Bitcoin halving is the most concerning thing in the current currency circle. This incident not only means that the difficulty of Bitcoin mining will increase, but also means that the subsequent trend of Bitcoin prices will affect the price fluctuations of the entire cryptocurrency market. For newbies, understanding the Bitcoin halving can be a bit difficult. First, we need to understand what the Bitcoin halving is before we can prepare for it. The Bitcoin halving refers to the process by which the number of new Bitcoins created every ten minutes decreases. This event occurs approximately every four years and is an important aspect of cryptocurrency policy. The following is a must-read guide to the countdown to Bitcoin halving for beginners.

The Bitcoin Halving is a scheduled event that occurs every 210,000 blocks mined on the Bitcoin network. The process involves miners solving complex mathematical equations to verify transactions, cutting the block rewards they receive in half. This mechanism aims to limit the total number of Bitcoins in circulation to 21 million.

Bitcoin halving refers to the reduction of block rewards. The first halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. The second halving occurred in July 2016, reducing the reward to 12.5 BTC. The most recent halving occurred in May 2020, reducing the reward to 6.25 BTC. This halving mechanism is one of the important features of Bitcoin and is designed to control the supply of Bitcoin, increase its scarcity, and stabilize its value.

The Bitcoin halving has a significant impact on the price of Bitcoin and the overall health of the network. As block rewards decrease, miners will make less mining profits, which can lead to lower hash rates and slower transaction processing times. However, a reduction in supply can also increase demand, pushing Bitcoin prices higher, as was observed in the months following the halving event. Therefore, the Bitcoin halving has both positive and possibly negative impacts, but overall it is crucial to the health of the Bitcoin network and price stability.

The significance of Bitcoin halving is to maintain its scarcity to prevent inflation. By reducing the production of Bitcoin, its value is maintained, and due to the limited supply, may increase over time. This scarcity is often compared to one of the reasons why gold is a store of value.

The impact of the Bitcoin halving event on the price of Bitcoin has attracted much attention. Although the halving only affects the rewards miners receive, many analysts believe that Bitcoin prices may be affected due to reduced supply and increased demand. This is because as the number of Bitcoins available for mining decreases, miners need to devote more resources to maintaining profitability. Therefore, after the halving, Bitcoin becomes more difficult to mine, which may lead to an increase in the price of Bitcoin. However, this is just a speculation and the actual impact remains to be seen.

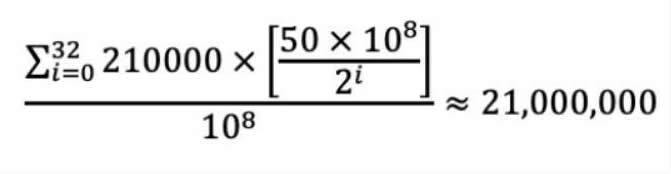

Bitcoin’s halving is an important mechanism based on the principle that the block reward is halved after every 210,000 blocks. This means that the production of Bitcoin will gradually decrease until all is mined in 2140. Therefore, it is crucial for investors to understand this principle. Additionally, as Bitcoin is mined less, transaction fees are likely to increase, which will become a new source of rewards for miners. The initial block reward is 50 BTC, but after every 210,000 blocks, this amount will be halved. This also means that the way new Bitcoins are added to the network will be limited to post-halving rewards. This mechanism ensures Bitcoin’s scarcity and value.

The Bitcoin halving time is calculated as follows:

In a halving event, Bitcoin mining rewards are halved and the number of newly mined Bitcoins is halved. This usually has some impact on the Bitcoin market, but does not necessarily lead to a large price drop. Historical Bitcoin halvings are often seen as an inflationary slowing mechanism, as the halving of mining rewards slows the supply of new Bitcoins.

Before the halving event, the market usually has some expectations and speculations, which may cause the Bitcoin price to rise in advance. This is due to expectations that reduced supply may have a positive impact on prices. After the historical Bitcoin halving event, sometimes the price will experience fluctuations in the short term, but sometimes it will gradually rise. However, there is no fixed rule, and the market reaction is affected by a variety of factors.

In the Bitcoin market, market sentiment and participant behavior will also have an important impact on prices. Investors' buying and selling decisions, the overall market sentiment, and macroeconomic factors may lead to price fluctuations. The impact of the halving event may be seen in both the short term, where prices may be affected by speculation and market sentiment, and the long term, where reduced supply may have a more significant impact on prices.

The above is the detailed content of Bitcoin Halving Countdown Guide: Essential Knowledge for Newbies. For more information, please follow other related articles on the PHP Chinese website!