blockchain technology themselves may face technical risks, such as smart contract vulnerabilities, network attacks, protocol upgrades, etc. These issues may affect the security and availability of digital assets. Since the cryptocurrency market is relatively small, it may be more susceptible to manipulation. Market manipulation may lead to abnormal price fluctuations, causing potential losses to investors.

The above is the detailed content of Risks of Dual Currency Win exposed: Are there risks in Dual Currency Win?. For more information, please follow other related articles on the PHP Chinese website!