As the critical moment for the approval of Bitcoin spot ETFs approaches, the market’s attention to this continues to increase. According to sources, the U.S. Securities and Exchange Commission (SEC) may approve the first batch of Bitcoin spot ETFs on Tuesday or Wednesday. However, Fox Business reporter Eleanor Terrett said approval this week is unlikely, but there is still a chance in the next two weeks. The news appears to have had a positive impact on Bitcoin price, allowing it to break above the key $45,000 level this morning.

Cryptocurrency financial services platform Matrixport predicted earlier today that the price of Bitcoin will rise significantly in January, reaching $50,000.

According to the Matrixport report, the prediction is based on the observation of market conditions and investor behavior. After Bitcoin experienced consolidation in mid-to-late December, it is expected to usher in an increase in buying momentum in the New Year. It is said that institutional investors who have held bearish views in the past are expected to quickly launch buying actions when the market opens in 2024 in order not to miss potential upside opportunities.

Matrixport predicts that the potential approval of a Bitcoin spot ETF may be announced next week, and this news may come sooner to traders’ expectations. This unexpected early approval could further boost Bitcoin prices. Furthermore, Matrixport believes that this approval will not lead to a decline in the price of Bitcoin, as the Bitcoin spot ETF will make Bitcoin a legitimate asset in institutional investment portfolios.

In the current market environment, Bitcoin holders are increasingly inclined to transfer assets from exchanges to their own custodial wallets. This behavior resulted in a decrease in Bitcoin trading volume available on exchanges. At the same time, the supply of Bitcoin may be further scarce as mining companies may further restrict supply around the time of the Bitcoin halving cycle (expected in April 2024). Matrixport has predicted that Bitcoin spot ETFs may bring $24-50 billion in capital inflows to the market. In the context of a supply-constrained market, this could lead to significant price increases for Bitcoin.

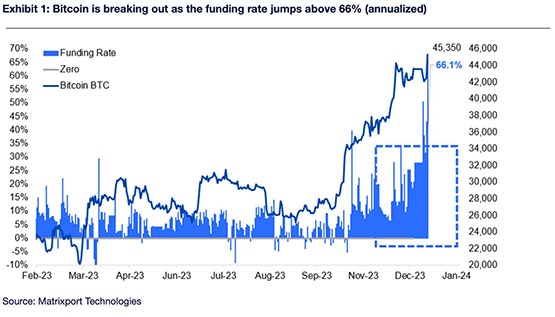

Finally, the report pointed out that observing historical trends, Bitcoin performed well during the halving cycle and the US election year. In addition, the market’s bullish indicators also support the price increase prediction, such as Bitcoin’s new high funding rate this morning (annualized 66%). Taking these factors into consideration, Matrixport believes that Bitcoin has the potential to break through the January target level of $50,000.

Bitcoin Funding Rate

The above is the detailed content of Matrixport predicts Bitcoin price will climb significantly to $50,000 in January. For more information, please follow other related articles on the PHP Chinese website!