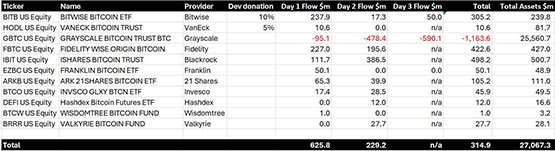

The U.S. Bitcoin spot ETF performed strongly in three days of trading. According to Bloomberg ETF analyst data, the total trading volume was close to 10 billion U.S. dollars, and the net inflow of funds in the first two days exceeded 800 million. Dollar.

Under the current circumstances, GBTC seems to be continuing to be redeemed. According to statistics from BitMEX Research, Grayscale’s GBTC outflowed US$590 million on the 3rd day, reaching a total outflow of US$1.169 billion.

If these outflows of funds do not flow to other Bitcoin spot ETFs (because Grayscale charges a higher 1.5% handling fee), the continued rise of Bitcoin will be affected.

According to Arkham data, the Grayscale GBTC trust account once again transferred 9,000 Bitcoins to Coinbase yesterday evening , worth $385 million. Including the 4,000 Bitcoins previously transferred, a total of 130 million BTCs have been transferred, worth approximately $585 million.

Currently, according to Arkham statistics, Grayscale GBTC still holds 617,000 BTC, worth approximately US$26.65 billion.

In addition, four European Bitcoin ETPs have seen $61.4 million in outflows over the past two days, showing that funds appear to be moving away from high-fee European ETPs move to low-fee U.S. ETFs. Previously, Circle EU Strategy Director Patrick Hansen compared the two from a fee and security perspective and concluded that the U.S. Bitcoin Spot ETF was more attractive.

The US Bitcoin ETF has lower fees than the EU ETF (UCITS). According to data, the average fee of the top 10 ETP/ETNs in the EU is 1.047%, while the average fee of the 10 U.S. Bitcoin ETFs (excluding GBTC) is 0.451%, which is less than half.

European ETPs and ETNs are structured as debt securities, and investors face the risk of bankruptcy. In contrast, capital invested in ETFs is protected against loss if the issuer becomes insolvent.

The above is the detailed content of Grayscale transferred 9,000 Bitcoins to Coinbase, GBTC had a net outflow of $1.16 billion in three days. For more information, please follow other related articles on the PHP Chinese website!